Does Medicare Supplement Cover Deductibles

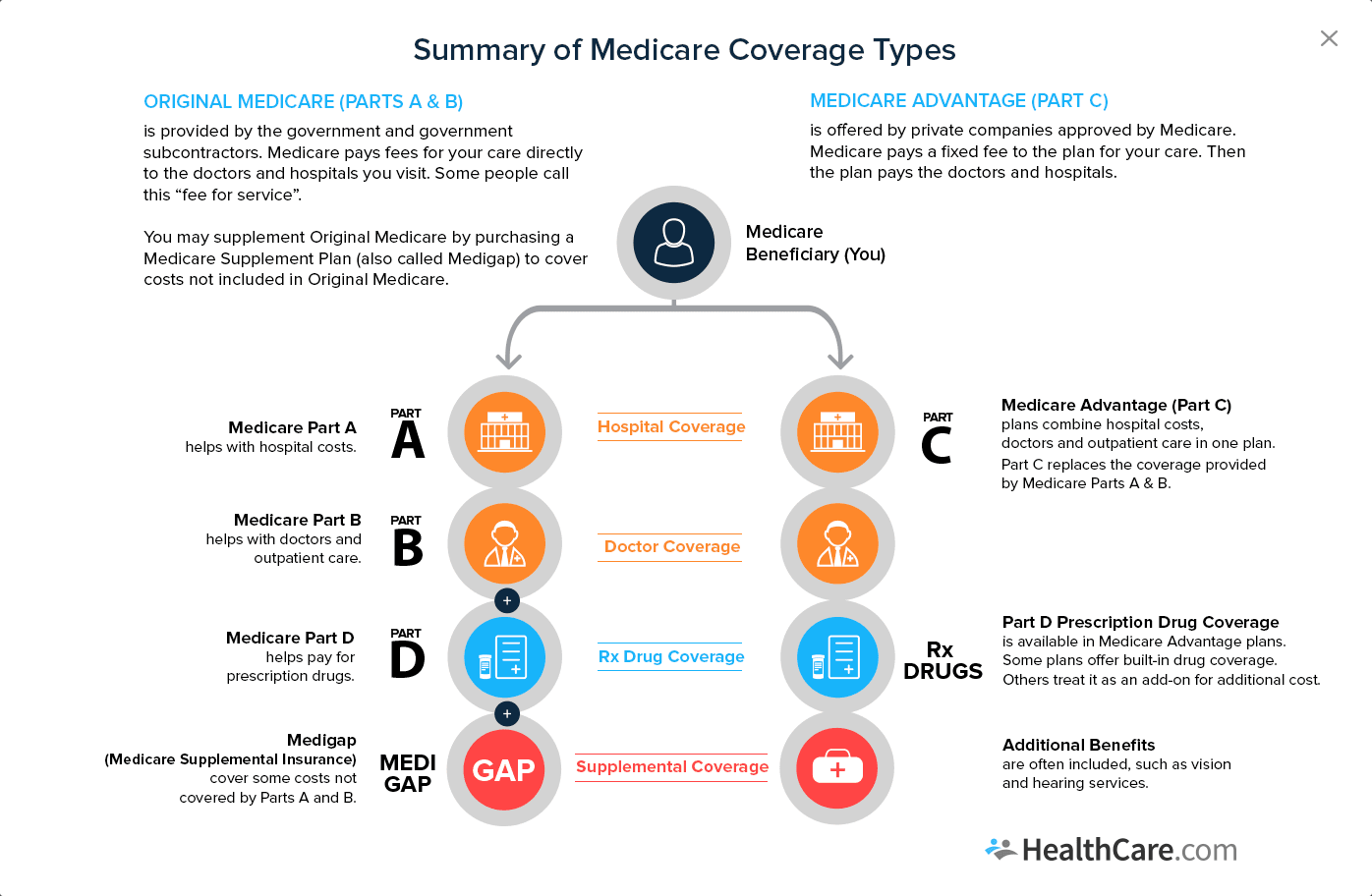

Original Medicare covers the costs of many healthcare-related services for millions of Americans. Part A and Part B cover a wide array of services and care, but many Medicare recipients find that their total out-of-pocket costs associated with Original Medicare can be higher than they are comfortable with. Medicare recipients can purchase supplemental insurance to help cover some of the costs that you are responsible for paying with Original Medicare. Medicare Supplement, or Medigap, plans can help to pay many out-of-pocket expenses that you incur when you have Original Medicare, including deductibles.

What is Medigap Supplement Insurance?While Original Medicare does offer coverage for an array of different medical services and supplies, the costs associated with them often include a monthly or annual premium and an annual deductible. Some services require you to pay coinsurance, usually 20 percent of the Medicare-approved amount as long as you visit a physician who accepts assignment. These costs can add up, especially if you have unexpected medical costs or have a chronic illness that requires continued care and services. Part A and Part B also have annual deductibles. In 2019, the Part A inpatient hospital deductible is $1364 and the Part B deductible is $185.

Are You Eligible to Purchase a Medicare Supplement Plan?

Related articles:

People With Esrd Can Join Medicare Advantage Plans

Under longstanding rules, Medicare Advantage plans have been unavailable to people with end-stage renal disease unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which gives people with ESRD access to any Medicare Advantage plan in their area as of 2021.

Many people with ESRD will still find that Original Medicare plus a Medigap plan and Medicare Part D plan is still the most economical option overall, in terms of the coverage provided. But in some states, people under 65 cannot enroll in guaranteed-issue Medigap plans, or can do so only with exorbitantly high premiums. And some of the states that do protect access to Medigap for most beneficiaries under 65 do not extend those protections to people with ESRD. Without supplemental coverage, there is no cap on out-of-pocket costs under Original Medicare.

Medicare Advantage plans do have a cap on out-of-pocket costs, as described below. So for ESRD beneficiaries who cannot obtain an affordable Medigap plan, a Medicare Advantage plan could be a viable solution, as long as the persons doctors and hospitals are in-network with the plan.

Does Everyone Have To Pay The Part B Deductible

Some Medicare enrollees arent directly responsible for the Part B deductible:

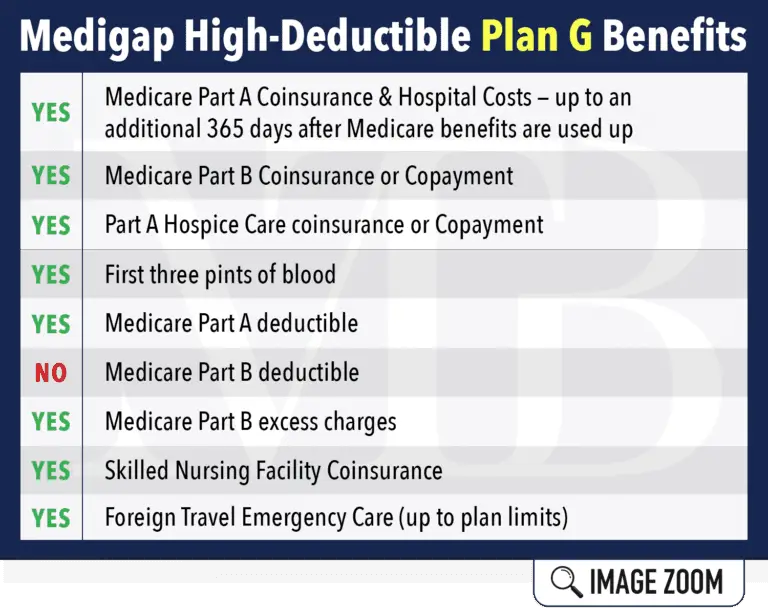

- Medigap plans C and F cover the deductible .

- Enrollees who have Medicaid or retiree health benefits from an employer generally dont have to pay the Part B deductible, as the other coverage picks up the tab.

- Some Medicare Advantage plans have no deductibles and low copays benefits into one plan for the enrollee, with cost-sharing that can differ greatly from the standard Original Medicare cost-sharing).

But according to a Kaiser Family Foundation analysis, about 19% of Original Medicare beneficiaries only have Medicare Parts A and B. They dont have Medigap coverage, retiree health benefits from a former employer, or Medicaid. These enrollees have to pay the full Part B deductible if and when they need services that are covered under Medicare Part B. For 2021, that deductible is $203.

After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%. But again, supplemental coverage can pay some or all of this 20% cost, leaving the enrollee with far lower out-of-pocket costs than they would have under Part B by itself.

Read Also: How Much Medicare Is Taken Out Of Social Security Check

What Is The Medicare Part D Deductible For 2020

A Medicare Part D deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to pay its share of your medications that are covered. This is for a calendar year and resets every January 1. The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible. Of those, 69% use the $435 maximum established by CMS. If you get your Medicare Part D coverage through a Medicare Advantage plan, you may not pay a deductible.

Once you reach your Medicare Part D deductible, your plan pays its share of your medications. Most plans use a tiered copayment system. Generic medications are in the lower tiers and generally have a copayment of between $0 and $10 each. Expensive brand-name and specialty medications may have a higher copayment or coinsurance amount.

What Are The Options To Cover Medicare Costs

While Medicare Parts A and B provide coverage for some healthcare services, you could still end up paying a significant out-of-pocket amount for services that arent covered, plus premiums, deductibles, co-pays, coinsurance and medications.

To cut down on those high costs, many seniors choose to supplement their Original Medicare coverage. You have several options for doing that.

Medicare Part C: Medicare Advantage Plans

These plans work similarly to private health insurance, and are offered through private insurance companies that have contracted with Medicare. Medicare Advantage plans replace your Original Medicare coverage. All Medicare Advantage plans include Part A and Part B services, and most but not all Medicare Advantage plans include prescription drug coverage.

Similar to private health insurance, many different types of Medicare Advantage plans are available depending on your location.

Medicare Part D: Prescription Drug Coverage

These plans add prescription drug coverage to your Original Medicare coverage. Many different Medicare Part D plans are available the specific plans and costs depend on your location. For all plans, youll be responsible for out-of-pocket payments, including a premium and deductible.

Before you decide on a Medicare Part D plan, gather a list of any medications you take and the dosage. Youll need that information to ensure a plan covers the medications you need and you get more accurate cost information.

Medicare Supplement Plans

Read Also: Will Medicare Pay For An Inversion Table

What Is Not Covered By Original Medicare

There are certain healthcare products and services that are excluded never covered by Medicare Parts A and B. If you need one of those services, youll have to pay for the full cost. Surprisingly, many of the services Medicare doesnt cover are necessary for seniors to stay in good health. For example, Original Medicare doesnt cover:

- Drugs you take at home

- Vision exams or glasses

- Most dental care

- Hearing exams or aids

- Elective procedures

- Routine foot care

- Acupuncture

- Care furnished outside the US

- Care necessary as a result of war

- Investigational devices

- Anything thats not medically necessary

- Custodial care

As you can see, there is a long list of items and services Medicare wont pay for. And even if you pay for them out of pocket, those payments wont go toward covering your Part A or Part B deductibles. Luckily, options are available for you to get extra coverage beyond what Original Medicare offers. But before you start comparing options for better Medicare coverage, youll want to make sure youre eligible.

MORE ADVICE

Medigap plans fill the gaps in your Original Medicare coverage.

What Happens Once You Reach The Deductible

Once you meet the required Medicare Part B deductible, you will typically be charged a 20 percent coinsurance for all Part B-covered services and items for the remainder of the year.

Coinsurance is the amount of the total bill that you must pay. A 20 percent coinsurance means you would be responsible for 20 percent of a medical bill, while Medicare would pay the remaining 80 percent.

Its worth noting that the 20 percent you will pay as coinsurance is 20 percent of the Medicare-approved amount.

The Medicare-approved amount is the maximum amount that a health care provider is allowed to charge for a service or item as determined by Medicare.

Lets use the broken leg scenario from above and say that the cost of the pair of crutches was $80.

- If the injury happened before reaching your Medicare Part B deductible, you would be responsible for the full $80 .

- If you had already met the Part B deductible prior to the injury happening in this hypothetical situation, you would only be responsible for $16 . Medicare would then pay the remaining $64.

Also Check: Does Medicare Pay For Foot Care

How Much Is The Medicare Part A Coinsurance For 2021

The Part A deductible covers the enrollees first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage during that same benefit period, theres a daily coinsurance charge. For 2021, its $371 per day for the 61st through 90th day of inpatient care . The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

Medicare Part D Premiums And Costs

Medicare Part D plans are sold by private insurance companies as an optional addition to Original Medicare. These plans provide their members with coverage for the prescription drugs they need to survive. Each Part D plan has a uniqueformulary, which is the list of drugs it covers.

It is important to ensure that the drugs you are currently taking or expect to take in the future are included in your plans formulary. Otherwise, you could end up paying for those drugs entirely out of pocket.

Also Check: How To Check Medicare Status Online

Hospital Stay Deductible & Coinsurance

The amount you pay in out-of-pocket expenses depends on the length of the hospital stay.

- For each benefit period, there is a Medicare deductible of $1,408

- Day 1-60: $0 for each benefit period.

- Day 61-90: $352 per day for each benefit period.

- Lifetime reserve days : $704 for each day.

- Beneficiaries are 100% responsible for all costs beyond lifetime reserve days .

Original Medicare will cover up to 90 days of inpatient hospital care during each benefit period. Recipients also have an additional 60 days of coverage- these are called lifetime reserve days. These additional 60 days may only be used once.

What Is The 2022 Medicare Part B Deductible

The estimated rate for the 2022 Part B deductible is $217 per year . This is an increase of $14 per year from the 2021 Part B deductible

Premiums for Medicare Part C and Medicare Part D are on an opposite trajectory. While Medicare Part A and Part B premiums have historically gone up nearly every year, premiums for private Medicare plans have been dropping in recent years.

Medicare Advantage plans with prescription drug coverage featured an average monthly premium of $33.57 in 2021. Medicare Advantage plan premiums have trended downward in recent years, so we will soon know if 2022 Medicare Advantage premiums will be lower again next year.

Standalone Part D plans had an average monthly premium of $41.64 in 2021 and will likely be somewhere near that amount in 2022.

Read Also: Are Cancer Drugs Covered By Medicare

Medicare Advantage In : Premiums Cost Sharing Out

Medicare beneficiaries have the option of receiving their Part A and Part B Medicare benefits through a private Medicare Advantage plan. Since 2011, the federal government has required Medicare Advantage plans to cap out-of-pocket spending, and these plans may provide additional benefits or reduced cost sharing compared to traditional Medicare. They are also permitted to limit provider networks, may require prior authorization for certain services, and sometimes carry an additional premium on top of the monthly Part B premium all Medicare beneficiaries pay. This brief provides current information about Medicare Advantage premiums, cost sharing, out-of-pocket limits, and supplemental benefits, as well as trends over time. Two companion analyses examine trends in Medicare Advantage enrollment and Medicare Advantage plans star ratings and federal spending under the quality bonus program.

What Is The Medicare Deductible For Hospice 2021

Part A covers hospice completely with no deductible. Hospice includes hospice nurses, medications, and counseling. Medicare Advantage plans actually do not cover hospice, rather the beneficiary reverts back to Original Medicare, at least for the hospice care. The Medigap policy likewise does not cover the cost. Medicare picks up the entire tab.

That being said, there is some confusion about what hospice covers. I had a clients family member call to cancel her mothers supplement. Someone in hospice told her because hospice was paying for everything, she could save money by canceling the Medigap policy. But hospice will not cover things like your primary care physician visiting you, a special hospital bed, or other medical treatments that are not life-sustaining but you might prefer.

Those services fall under Original Medicare and your supplement or your Medicare Advantage plan. For the short time someone is on hospice, I would focus on them rather than a few dollars.

Recommended Reading: Does Medicare Cover A1c Test

How The Part B Deductible Works

David schedules his annual wellness check in January. Its the first time hes using Part B in the new year, but he pays nothing for this appointment anyway because its preventative care. However, during this appointment, his doctor suggests David get his heart checked out.

David schedules an appointment with a cardiologist who orders a stress test and some blood work. Davids bill comes to $400, of which he pays $238$198 plus 20% of the remaining $202.

For his follow-up appointment a few weeks later, David pays just 20% of the total bill because hes already met his deductible for the year.

Medicare Part A Deductible Conclusion

I have discussed Medicare Part A as Part A without a supplement or referring to Medicare Advantage. Many Medicare beneficiaries have only Medicare Part A or Part A with Part B. They do not have a supplement, advantage plan, or other insurance. So this speaks to them.

However, to understand Part A and how it fits within the bigger picture of Medicare health insurance, it is important to understand what it is, what it covers, and what it costs in its various iterations.

If this is confusingand I dont blame you for feeling that waygive us a call. Medical expenses can be astronomical. If the correct insurance is not in place with sufficient coverage, costs may surprise and overwhelm you. Not following the eligibility requirements could result in surprise penalties and permanent premium hikes from Medicare.

Call 402-614-3389or email [email protected] for a free consultation to make sure all letters of your Medicare alphabet are in place.

Read Also: How Can I Get My Medicare Card Number

Medicare Deductibles Affect Insurance Costs

It is important to note for those on Medigap policies or even Medicare Advantage that Medicare deductibles impact insurance costs. This extended coverage is the obligation of your Medigap policy or MA plan. Consequently, the insurance company actuaries must factor in the probability of occurrence and cost.

The cost is transferred to the price of the Medigap plan or co-pays on the MA plan. Many clients wonder why their Medigap plan premium is going up? There are many factors, but when Medicare lowers the amount it will cover, the insurance companies pass on the cost to the consumer.

How Much Does Medicare Part B Cost

Medicare consists of several different parts, including Part B. Medicare Part B is medical insurance and covers medically necessary outpatient care and some preventative care. Together with Medicare Part A , it makes up whats called original Medicare.

If youre enrolled in Part B, youll pay a monthly premium as well as other costs like deductibles and coinsurance. Continue readingto take a deeper dive into Part B, its costs, and more.

You May Like: How To Know If I Have Medicare

What Is Medicare Part A

Medicare Part A covers four areas of care: inpatient hospital stays, skilled nursing facility stays, home healthcare, and hospice.

Inpatient hospital covers, as you might expect, when patients go to the hospital. Patients can go to the hospital for treatment, they may even stay overnight, but they may not necessarily have been admitted as an inpatient. Inpatient hospital is its own category, billing codes, and Medicare costs. A patient is generally not admitted for an inpatient hospital stay unless the condition is serious enough to warrant at least a two-day hospital stay.

Observation in the hospital is not admittance. You are under hospital observation, but you are not an inpatient. Medicare Part A deductible will not cover observation in 2021, and most Medicare Advantage plans will not cover hospital observation, either. However, some MA plans are starting to.

Check your MA plans evidence of coverage before proceeding. Note that a doctor must sign an order for a medically necessary service in the hospital for a person to be admitted as an inpatient.

Is Medicare Part B Premium Tax Deductible

Yes , your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since its not mandatory to enroll in Part B, you can be rewarded with a tax break for choosing to pay this medical expense.

Medicare Part B is very rarely free, there are monthly premiums most people have to pay for their Medicare Part B coverage. There are several programs that can help to reduce the cost of your Medicare Part B premium and even cover the cost entirely.

You May Like: When Do You Receive Medicare Card

New Medicare Changes For 2021

Home / FAQs / General Medicare / New Medicare Changes for 2021

Every year, changes come to Medicare. In 2021, Medicare has several new benefits and adjustments to speak of. As a beneficiary, its important to keep up with these developments. Below, well provide the information you need to know about how Medicare is different this year including how much Medicare costs in 2021.