When Can I Switch From Medicare Advantage To Medigap Without Losing My Guaranteed

It can be expensive to buy a Medicare Supplement insurance plan without guaranteed-issue rights. However, there are certain situations where you have time-limited guaranteed-issue rights outside your Initial Enrollment Period:

- You bought a Medicare Advantage plan when you first became eligible for Medicare, but decided within the first 12 months that you werenât happy with it. In this case, you can switch to Original Medicare with short-term guaranteed-issue rights for a Medicare Supplement insurance plan.

- You lost your Medicare Advantage plan because you moved outside the planâs service area, or the plan stopped operating where you live. If you switch to Original Medicare, you have short-term guaranteed-issue rights for a Medicare Supplement insurance plan.

Keep in mind, however, that these special situations may limit your choice of Medicare Supplement insurance plans. Although there are 10 standardized plans available in most states, some states only allow you to buy certain ones with guaranteed-issue rights outside your Initial Enrollment Period.

If you would like to begin searching for a Medicare Advantage or Medicare Supplement insurance plan, just enter your zip code on this page.

Finding the Medicare plan thatâs right for your life and budget doesnât have to be overwhelming â eHealth is here to help. Get started now.

Can I Switch From Medigap Plan N To Plan G

You can change from Medigap Plan N to Plan G and vice versa. In many cases, youll need to go through underwriting to make the changes. Underwriting will look at your past health conditions to determine your eligibility.

Its important that you choose healthcare that will benefit your situation no matter which changes you make.

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Recommended Reading: What Is The Best Medicare Advantage Plan In Alabama

How Do I Switch From Medicare Advantage To Original Medicare

Original Medicare does not provide any medical insurance other than part A. It is not available to people with Medicare Advantage plans such as health insurance, dental, vision and fitness insurance. Medicare also does not provide any deductibles for an individual, so it’s not built into any financial protections. If you need any additional help in switching to Medicare Advantage plans, you should contact the plan provider directly.

How To Switch To Medigap When You Have Medicare Advantage

Getty

Switching to Medigap from Medicare Advantage requires some planning. There are several crucial points you should know.

Even if you haven’t considered changing plans before, understanding the process and options is beneficial. Here I’ll discuss when, how and why to consider changing plans.

When Can I Disenroll From A Medicare Advantage Plan?

There are two times to disenroll from a Medicare Advantage plan: the annual enrollment period and the Medicare Advantage open enrollment period. Annual enrollment takes place in the fall from October 15 through December 7.

The Medicare Advantage open enrollment period is one last chance to change your policy for the year. It takes place from January 1 through March 31 each year. There are other enrollment periods available, such as the initial enrollment period for those newly eligible for Medicare.

If changing from an Advantage plan to Medigap is your goal, you need to apply as early as possible. You want to be sure the Medigap plan accepts your application before you cancel your Advantage plan. The most important information any insurance agent will tell you: Never cancel a policy over a quote. It’s best to wait until you have the final plan in your hands before you cancel current coverage.

Can I Be Denied Medigap Coverage?

When Can I Change My Medicare Supplement Policy?

Why Might You Want To Change Medicare Plans?

You May Like: How Do You File For Medicare

Do I Need To Do Anything After I Enroll In A Medicare Advantage Plan

Once you enroll in a Medicare Advantage plan during Annual Enrollment, the plan will work with Medicare to transfer your benefits. You dont have to contact Medicare yourself. Your new plan will begin covering you on January 1.

If you have a stand-alone Part D prescription drug plan or other private Medicare plan, youll need to contact the plan provider directly to dis-enroll. Simply call the number on the back of your insurance member ID card.

When deciding to change to a Medicare Advantage plan, keep the following in mind:

- You may choose a different Medicare Advantage plan or return to Original Medicare during the Medicare Advantage Open Enrollment Period, January 1 March 31.

During The Medicare Advantage Oep

From each year, a person can switch from one Medicare Advantage plan to another or drop their Medicare Advantage plan altogether in favor of original Medicare. During this time, a person can also join a prescription drug plan and Medigap.

Although this period sounds similar to the OEP that runs from October to December, it works in a slightly different way a person cannot switch from original Medicare to Medicare Advantage during this time. A person also cannot enroll in new prescription drug coverage or switch prescription drug coverage if they already have original Medicare.

Read Also: Does Medicare Cover Air Evac

How To Switch From Medicare Advantage To Medigap

A person can take the following steps to switch from Medicare Advantage to original Medicare plus Medigap during an enrollment period:

- It is possible to disenroll from a Medicare Advantage plan by contacting the insurance company directly and requesting a disenrollment form. People can also call Medicare at 800-633-4227 and ask for disenrollment from their plan, or they can visit their local Social Security office.

- A person who previously had Medigap coverage before joining Medicare Advantage and has been enrolled in Medicare Advantage for under a year has the right to return to their previous Medigap policy, as long as the insurer still offers it. If it is not available, the person can enroll in a new plan that the insurance company offers. People have to switch within 63 days of leaving their Medicare Advantage plan.

- If a person has never enrolled in a Medigap plan, they can find available Medigap policies by searching on Medicare.gov, contacting a State Health Insurance Assistance Program, or contacting an insurance agent or company to obtain a Medigap quote.

If, at any time, a person is not sure about their rights or enrollment periods, they can contact Medicare or visit their Social Security office.

There are different circumstances under which a person can switch from Medicare Advantage to Medicare with Medigap. The sections below cover these in more detail.

You Cant Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Anyone whoâs ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Read Also: Is Kidney Dialysis Covered By Medicare

Switching From Medigap To Medicare Advantage

If you’re thinking about switching from your Medigap plan to a Medicare Advantage plan, you can make the move during the Medicare Annual Enrollment Period from Oct. 15 to Dec. 7.

FYI: If you drop your Medigap policy to join a Medicare Advantage plan, you may not be able to get it back. Rules vary by state and your situation.5

Why Medicare Advantage Plans Can Fall Short

For many older Americans, Medicare Advantage plans can work well. A JAMA study found that Advantage enrollees often receive more preventive care than those in traditional Medicare. Advantage plans are competing not just on cost but on delivering quality care, says Kenton Johnston, PhD, associate professor of health management and policy at Saint Louis University, co- author of the study.

But if you have chronic conditions or severe health needs, you may want to think twice about Medicare Advantage because of the requirements for pre-authorization and staying in-network, says Melinda Caughill, co-founder of 65 Incorporated, a firm that provides Medicare enrollment guidance to financial advisers and individuals.

If you need to see multiple specialists, and you have to get referrals for each appointment or fight to overturn denials, it can be really challenging, Caughill says.

Steven Feld, 65, a retiree in South Pasadena, Fla., struggled to get coverage for an injection to treat his arthritic knee. The treatment, a prefilled injection administered in a doctors office, is deemed a medical device by the FDA, so the plan twice denied the coverage. When I was on my employers group plan, there was no problem getting the injection covered, says Feld, who joined his Medicare Advantage plan in May.

Recommended Reading: Does Medicare Cover Ear Nose And Throat Doctors

Think Carefully When Choosing Your Medicare Coverage

Think carefully about your options and which coverage is right for your health and lifestyle. Your next opportunity to change your Medicare coverage wont be until the next years Annual Enrollment Period, unless you experience a qualifying life event and become eligible for a Special Enrollment Period.

Do I Have To Do Anything After Enrolling In Medicare Advantage

After registering in Medicare’s Medicare Advantage plan during the year-round enrollment process, it works closely with Medicare to transfer your benefits. It’ll not take much time for Medicare to reach them directly. You will start receiving coverage on January 1. You may need to contact your Medicare plan provider directly to cancel any Medicare Part D plan. You can also call the number on your insurance cards. In the decision making process of switching Medicare Advantage plans, you must remember:

Read Also: What Glucometer Is Covered By Medicare

Next Steps For Switching To Medigap

Changing plans from Medicare Advantage to a Medicare Supplemental plan is not for everyone. You must make sure that it fits your budget and make sure you are approved on a Medigap plan before your MA plan is cancelled. Please call our licensed independent agents at 800-930-7956 to discuss your situation.

Check out our detailed guide on Switching Medicare Insurance if you learn more about all the possibilities.

If You Enroll In Drug Coverage Thats Equivalent To Medicare Part D

If you enroll in TRICARE, VA coverage, or another plan that offers comprehensive prescription drug benefits and you have a Medicare Advantage plan that includes prescription drug coverage then you can leave your Medicare Advantage plan and return to Original Medicare.

- Youll want to check with your prescription drug plan to make sure that it provides you with credible drug coverage.

- You can do this at any time, but your ability to enroll in the alternative creditable drug coverage may be limited by that plans rules.

Read Also: How Do I Sign Up For Medicare In Massachusetts

Nearly All Medicare Advantage Enrollees Are In Plans That Require Prior Authorization For Some Services

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees are in plans that require prior authorization for some services in 2022. Prior authorization is most often required for relatively expensive services, such as Part B drugs , skilled nursing facility stays , and inpatient hospital stays , and is rarely required for preventive services . Prior authorization is also required for the majority of enrollees for some extra benefits , including comprehensive dental services, hearing and eye exams, and transportation. The number of enrollees in plans that require prior authorization for one or more services stayed the same from 2021 to 2022. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services and does not require step therapy for Part B drugs.

Can I Switch From Medicare Advantage To Medicare

You can switch from a Medicare Advantage plan to Original Medicare during the Annual Enrollment Period, which takes place every October 15 through December 7. The new coverage goes into effect in the approaching January.

Medicare beneficiaries can also change back to Medicare from an Advantage plan during the Medicare Advantage Open Enrollment Period.

Also, if youre new to Medicare and want to leave your new Medicare Advantage plan, you may qualify for a trial right which means you can leave the Part C program any time during the first year.

Of course, if there is a special circumstance such as moving, youll be able to change plans using a Special Enrollment Period.

Don’t Miss: How To Terminate Medicare Part B

Can I Drop My Medicare Advantage Plan And Go Back To Original Medicare

Yes, but you must do it during one of the open enrollment periods. You can switch back to Original Medicare during the annual Medicare Open Enrollment period from October 15 to December 7. Your new coverage will go into effect January 1. Or, you can switch during Medicare Advantage Open Enrollment from January 1 to March 31. Your new coverage will go into effect on the first day of the month after you ask to join the plan.

Also Check: Does Medicare Cover Medical Massage

Can You Switch Between Medicare Advantage And Medigap

If you originally sign up for Medicare Advantage and decide it isnt right for you, you can switch to Medigap supplemental coverage. You can also switch from Medigap to a Medicare Advantage plan.

However, you have to follow certain rules and there may be some problems if you decide to switch down the line.

If you are in a Medicare Advantage plan, you can make a switch to a different Medicare Advantage plan during Medicares open enrollment period, which runs from October 15 through December 7 each year.

You may also not be able to get a Medigap policy if you give up your Medicare Advantage plan. If you are new to Medicare, insurers are required to sell you a Medigap policy. But after that initial enrollment, theres no guarantee that they will sell you one.

Insurers can also charge you more for a Medigap policy if you have serious medical problems when you decide to switch from a Medicare Advantage plan.

A handful of states protect your ability to switch back to Original Medicare with Medigap coverage.

States That Allow You to Switch Year-Round

Rules guaranteeing your ability to switch vary between each of these states. You should check with your states rules to determine what applies in your case.

Also Check: Does Medicare Cover Bathroom Equipment

You May Want To Add Coverage If You Switch To Original Medicare From A Medicare Advantage Plan

When you drop your Medicare Advantage plan, you will lose coverage for other health services and items such as for prescription drugs and vision or dental. You will also lose built-in financial protection on out-of-pocket costs.

If you want to still have these items, you will need to purchase additional coverage, or pay directly out-of-pocket. For example, if you want prescription drug coverage, you will now need to find and enroll in a stand-alone Part D plan. If you decide you want additional coverage, you will need to choose a plan and enroll directly with the plan provider. Search available plans using your zip code here.

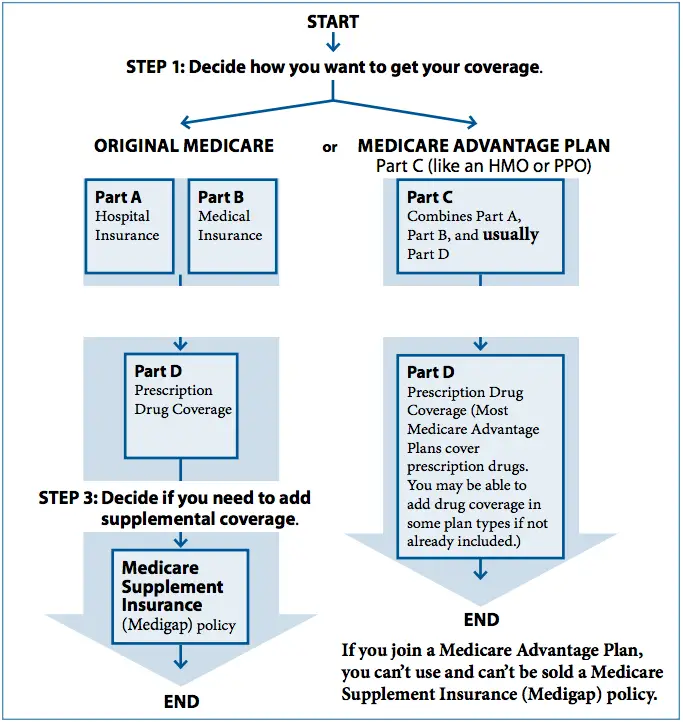

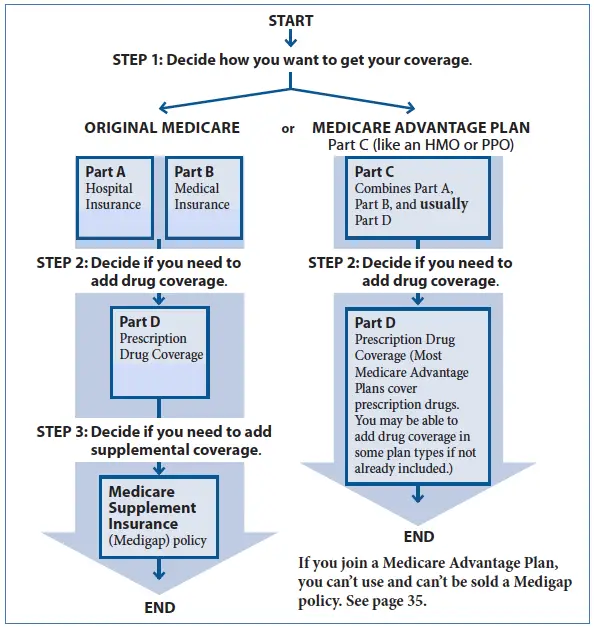

What Is Medicare Advantage

Medicare Advantage plans are offered by private insurance companies contracted through Medicare. They offer the same hospital and medical coverage that Original Medicare does , but they also offer additional coverage such as vision, dental, hearing aids, travel, wellness/gym memberships, and more. Most MA plans also include Part D prescription drug coverage.

While MA plans offer additional benefits, more personalized coverage, and coordinated care often at a lower cost, there are some disadvantages including select providers, service area limitations, complex coverage, and necessary prior authorizations or referrals.

In order to be eligible to enroll in a MA plan, you must:

- Already be enrolled in Medicare Part A and Part B.

- Reside within the plans service area.

Also Check: Which Insulin Pumps Are Covered By Medicare

What Is The 6 Month Medigap Open Enrollment Period

Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During your open enrollment period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

What Should I Know About Drug Plans

Unlike most Medicare Advantage plans, traditional Medicare does not include drug coverage. For that, you must buy a separate Part D plan.

For 2023, beneficiaries can typically choose between 24 stand-alone Part D plans, at premiums that range from $6 to $111 a month and average $43 for policies available nationwide, said Juliette Cubanski, the deputy director of the program on Medicare policy at the Kaiser Family Foundation.

If youre the person who doesnt take many medications or only uses generics, the best strategy might be to sign up for the plan with the lowest premium, Dr. Cubanski said. But if you take a lot of medications, the most important thing is whether the drugs you take, especially the most expensive ones, are covered by the plan.

Different plans cover different drugs and place them in different pricing tiers, so how much you pay for them varies. And, to make comparisons more dizzying, certain pharmacy chains are preferred by certain plans, so you could pay more at CVS than at Walmart for the same drug, or vice versa.

How does Part D work? First, most stand-alone plans have a deductible: $505 in 2023. You pay that amount out of pocket before coverage kicks in.

Drugs on the next highest tier, for nonpreferred brand-name drugs, usually involve coinsurance paying a percentage of the drugs list price rather than a flat co-pay. For national stand-alone plans, that ranges from 34 to 50 percent, Dr. Cubanski said.

Recommended Reading: How Much Does Ss Take Out For Medicare