Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.17

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.

Do I Really Need Supplemental Insurance With Medicare

Have you ever considered obtaining supplemental insurance? If so, did you also have an Original Medicare plan? Deciding whether or not to purchase a supplemental insurance plan can be a difficult decision. Although it may be a dubious choice at first, you may stand to benefit by purchasing a plan to supplement your Original Medicare. How so? Well, for the many reasons you will see below.

Basics Of Medicare Part D

There are two ways to get prescription drug coverage through Medicare Part D.

- Enroll in a stand-alone Medicare prescription drug plan . If you enroll in a stand-alone prescription drug plan, it works alongside your Original Medicare benefits.

- Or, enroll in a Medicare Advantage plan with prescription drug coverage, or an MA-PD. A Medicare Advantage plan is an alternative way to get your Original Medicare benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.

Prescription Drug plans include formularies, which are a list of the medications that are covered under the plan. Some formularies have tiers. Medications in lower tiers may have lower costs. Generic medications are often included in the lower tiers. When you are preparing for Medicare Part D enrollment, it is important to make sure the medications you take are included in the plans formulary.

Also Check: Is Signing Up For Medicare Mandatory

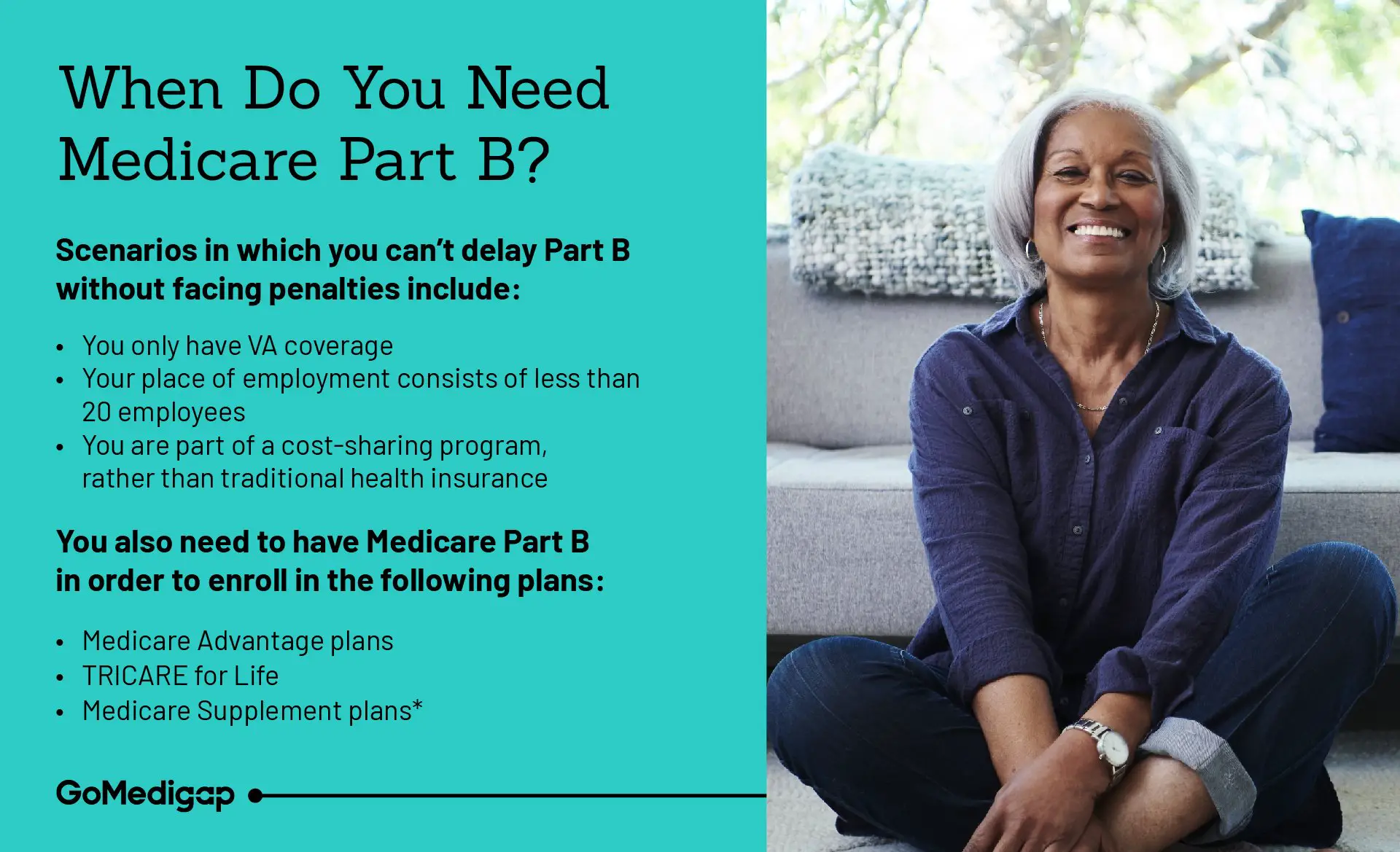

If The Employer Has 20 Or More Employees

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops , without incurring any late penalties if you enroll later. When the employer-tied coverage ends, youre entitled to a special enrollment period of up to eight months to sign up for Medicare.

Note that active employment is the key phrase here. You cant delay Medicare enrollment without penalty if your employer-sponsored coverage comes from retiree benefits or COBRA by definition, these do not count as active employment.

Nor does it count if you work beyond 65 but rely on retiree benefits from a former employer. You must be actively working for the employer that currently provides your health insurance in order to delay Medicare enrollment and qualify for a special enrollment period later on.

The law requires a large employer one with at least 20 employees to offer you the same benefits that it offers to younger employees . It is entirely your choice whether to:

- accept the employer health plan and delay Medicare enrollment

- have the employer coverage and Medicare at the same time

Read Also: What Age Do You Apply For Medicare

Finding Part D Drug Insurance

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings .

If you dont take many prescription drugs, look for a plan with a low monthly premium. All plans must still cover most drugs used by people with Medicare. If, on the other hand, you have high prescription drug costs, check into plans that cover your drugs in the donut hole, the coverage gap period that kicks in after you and the plan have spent $4,430 on covered drugs in 2022.

Read Also: How To Verify Medicare Eligibility Online

Enrollment Period For Medicare Part C

You are eligible to enroll in Medicare Part C during your Initial Enrollment Period . This is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes the month of your birthday, and lasts up to three months after the end of your birthday month.

Enrollment is optional and not automatic. You must first have Medicare Parts A and B, and then you can sign up for Medicare Part C with a private insurance company. With this plan, you make payments directly to your insurance provider.

Other Points To Keep In Mind:

Medicare Advantage plans have maximum out-of-pocket limits that cant exceed $6,700 in 2019, and that limit will continue to apply in 2020. But prescription costs dont count towards the out-of-pocket cap, since it only applies to services that are covered under Medicare Parts A and B.

Part D prescription drug plans vary considerably from one plan to another, but they fall into two basic categories: Basic and Enhanced. As implied by the names, Enhanced plans will provide more benefits, but also tend to have higher monthly premiums. A broker and/or the plan finder tool will help you pinpoint the best plan for your needs, but its helpful to keep the distinction between Basic and Enhanced plans in mind when comparing options.

Don’t Miss: Does Medicare Pay For Someone To Sit With Elderly

Medicare Doesn’t Cover Medical Care Overseas

Medicare usually doesnt cover care you receive while traveling outside of the U.S., except for very limited circumstances . But some medigap plans will cover 80% of the cost of emergency care abroad up to a certain limit. Additionally, some Medicare Advantage plans cover emergency care abroad. Or you could buy a travel insurance policy that covers some medical expenses while youre outside of the U.S. and may even cover emergency medical evacuation, which can otherwise cost tens of thousands of dollars to transport you aboard a medical plane or helicopter.

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

Recommended Reading: Does Medicare Cover Wheelchairs And Walkers

What Should You Do With Your Medicare Supplement Each Year

The Medicare Annual Open Enrollment Period starts October 15th and ends on December 7th of each year. During this enrollment period, youâre likely getting swamped with advertisements, mailers, and phone calls from people trying to get you to switch or buy a new Medicare plan. But what you need to know is that for Medicare Supplements, there is no annual enrollment required!

Your renewal date for your Medicare Supplement could be any time of the year. Letâs say you turned 65 in April, so your Medicare Supplement became effective that month. That means that your personal renewal date for your Medicare Supplement is in April.

So, what do you need to do when your renewal month comes around, if anything?

Is Having Original Medicare Insurance Sufficient

For some people, only having access to Original Medicare may not always be enough. However, for others, having Original Medicare is sufficient, but why? This happens because many low-income Medicare beneficiaries are also eligible for Medicaid benefits. Since many of the Medicare eligibility requirements can be similar to those of Medicaid, applicants are able to fulfill their coverage and cost needs.

For instance, through the dual eligibility coverage, enrollees can cover their coinsurance, copayment and deductible costs while also obtaining coverage for care not granted by Medicare . So, who ends up needing a Medigap plan? Enrollees that only have Medicare assistance are the ones that may require supplemental insurance to fill the gaps of Medicare.

Read Also: Is Medicare A Social Security Benefit

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Understanding Medicare Coverage Plans

Medicare is divided into four parts, named alphabetically from Part A through Part D.

Parts A and B are sometimes referred to as Original Medicare. Parts C and D are newer options. Generally, you can get coverage through Original Medicare or through Medicare Advantage plans if you qualify.

Medicare Advantage plans require that you live in the service area of the plan you want to join.

Also Check: Is Medicare A Form Of Socialism

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

Recommended Reading: What Benefits Do You Get With Medicare

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

Common Services That Medicare Does And Doesnt Cover

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plans Summary of Benefits to learn whats covered.

Medicare has some coverage for acupuncture and it is limited to treatment of chronic low back pain. Some Medicare Advantage plans have benefits that help pay for acupuncture services beyond Medicare such as treatment of chronic pain in other parts of the body, headaches and nausea.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for corrective lenses if an intraocular lens was implanted. Coverage is one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Read Also: How To Receive Medicare Card

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

Can I Get My Health Care From Any Doctor Other Health Care Provider Or Hospital

- Original Medicare

-

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

In most cases, you don’t need a

referral

to see a specialist.

- Medicare Advantage

-

In many cases, youll need to only use doctors and other providers who are in the plans network . Some plans offer non-emergency coverage out of network, but typically at a higher cost.

You may need to get a

referral

-

You can join a separate Medicare drug plan to get Medicare drug coverage.

- Medicare Advantage

-

Medicare drug coverage is included in most plans. In most types of Medicare Advantage Plans, you cant join a separate Medicare drug plan. You can join a separate Medicare drug plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

Don’t Miss: What Age Can You Get Medicare Health Insurance