Specialty Drug Tier May Lower Costs

Many Medicare Part D plans place drugs on different tiers that determine what percentage patients pay in cost sharing. Patients typically pay 25% to 50% of the cost for drugs on the highest-priced specialty tier and all drugs on the specialty tier have the same level of cost sharing.

But starting in 2022, Centers for Medicare & Medicaid Services will allow Medicare Part D plans to have a lower preferred specialty tier. This means plans can negotiate with drug makers to get better discounts on specialty tier drugs in exchange for being listed on the preferred tier. Plans can then pass the savings along to patients.

About The Medicare Savings Program

Indiana helps eligible, low-income beneficiaries pay for Medicare with the Medicaid program. Medicaid is a health care program that helps pay for medical services for people who meet specific requirements.

You may be eligible depending on your income and the value of things you own :

| $2,706 | $11,960 |

Assets are things you own, such as checking and savings accounts, certificates of deposit, cash value of life insurance, stocks and bonds. Some things you own dont count toward your asset limit, such as your home and furnishings, your car, burial plots, and, at least $1,500 in life insurance.

These limits are guidelines. The only way to know for sure if you are eligible is to apply.

What Is Troop In Medicare

If you have a Medicare Part D plan, you do have a special MOOP limit, called the TrOOP, short for True Out-of-Pocket limit. Each TrOOP Medicare Part D limit is there to regulate the amount of out-of-pocket costs you have through your drug plan in a year. Once youâve reached your TrOOP Part D limit, youâll exit the âdonut holeâ and enter catastrophic coverage. This means Medicare and your plan will start covering most of your out-of-pocket costs for applicable prescriptions.

While these limits are set by the Centers for Medicare & Medicaid Services , there are other ways you can save money depending on your Medicare Part D plan. These can all help you avoid reaching your TrOOP limit by keeping costs down. If this strategy interests you, check out the Medicareful Plan Finder to compare plans.

Read Also: How To Apply For Medicare In Alaska

What Doesnt Count Toward Troop

Not all the money you spend on your prescriptions counts toward your out-of-pocket limit. For example, the amount your plan covers does not count.

For example, lets say your prescription costs $50. Your copay is $15 and your insurance policy pays $35. Only the $15 you pay for your prescription goes toward your limit. Other items that dont count include monthly premiums and excluded drugs.

CMS considers excluded drugs to be optional, and are therefore not covered. According to the Center for Medicare Advocacy, excluded drugs include:

- Over-the-counter medications

- Drugs to promote weight loss or weight gain, even if they cosmetic use, such as to treat morbid obesity. One exception is that that drugs to treat AIDS wasting are not considered to be for cosmetic purposes and are therefore NOT excluded.

- Fertility medications

- Erectile dysfunction drugs, except when medically necessary and when they arent used to treat sexual dysfunction

- Hair growth and other cosmetic drugs. Note that drugs to treat acne, psoriasis, rosacea and vitiligo are not considered cosmetic drugs.

- Foreign drug purposes

- Vitamins and minerals, except niacin, Vitamin D supplements , prenatal vitamins and fluoride

Consult your formulary if you have more questions about what medications are included in your plan.

What If I Need Additional Assistance Paying For Prescription Drugs

There are various proactive steps you can take to help you afford the cost of your prescription medications. For example, you can switch from generic medications to other lower-cost drugs or choose a Medicare drug plan with additional coverage during the Donut Hole.

You can also apply for the Medicare Extra Help program that provides help to people with limited income and resources. Other resources include State Pharmaceutical Assistance Programs and Pharmaceutical Assistance Programs that pharmaceutical companies provide.

You can also review local prescription drug assistance programs. And a licensed insurance agent can help you compare your Medicare prescription drug plan options so you can find a plan that covers your drugs and meets your budget needs.

Recommended Reading: Is Keystone First Medicare Or Medicaid

Troop Examples And Exclusions

Medicare defines TrOOP as whatever amount you pay out-of-pocket for your prescription medications that count toward your prescription drug plans out-of-pocket threshold. This amount resets to zero at the start of each year. The TrOOP amount includes your annual deductible amount. It also includes the copayment or coinsurance amount that you pay for each individual prescription thats covered by your plan. If/when you enter your plans coverage gap , these costs are generally applied to your TrOOP also, unless the prescription is not covered by your plans formulary , and therefore has not been allowed into your coverage through an exception rule.

State Pharmaceutical Assistance Programs are available in some states and might count toward your TrOOP. These programs may help with your prescription drug costs.

This may also count toward TrOOP: AIDS Drug Assistance Programs , which only cover HIV/AIDS-related medications

There are other scenarios where out-of-pocket spending may not be applied to your TrOOP. If you purchased the prescription outside the U.S. and its territories or if the drugs are not covered by Medicare Part D at all , those costs will not count towards your TrOOP.

Once you have reached your TrOOP amount, Medicare covers most of your prescription drug costs for the rest of the year. Youll typically pay a small copayment or coinsurance amount.

Find Plans in your area instantly!

What You Need To Know About Medicare Part D For 2022 October 2021

Prescription drug costs can be a significant problem for older adults. According to a 2019 report published by the CDC, more than 88% of adults 65+ take at least one prescription drug per month and almost 42% take five or more prescription drugs monthly.

If youll be at least 65 before 2023, its worth looking into how Medicare Part D prescription drug coverage may save you money especially if you are already taking multiple prescriptions. Medicare Open Enrollment is October 15, 2021 to December 7, 2021 for those who are already at least 65. Those turning 65 later in 2021 can take advantage of a special enrollment period. Heres what you need to know about changes to Medicare Part D for 2022.

Recommended Reading: What Age Can I Qualify For Medicare

What Does Medicaid Cover

- If you have Medicare and full Medicaid coverage, most of your health care costs are covered. You can get your Medicare coverage through Original Medicare or a Medicare Advantage Plan.

- If you have Medicare and/or full Medicaid coverage, Medicare covers your Part D prescription drugs. Medicaid may still cover some drugs that Medicare doesnt cover.

- People with Medicaid may get coverage for services that Medicare doesnt cover or only partially covers, like nursing home care, personal care, transportation to medical services, home- and community-based services, anddental, vision, and hearing services.

PACE is a Medicare and Medicaid program offered in many states that allows people who otherwise need a nursing home-level of care to remain in the community. To qualify for PACE, you must meet these conditions:

- Youre 55 or older.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Dont Miss: How Old Do I Have To Be For Medicare

Also Check: How Do I Apply For Medicare Part A

How To Pay For Part D

After youve signed up, youll pay monthly Part D premiums to the insurance company. You may either receive bills or sign up for automatic payments. You also may be able to request that your premium be deducted from your monthly Social Security or Railroad Retirement Board payment.

Medicare beneficiaries with low incomes and few assets may qualify for the federal Extra Help program that givesfinancial assistance to pay for Part D premiums, deductibles and copayments.

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Dont Miss: What Is The Best Medicare Plan To Get

What Doesnt Count Toward My Troop Limit

Medicare Part D premium payments and pharmacy dispensing fees dont count toward your TrOOP limit. TrOOP also doesnt include what you pay for drugs that arent covered by your plan as well as payments made for your drugs by employer or union health plans, TRICARE, VA, Workers Compensation, and some other programs.

As stated above, you also dont get credit for generic drug costs that your Medicare Part D plan pays during the Donut Hole.

Recommended Reading: Does Medicare Cover Any Dental Surgery

Who Pays The Additional Medicare Tax

Not everyone that has earned or unearned income pays the additional Medicare tax. Its based on predetermined income levels based on your taxable income amounts, as outlined below:

| Single taxpayer | |

| Qualified widow with dependents | Over $200,000 |

You are responsible for paying the additional Medicare tax, not your employer, and you only pay the additional tax over the threshold above.

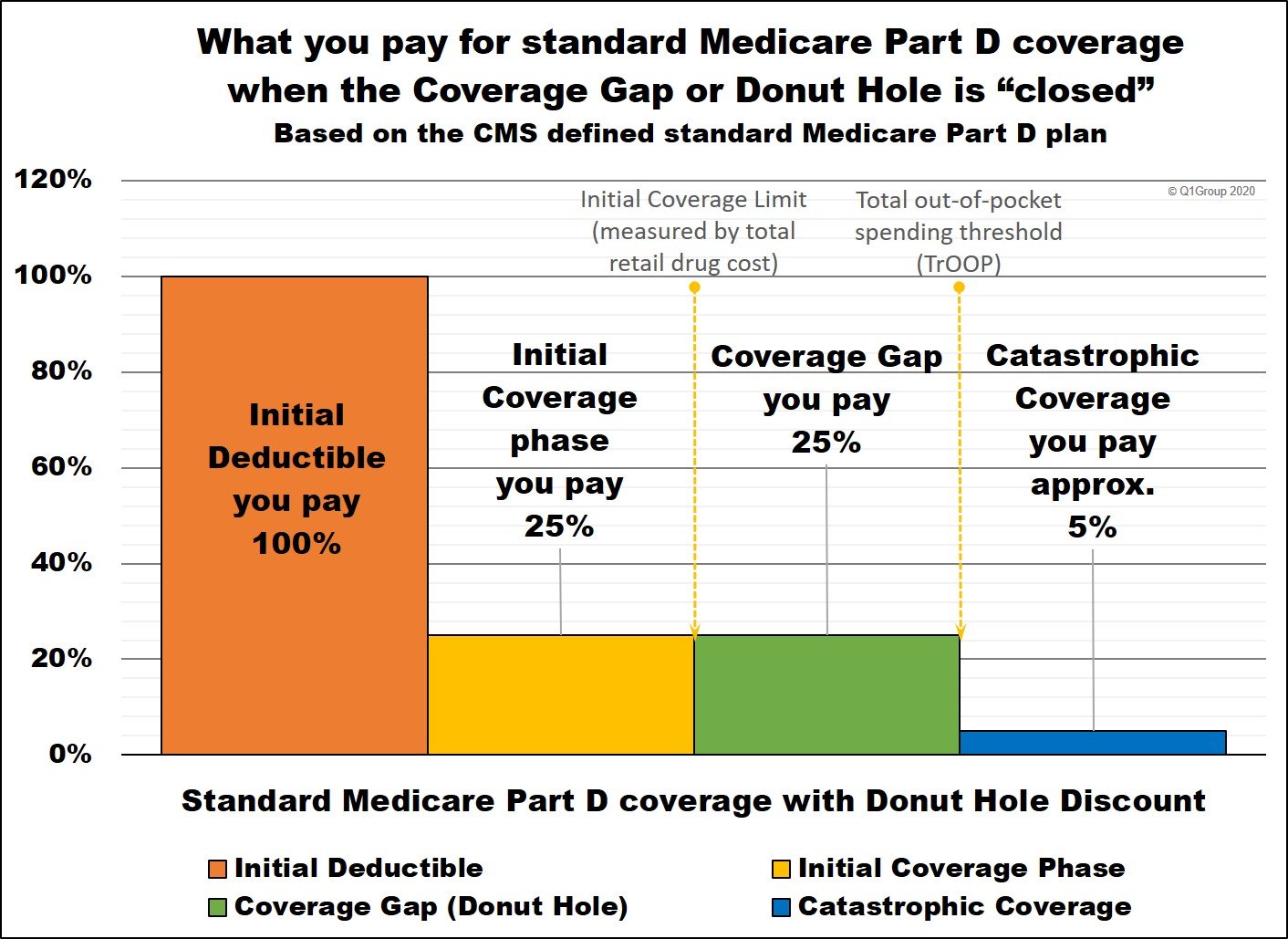

Medicare Part D Standard Drug Benefit

The following table shows the Medicare benefit breakdown for 2020.

2020 Medicare Part D Standard Benefit| Coverage Phase |

|---|

|

|

The costs shown in the table above represent the 2020 defined standard Medicare Part D prescription drug plan parameters released by the Centers for Medicare and Medicaid Services in April 2017. Individual Medicare Part D plans may choose to offer more generous benefits but must meet the minimum standards established by the defined standard benefit.

The 2020 Medicare Part D standard benefit includes a deductible of $435 and 25% co-insurance, up to $6,350. The catastrophic stage is reached after $6,350 of out of pocket spending, then beneficiaries pay 5% of total drug cost or $3.60 and $8.95 , whichever is greater.

2020 Donut Hole Discount:Part D enrollees will receive a 75% Donut Hole discount on the total cost of their brand-name drugs purchased while in the Donut Hole. The discount includes, a 70% discount paid by the brand-name drug manufacturer and a 5% discount paid by your Medicare Part D plan. The 70% paid by the drug manufacturer combined with the 25% you pay, count toward your TrOOP or Donut Hole exit point.For example: If you reach the Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your 2020 total out-of-pocket spending limit.

Also Check: Does Southeastern Spine Institute Accept Medicare

Costs In The Coverage Gap

Most Medicare drug plans have a coverage gap . This means there’s a temporary limit on what the drug plan will cover for drugs.

Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022 , you’re in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs wont enter the coverage gap.

Medicare Part D Coverage Gap

The Medicare Part D coverage gap is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member of a Medicare Part Dprescription-drug program administered by the United States federal government. The gap is reached after shared insurer payment – consumer payment for all covered prescription drugs reaches a government-set amount, and is left only after the consumer has paid full, unshared costs of an additional amount for the same prescriptions. Upon entering the gap, the prescription payments to date are re-set to $0 and continue until the maximum amount of the gap is reached OR the current annual period lapses. In calculating whether the maximum amount of gap has been reached, the “True-out-of-pocket” costs are added together.”TrOOP includes the amount of your Initial Deductible and your co-payments or co-insurance during the Initial Coverage stage. While in the Donut Hole, it includes what you pay when you fill a prescription and of the 75% Donut Hole discount on brand-name drugs, it includes the 70% Donut Hole Discount paid by the drug manufacturer. The additional 5% Donut Hole discount on brand-name drugs and the 75% Donut Hole discount on generics do not count toward TrOOP as they are paid by your Medicare Part D plan.”

Provisions of the Patient Protection and Affordable Care Act of 2010 gradually phase out the coverage gap, eliminating it by 2020.:1

You May Like: Is Medicare Available For Green Card Holders

Is There Also Extra Help For Medicare Part B

While Extra Help only helps you with your prescription drugs, there are other Medicare Savings Programs which are run by the State and may help qualified persons with their Medicare Part B costs for medical insurance. If you qualify for Extra Help, you may also submit your application for the Medicare Savings program in your state. Each state has different regulations about the eligibility. You can get more information at your states Medicaid office or your State Health Insurance Assistance Program .

You May Like: Do You Automatically Get Medicare When You Turn 65

Why Do You Pay The Additional Medicare Tax

The additional Medicare tax was added in 2013 under the ACA. These funds are used to offer the premium tax credit and additional services:

- Closure of the Part D benefit gap, or donut hole

- Inclusion of free vaccines

- Inclusion of free preventive care services

- Inclusion of free screenings for depression, heart disease, diabetes, and some cancers

- Increased chronic care management programs

- Lower premiums for Medicare Advantage plans

- Lower prescription drug costs

You May Like: Does Medicare Cover Inspire Sleep Apnea Treatment

Reviewing Troop And A Little

Posted by Karen Fletcher on November 12, 2008

Calls regarding what to do while in the Part D donut hole continue to pour in on California Health Advocates helpline, comprising 25-30% of all calls this fall. These numbers reflect the national average, being 1 in 4 or 26% of beneficiaries who fill prescriptions fall into this hole during the year. For 2008, people who reach their initial coverage maximum of $2,510 are responsible for paying the next $3,216 out-of-pocket before they qualify for catastrophic coverage.

Once they qualify for catastrophic coverage, beneficiaries are only responsible for 5% of their drug costs. Yet, getting to this point means spending a total of $4,050 in 2008. In 2009, beneficiaries need to spend $300 more, or $4,350 out of pocket, before reaching catastrophic coverage. While in the donut hole, beneficiaries must spend $3,454 out of pocket, or $238 more than in 2008. See chart below.

Not all out-of-pocket expenses count to determine if a beneficiary has reached catastrophic coverage. Knowing what out-of-pocket costs count and what does not count is important. These out-of-pocket costs are often referred to as TrOOP, which stands for true out-of-pocket costs. Below is a review of what does and does not count towards a beneficiarys TrOOP costs, a review of CMS cash price policy, and a list of resources regarding TrOOP costs and help when in the Part D donut hole.

After The Troop Comes Catastrophic Coverage

Once youâve reached your Medicare TrOOP limit, youâll enter whatâs called catastrophic coverage. Donât worry, itâs not as scary as it sounds! Once youâve automatically entered catastrophic coverage for reaching the TrOOP limit, your drug costs are almost completely covered, except for a small coinsurance or copayment for covered drugs. Youâll continue in catastrophic coverage for the remainder of the calendar year.

â â â

Itâs worth remembering that these coverage limits are set by CMS. Part D plans are able to offer lower deductibles than the federally set maximum of $445 in 2021 , but all plans have the same initial coverage limit, and all enrollees have the same out-of-pocket limit. The Medicareful Plan Finder is a great way to find Part D plans in your area and compare the different coverages and costs directly.

Just like you, your health is one of a kind. What works for one person may not for another, so the information in these articles should not take the place of an expert opinion. Before making significant lifestyle or diet changes, please consult your primary care physician or nutritionist. Your doctor will know your own health best.

Each newsletter comes with articles, news, and a special sneak preview for the coming week!

Read Also: How Much Does Medicare Pay For Assisted Living Facility

Why Do You Pay Medicare Tax

The Medicare tax is used to fund approximately 88% of Medicare Part A services for seniors and people with disabilities. These funds are used to pay for current services and also prepay your premiums for Part A when you become eligible for Medicare.

Medicare Part A premiums are broken down into three categories, outlined below. The amount you are responsible for is based on the number of quarter credits that you or a spouse have paid into the system. The maximum amount of quarter credits you can earn in a year is four.

| Under 30 quarter credits |

All revenue from Part A is put into the Hospital Insurance Trust.