Beware Of Medicare Scams

There are many facets of Medicare that need to be considered once youre eligible, but scams to keep your eye out for might not be on your radar.

We usually have a Medicare 101 session once a year, and we just had a speaker on Medicare scams, said Brian Parkes, executive director of the TriCounty Active Adult Center in Pottstown.

Attendees were given tips by a speaker from Senior Medicare Patrol on how to detect scams.

They were encouraged to review their statements of benefits for things like doctors overbilling Medicare or charges for medical equipment they never received or dont need, Parkes said.

AARP has its own Fraud Watch Network that serves as watchdogs for such scams. It emphasizes that criminals target medical benefits to reap millions of dollars and offer ways to stay safe on its website. The more knowledge you have about potential scams, the better equipped you will be to stay ahead of scams.

Never give your Medicare number to anyone who calls on the telephone, AARP advises. Share it only with your health care providers or if you have placed a call to Medicare.

If someone offers you free genetic testing in person or online, AARP states it is a scam.

Medicare does not pay for these tests unless they are ordered by a medical professional, AARP advises.

Other phone calls to look out for that are fraudulent, according to AARP, are those where someone promised you COVID-19 tests, medical equipment or medical services in return for your Medicare number.

Enroll In Medicare Parts A And B When The Time Is Right

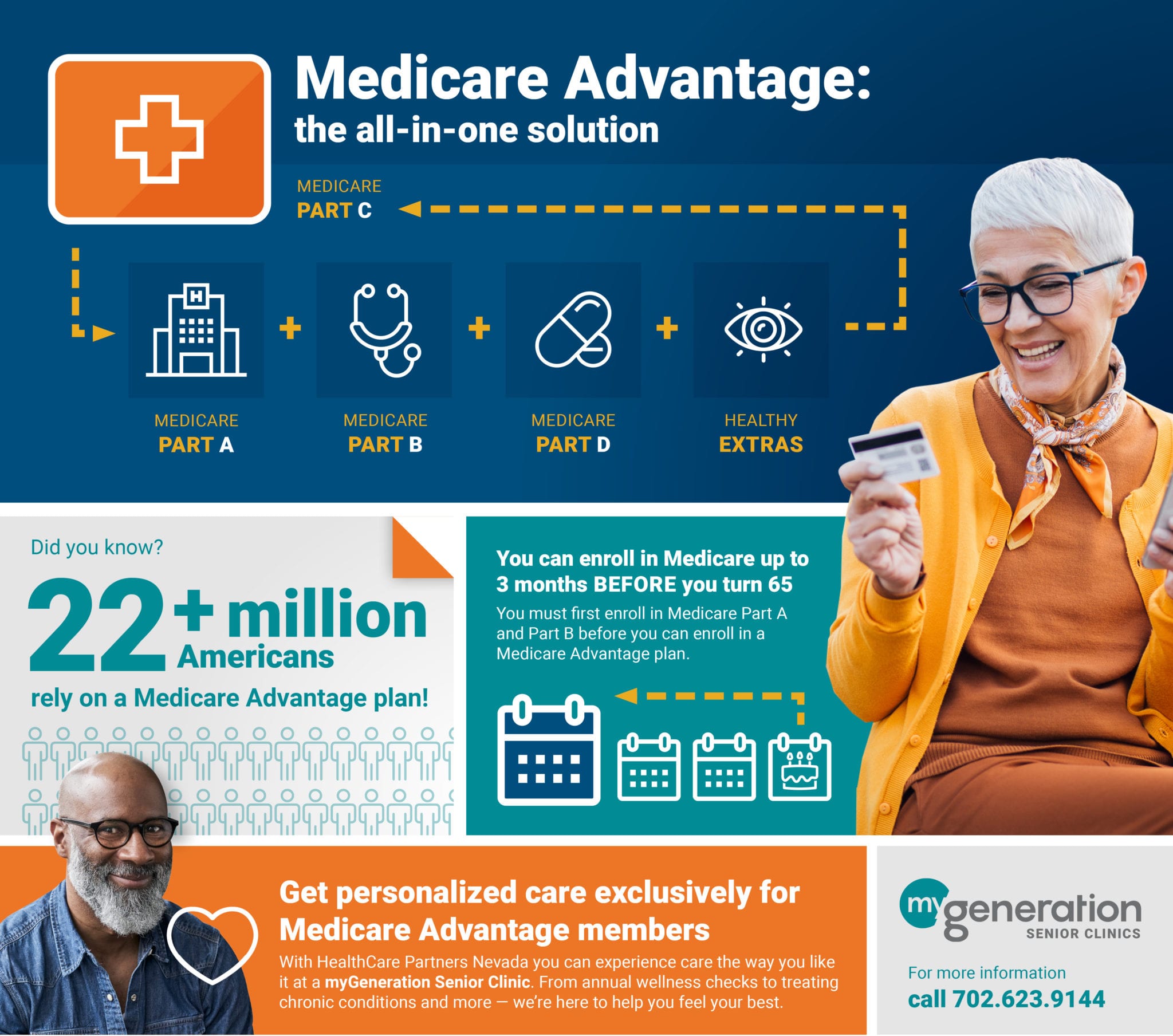

Seniors who are ready to switch to Medicare Advantage need to start by making sure they are enrolled in Medicare Parts A and B. Some people are automatically enrolled, but others need to apply. Both situations are explained below.

- Automatic Enrollment: If youre getting Social Security or Railroad Retirement Board Benefits at least three months prior to turning 65, then youll be automatically enrolled in Medicare Parts A and B. Youll also be automatically enrolled if you have been getting disability benefits for more than 24 months or if you have ALS or ESRD and have started receiving disability . Note that ESRD patients are always eligible for Original Medicare but may not be eligible for most Medicare Advantage plans except for some Special Needs Plans.

- Enrollment by Application: If you dont meet one of the requirements listed in the previous point, then youll need to actively apply for Medicare. If youre still unsure of your eligibility or enrollment status, you can use this tool that Medicare provides. The tool can also help you calculate your Parts A and B premiums.

If you are automatically enrolled or if you apply when first eligible then youll get a Medicare number and card as early as three months before your Parts A and B coverage begins. Youll use the enrollment dates and Medicare member number on your card to enroll in a Medicare Advantage plan when you have a Medicare Advantage enrollment period.

Who Is Eligible To Receive Medicare Benefits

Two groups of people are eligible for Medicare benefits: adults aged 65 and older, and people under age 65 with certain disabilities. The program was created in the 1960s to provide health insurance for senior citizens. Older Americans had trouble finding affordable coverage, which spurred the government to create a program specifically for this portion of the population. Its an entitlement program in that the federal government finances it to some degree, but its also supported and financed directly by the very people who use it. Youre eligible for Medicare because you pay for it, in one way or another.

To receive Medicare benefits, you must first:

- Be a U.S. citizen or legal resident of at least five continuous years, and

- Be entitled to receive Social Security benefits.

That means that every U.S. citizen can enroll in Medicare starting at age 65 . When we say Medicare, were referring to original Medicare. This comprises Parts A and B. Part A covers hospital care while Part B covers medical care. There are four parts to the program Part C is a private portion known as Medicare Advantage, and Part D is drug coverage. Please note that throughout this article, we use Medicare as shorthand to refer to Parts A and B specifically.

To qualify for Medicare based on ESRD, you first need to meet the following qualifications:

Don’t Miss: Is Synvisc Covered By Medicare In Australia

Advantages Of Medicare Advantage

- Research suggests that those enrolled in Advantage plans can save more money on certain healthcare services. In addition, all Part C plans have an out-of-pocket maximum.

- Plan variety. There are roughly five types of Advantage plan structures to choose from, including HMO, PPO, PFFS, SNP, and MSA. Each of these has its own advantages and disadvantages.

- Coordinated care. If youre enrolled in a Medicare Advantage plan, youll likely have the benefit of coordinated care from in-network providers.

Combine Medicare And Veterans Benefits

Veterans who served honorably in the Army, Navy, or Air Force may be eligible for veteran benefits. For more flexibility and peace of mind, retirees with VA benefits are encouraged to enroll in Medicare. Medicare allows seniors to see doctors and facilities that are not affiliated with the VA, which might be helpful for specialty appointments. Prescription medicines are covered by Medicare Part D, which also allows seniors to fill their prescriptions at local pharmacies rather than through the VAs mail-order service.

According to the official Medicare website, if a veteran does not sign up for Medicare when they are first eligible but wants to sign up later, they may be charged a penalty cost.

Also Check: How Old Before Medicare Starts

How To Enroll In Medicare And When You Should Start Your Research Process

Getting older means making more decisions, from planning for your kids futures to mapping out your retirement years. One of the most important decisions that youll make as you prepare to retire or head into your 60s is what to do about health insurance. If youve been working, then you probably have a plan through your employer. Most people do. But once you turn 65, you become eligible for Medicare, a government-backed program designed specifically for seniors. There are also other reasons that you might be eligible for Medicare, which can muddy the waters when youre researching your options for coverage.

Medicare is administered by the Centers for Medicare and Medicaid Services , but technically speaking, youll enroll via Social Security. In this article, well outline eligibility guidelines so that you can sign up with confidence, and as always, if you have any questions about how to sign up, or what plan might be best for your needs, were always available toll free to answer any questions you might have. Well also highlight the importance of enrolling on time to avoid penalties and delays in coverage. Heres what you need to know about eligibility and Medicare.

Types Of Medicare Cost

If you wish to participate in a Medicare plan, you have 4 options for cost-sharing.

1. Premium

This is a monthly and fixed amount to take part in a plan. It works differently for different Medicare parts:

- Medicare Part A- free of premium costs

- Medicare Part B- premiums are published each year

- MA premiums vary by plan

- Medicare Part D- premium plans will vary

2. Deductible

Deductible is an already set and fixed amount that you pay before the insurance begins to reimburse. This is how it works for each Medicare part:

- Medicare Part A- each year deductible is published for inpatient seniors

- Medicare Part B- standard deductible is published each year applies to Part B covered services

- MA deductibles vary by plan

- Medicare Part D- deductibles vary by plan

3. Co-pay

A co-pay is another already set and fixed amount that you pay for every service. This is how co-pay works for every Medicare plan:

- Medicare Part A- free of co-pay costs

- Part B Medicare- co-pays are published each year

- Medicare Part D- co-pay plans will vary

4. Co-insurance

Finally, co-insurance includes a percentage of costs that you pay. This is how co-insurance works differently for each part:

- Medicare Part B- you pay only 20% of the total cost

- MA co-insurance vary by plan

- Medicare Part D- co-insurance plans will vary

You May Like: Do You Have To File For Medicare

B: Doctor And Outpatient Services

Doctor visits, lab testing, diagnostic screenings, medical equipment, ambulance services, and other outpatient care are all covered under this section of Medicare. Part B, on the other hand, pays the total cost of preventive care services. It provides an approved amount directly to the providers who accept Medicare patients. You have to pay a premium every month to get Part B benefits.

Medicare Benefits Coverage

Decide If Delaying Medicare Enrollment Is Right For You

As mentioned earlier, before enrolling in Medicare Advantage plans seniors need to enroll in Medicare Parts A and B. For a small portion of the population, it can be beneficial to delay enrollment in Medicare for a few years. This applies primarily to those who are nearing 65 but who still work . It cannot be stressed enough that enrolling late in Medicare can carry steep, recurring fees for many people, so delaying coverage is only a good option for those who have a fee exemption. Having a fee exemption is most likely, though not guaranteed, for those who fit the profile below.

A senior whos nearing age 65 may have a fee exemption if:

- The senior receives health coverage through work

- The workplace includes more than 20 employees

- The senior plans to work beyond age 65 or the company offers retiree coverage

Essentially, someone in this situation may be able to and may want to delay starting their Medicare coverage because they decide that their work-provided coverage meets all of their needs at a low cost. However, no one should decide this without consulting with their companys benefits manager. When asked, a benefits manager should be able to provide information on whether or not the provided health coverage is considered group coverage by the IRS. Seniors in qualified plans can delay coverage without a late enrollment fee later.

Also Check: Can I Cancel My Medicare

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Medicare Enrollment Options For Seniors

Eligible seniorshave a 7-month timeframe to enrollforMedicare, which begins three months before and ends three months after their 65th birthday. Those who have been receiving Social Security Disability Insurance for 24 months or who have become 65-years-old will be automatically enrolled in Medicare Parts A and B.

Seniorswho are 65 but do not get Social Security retirement benefits should register forMedicare benefitsas soon as possible.

Recommended Reading: Does Medicare Cover Dr Visits

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Raising The Medicare Eligibility Age Would Harm Seniors And Increase Health Care Spending

This misguided approach would not only undermine the promise of health care and financial security for millions of low- and middle-income seniors but would also increase systemwide health care spending.

See also: Infographic: Raising the Medicare Eligibility Age to 67 Would Increase Costs and Harm Seniors by Lindsay Rosenthal and Emily Oshima Lee

In every deficit-reduction debate, policymakers look at the Medicare program to see where savings can be found, and the latest fiscal showdown negotiations are no different. There are opportunities to strengthen Medicare while achieving program savingsindeed, the Center for American Progress has put forward $385 billion in savings that would bolster the program without harming seniors. Nevertheless, too many proposals to lower Medicare costs simply shift those costs to seniors, businesses, and states. One such proposal is raising the eligibility age for Medicare from 65 to 67 years old.

Using 2011 census data to add to existing Congressional Budget Office calculations, we estimate that in a single year, almost 435,000 seniors would be at risk of becoming uninsured. Our estimate is conservative and understates the impact of raising the eligibility age because the number of seniors affected will only continue to grow over the next decade as the boomer generation retires.

You May Like: Does Kaiser Medicare Cover Dental

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Recommended Reading: What Is Medicare Part C & D

Choosing The Best Medicare Coverage For Seniors

The Medicare program provides health insurance to individuals 65 and older, as well as to individuals who receive disability benefits. You can select from several different coverage options when you enroll in Medicare.

To make an informed decision, we need to evaluate the advantages and drawbacks of each Medicare plan so you can choose which is best for you.

Raising The Medicare Eligibility Age Would Increase The Number Of Uninsured Seniors

Studies that have modeled the effects of raising the Medicare eligibility age on access to insurance coverage have assumed that the majority of seniors would find alternate coverage because of the Affordable Care Act, either through the exchangesnew marketplaces where individuals and businesses will be able to purchase insuranceor the Medicaid expansion. Even if the Affordable Care Act were fully implemented when the Medicare eligibility age is increased, the Congressional Budget Office estimates that about 5 percent of the seniors affected, or 270,000 individuals, would become uninsured.

But the Supreme Court decision to uphold the Affordable Care Act also rendered the Medicaid expansionwhich accounts for nearly half of the Affordable Care Acts coverage expansionoptional for states. At least 10 statesincluding Texas and Louisianahave indicated publicly that they do not plan to participate in the Medicaid expansion, and many more are on the fence. As a result, the number of seniors who would become uninsured if the Medicare eligibility age were increased and states did not adopt the Medicaid expansion would likely be much higher than 270,000.

Still, even when taking these sources of coverage into account, there are tens of thousands of nondisabled seniors with incomes below the federal poverty level in the states that may not expand their Medicaid programs who would not qualify for coverage under their states current Medicaid eligibility criteria.

Recommended Reading: What Is A Coverage Gap In Medicare

Medicare Assistance Programs Near You

Medicare has collaborated with state-specific health plans to provide demonstration plans for seniorswho have both Medicare and Medicaid. As a result, the programs have been making it easier for seniorsto access the services they require. Any or all of the following assistance programs may be available in your area:

Top Rated Assisted Living Communities By City

- Monthly Plan Premiums Start at $0

- Zero Cost, No Obligation eHealth Review

- Find Plans That Cover Your Doctors and Prescription Drugs

Medicare is a comprehensive health care plan, but one that Americans must pay for via deductibles and premiums. Those who have low income may be eligible for Medicaid in addition to Medicare. This is known as dual eligibility and means those who are unable to pay Medicare-related expenses can still access the medical services they need.

Helpful Resources

You May Like: Does Medicare Cover Cancer Treatment Centers Of America

Signing Up For A Flex Card For Seniors

Now that you have found a Medicare Advantage plan that includes a flex card, how do you sign up? The process varies a little depending on whether or not you have alreadysigned up for Medicare. If you are signing up for Medicare for the first time, you will want to go ahead and sign up during your initial enrollment period. Go ahead and contact the insurance company that manages the Advantage plan to get started. The process usually just requires providing them with your basic personal information to get you signed up. Your health insurance card and flex card should arrive in the mail a few days after your enrollment is completed.

Current enrollees in Medicare who wish to switch to a Medicare Advantage plan with a flex plan benefit will have to follow a slightly different process. Remember that you cannot simply change Medicare plans at any time during the year. You will need to wait until the annual open enrollment period unless you qualify for a special enrollment period. Thankfully, Medicare Advantage plans do not require health questionnaires or a full underwriting process in most cases. You will simply need to contact the insurance company to get signed up. In many cases, you can enroll for health care coverage with the company online.