Does Tricare For Life Cover Silver Sneakers

The simple answer to this question is ,no, tricare does not provide coverage for Silver Sneakers. Silver Sneakers provide you with entry to wellness clubs, and is not offered by either Medicare or TRICARE. You can choose to take on a Medicare Supplement or Advantage plan for advantages like SilverSneakers, yet you ought to consider the impact that it might have on your wellbeing inclusion. Understanding the intricate details of TRICARE and Medicare can be troublesome. In case youre ever in question, you can contact your supplier or a TRICARE delegate for help.

In addition, you ought to consistently talk with your clinical supplier with respect to determination or treatment for an ailment, including choices about the right prescription for your condition, just as preceding endeavor a particular exercise or dietary daily practice.

You May Like: What Does Medicare Part A And B Not Cover

What Is Medicare Supplement Insurance

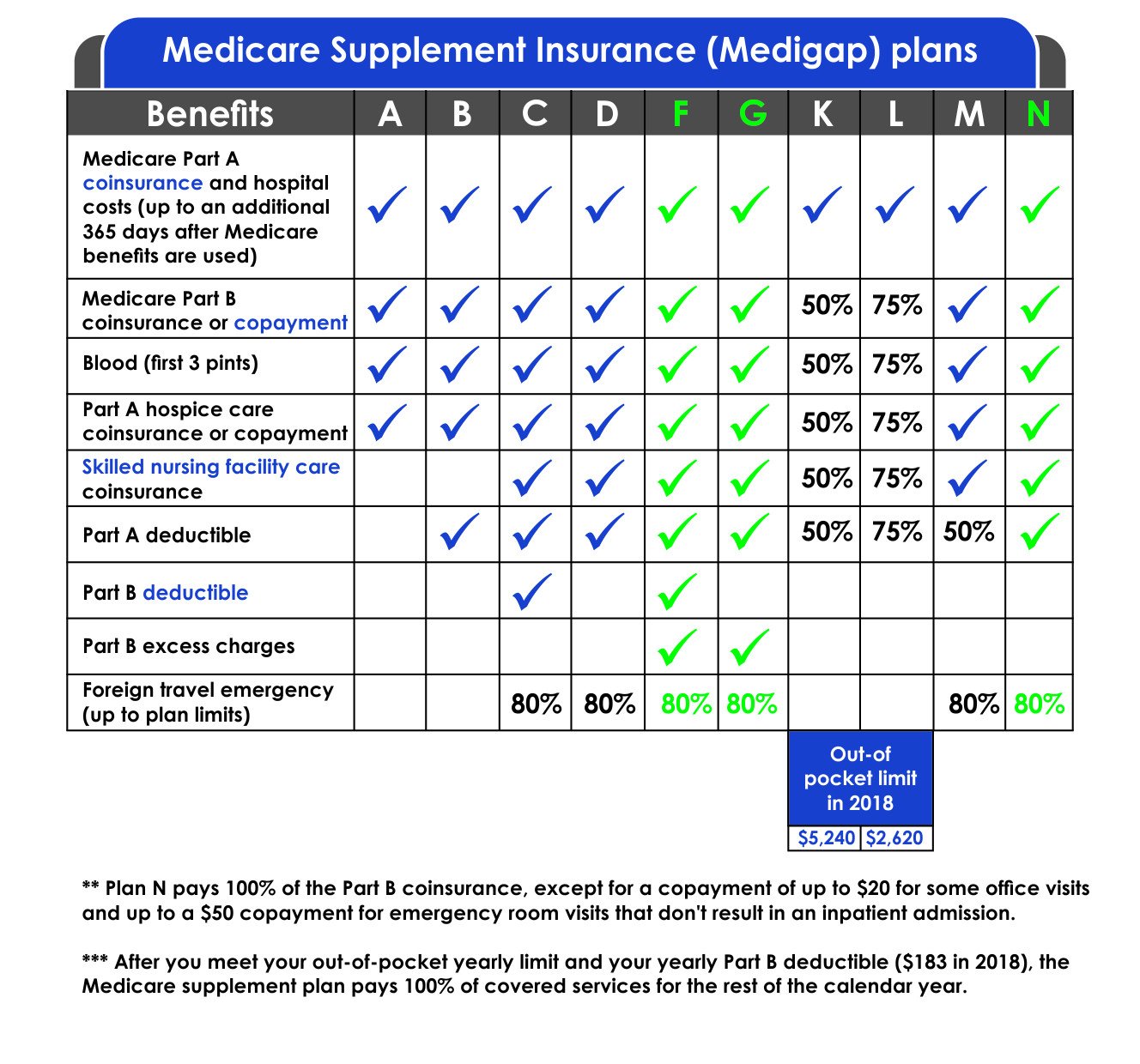

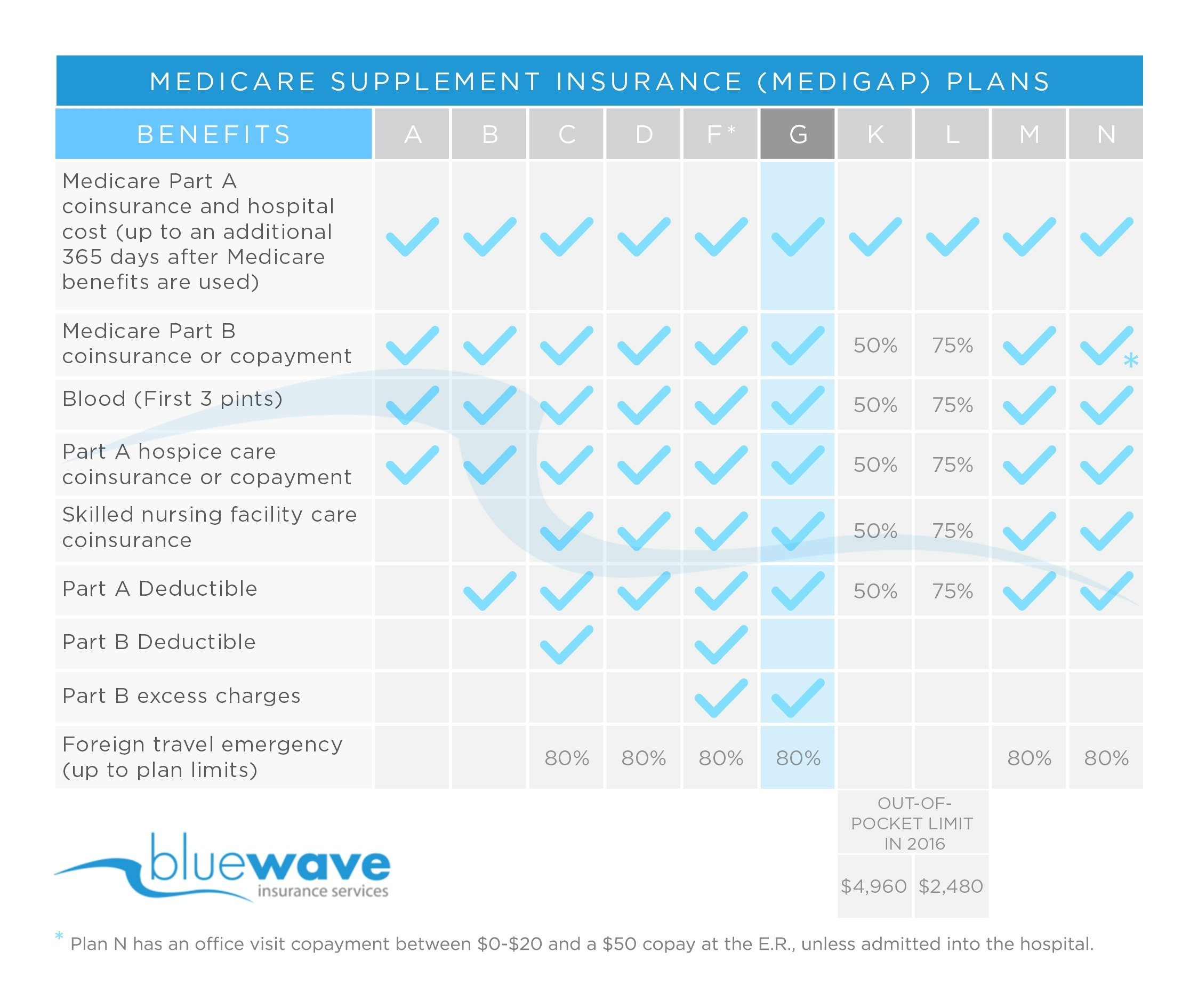

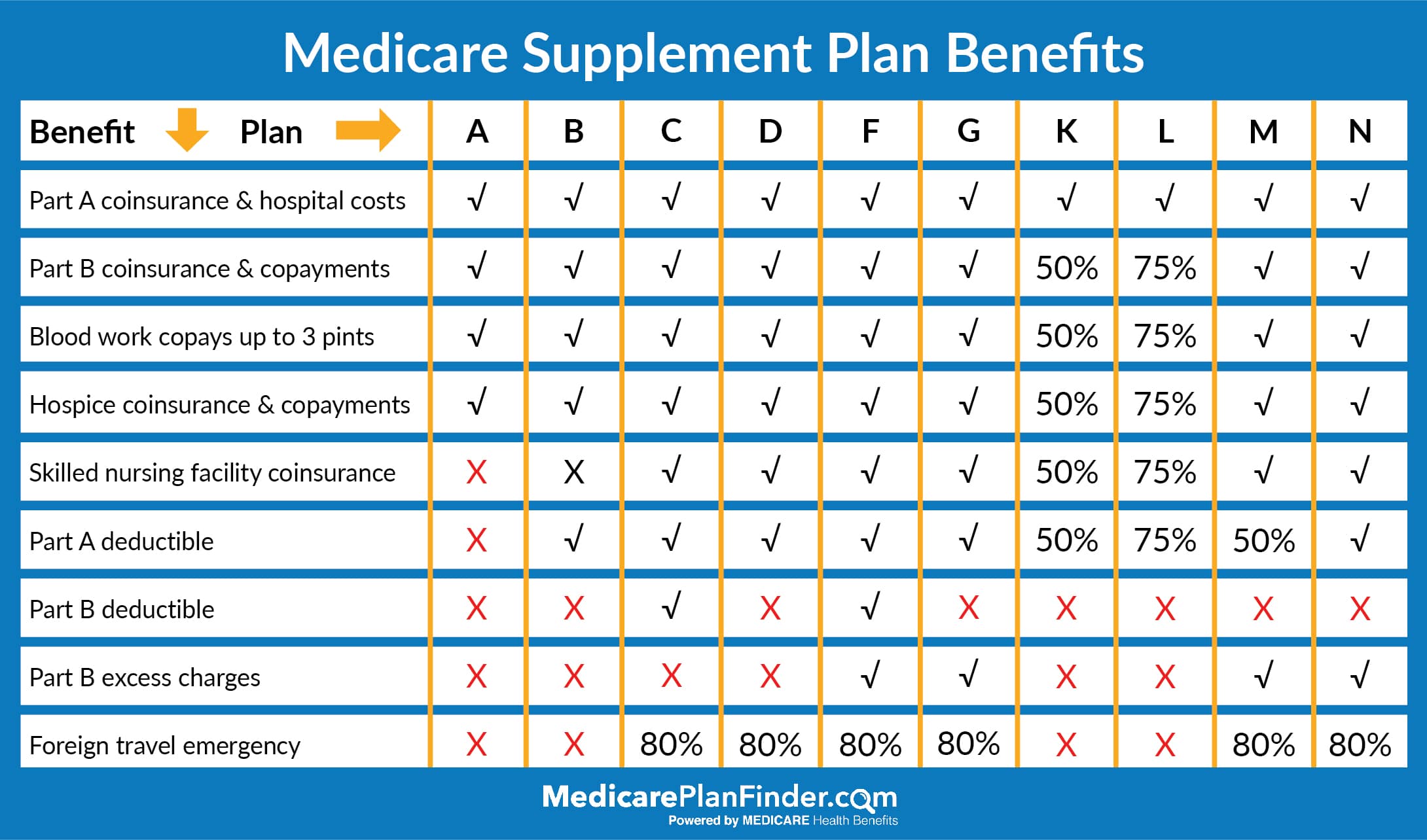

Medicare Supplement Insurance, also known as Medigap insurance, was created to fill in the gaps in costs left behind by Medicare Part A and Part B. Medicare Part A and Part B sometimes require you to pay deductibles, copays, and coinsurances. A Medicare Supplement policy can help you cover these costs.

A Medigap policy only supplements, not replaces, your Medicare Part A and Part B. That means you must enroll in Original Medicare before you can purchase a Medigap policy.

Medigap plans are named after letters, just like Medicare parts. This gives way to some confusion.

Remember, Medicare has Part A, Part B, Part C, and Part D.

Medicare Supplement Insurance has Plan A, Plan B, Plan C, etc., up to Plan N.

Medicare Supplement plans are standardized across almost all states. This means insurance companies cant change the plans to offer more or less benefits. Insurers can, however, decide which plans they will offer, though the government requires them to offer certain plans.

Every insurance company that offers Medicare Supplement insurance has to offer Plan A. If they offer any plan in addition to Plan A, they must also offer either Plan C or Plan F to current Medicare beneficiaries and either Plan D or Plan G to new Medicare beneficiaries.

Like we mentioned earlier, Medigap plans are the same in almost every state, except Massachusetts, Minnesota, and Wisconsin. Well discuss the differences later.

Enroll In Medicare Supplement Plan G

Some plans will allow you to enroll online on their company website. Others may require you to speak with an agent. Regardless, you will need to gather the necessary information to complete your application. There is no option to sign up on the Medicare website.

Every Medicare Supplement Plan G covers the same items. In that way, choosing the best plan is less about coverage than it is about pricing and customer service. After researching the companies offering Plan G in all 50 states , these six companies stood out for their cost structure, website friendliness, and perks.

Don’t Miss: How Do You Qualify For Medicare Part A And B

Does United Healthcare Pay For Gym Membership

Administrative services provided by United HealthCare Services, Inc. or their affiliates. The fitness reimbursement program allows members to earn a credit of $20 per month up to $240 per year for subscribers and enrolled spouses1 by working out at a contracted fitness center at least 12 times per month.

Whats The Purpose Of Medigap

With Original Medicare, you pay the deductibles, copays, and 20% for services you receive from doctors. Medicare Supplement plans can pay some or all of these costs for you. They supplement or fill the gaps in Original Medicare. If Medicare doesnt cover the service, then generally your Medicare Supplement plan doesnt cover the costs either and you would pay for those services yourself.

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

In general, Medicare plans are individual plans and only cover one person per policy. This is a great advantage since a husband and wife with different needs can have different plans. They are able to pick the plan that is right for them.

Read Also: What Is The Average Cost Of A Medicare Advantage Plan

Blue Cross Blue Shield

According to Blue Cross Blue Shield , Plans F and N are available in most areas. When you purchase a Medicare Supplement insurance policy from BCBS, you will have access to the following benefits:

- A 30-day free look periodThis means once you have your Medicare Supplement plan with BCBS, you are allowed 30 days to review the coverage. If you decide to change your mind within this period of time, you can get a full refund.

- Gym benefit Youll have free gym access to several fitness clubs and exercise classes.

- Household discountsIf you and someone that lives with you both have a BCBS Medicare Supplement insurance plan, you may be eligible for a 5 percent discount on your premium.

- Portable coverageYou can use your BCBS Medicare Supplement insurance plan anywhere in the U.S. that accepts Medicare.

- Provider optionsYou can use any doctor who accepts Medicare.

BCBS Plan F has been the most popular and the most comprehensive plan, but its no longer available to new enrollees. The good news is if you had it before January 1, 2020, you can keep it.

With Plan F, you are covered for an array of benefits. These benefits include 100 percent coverage for:

- Your Part A Medicare coinsurance and hospital costs

- Your Medicare Part B coinsurance or copayment

- Part A Hospice Care coinsurance or copayment

- Skilled nursing facility coinsurance

- Emergencies for foreign travel

- The first three pints of blood for a blood transfusion

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best. While prices vary by person and location, here are three top insurance providers to consider as you start your search for the best plan for you. Each of them offers coverage nationwide and holds an A.M. Best rating of A- or higher.

Read Also: How To Apply For Medicare In Kentucky

Tips For Choosing A Medigap Plan

The right plan for you will depend on your needs and budget.

For example, if youre planning on foreign travel, you can select a plan that covers foreign travel emergencies. Plans A, B, K, and L dont offer foreign travel coverage, so they might not be the best choice for you.

Other considerations include:

- How much can you spend on a premium each month?

- How much do you typically spend on each covered expense?

- Do you have any surgeries or procedures that might require an upcoming hospital stay?

Looking ahead at your needs can help you select the best plan for you. The right Medigap plan might be very different depending on your care needs.

As another example, lets say you were planning a total knee replacement in the coming months. You might need both an inpatient hospital and an inpatient skilled nursing facility stay during your recovery.

In this case, it could be helpful to have a plan like Medigap Plan G that covers your Part A deductible, Part A coinsurance, and skilled nursing facility coinsurance.

A Skilled Nursing Care Coinsurance

Medicare Part A covers some skilled nursing facility services. But after 20 days of inpatient skilled nursing facility care, you need to start paying daily coinsurance to keep your coverage going.

For days 21 through 100 in a skilled nursing facility, the daily c-insurance is $194.50 per day in 2022.

Medicare Supplement plans will cover this cost unless you have Plan A or Plan B. If you have any other plan, it will be covered at least partially.

Note: Plan K covers only 50% of the coinsurance and Plan L only covers 75% of it.

Don’t Miss: Will Medicare Pay For Palliative Care

Medicare Supplement Plans: Coverage Costs And More

As you approach age 65, navigating Medicare and all of its parts and plans may sound daunting, but it can be easier than you think. Original Medicare contains two parts: Part A and Part B. Medicare Part A covers hospital care, skilled nursing facility and hospice fees, and is usually premium-free. Medicare Part B covers medical and preventive services, as well as some medical equipment, for which there is a monthly premium .

In addition to Original Medicare, many people choose to purchase a Medicare Supplement plan to cover services like routine hearing, eye exams and other costs not covered by Parts A and B. Heres what you need to know about Medicare Supplement plans.

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

You May Like: Who Is Eligible For Medicare Extra Help

Medicare Supplement Plans Must Adhere To State And Federal Laws

Every Medicare Supplement plan must follow strict federal and state laws. The federal government has 10 standardized Medicare Supplement plans. Below is a chart from the Centers for Medicare and Medicaid Services describing what these plans might cover:

nsurance companies can only sell you a standardized Medicare policy. These policies must be clearly identified as Medicare Supplement insurance.

These standardized policies offer the same primary benefits, along with additional benefits to help you meet your particular health care requirements.

Medicare Supplement Insurance Plan Enrollment And Eligibility

To be eligible to enroll in a Medicare Supplement insurance plan, you must be enrolled in both Medicare Part A and Part B. A good time to enroll in a plan is generally during the Medigap Open Enrollment Period, which begins on the first day of the month that you are both age 65 or older and enrolled in Part B, and lasts for six months. During this period, you have a guaranteed-issue right to join any Medicare Supplement insurance plan available where you live. You may not be denied basic benefits based on any pre-existing conditions** during this enrollment period . If you miss this enrollment period and attempt to enroll in the future, you may be denied basic benefits or charged a higher premium based on your medical history. In some states, you may be able to enroll in a Medigap plan before the age of 65.

Also Check: How Much Does Medicare Pay For Knee Replacement

Top 5 Rated Medicare Prescription Drug Plans For 2022

Home / FAQs / Medicare Part D / Top 5 Part D Plans

When choosing Part D coverage, its important to know which is the best Medicare prescription drug plan for 2022. Also, by knowing what to expect, you can stay ahead of the game.

Drugs can be costly, and new brand-name drugs can be the most expensive. With age, youre more likely to require medications.

Medicares standalone Part D plan can cover you. Part D plans have a monthly premium that insurance companies determine.

There may be several plans as well as companies to choose from in your state. Policies vary by county, so moving may warrant a plan change.

Comparing Medicare Supplement Insurance Companies

The list below includes some of the companies that sell Medicare Supplement Insurance plans in select states across the U.S.

Please note that our guide is meant to be informational and to help you as you start finding the right plan and plan carrier for your needs. Some of the companies listed below may not offer Medigap plans in your area, and you may find a Medicare Supplement carrier in your area that fits your need and isnt on this list.

This list identifies several of the top 10 insurance companies in no particular order.

- Humana

- Medico Insurance Company

- WellCare

Its important to keep in mind that although each companys plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

In other words, Medigap Plan A sold by one company will include the same essential benefits as Medigap Plan A sold by any other insurance company. Their costs and the availability of the types of plans, however, may vary.

Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state.

You can use the chart below to compare each type of 2022 standardized Medicare Supplement plan.

| 80% | 80% |

Recommended Reading: Will Medicare Pay For In Home Caregivers

Medicare Supplement Plans Comparison Chart

- Medigap plans can help you cover the out-of-pocket costs of Medicare.

- You can often choose from among 10 different Medigap plans.

- Medigap plans are standardized, which means theyre the same nationwide.

- Purchasing a Medigap plan when you first become eligible can save you money in the long run.

You can purchase Medicare supplement insurance, also known as Medigap plans, to help cover some of the costs of Medicare.

Youll pay a monthly premium for your Medigap plan, and the plan will pay for costs that would normally fall to you, such as copayments for doctors office visits.

You can choose from among 10 Medigap plans. The plans are standardized across the United States however, your cost will depend on your location and on the company you purchase your plan from.

You can check out the coverage offered by each plan in the chart below.

| Plan A | |

|---|---|

| Skilled nursing facility care coinsurance | no |

Medicare F Went Away Will Plan G Stick Around

When Congress passedthe Medicare Access and CHIP Reauthorization Act of 2015, it changed which Medicare Supplement Plans could be made available to new Medicare beneficiaries. The law required discontinued plans that paid the Part B deductible. This is why, starting on January 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. There are no current plans to discontinue Plan G, and high-deductible plans were made available for the first time in 2020.

Don’t Miss: What Is Medicare Part B Deductible Mean

Does It Matter Which Insurance Company I Purchase My Medicare Supplement Plan From

While it is true that every insurance company must provide identical coverage under each standardized plan type, the prices each charged for that same coverage can vary. Once you identify the plan type that will work best for your specific needs, it is definitely in your best interests to do a bit of shopping around to find the coverage you want at the best possible price.

Aarp Medicare Supplement Insurance Plans

AARP Medicare Supplement insurance plans offered through UnitedHealth are not one size fits all. Instead, coverage consists of 10 different plans offering the same basic benefits, but with varying coverage limits based on your needs. Plans also vary by location.

Heres a sample of benefits included:

| Benefits |

Read Also: Who To Talk To About Medicare

Recommended Reading: When Must You File For Medicare

How To Shop And Compare Medicare Supplement Plan G

When you sign up for Medicare, or during Open Enrollment, you must first decide if you want to be on Original Medicare or Medicare Advantage. Original Medicare has a nationwide network of providers but has fixed benefits. Medicare Advantage plans are based on a local network of providers but can offer additional benefits. If you sign up for Original Medicare, you are eligible for a Medicare Supplement Plan.

Does Medicare Supplement Insurance Cover Prescription Drugs

Medicare Supplement insurance plans sold today donât include prescription drug coverage. But you can sign up for a stand-alone Medicare Part D prescription drug plan to get that benefit.

So, your coverage could consist of:

- Medicare Part A, hospital coverage

- Medicare Part B, medical coverage

- Medicare Supplement insurance

- Prescription drug coverage under Medicare Part D

Don’t Miss: Can You Cancel Medicare Part B

Mutual Of Omaha Medicare Part D Plans

There are two Mutual of Omaha Part D plans. They are the MOO Rx Value PDP and the MOO Rx Plus PDP.

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $480 deductible on all other tiers.

The Plus Plan has a deductible of $480 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

Mutual of Omaha Network Pharmacies

The Value plan allows you to get your tier 1 generics for $0 through mail order or a preferred pharmacy.

Further, this carrier includes an extensive pharmacy network like CVS, Walmart, and various local shops.

Mutual of Omaha Part D Reviews

Mutual of Omaha has been in the Supplement industry since Medicare began. Those looking for a reliable company could find benefits here.

While theyre new to the Part D sector, we dont doubt the quality of coverage. The top-rated insurance carrier helps many people each day, by incorporating Part D into their business plan, theyre able to assist even more.

Silverscript Medicare Prescription Drug Plans

There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan.

All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

For example, someone with a few generics would find the Plus plan to be more insurance than necessary.

On the contrary, a person with many brand name drugs could find the Plus plan is more suitable than the Choice policy.

SilverScript Network Pharmacies

The preferred pharmacies with SiverScript vary depending on which policy you have. For those with the Choice plan, there are fewer options.

For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores.

Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

CVS Caremark Mail Order pharmacy is an option with your plan, so if you want to skip driving to the pharmacy, you can!

SilverScript Reviews

Both plans offer $0 copays for preferred generics at preferred pharmacies during the initial coverage phase.

SilverScript is one of the largest Part D insurers. They have 24/7 customer service, online tools, and medication programs to keep you on track.

The only downside I can think of, they only offer two plans. Many of the other top companies have at least three options.

You May Like: What Is A Medicare Discount Card