Before You Make Your Decision

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person’s situation is different. It is important to remember:

- If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit.

- That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

When Older People Are Eligible For Social Security

Today, older adults become eligible for full Social Security retirement benefits at age 66 or 67 depending on their birth year and whether they or their spouse have met the work credit requirement.

For anyone born in 1929 or later, the minimum work credit requirement for Social Security benefits is 40 credits or 10 years of work. The year you can start taking full Social Security benefits is known as your full retirement age or normal retirement age.

| Age for Receiving Full Social Security Benefits | |

|---|---|

| Birth Year | |

| 1960 and later | 67 |

If you were born on January 1 of any year, refer to the previous year when calculating your full retirement age.

Unlike Medicare, older people can opt to start taking their benefits before their full retirement age. The earliest you can begin taking Social Security benefits is age 62. However, if you begin taking Social Security payments before your full retirement age, you will receive a reduced monthly benefit for the remainder of your life.

If you are a widow or widower, you can start claiming your spouse’s reduced Social Security benefits when you are age 60, or 50 if you are disabled. You can then switch to taking your own full benefit at your full retirement age.

You can also choose to delay your Social Security benefit past full retirement age until age 70. This will often make you eligible for delayed retirement credits, which increase your monthly benefit for the remainder of your life.

In General It’s 65 But You Might Be Eligible Sooner

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

When you think of Medicare, you probably assume that its for people of retirement age. Thats true, but the program covers more than just those who have worked all their life. You might be eligible right now and not know it. Our research has found that while more than 80% of beneficiaries are people aged 65 or older, others receive services at a younger age due to a qualifying disability.

Read Also: What Age Do You Apply For Medicare

During Your Initial Enrollment Period

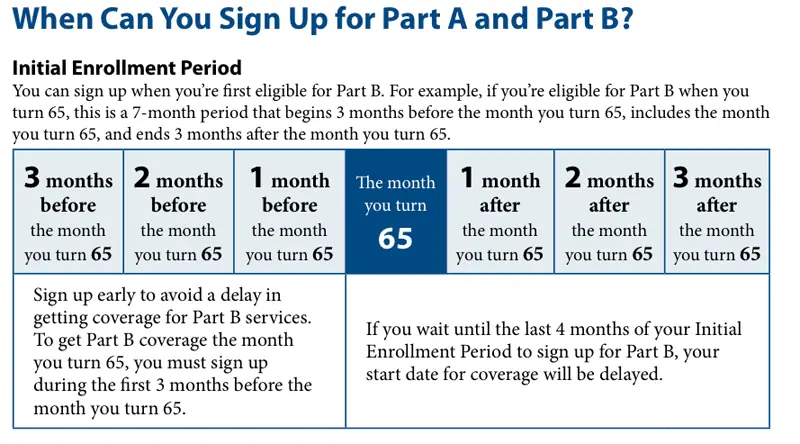

This lasts for seven months, of which the fourth one is the month in which you turn 65. For example, if your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

To avoid late penalties and delayed coverage, you need to sign up for Medicare during your IEP in these circumstances:

- You have no other health insurance

- You have health insurance that you bought yourself

- You have retiree benefits from a former employer

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

- You have veterans benefits from the Department of Veterans Affairs health system

- Youre in a nonmarital domestic relationship with someone of the same or opposite sex and you are covered by his or her employer insurance

If you enroll during the first three months of your IEP, your Medicare coverage begins on the first day of the month you turn 65 . If you sign up during the fourth month, coverage begins on the first day of the following month. But if you leave it until the fifth, sixth or seventh month, coverage will be delayed by two or three months. For example, if your birthday is in June and you sign up in September , coverage will not begin until Dec. 1.

Medicare Special Enrollment Period

Special situations may come up that give you the chance to sign up for or change your Medicare plan outside of your Initial Enrollment Period or the Annual Enrollment Period.

There are several special cases that make you eligible for a Special Enrollment Period.

Here are some common situations:

- You move: If you move to an address outside your plans service area, into a nursing home, or you have different plan options at your new address, youll be able to apply for a new plan.

- You want to switch to a 5-star Medicare plan: Every year, Medicare evaluates plans based on a 5-star rating system. Medicare considers these plans excellent. You can make the switch once to a 5-star plan anytime from Dec. 8 through Nov. 30 if one is available in your area.

- You lose your current coverage: This applies if you or your spouse will retire or change to a job that doesnt offer coverage. It doesnt apply if your insurance company cancels your coverage because you didnt pay your monthly premiums.

- Your plan changes its contract with Medicare: Enrollment in a plan depends on the plans contract with Medicare, and for various reasons these contracts could change.

Your new coverage begins on the first day of the month after you sign up.

Read Also: How Much Is Premium For Medicare

Apply For Retirement Benefits

Starting your Social Security retirement benefits is a major step on your retirement journey. This page will guide you through the process of applying for retirement benefits when youre ready to take that step. Our online application is a convenient way to apply on your own schedule, without an appointment. You can also apply by phone or by appointment at a Social Security office.

How To Enroll For Medicare

If you meet the requirements for people age 65 or older, you can receive Medicare Part A without any premiums. However, if you or your spouse do not pay Medicare taxes, you may have to pay Part A. Medicare Part A covers hospital insurance. Medicare Part B covers things like outpatient care, preventive services, and medical equipment. It can also cover part-time home health services and naturopathy. If you decide you also want Medicare Part B, you must pay a monthly premium.

If you have received Social Security disability benefits for 24 months, you will automatically be enrolled in Medicare at the start of the 25th month. If you have Lou Gehrigs disease, you will be automatically registered the first month you start receiving benefits. In these cases, enrollment includes both Medicare Part A and Part B. However, if you have end-stage kidney disease, your Medicare benefits will be determined on a case-by-case basis. In this case, you will need to apply manually.

Read More: Is Medicare Part B Coverage Enough for Me?

You May Like: Is Stem Cell Treatment Covered By Medicare

What Is The Medicare Eligibility Age

You may decide to retire at the age of 62 because you can start collecting Social Security at this age and feel ready to move to a new stage in life. According to the Social Security Administration, you may start receiving retirement benefits as early as age 62. An employers health benefits will likely expire upon retirement and you may be wondering about the age of your Medicare eligibility.

Medicare is the state health care program for people age 65 or older and people under the age of 65 who have certain disabilities whose eligible age for Medicare does not correlate with your retirement time and early retirement will not make you eligible for Medicare. In general, the only ways to be eligible for Medicare before age 65 are to:

- If You have kidney disease at the end of the stage

- Have ALS

- If You have a disability and are receiving disability benefits from Social Security for at least 24 months

If you retire at 62 and not have a disability, you generally will have to wait three years to get Medicare coverage. You can search on eHealth for an affordable individual or family health insurance plan while you wait to reach Medicare age.

There are certain benefits to waiting for retirement after age 62 besides reaching Medicare age. If you retire early, your benefits will be cut slightly for each month before full retirement age, according to the Social Security Administration. The amount to be reduced depends on your year of birth.

Should I Sign Up For Medicare Part A

Most people who have worked and paid Medicare taxes for 10 years can get Medicare Part A with no monthly premium. Because of this, many people choose to sign up for Medicare Part A even if they have health insurance through work.

Medicare Part A covers things like hospice care and skilled nursing facility care that your health plan through work might not cover.

When youre getting Social Security benefits, youre automatically signed up for Part A. If youre not getting Social Security, you should sign up directly through Social Security. Find out how to sign up in our Help Center.

Tip: Always talk to your company’s human resources department before you make the decision to sign up for Medicare. Your health insurance plan might work differently for you after you sign up for Medicare.

Also Check: Does Medicare Cover Bed Rails

When Does Medicare Open Enrollment Start

For most people, its best to enroll during your seven-month Initial Enrollment Period. Begin three months before you turn 65. It includes your birth month, and it ends three months after your birth month.

If you want your benefits to start at the beginning of the month, you turn 65, be sure to sign up at least a month before your birthday. You can also enroll in Part D prescription coverage or a Medicare Advantage plan at this time.

Those that dont sign up for Part B during the Initial Enrollment Period may pay a late enrollment penalty. Youll pay the penalty every month for the rest of your life for as long as you have coverage.

Examples of Creditable Coverage

For example, you work for a large employer, and the health plan is creditable coverage. In this scenario, delaying enrollment would make sense, especially if the coverage is better than Medicare.

Although, group coverage better than Medicare isnt the typical scenario. Many people work for small employers when this is your situation, Medicare is primary. So, if you dont have Medicare, and you only have the group plan, the employer plan wont pay until your Medicare is active.

Further, COBRA is NOT creditable coverage for Medicare. When you delay Part B without creditable coverage, a late enrollment penalty could be coming your way.

Even those with TRICARE need to enroll in Medicare to keep their benefits. However, if you have TRICARE, its unlikely youll benefit from extra Medicare coverage.

Should I Sign Up For Medicare Part B

If youre still working and have health insurance through your employer, you might not need to sign up for Medicare Part B right when you turn 65.

Thats because your health insurance plan probably provides coverage thats at least as good as what Medicare Part B would give you.

If thats the case, you qualify for a special enrollment period. That means you have eight months after your health insurance through work ends to sign up for Medicare Part B.

Tip: Always check with Social Security to make sure you’re eligible for a special enrollment period. You can find their phone number on our Contact Us page.

Don’t Miss: When Can I Start Collecting Medicare Benefits

Am I Eligible For Medicare Part A

Generally, youre eligible for Medicare Part A if youre 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as youre already collecting Social Security or Railroad Retirement benefits.

If youre already receiving Social Security or Railroad Retirement benefits, all you need to do is check your mail for your Medicare card, which should automatically arrive in the mail about three months prior to your 65th birthday . The card will arrive with the option to opt-out of Part B , but opting out of Part B is only a good idea if youre still working and have employer-sponsored coverage that provides the same or better coverage, or if your spouse is still working and you have coverage under their plan.

If youre not already receiving Social Security or Railroad Retirement benefits, youll need to enroll in Medicare during a seven-month open enrollment window that includes the three months before the month you turn 65, the month you turn 65, and the three following months. If you enroll before the month you turn 65, your benefits will start the month you turn 65 . If you enroll in the three months after you turn 65, your coverage could have a delayed effective date.

In addition to turning 65, people can become eligible for Medicare due to a disability , or due to end-stage renal disease or amyotrophic lateral sclerosis .

Coordinating Start Dates For Medicare Advantage Or Drug Coverage And Medicare

Same as above. Once you learn your Original Medicare effective date, youll want to apply for Medicare Advantage prior to that date, so that you have the coverage you desire.

- If you have delayed Part B, your start date will be different from above, as will your Medicare Advantage and Medigap effective dates

- If you are enrolled in Medicare Advantage and want to switch to Medigap,

- If you are enrolled in Medigap and Switch to Medicare Advantage,

- Dont forget to coordinate your Part D drug plan enrollment with your Original Medicare

Related Articles:

Don’t Miss: Does Medicare Cover Cancer Treatment Centers Of America

At What Age Can You Get Medicare

You are eligible for Medicare when you turn 65. You may be working, not working or retired. You may or may not be receiving Social Security or other retirement benefits. As far as Medicare eligibility goes, your age is what matters.

Key word your. Medicare is individual insurance. Its your age that counts, not your spouses, even if you are both covered by the same employer insurance when one of you turns 65.

Also, Medicare is separate from Social Security benefits, and there are different eligibility requirements for each. The age for Medicare eligibility is 65. The age for full Social Security benefits depends on what year you were born.

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

You May Like: Does Medicare Advantage Pay For Hearing Aids

What If Your Medicare Card Didnt Arrive

If youre expecting to receive a Medicare card but havent yet received one three months before your 65th birthday, the first thing to do is to not worry. Medicare sends out hundreds of thousands of cards per year without issue. Its possible for the card to be delayed or for there to be an error. To confirm whether a Medicare card is heading your way, check with your local Social Security office to make sure that youre enrolled.

Medicare Eligibility: Key Takeaways

- Generally, youre eligible for Medicare Part A if youre 65 and have been a U.S. resident for at least five years.

- When youre notified youre eligible for Part A, youll be notified that youre eligible for Medicare Part B.

- You need to be eligible for both Medicare Part A and B in order to enroll in Medicare Advantage.

- To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both.

- If youre enrolled in both Medicare Part A and B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy.

For the vast majority of Americans who look forward to receiving Medicare health benefits, eligibility is as uncomplicated as celebrating your 65th birthday.

But your eligibility to receive Medicare coverage without having to pay a premium and your eligibility for other Medicare plans depends on such factors as your work history and your health status. Heres what you need to know:

Don’t Miss: Will Medicare Pay For A Patient Lift

Your Options: Working Applying For Retirement Benefits Or Both

Choosing when to start receiving your Social Security retirement benefits is an important decision. Theres no one choice that works for everyone because your lifestyle, finances, and goals are not the same as others.

Do you want to retire early, stay on the job, or work beyond retirement age?

Should you start receiving retirement benefits now, or wait until you can receive a higher benefit amount?

These are important questions youll need to answer as you plan for your retirement. Consider the four options below to help you make the best decision.

| Continue Working |

|---|