What Is A Medicare Supplement Insurance Plan

As stated, Original Medicare, which consists of Part A and Part B, doesnt cover all health care costs. You will still be required to pay your monthly premiums, annual deductibles, coinsurance, copayments, and other medical-related expenses. Original Medicare also has several coverage gaps, including the lack of hearing, dental, and vision coverage. Please see my article Does Medicare Cover Dental? for details on what dental and vision services Medicare covers and how to improve on it.

All these out-of-pocket expenses can quickly add up and put you under pressure, which is something youd want to avoid when your health and savings are at stake. To help cover these gaps and expenses, you can opt for supplemental coverage for your Medicare plan. Medigap coverage can help pay the remaining health care costs your current Medicare plan doesnt cover.

Whats important to note here is that Medigap plans dont add any additional coverage to your existing health insurance plan. They only cover the costs that Original Medicare plans dont cover for the services approved by Medicare. Your Medicare supplement plan will work hand-in-hand with your Medicare insurance, guarding you against unexpected medical expenses that tend to increase as you get older.

What Is A Medigap Plan And Why Should I Buy It

A Medigap plan , sold by private companies, can help pay some of the health care costs Original Medicare doesn’t cover, like copayments, coinsurance and deductibles.

Some Medigap plans also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap plan, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap plan pays its share.

Medigap & Medicare Advantage Plans

Medigap policies can’t work with Medicare Advantage Plans. If you have a Medigap policy and join a

, you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

If you want to cancel your Medigap policy, contact your insurance company. If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a “trial right.“

If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to

. Contact your State Insurance Department if this happens to you.

If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you’re able to disenroll.

If you join a Medicare Advantage Plan for the first time and you arent happy with the plan, you have a trial right under federal law to buy a Medigap policy and a separate Medicare drug plan if you return to Original Medicare within 12 months of joining the Medicare Advantage Plan.

Don’t Miss: Does Medicare Pay For Maintenance Chiropractic Care

What Types Of Insurance Plans Are Available Through Medicare

There are four types of insurance plans available through Medicare:1. Original Medicare 2. Medicare Advantage Plans 3. Medicare Supplement Insurance Plans 4. Prescription Drug Plans Original Medicare is the traditional fee-for-service health insurance plan offered by the federal government. It includes Part A and Part B . You can also add on a prescription drug plan .Medicare Advantage Plans, also known as Part C, are private health insurance plans that contract with Medicare to provide you with all your Part A and Part B benefits. Some plans may also offer extra coverage, such as dental, vision, and prescription drugs.Medicare Supplement Insurance Plans are sold by private companies to fill in the gaps in Original Medicare coverage. Medigap plans must follow federal and state laws designed to protect consumers, and they must be clearly identified as Medicare supplement insurance. These plans do not include prescription drug coverage.Prescription Drug Plans are stand-alone plans that add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service Plans, and certain Medicaid programs. If you have one of these plans, you can join a stand-alone Prescription Drug Plan to get this coverage.

How Does Medicare Supplement Insurance Work With Medicare

Medicare Supplement Insurance works with Original Medicare Parts A and B. If you choose to buy a standalone Part D Prescription Drug plan, Medicare Supplement works with that, too.

Medicare Supplement Insurance is different from Medicare Advantage. You can have either a Medicare Advantage Plan or a Medicare Supplement Plan, but not both at the same time.

Also Check: What Insulin Pumps Does Medicare Cover

Services Medicare Doesnt Cover

- Most long-term care. Medicare only pays for medically necessary care provided in a nursing home.

- Custodial care, if its the only kind of care you need. Custodial care can include help with walking, getting in and out of bed, dressing, bathing, toileting, shopping, eating, and taking medicine.

- More than 100 days of skilled nursing home care during a benefit period following a hospital stay. The Medicare Part A benefit period begins the first day you receive a Medicare-covered service and ends when you have been out of the hospital or a skilled nursing home for 60 days in a row.

- Homemaker services.

- Most dental care and dentures.

- Health care while traveling outside the United States, except under limited circumstances.

- Cosmetic surgery and routine foot care.

- Routine eye care, eyeglasses , and hearing aids.

When Should I Apply For A Medicare Supplement Policy

When you elect coverage under Medicare Part B either due to age or disability, you have a 6-month open enrollment for a Medicare supplement policy, which guarantees you coverage with a plan and company of your choice. You may choose from a list of standardized plans listed as A through L. If you do not purchase a plan within your 6-month open enrollment, any company you apply to can deny coverage based on your health conditions. There are some limited additional open enrollment periods available to some persons disenrolling from a Medicare HMO.

You May Like: How To Sell Medicare Advantage Plans

Do I Need A Medicare Supplement

To know whether you need a Medicare Supplement plan, its helpful first to understand what the plans do. A Medigap plan covers costs left by Original Medicare.

Having a Medigap plan can help you keep your health care costs down by covering the costs youd otherwise pay. While its not necessary, its certainly beneficial.

Facts About Medicare Supplemental Insurance

Despite the fact that Medicare supplement insurance has become a hot issue of debate, there are some common misconceptions about it that everyone should be aware of. Before you sign up for any particular plan, you should consider the following facts concerning this insurance.

The cost of Medicare supplement insurance varies from one insurance provider to the next, despite the fact that these plans are equal regardless of who you buy them from. So, before you make a purchase, make sure you check around with a few other companies. Because no insurance company is mandated to offer all 12 plans, one insurance company may try to persuade you to buy one of theirs when another plan may be exactly what you need.

No matter where you get Medicare supplement insurance, the coverage is the same. This insurance fills in the gaps left by Medicare. This complete 12-plan package, called part a through part l, offers various levels of benefits, and many private insurance providers may offer one or more of them. The coverage, however, will be the same regardless of where you purchase these policies. So, if a corporation claims that its plans offer specific advantages over others, do not believe them.

You are the only individual who can be protected by a Medicare insurance policy unlike regular insurance policies, which sometimes include coverage for your husband or wife, your Medicare policy solely covers you.

Recommended Reading: Humana Medicare Supplement Plan G

Read Also: Is Xeljanz Covered By Medicare

What Is Supplemental Insurance

Find Cheap Health Insurance Quotes in Your Area

Supplemental health insurance provides an extra level of coverage by helping consumers meet out-of-pocket expenses and other costs not covered by their regular insurance.

Supplemental plans serve as secondary payers, filling in coverage gaps and complementing regular insurance. This mitigates, and in some cases eliminates, costs associated with copays, deductibles and other expenses depending on the extent of coverage of the supplemental insurance.

What Does Medicare Supplement Insurance Cost

The primary goal of a Medicare Supplement insurance plan is to help cover some of the out-of-pocket costs of Original Medicare . As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly.

Don’t Miss: Will Medicare Pay For An Upwalker

Why Do I Need Supplement Insurance With Medicare

- Original Medicare Parts A & B dont cover all medical benefits necessary for beneficiaries, such as prescription medication and vision and dental care.

- Medicare supplement insurance covers medical services that Original Medicare doesnt cover.

- Medigap, Medicare Advantage, and Medicare Part D are the most common examples of supplemental coverage.

- Supplemental coverage isnt a health insurance requirement but may be necessary if you need extra health care.

You Can’t Join A Medicare Prescription Drug Plan And Have A Medigap Policy With Drug Coverage

If your Medigap policy covers prescription drugs, you’ll need to tell your Medigap insurance company if you join a Medicare Prescription Drug Plan. The Medigap insurance company will remove the prescription drug coverage from your Medigap policy and adjust your premium. Once the drug coverage is removed, you can’t get that coverage back, even though you didn’t change Medigap policies.

You May Like: How Is Bernie Paying For Medicare For All

What Are The Differences Between Medigap And Medicare Advantage Plans

A Medigap plan is different from a Medicare Advantage plan . MA plans are a way to get Medicare benefits, while a Medigap only supplements your Original Medicare benefits.

A comparison of Medigap and Medicare Advantage plans|

Where you can get care |

Works in any state |

Works only in your state, by region |

|---|---|---|

|

Provider network |

Don’t need a provider network |

Must use a provider network |

|

Prescription drugs |

Medicare Part D not included |

Medicare Part D usually included |

What Is Every Medicare Advantage Plan Required To Include

Every Medicare Advantage plan must include the benefits provided by Original Medicare Part A and Part B. Original Medicare Part A covers 80% of hospital stays, skilled nursing, home health care and hospice care. Original Medicare Part B covers 80% of doctors visits, preventative care, mental health services, physical therapy, occupational therapy, lab services and other outpatient services.

Don’t Miss: Is Synvisc Covered By Medicare In Australia

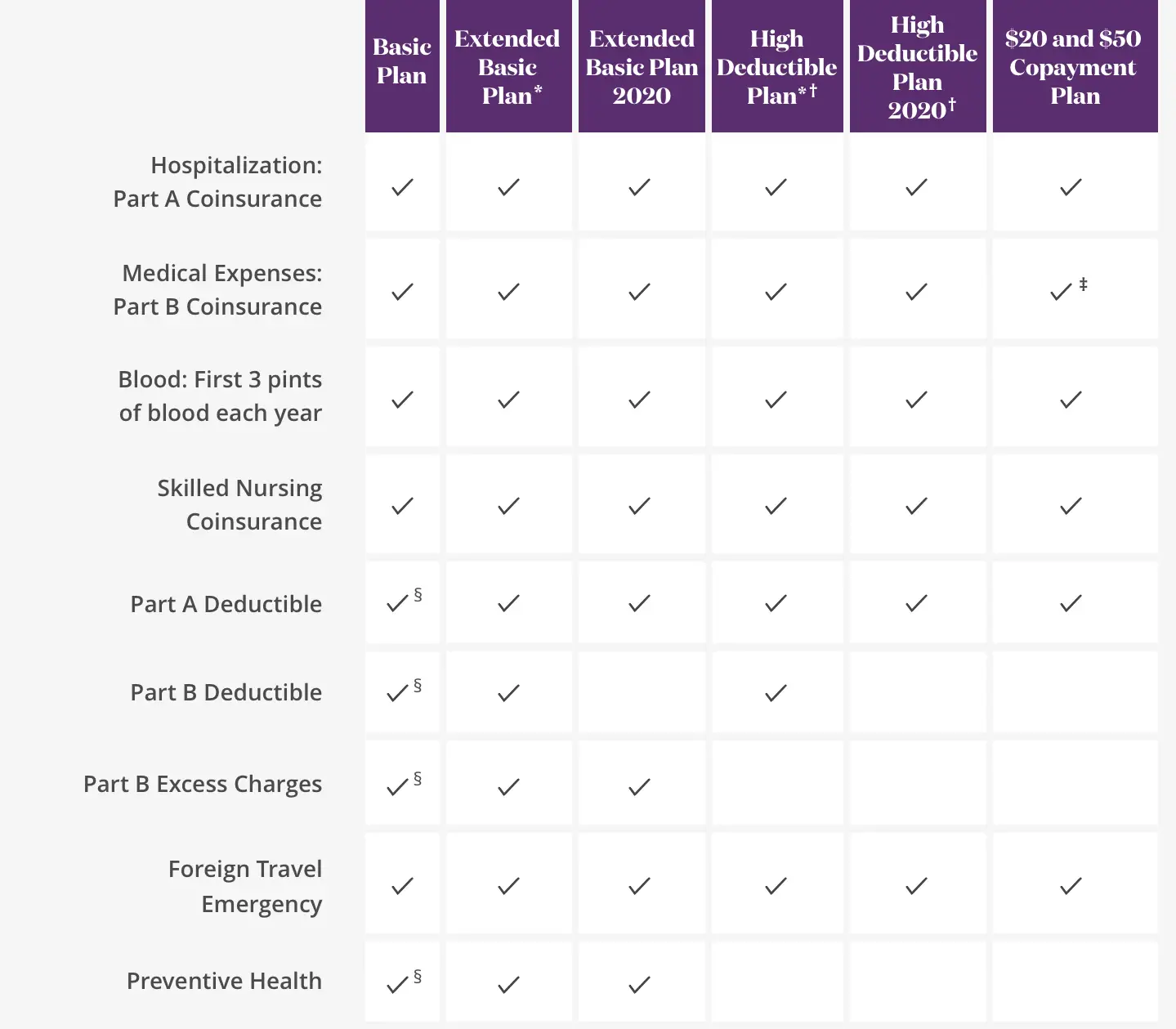

Medicare Supplement Vs Medicare Advantage In Wisconsin

Medicare Supplement Plans and Medicare Advantage Plans are two ways of getting the essential coverage that Original Medicare does not offer. Medicare Supplement, or Medigap, Plans supplement the gaps left by Original Medicare, while Medicare Advantage Plans replaces the benefits of Original Medicare. Part C Plans are alternative ways of recieving these benefits. These plans are much like private health insurance, covering most services after copays, and must provide at least the same level of coverage that Original Medicare does. These plans may also include additional benefits. However, about 80% of Americans choose a Medicare Supplement Plan, as it gives you the freedom to see any doctor or provider, anywhere in the U.S., without a referral, that accepts Medicare .

Medicare Supplement Plans and Medicare Advantage Plans cannot work together. It is illegal for any insurer to sell you a Medigap Plan if you currently have a Medicare Advantage Plan unless you are switching back to Original Medicare.

Is Supplemental Medicare Insurance A Waste Of Money

Home / FAQs / Medigap Plans / Is Supplemental Medicare Insurance a Waste of Money?

If youre on Medicare, you might be wondering if Medicare Supplement plans are worth it. Consider that Medicare only covers a portion of your medical costs, leaving you to pay the remaining balance. Add deductibles as well as copays, and suddenly Medigap premiums make sense.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Were here to help answer frequently asked questions about supplemental insurance. Youll walk away knowing whether its worth looking into Medigap, as well as other supplemental insurance.

Recommended Reading: What Is Medicare Advantage Otc Card

Which Companies Sell Medicare Supplement Insurance In Indiana

Companies must be approved by IDOI in order to sell Medicare Supplement policies. All of the companies listed below have been approved by the state. The plans are labeled with a letter, A through J. Not all companies sell all ten plans. Following each company name and phone number, we have listed the Medicare Supplement plans sold by that company based on the following categories:

- Medicare Supplements for Persons 65 and Older

- Medicare Supplements for Persons Under 65 and Disabled

- Medicare SELECT Insurance Companies

What Are The Benefits Of Medicare Supplement Plans

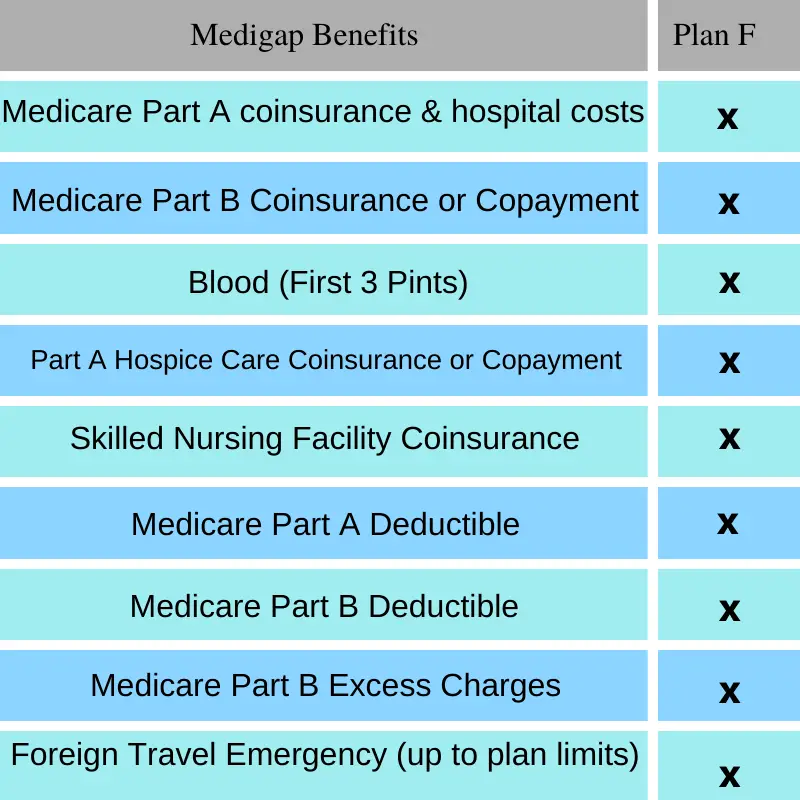

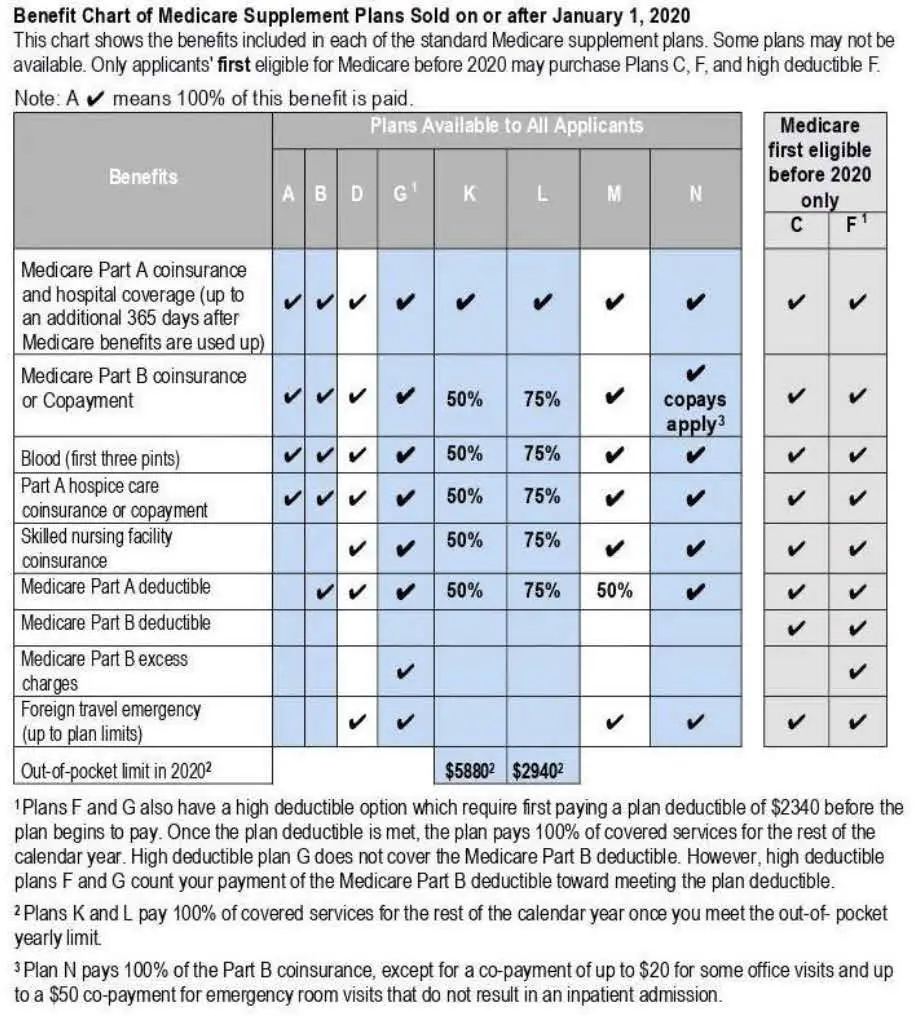

There are twelve standardized Medigap plans A, B, C, D, E, F, G, K, L, M, and N . Plans F & G both also have high deductible options. Each offers slightly different benefits, although there are several mutual out-of-pocket costs all these policies cover, including:

- Medicare Part A coinsurance and hospital costs up to a period of 365 additional days after using up Medicare benefits

- Medicare Part A deductible

- Medicare Part B coinsurance and copays

- The first three pints of blood each calendar year

- Part A hospice care coinsurance or copay payments

- Skilled nursing facility care coinsurance.

Several Medicare supplement plans also cover some medical care when traveling outside the United States. That can be a significant advantage if you travel abroad a lot.

A Medigap plan doesnt cover long-term care, vision, dental, and hearing. Medigap coverage plans written after 2006 also dont cover prescription drugs. For this purpose, you need to enroll in a dedicated Medicare Part D plan.

Read Also: Do You Have To Take Medicare

What Medicaid Helps Pay For

If you have Medicare and qualify for full Medicaid coverage:

- Your state will pay your Medicare Part B monthly premiums.

- Depending on the level of Medicaid you qualify for, your state might pay for:

- Your share of Medicare costs, like deductibles, coinsurance, and copayments.

- Part A premiums, if you have to pay a premium for that coverage.

Are Medigap Plans Worth The Cost In All States

The federal government regulates the benefits of all the plans, but it doesnt have any influence on their costs. The plan rates vary in different insurance companies and states. For example, Medigap costs are different in Louisiana than they are in South Dakota.

The insured should consider comparing different companies to avoid overpaying for what they need. Comparing prices includes checking how insurance companies price their policies as well as the features that would contribute to increased rates.

Remember that the cost also varies from one letter plan to another So, if you find a Plan G cheaper than a Plan F, you should see what both companies are offering the Plan G and Plan F for, then you can make the best decision.

Don’t Miss: When Applying For Medicare What Documents Do I Need

Do I Need Medicare Part D If I Have Supplemental Insurance

Navigating Medicare can be confusing, especially if you are covered under an employer health plan or another supplemental insurance plan. Medicare beneficiaries often question, Do I need Medicare Part D if I have supplemental insurance? The answer is, it depends. Keep reading to find out whether or not you will need to enroll in a Medicare Part D plan alongside supplemental insurance, as well as what happens if you dont enroll in a Part D plan when you are first eligible.

How Does The Funding Of Medicaid Differ From The Funding For Medicare

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

Also Check: Does Medicare Pay For Assisted Living In Ohio

What Is Medicare Insurance

Medicare is a federal health insurance program for individuals who are 65 or older, younger people with specific disabilities, and people with End-Stage Renal Disease. Medicare is divided into three separate plans, Part A, B, and D, each covering specific health care services. Essentially, Medicare Part A is hospital insurance, Part B outpatient medical insurance, and Part D prescription drugs coverage.

However, while Original Medicare covers numerous services, there are several coverage gaps. Individuals can then opt for Medicare Advantage or Medigap. Both policies are offered by private insurance agencies that are licensed to sell Medicare-related policies. The two policies operate on monthly premiums, covering expenses Medicare Parts A and B dont.

Do You Need Supplemental Health Insurance

Whether or not you need supplemental health insurance depends on a lot of different factors, such as what your current health insurance covers and how high your deductible is. Although many supplemental policies are not overly expensive, duplicate coverage may be unnecessary for many people.

Generally speaking, if youre over 65 and have Medicare, you can get the full coverage you need by:

- Purchasing a standard Medigap policy plus a Medicare Part D prescription drugs plan and possibly a stand-alone dental/vision plan.

If you are under 65 and/or dont have Medicare, your first step is to determine whether you and your family are fully protected with a regular health plan. If you think you need supplemental insurance, ask yourself the following questions:

- If you become seriously ill or get into an accident, will your current health plan cover the care youll need? If not, you should probably consider other health insurance options.

- Do you have a way to cover the out-of-pocket costs that would be incurred under your current health plan on top of being sick and/or out of work for an extended period of time?

- How likely are you or your family members to be in a serious accident or develop a major illness?

- Does the extra cost of the supplemental insurance policy make sense over time?

When looking at that final questions, ask yourself:

Theres no one-size-fits-all answer, as it depends on your circumstances and the specific policy youre considering.

Read Also: How Much Medicare Pays For Home Health Care