What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

How To Enroll In Medicare Part D

You can enroll in a Medicare Part D plan during initial enrollment for Medicare parts A and B.

If your prescription drug plan isnt meeting your needs, you can change your Medicare Part D option during open enrollment periods. These open enrollment periods happen twice throughout the year.

Costs depend on the plan you choose, coverage, and out-of-pocket costs. Other factors that affect what you may pay include:

- your location and plans available in your area

- type of coverage you want

- coverage gaps also called the donut hole

- your income, which can determine your premium

Costs also depend on medications and plan levels or tiers. The cost of your medications will depend on which level your medications fall under. The lower the level, and if theyre generic, the lower the copay and cost.

Here are a few examples of estimated monthly premium costs for Medicare Part D coverage:

- New York, NY: $7.50$94.80

- Atlanta, GA: $7.30$94.20

- Des Moines, IA: $7.30$104.70

- Los Angeles, CA: $7.20$130.40

Your specific costs will depend on where you live, the plan you choose, and the prescription medications youre taking.

You May Like: Is Marriage Counseling Covered By Medicare

Low Income Subsidy Questions

No. The “extra help” is a subsidy that people with Medicare and Medicaid automatically qualify for without having to complete an application.

If you do not have Medicaid, but Medicaid pays your Medicare Part B premium, you automatically qualify for “extra help” and you don’t need to apply.

You may still be eligible for “extra help” to pay for the Medicare prescription drug plan premiums. To apply for extra help, you should visit or call your local Social Security Administration office or apply on line at

Enrollment Period For Medicare Part C

You are eligible to enroll in Medicare Part C during your Initial Enrollment Period . This is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes the month of your birthday, and lasts up to three months after the end of your birthday month.

Enrollment is optional and not automatic. You must first have Medicare Parts A and B, and then you can sign up for Medicare Part C with a private insurance company. With this plan, you make payments directly to your insurance provider.

Read Also: How Often Does Medicare Pay For A1c Blood Test

Medicare Part D Enrollment Has Doubled Since 2006 Now Totaling 45 Million People In 2019

Figure 1: Medicare Part D Enrollment, 2006-2019

A total of 45 million people with Medicare are currently enrolled in plans that provide the Medicare Part D drug benefit, representing 70 percent of all Medicare beneficiaries. This total includes plans open to everyone with Medicare, including stand-alone PDPs and MA-PDs, and plans for retirees of a former employer or union. Part D enrollment has doubled since the program started in 2006, when the number of enrollees was 22.0 million, or roughly half of all Medicare beneficiaries.

We Are A Preferred Pharmacy For Elixir Insurance

Low cost. Great Coverage. Caring Service.

Elixir Insurance is a Prescription Drug Plan with a Medicare contract. Enrollment in Elixir Insurance depends on contract renewal.

Other pharmacies are available in the Elixir Insurance network. Customers can choose from many Med D plans in which Rite Aid participates.

You May Like: What Is The Average Medicare Supplement Premium

Open To Anyone With Medicare

Medicare Part D plans are open to everyone eligible for Medicare in the U.S. and U.S. territories. Generally, that means anyone 65 years old or older and some younger people with certain disabilities. You cannot be denied coverage for health reasons. Participation is voluntary, which means you get to decide if you want to enroll or not. If you have Medicare and Medicaid, you will be enrolled automatically, so there is no lapse in your Medicaid prescription drug coverage. The annual open enrollment period is October 15 to December 7, for coverage beginning January 1. If you decide to join later, your monthly premiums may be higher because there’s an additional fee for late enrollment.

What Will I Pay For Part D Coverage

CMS has announced that the average Part D plan will cost $33/month in 2022. But the plans are issued by private insurers, and theres significant variation in terms of the benefits, the formularies and the pricing. Among the Part D plans that are available in 2022, premiums range from under $6/month to more than $207/month.

High-income enrollees pay extra for their Part D coverage. For 2022, the additional premiums range from $12.40/month to $77.90/month.

The premium adjustment for high-income enrollees is based on income tax returns from two years prior, since those are the most recent returns on file at the start of the plan year . Theres an appeals process you can use to contest the income-related premium adjustment if youve had a life-change event that has subsequently reduced your income.

In addition to the premiums, youll pay a copay or coinsurance for drugs. The donut hole in Part D plans has closed, thanks to the Affordable Care Act. It was fully closed as of 2020: Enrollees with standard Part D coverage now pay 25% of the cost of generic and brand name drugs while in the donut hole, which is the same percentage they pay before entering the donut hole.

Once you select a PDP, there are four ways to pay the premium:

- deducted from your personal account

- charged to credit or debit card

- billed monthly or

Read Also: How To Sign Up For Medicare Part D

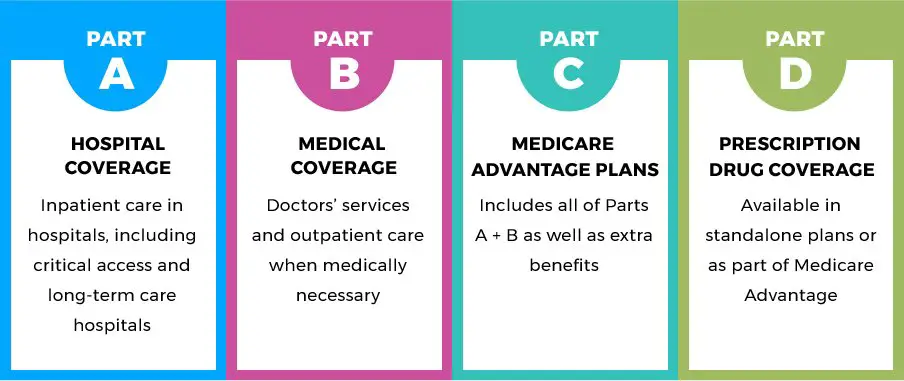

What Does Medicare Part D Cover

Medicare Part D offers prescription drug plans that cover both generic and brand-name drugs. Each policy has a standard level of coverage and its formulary lists. Prescription drug costs and availability may vary based on your Part D plan, insurer and location. All plans must offer the same drug categories, but drug brand names vary based on the formularies.

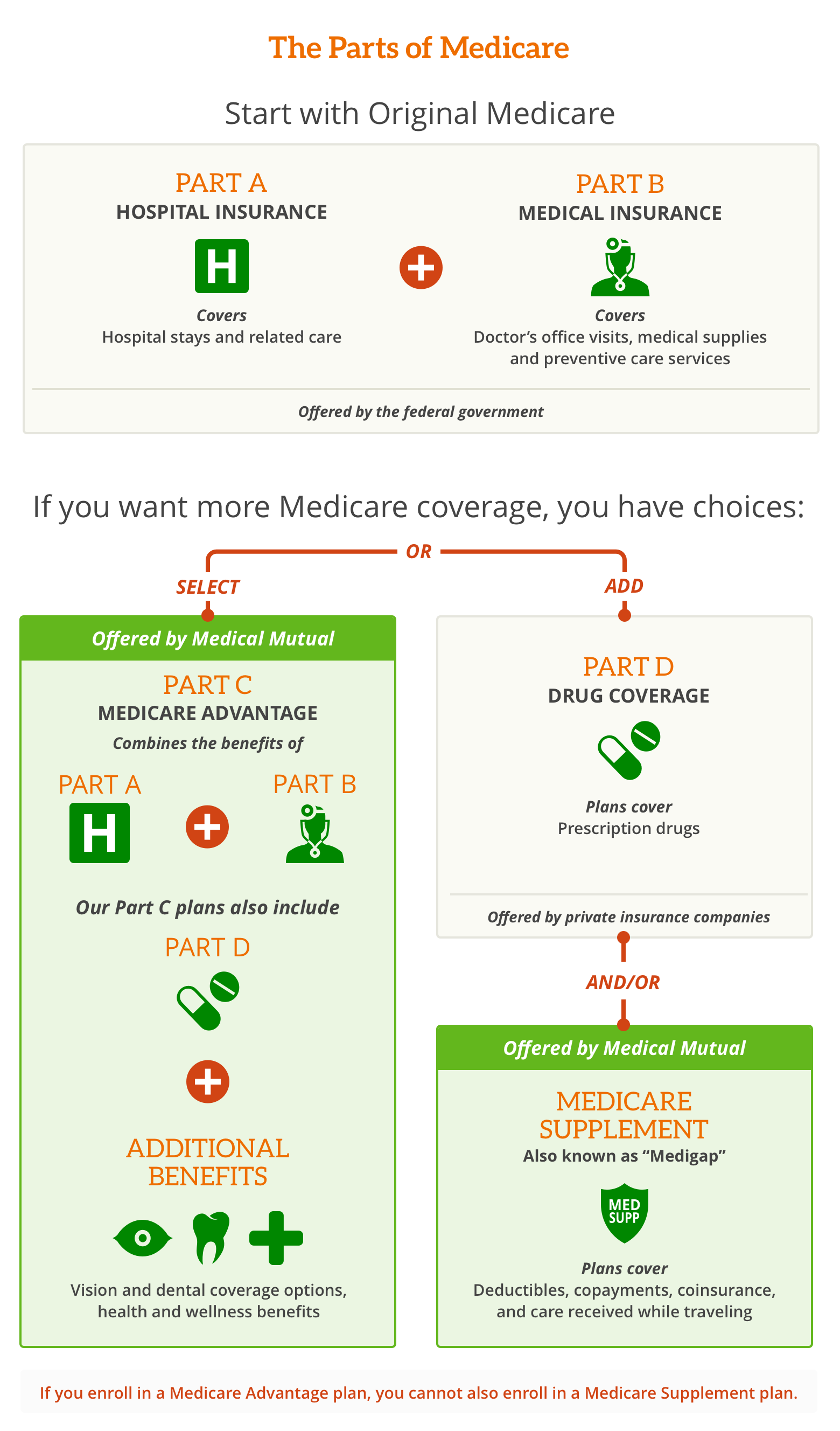

You can get Medicare Part D coverage by:

- Adding standalone Medicare Part D coverage to your Original Medicare benefits

- Enrolling in a Medicare Advantage plan that includes Part A, B and D

D Plan Premiums And Benefits In 2022

Premiums

The 2022 Part D base beneficiary premium â which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment â is $33.37, a modest increase from 2021. But actual premiums paid by Part D enrollees vary considerably. For 2022, PDP monthly premiums range from a low of $5.50 for a PDP in Colorado to a high of $207.20 for a PDP in South Carolina . Even within a state, PDP premiums can vary for example, in Florida, monthly premiums range from $7.70 to $174.30. In addition to the monthly premium, Part D enrollees with higher incomes pay an income-related premium surcharge, ranging from $12.30 to $77.10 per month in 2021 .

Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it does not have a hard cap on out-of-pocket spending. Between 2021 and 2022, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, as they have in prior years, and will have to pay more out-of-pocket before qualifying for catastrophic coverage .

- The standard deductible is increasing from $445 in 2021 to $480 in 2022

- The initial coverage limit is increasing from $4,130 to $4,430, and

- The out-of-pocket spending threshold is increasing from $6,550 to $7,050 .

Figure 6: Medicare Part D Standard Benefit Parameters Will Increase in 2022â

Don’t Miss: Can You Get Medicare If You Work Full Time

There Are Two Types Of Plans

Plans come in two basic types. The most simple is a prescription drug plan , which covers only drugs and can be used with your traditional Medicare and/or a Medicare supplement plan. The other type combines a prescription drug plan with a Medicare Advantage plan and includes medical coverage for doctor visits and hospital expenses. This kind of plan is called Medicare Advantage plus Prescription Drug, or MA-PD.

Cvs Health : Best Plan Features

Medicare stars: 3.75 out of 5

Avg. monthly cost: $35

Avg. Part D drug deductible: $250

NAIC Complaint Index: Variable based on subsidiary

CVS Health and its subsidiaries, Aetna and Silverscript, are very popular for prescription drug coverage, accounting for about 23% of all Medicare Part D enrollments.

Plans are affordably priced, and the SilverScript SmartRx plan costs just $7.15 per month. The strongest coverage is available with the SilverScript Plus plan, which has a $0 deductible across all drug tiers and additional gap coverage.

A key advantage of these plans is that members get access to the digital tools of CVS Caremark. This includes resources for prescription pricing, discounts, deductible tracking, spending summaries and more.

Note that CVS Caremark mail order pharmacy had the worst customer satisfaction of all pharmacies studied by J.D. Power. This reveals that even when plan coverage is strong, there could be frustrations when ordering medications via mail.

If you want to combine your prescription drug coverage with other types of Medicare, Aetna offers some of the cheapest Medicare Advantage plans on the market.

Don’t Miss: How To Apply For Part A Medicare Only

Use Medicare Star Ratings To Compare Plans

Every year, Medicare evaluates plans based on a 5-star rating system. The CMS rates the quality of all Medicare Part D plans according to various quality metrics such as customer satisfaction and benefit accessibility.

A plan with a higher quality rating may be able to use that as leverage to charge a higher premium, but higher star ratings doesnt necessarily always correlate with higher costs.

You Can Consider Medicare Advantage Plans With Prescription Drug Coverage

Medicare Part D can come in the form of a standalone plan or as part of a Medicare Advantage plan. Medicare Advantage plans are required to cover everything covered by Original Medicare , and most plans also offer extra benefits such as coverage for dental, vision, hearing and other services that Original Medicare doesnt cover.

Most Medicare Advantage plans include prescription drug coverage as an added benefit. These plans are called Medicare Advantage Prescription Drug plans, or MA-PD. The average cost of these plans is on par with standalone Part D plans, and many MA-PD plans are available for a $0 premium.

You May Like: How To Get A Lift Chair From Medicare

How Much Does Medicare Part D Cost In 2022

- The average Part D plan premium in 2022 is around $33 per month, and the standard Part D deductible is $480 per year, though plan costs can vary. Learn more about Medicare drug costs and compare plans to see if there are $0 deductible plans available where you live.

Costs are among the first concerns many Medicare beneficiaries may have about Part D Medicare prescription drug. So how much does Medicare Part D cost?

According to the Centers for Medicare & Medicaid Services , the average cost of a Medicare Part D plan in 2022 will be approximately $33 per month. That represents a 4.9% increase from the 2021 average of $31.47 per month.

But what exactly factors into the cost of a Medicare Part D plan, and how are premiums influenced?

You can compare Medicare Part D prescription drug plans online for free, with no obligation to enroll. If you find a plan you want and are eligible, you can enroll online from the comfort of your own home. You can also call to speak with a licensed insurance agent who can help you compare different plans, and they may be able to help you enroll find a plan that covers the drugs you take at a price you can afford.

How Do I Know If I Should Sign Up

You will need to review your options carefully to see if a Part D plan is right for you. Part D plans are designed to provide financial savings to most people with Medicare. As insurance plans, they provide protection against future, unexpected costs. They also provide additional financial assistance for people with lower incomes.

Recommended Reading: What Age Do You Register For Medicare

For People With Both Medicaid And Medicare

The Medicare Modernization Act of 2003 added prescription drug benefits for Medicare beneficiaries and is known as Medicare Part D. Medicare Part D offers prescription drug coverage through Medicare. A Medicare Part D eligible individual is one who is entitled to or enrolled in Medicare benefits under Part A and/or Part B.

Dual eligibles are people who have both Medicare and Medicaid.

Dual eligibles receive their prescription drug coverage through Medicare rather than through the Medicaid program. Medicare Part D replaces Medicaid as the pharmacy coverage for dual eligible enrollees.

If enrollees do not participate in a Medicare prescription drug plan, they may lose all their Medicaid benefits. However, some people on Medicare and Medicaid may receive a letter from their employer or union stating that if they enroll in Medicare Part D they will lose the health care benefits provided by the union or employer. If an enrollee has received this letter, they may disenroll from the Medicare Prescription Drug program by calling 1-800-MEDICARE . They must also give a copy of this letter to their Medicaid worker in order to continue receiving Medicaid benefits.

Where You Live Your Insurance Provider And Your Income Can Affect Your Part D Premiums

Insurance of any kind is typically at the mercy of the local market and economy. Premiums vary between large cities and small towns depending on things like cost of living, available resources and local competition among insurance carriers.

Medicare Part D does not have standardized premiums the way Part A and Part B do. The insurance company selling a Medicare Part D drug plan has the discretion to set their own premiums, deductibles and copayments within certain parameters. Its not uncommon to see two very identical Part D plans sold in the same area by two different insurance companies with slightly different premiums.

The chart below shows examples of some Medicare Part D drug costs for Los Angeles, CA.1 The sample does not reflect the complete selection of plans in the area and is used to display examples of how plan costs can vary from one plan to another.

Sample Part D Plan Costs

| Plan Name |

|---|

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

Read Also: How Much Does Medicare A And B Cost Per Month

Introduction To Medicare Part D

This section constitutes an introduction to Part D. For more detailed information on any of the topics in this section, please click on the links within the topics. There, you will also find relevant legislative, statutory and CFR citation.

Prior to 2006, Medicare paid for some drugs administered during a hospital admission , or a doctors office . Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. This Act is generally known as the MMA.

The Part D drug benefit helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies.

Unlike Parts A and B, which are administered by Medicare itself, Part D is privatized. That is, Medicare contracts with private companies that are authorized to sell Part D insurance coverage. These companies are both regulated and subsidized by Medicare, pursuant to one-year, annually renewable contracts. In order to have Part D coverage, beneficiaries must purchase a policy offered by one of these companies.

The costs associated with Medicare Part D include a monthly premium, an annual deductible , co-payments and co-insurance for specific drugs, a gap in coverage called the Donut Hole, and catastrophic coverage once a threshold amount has been met.