What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicares network to cover more telehealth services.

What Isnt Covered By Original Medicare

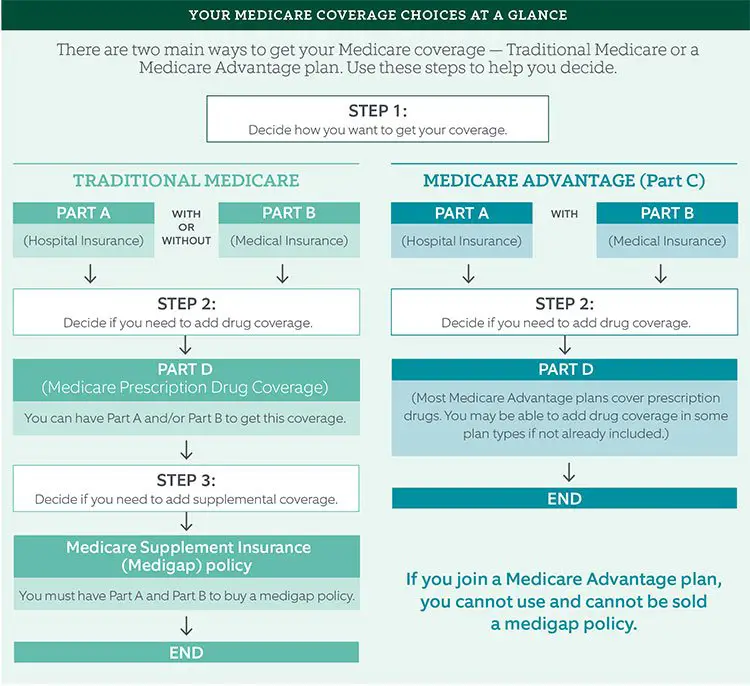

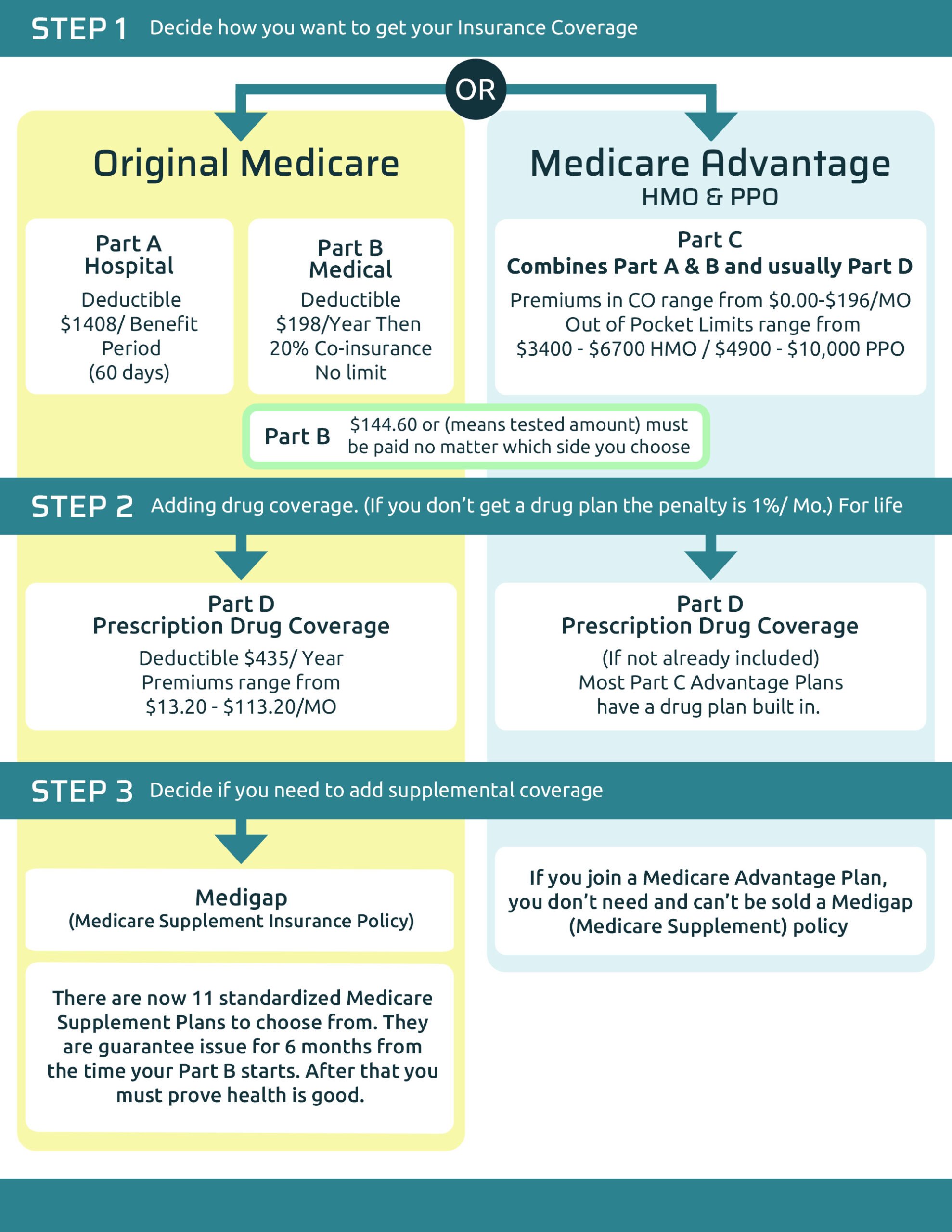

Original Medicare doesnt cover everything you might need for your healthcare. First, Original Medicare does not include Part D, which is coverage for prescription drugs. If you enroll in Original Medicare and choose a Medigap plan instead of an Advantage plan, you will need to enroll in a stand-alone Part D plan and pay its associated monthly premiums separately.

Additionally, Original Medicare will not cover the following health-related needs:

Coverage Choices For Medicare

If youre older than 65 and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesnt happen automatically. However, if you already get Social Security benefits, youll get Medicare Part A and Part B automatically when you first become eligible .

There are two main ways to get Medicare coverage:

Also Check: Does Medicare Cover The Cost Of A Shingles Shot

Original Medicare Vs Medicare Advantage: Covered Services

When you have Original Medicare, you can see any doctor or specialist that accepts Medicare. You do not need to obtain a referral to see a specialist. Additionally, because plans do not change annually, you will not need to worry about your doctor leaving the plans network.

When you have Medicare Advantage, your coverage will be very similar to your employer group coverage. The majority of them are health maintenance organizations and preferred provider organizations.

Often, on a Medicare Advantage plan you will have a primary care physician that directs all your care. Therefore, you need a referral to see a specialist.

On top of this, physicians can leave the plans network at any time. You could find yourself searching for a new primary care physician at any point of the year without notice.

With Original Medicare, you receive coverage for a wide range of medical services. These include diagnostic tests, durable medical equipment, outpatient surgery, hospitalization, preventive services, and much more. However, Original Medicare does not include coverage for routine dental care, vision, or hearing care.

With Medicare Advantage, you will have coverage for the same services as Original Medicare. In addition, you can receive coverage for some dental, vision, and hearing care, or even prescription drug coverage. The downside is you may have trouble finding a dentist, eye care practitioner, or audiologist that accepts your Medicare Advantage plan.

Managed Care Vs Medicare Supplements

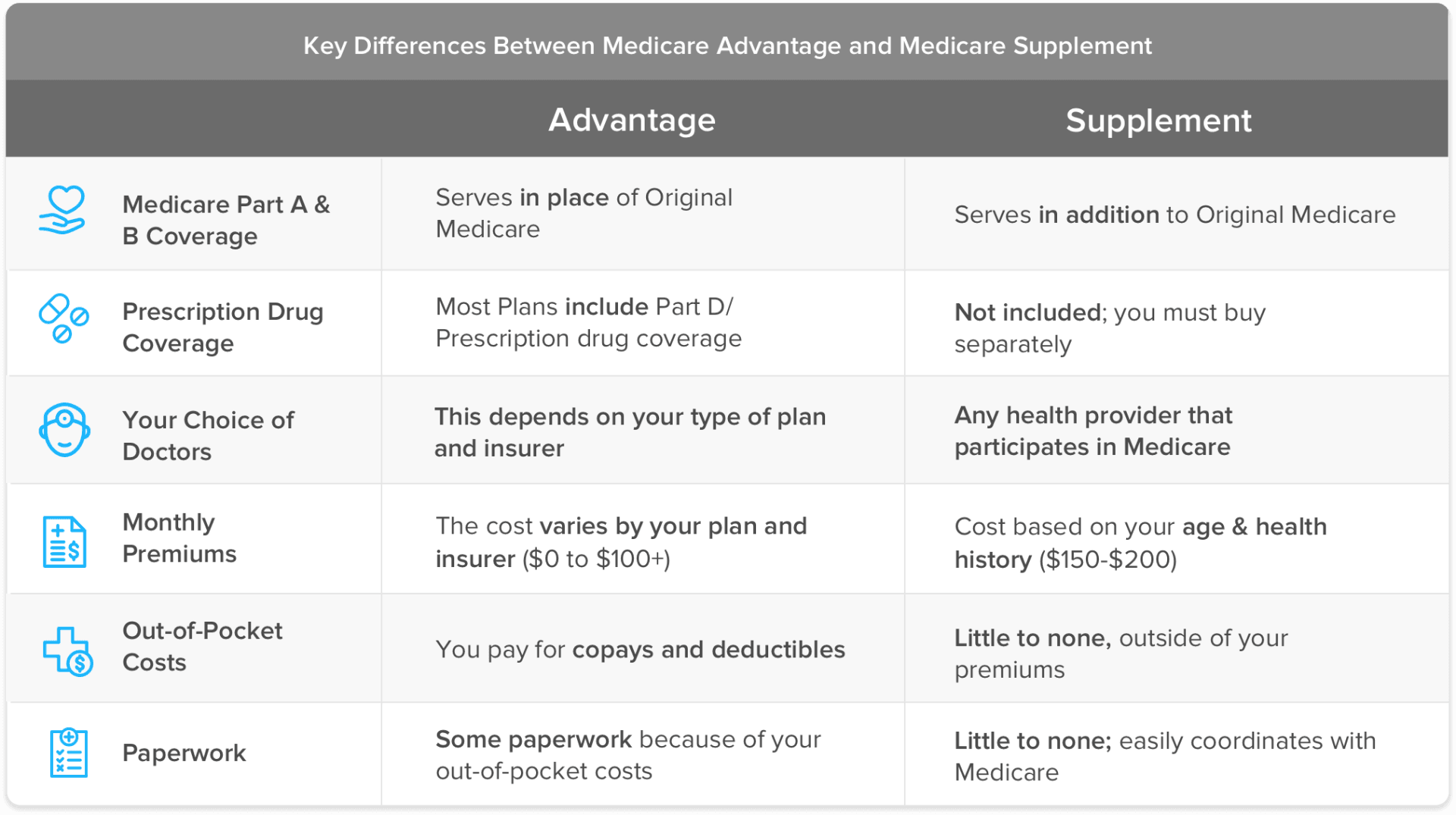

Managed-care plans and Medicare Supplement plans are not the same. This misconception is common. Both provide additional benefits to Original Medicare. However, they serve two totally different purposes. Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan.

MA plans decide on rate amounts, making prices different from plan to plan. Processing payments are done through the private plan, not Medicare.

Medicare Supplement plans or Medigap policies also cover some gaps that Medicare doesnt. However, Supplement insurance works in combination with Original Medicare.

Medigap can help cover expenses such as deductibles, co-payments, and co-insurances. Medicare covers its part of the approved medical charges then Medigap pays its part of the bill. Beneficiaries are responsible to pay the remaining balance.

Don’t Miss: Do I Need Medicare If I Have Tricare

Where Are You In Your Medicare Journey

1 Original Medicare coverage is required in order to purchase a Medicare Supplement plan.

2These programs are NOT insurance and do not provide reimbursement for financial losses. Some restrictions may apply. Programs and services may be added or discontinued at any time. Customers are required to pay the entire discounted charge for any discounted products or services available through these programs. The Healthy Rewards program is provided by Cigna Health and Life Insurance Company. Programs are provided through third party vendors who are solely responsible for their products and services. Program availability may vary by location, and are not available where prohibited by law.

4 Medicare Supplement plans may be subject to medical underwriting, and coverage may be denied.

Notice for persons eligible for Medicare because of disability:

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Tennessee Medicare Supplement Policy Forms

Plan A: CNHIC-MS-AA-A-TN Plan F: CNHIC-MS-AA-F-TN Plan G: CNHIC-MS-AA-G-TN Plan N: CNHIC-MS-AA-N-TN

- Customer Plan Links

Factors That Affect Original Medicare Out

- Whether you have Part A and/or Part B. Most people have both.

- Whether your doctor, other health care provider, or supplier accepts assignment.

- The type of health care you need and how often you need it.

- Whether you choose to get services or supplies Medicare doesn’t cover. If you do, you pay all the costs unless you have other insurance that covers it.

- Whether you have other health insurance that works with Medicare.

- Whether you have Medicaid or get state help paying your Medicare costs.

- Whether you have a Medicare Supplement Insurance policy.

- Whether you and your doctor or other health care provider sign a private contract.

Read Also: What Is A Medicare Wellness Checkup

Social Security Prototype Bill

AMACs founder, Dan Weber, has been in the forefront of the fight to address the problems facing Americas Social Security program. Put simply, the program is paying out more than its taking in, causing a gradual depletion of the Social Security Trust Fund. If left unchecked, projections are that this depletion will cause the Trust Fund balance to be exhausted by 2034, with the result being a scale-down of paymentsas much as 25%to Social Security recipients. As an action-oriented association, AMAC is resolved to do its part to call for action on this very serious problem.Most recently, AMAC has developed a bipartisan compromise bill, titled Social Security Guarantee Act,” taking selected portions of bills introduced by Rep. Sam Johnson and Rep. John Larson and merging them with the Associations original legislative framework to create the new Act.AMAC representatives have been resolute in their mission to get the attention of lawmakers in Washington, meeting with many, many congressional offices and their legislative staffs over the past several years. The Association is gaining ground every day, and you can help–support AMAC in this fight by contacting your congressional representative to add your voice! Visit the Associations website at www.AMAC.us to learn more about AMACs proposed solution and to obtain a copy of a document outlining the steps that AMAC advocates to resolve this very serious problem.

What Is Your Insurance Agents Advice And Why

If you ask 10 insurance agents which is better traditional Medicare or Medicare Advantage Ill bet the majority will say Medicare Advantage. Why? We make more commission in the first year when we sell a Medicare Advantage plan.

Its kind of backwards really. Traditional Medicare with a supplement, a Part D, and a dental plan will typically cost you more, but it pays agents less. Medicare Advantage plans typically cost you less each month, but they pay us more.

Medicare Advantage plans are heavily subsidized by the government. Research shows that many insurance companies that sell Medicare Advantage plans derive a disproportionate amount of profit from these plans. Since these plans are so profitable they really incentivize agents to push them.

Don’t Miss: How Much Is Medicare Copay For A Doctor’s Visit

Can You Have A Medicare Advantage Plan And A Medicare Supplement Plan

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Is It Better To Have Medicare Advantage Or Medicare Supplement

Whether you choose to apply for a Medicare Advantage plan vs. a Medicare Supplement insurance plan depends on your needs. Here are a few factors to consider when deciding whether Medicare Advantage or Medicare Supplement is better for you:

- Do you prefer to have all your coverage rolled into one plan? If so, a Medicare Advantage Plan may be the way to go. Many include Part D drug coverage, as well as vision, dental, and hearing, depending on the plan.

- Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesnt cover.

- Do you need a plan that provides coverage for disabilities or long term care facilities? If so, Medicare Advantage offers Special Needs Plans that provide this type of coverage.

- Do you want the freedom to see any doctors you choose? If so, Medicare Supplement plans have no required network and you can see any doctor that accepts Medicare, even if youre away from home or traveling. Some Medicare Advantage plans may also allow you to see doctors and hospitals that are not in the plans network, giving you additional freedom to choose your doctors.

Also Check: Does Medicare Pay For Penile Pumps

Cons Of Original Medicare

When you enroll in Original Medicare, you are responsible for the Medicare Part B premium, Medicare Part A and Part B deductibles, and Medicare Part A and Part B coinsurances. With these costs, there is no out-of-pocket maximum for Original Medicare.

Alongside the out-of-pocket costs, another con is that Original Medicare does not provide additional benefits. These include dental, vision, hearing, and drug coverage. If you require this coverage, you will have to seek additional policies.

Whats The Difference Between Medicare Advantage And Medicare Supplement

Medicare Advantage combines Medicare Part A and B for comprehensive coverage, all in one plan. It often includes Part D Prescription Drug coverage, too. These are also called Part C plans.

Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare . It is not part of the governments Medicare program, but provides coverage in addition to it.

Don’t Miss: What Are Medicare Part Abcd

Understanding Your Medicare Choices

If you’re nearing age 65 or have already reached that milestone, you’ve undoubtedly heard about Original Medicare and Medicare Advantage. Even if you choose Medicare Advantage, remember you’ll need to first enroll in Original Medicare .

To decide which option is best for you, you’ll need to consider your health care needs, budget, and personal preferences. Read on for a summary of facts that will help you weigh the pros and cons of each coverage approach.

Medicare Star Quality Ratings

Kaiser Permanente Medicare Advantage health plan is rated 5 out of 5 Stars in Washington for 2022. The Medicare Star Rating is based on quality, service, and member satisfaction. Our high rating means you can have peace of mind knowing that you’re getting high-quality care and coverage all in a single plan at a great value.2

Read Also: When Must You File For Medicare

Care Management Appears Somewhat Better For Beneficiaries In Medicare Advantage Plans Than For Beneficiaries In Traditional Medicare

Self-management of conditions. Across both types of Medicare coverage, most people age 65 and older said they felt confident they could manage and control their own health conditions . A somewhat larger share of people with diabetes in Medicare Advantage plans than people with diabetes in traditional Medicare felt confident they could manage their health conditions.

Among people age 65 and older with a health condition, a somewhat larger, though not statistically significantly different, share of those in Medicare Advantage plans than those in traditional Medicare that said they had a treatment plan for their condition. A larger share of Medicare Advantage enrollees said that a health care professional had given them clear instructions about symptoms to monitor and had discussed their priorities in caring for the condition .

Self-care among people with diabetes. Among beneficiaries with diabetes, no significant difference was observed by type of Medicare coverage in the proportion reporting their blood sugar was under control .9 While a larger share of SNP enrollees with diabetes engaged in self-care behaviors than their counterparts in other Medicare Advantage plans or traditional Medicare, the differences did not meet the statistical test for significance .

You May Like: Who Is Entitled To Medicare Part A

Understanding The Parts Of Medicare

Before going into the inner details of traditional Medicare and Medicare Advantage plans, it’s essential to have a good grasp of the different parts of Medicare and how they are bundled together in providing care for you. The four parts of Medicare include:

Part A: This covers hospital-related services and costs. This includes hospital care, home health care, skilled nursing facility care, and hospice care.

Part B: This covers medical-related services such as diagnostic, preventive, and treatment services for various health conditions. It also covers your visits to the doctor, outpatient procedures, medical equipment, x-rays, lab tests, and ambulance services.

Part C: This is the Medical Advantage plan and will form a huge part of our article. It revolves around the health services that are administered by private insurers who have contracts with the general Medicare program. In short, the Medicare Advantage plan is just a different way of accessing Medicare Part A and B but also covers Part D. In the end, it offers an entire package of benefits from private insurers but is regulated by the federal government.

Don’t Miss: Does Medicare Pay For Private Duty Nursing

Medicare Part A Costs

Most people who are eligible for Medicare are also eligible for premium-free Part A. You will most likely be eligible for premium-free Part A if:

- you are eligible for Social Security retirement benefits

- you are eligible for Railroad Retirement Board benefits

- you or your spouse had Medicare-covered government employment

- you are younger than age 65 but have received Social Security or Railroad Retirement Board disability benefits for at least 2 years

- you have end stage renal disease or amyotropic lateral sclerosis

If you are not eligible for premium-free Part A, you can purchase it.

Part A monthly premiums range from $274 to $499 in 2022, based on how much Medicare tax you or your spouse paid while working.

Typically, people who buy Part A must also buy and pay monthly premiums for Part B.

Online Access To Your Plan

myCigna.com gives you 1-stop access to your coverage, claims, ID cards, providers, and more. Log in to manage your plan or sign up for online access today.

Accidental injury, critical illness, and hospital care.

Controlling costs, improving employee health, and personalized service are just a few of the ways we can help your organization thrive.

Use Cigna for Brokers to access everything you need to manage your business and complete enrollments.

Read Also: Does Medicare Cover Disposable Briefs

The Types Of Care Covered

As a senior, Medicare will cover most of your healthcare and medical needs. However, you should always remember that there are other medical services such as cosmetic surgery that the program doesn’t cover. Under the traditional Medicare, you’ll be eligible for several medical services including doctor visits, diagnostics, hospitalization, scans, X-rays, blood tests, and outpatient surgery.

If you choose Medicare Advantage plans, you’ll not only be eligible for all the services provided by the traditional Medicare but you’ll also access additional services such as vision, hearing, and dental care. Some Medicare Advantage plans also offer gym memberships, access to wheelchair ramps, transportation to the doctor’s office, and meal deliveries. Remember, these additional services may vary from plan to plan.

Types Of Medicare Managed Care Plans

Moreover, care plans are private health insurance companies that Medicare-approves. Plans offer care from a specific network of providers at a lower overall cost. Medicare divides managed care plans into different plan types. Classifying each by using acronyms such as HMO, PFFS, PPO, or HMO-POS. Some are more popular, others are more expensive, and not all are available in certain areas.

Premium rates, out-of-pocket expenses, deductibles, coinsurance, and copayment amounts, and restrictions vary. Costs will depend on plan type, where you live, and insurance carrier.

Contact the plan directly for out-of-network coverage options and questions about available benefits.

Recommended Reading: What Preventive Care Is Covered By Medicare

Medicare Advantage Is An Alternative To Original Medicare

Medicare beneficiaries in most parts of the country have the option to enroll in Medicare Advantage instead of Original Medicare. Medicare Advantage plans combine Parts A and B into one private plan, and usually incorporate Part D prescription drug coverage as well, in addition to other benefits such as dental and vision coverage, and sometimes additional supplemental benefits.

But Medicare Advantage enrollees are confined to their plans provider network, rather than having access to doctors and hospitals all across the country. The majority of Medicare beneficiaries select Original Medicare, but more than four out of ten pick Medicare Advantage plans, and that percentage has been increasing with time.

Top 5 Medicare Advantage Plans

Before highlighting the top 5 Medicare Advantage plans, we have to note that it’s impossible to rank the top plans for traditional Medicare as it is run by the government and you can access care from just about any doctor or hospital throughout the country as long as they accept Medicare.

With that in mind, here are the top 5 Medicare Advantage plans.

Also Check: Do You Have To Pay Medicare Part B

Choosing Between Traditional Medicare And Medicare Advantage

If you are eligible for Medicare you can chose between getting Medicare benefits through traditional Medicare or a Medicare Advantage plan. Making this choice is personal and requires individuals to consider their circumstances, including their health, need for flexibility, budget and tolerance for financial risk. Before deciding how to receive Medicare, it is important to understand the different parts of Medicare, how they work together, and the key differences between traditional Medicare and Medicare Advantage. It is also important to ask questions and gather information before deciding whether to enroll in a Medicare Advantage plan.

A. Understanding the Parts of Medicare

Before discussing the differences between traditional Medicare and Medicare Advantage, it is important to understand the different parts of Medicare and how they work together. Medicare has four parts: Part A, Part B, Part C and Part D.

Part C, also known as Medicare Advantage plans, are administered by private insurers that have contracts with the Medicare program. MA is a different way of getting Medicare Part A and Part B coverage and is The plans combine Part A and Part B, and often Part D, into one plan so the entire package of benefits comes from a private insurance company, regulated by the federal government

B. Medigap

C. Key Differences between Traditional Medicare and a Medicare Advantage Plan

- Traditional Medicare