When And How To Apply For Medicare

Learn about Medicare enrollment periods and how to sign up for all the coverage you need.

Youre about to get Medicare! Thats great news because the program helps pay for your health care costs and brings peace of mind. But learning how Medicare works and how to apply can be overwhelming. This article breaks down the key Medicare enrollment periods, how they work, and helps you plan for your big enrollment day.

What You Need To Know About The Medicare General Enrollment Period

April 16, 2022 by John Norce

When Medicare considers you first eligible for Medicare benefits, its important to sign up during the applicable enrollment period to avoid penalties and coverage gaps. For most beneficiaries, the Initial Enrollment Period is often the first time to enroll in Medicare, other than being eligible for a Special Enrollment Period. The Initial Enrollment Period, or IEP, covers the seven month period beginning three months before and ending three months after your 65th birthday. It is important to enroll in Medicare when first eligible, however, should you miss this opportunity, there are other times during the year you are able to apply for Medicare.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

You May Like: Do All Medicare Plans Have A Deductible

General Enrollment Period And Medicare Savings Programs

You can qualify for Medicare financial assistance at any time during the year, including the GEP.

Medicare Savings Programs help you pay for Part A and Part B premiums, copays, deductibles, and coinsurance costs if you have limited income and assets. The threshold varies for each of the three programs, which include:

- Qualified Medicare Beneficiary Program

- Specified Low-Income Medicare Beneficiary Program

- Qualified Individual Program

If you receive Medicare benefits and meet Medicaid eligibility requirements for your state, you may qualify for both programs .

If you qualify for any of the MSPs, then you also automatically qualify for Extra Help, which helps you to pay for your prescription drugs.

How Does The Medicare Gep Work

GEP will be live from 1st January to 31st March for 3 months every year. It allows individuals who failed to enroll or missed registering for the Initial Medicare Enrollment for Parts A and B. Those registered for Federal Health Insurance during GEP will benefit from protection coverage starting from 1st July, probably by paying the penalty for delayed joining.

The open window to register for GEP appears between 1st January and 31st March. People who qualify for fitness shield Part A and B and cannot use the opportunity shall have the chance to join during the GEP.

People who automatically qualify for the first time can enroll for a health shield during the IEP. The initial registration stage window will open three months before the completion of 65 years of age. But in the case of people who got the Social Security Disability Insurance for two years before completing 65 years of age, the IEP window will open after two years.

Actively employed individuals who have crossed 65 years of age and have fitness cover from the employers assurance can safely postpone registering for protection section B until retirement. But individuals, who do not have the guard of other fitness safety and have not enrolled for well-being cover Part A and B may have to pay the penalty for late registration.

Read Also: How Do I Submit Medical Bills To Medicare For Reimbursement

Find Out When You Can Enroll In Medicare

For most people, the first time you can enroll in Medicare is around your 65th birthday. You can also qualify to enroll in Medicare with a qualifying disability — after youve received disability benefits for 24 months), or a qualifying medical condition — such as Lou Gehrigs disease or end-stage renal disease .

Initial Coverage Election Period

Another Medicare enrollment period is the Initial Coverage Election Period. The ICEP is your first opportunity to choose a Medicare Advantage plan instead of Original Medicare.

During the ICEP, you can also sign up for prescription drug coverage.

If you enroll in Part B when you turn 65, your ICEP is the same as your IEP. When you join later, your ICEP is the three months before your Part B coverage takes effect.

- If youre newly eligible for Medicare because you turned 65, you can sign up for a Medicare Advantage Plan or Prescription Plan.

- When on Medicare because of a disability, you can select a Medicare Advantage Plan or Medicare Drug Plan. Medicare coverage begins 24 months after SS or RRB disability benefits.

- If youre already eligible for Medicare because of a disability and you turned 65, you can sign up for a Medicare Advantage Plan or a Prescription Drug Plan.

- You can also switch from your current Medicare Advantage or Prescription Drug Plan to another plan.

- Additionally, you can drop a Medicare Advantage or Prescription Drug Plan altogether. If you sign up for a Medicare Advantage Plan during this time, you can drop that plan during the next 12 months and return to Original Medicare.

You May Like: Is Trelegy Ellipta Covered By Medicare

Am I Automatically Enrolled In Medicare Part A When I Turn 65

For most people, enrollment in Medicare Part A and Part B is automatic when they turn 65. A few months before eligibility, individuals receive a packet of information about Medicare. This includes an opportunity to opt out of enrollment.

Many people who are still working at 65 choose to delay Medicare enrollment so they can continue to contribute to their HSA. But if youre not enrolled in qualified group coverage, delaying Medicare enrollment could lead to a penalty.

Does The General Enrollment Period Impact Medicare Advantage Coverage

Since youre using the General Enrollment Period, you dont currently have Part A, Part B, or both. One of the requirements of a Medicare Advantage plan is you must be enrolled in both Part A and Part B of Medicare.

Since your coverage for these will start July first, youll have an Initial Coverage Election Period for a Medicare Advantage plan. Just like the Part D Special Enrollment Period, it begins on April 1st and continues until June 30th.

Your Medicare Advantage plan would also start on July 1st. An enrollment selection must be made prior to July 1st or youll lose your chance to enroll in a Medicare Advantage plan until the Annual Election Period.

Also Check: Does Aetna Medicare Cover Eye Exams

Late Enrollment Penalties During The General Enrollment Period

If you delay Original Medicare benefits without creditable coverage, you must pay the penalty. Each Part of Original Medicare, plus Medicare Part D, involves an ongoing penalty for late enrollment, which you must pay in addition to your monthly premium.

The Medicare Part A penalty only last two times the number of years you go without Medicare hospital coverage after you are eligible. However, the never goes away. Thus, you will be responsible for paying the penalty as long as you have this coverage.

Although Medicare is not mandatory, the late enrollment penalties exist to ensure seniors have adequate healthcare coverage in their most vulnerable years.

When Should I Enroll In Medicare For The First Time

Most people enroll in Medicare for the first time around age 65. Some people may qualify to enroll in Medicare earlier than age 65 with a qualifying disability or medical condition. If you become eligible for Medicare due to age or disability, you will have a 7-month Initial Enrollment Period. The rules for enrolling are different if you are enrolling due to a qualifying medical condition.

The Medicare Initial Enrollment Period

You can enroll in Medicare for the first time due to age or disability during what’s known as the Medicare Initial Enrollment Period.

Enrolling in Medicare at 65

Around age 65 you have your Medicare Initial Enrollment Period . It is 7 months long and includes your 65th birthday month, the 3 months before and the 3 months after. During this time, you can enroll in Medicare Part A, Part B, Medicare Advantage and Part D without penalty.

Video transcript

Blue text appears in the center of a beige background. Animated calendar pages are strewn in the corners of the screen.

ON SCREEN TEXT: Important Medicare Dates & Timelines

ON SCREEN TEXT:

More blue text appears at the top of the screen. White and black text on colorful cards fan out in a list beneath the blue text.

ON SCREEN TEXT: Keep these important Medicare dates in mind

ON SCREEN TEXT: Annual Enrollment Period October 15 – December 7

Initial Enrollment PeriodDates vary by person, 7 months

Special Enrollment Period Dates vary by person, 2-8 months

Recommended Reading: How Soon Before Turning 65 Should You Apply For Medicare

General Enrollment For Medicare Advantage And Part D

If you sign up for Medicare Part A and/or Part B during general enrollment, you will have a different opportunity to sign up for a Medicare Advantage or Part D prescription drug plan.

This special enrollment period for Medicare Advantage and Part D runs from April through June.

Your coverage will begin July 1.

Cms Proposes Medicare Enrollment Coverage Changes

The Centers for Medicare & Medicaid Services Friday released a proposed rule that would implement provisions in the Consolidated Appropriations Act of 2021 that revise the effective dates of coverage in traditional Medicare authorize special enrollment periods for certain eligible individuals and extend Part B coverage for immunosuppressive drugs for kidney transplant patients.

Beginning Jan. 1, 2023, coverage for individuals enrolling in traditional Medicare during the last three months of their initial enrollment period or during the general enrollment period would begin one month after enrollment, CMS said. The rule also would create SEPs for individuals impacted by an emergency or disaster who can demonstrate that their employer or health plan materially misrepresented information related to timely enrolling formerly incarcerated individuals after termination of Medicaid eligibility and other exceptional conditions.

Beginning this October, individuals with end stage renal disease who do not have other health insurance could enroll in Medicare Part B coverage for immunosuppressive drugs beyond the 36-month post-transplant period.

Among other changes, the rule also would require states to specify their policy for paying Medicare Part A and B premiums on behalf of low-income individuals in their Medicaid plan and limit states liability for retroactive Part B premiums to 36 months for certain full-benefit dually eligible beneficiaries.

You May Like: What Is The Window To Sign Up For Medicare

Medicare Special Enrollment Period

Special situations may come up that give you the chance to sign up for or change your Medicare plan outside of your Initial Enrollment Period or the Annual Enrollment Period.

There are several special cases that make you eligible for a Special Enrollment Period.

Here are some common situations:

- You move: If you move to an address outside your plans service area, into a nursing home, or you have different plan options at your new address, youll be able to apply for a new plan.

- You want to switch to a 5-star Medicare plan: Every year, Medicare evaluates plans based on a 5-star rating system. Medicare considers these plans excellent. You can make the switch once to a 5-star plan anytime from Dec. 8 through Nov. 30 if one is available in your area.

- You lose your current coverage: This applies if you or your spouse will retire or change to a job that doesnt offer coverage. It doesnt apply if your insurance company cancels your coverage because you didnt pay your monthly premiums.

- Your plan changes its contract with Medicare: Enrollment in a plan depends on the plans contract with Medicare, and for various reasons these contracts could change.

Your new coverage begins on the first day of the month after you sign up.

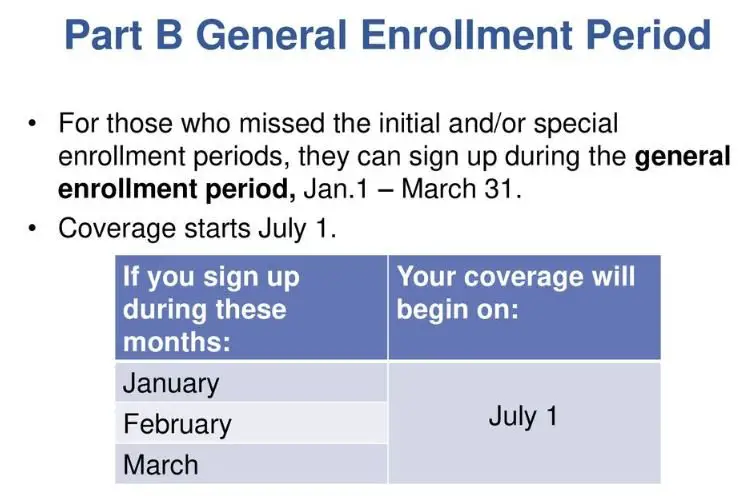

What Is The General Enrollment Period For Medicare

The Medicare general enrollment period happens every year between Jan. 1 and March 31.

If you miss initial enrollment or the seven-month window when you first become eligible to sign up for Medicare the general enrollment period is an opportunity to sign up for Medicare Part A and Part B for the first time.

The general enrollment period is different from a special enrollment period. Several situations may qualify you for special enrollment, including moving to a new home or losing employer health insurance.

You can only apply for Medicare during the general enrollment period if both of the following apply:

Once youre signed up, your coverage will begin July 1.

You May Like: Does Medicare Offer Dental And Vision

What Can I Not Do During General Enrollment

Despite fulfilling the requirements for Medicare Advantage once youve joined Original Medicare during this time, you wont be able to enroll in Medicare Advantage and/or Part D until later in the year.

If you want to join Medicare Advantage, you will need to wait until a Special Enrollment Period lasting from April 1 to June 30 in order to join Medicare Advantage or a Part D plan. If you miss this enrollment period, you can join these plans during the Annual Enrollment Period, which is from October 15 to December 7.

By Step Through The Online Process

1. To sign up, go to the Social Security Administration website. Click the Apply for Medicare Only button.

2. Youll need to accept the terms of service. After youve done that, click Next. On the Apply for Benefits page, choose Start a New Application. Note that you will be asked to sign in to your online Social Security account or create one.

3. On the next screen, indicate whether you have an online Social Security account.

4. If you have an online Social Security account, youll need to log in.

5. After youve logged in to your account, youll need to provide personal information.

6. On the next screen, youll need to answer a question about your Medicare application. Click Yes.

7. If you want to sign up for Part B benefits in addition to Part A, click Yes.

8. Now provide information about your group health plan, employment and health insurance.

9. After youve answered those questions, youll be ready to sign your application. Check the box and click the Submit Now button. Youll receive a receipt that you can print and keep for your records. Youll also get a number you can use to check on the status of your application.

About two weeks after you sign up, youll get your Medicare card in the mail, along with your Welcome to Medicare package.

Starting on the date listed on the front of the card, you should bring the card to all your doctors appointments and to the hospital.

Images: Social Security Administration and Medicare.gov

More on Medicare

Don’t Miss: Does Medicare Cover Rolling Walkers

Signing Up Late: General Enrollment Period

Part A. If you didn’t sign up for Medicare Part A when you were first eligible, you can sign up for Part A anytime, without penalty.

When coverage begins. Your Part A coverage will go back to six months before the date you signed up .

Part B, C and D. If you didn’t sign up for Medicare Part B when you were first eligible, you can sign up for Part B during a General Enrollment Period, which happens between January 1 through March 31 each year. You will also have from April 1 through June 30 of that year to add a Medicare Advantage plan or Medicare Part D plan.

When coverage begins. When you sign up for Part B, C, or D during a General Enrollment Period, your coverage will start July 1.

Late sign-up penalty. Individuals who did not sign up for Medicare Part B when they turned 65 might face a penalty of higher lifetime premiums when they do sign up. However, most individuals who were covered by a group health plan through an employer are not subject to the penalty. If you didn’t sign up for Part B because you had group health benefits through work, you should be able to sign up during your Special Enrollment Period.

What You Need To Know About Medicare Enrollment

You need to meet specific requirements before you can enroll in the various parts of Medicare. In general, these include:

- You must be 65 or older or under 65 with a qualifying disability or condition.

- You must be a U.S. citizen. You are also eligible for Medicare if you are a permanent legal resident who has lived in the United States for at least five consecutive years.

- You are already receiving Social Security benefits or Railroad Retirement Board benefits.

- You are disabled and receiving SSDI or Railroad Retirement Board disability insurance benefits. You do not need to be 65, but in many cases, there is a two-year waiting period after you start receiving disability benefits before you can receive Medicare benefits.

- You have end-stage renal disease . This can be at any age. To qualify for Medicare, your kidneys must no longer function, you need regular dialysis, or you have had a kidney transplant.

- You have amyotrophic lateral sclerosis . If you suffer from ALS, there is no two-year waiting period. Medicare benefits kick in when your SSDI benefits begin.

- To receive free Part A benefits, you or your spouse normally would have had to pay 40 quarters of Medicare taxes during your working life. If you paid into the system less than that threshold, you can still get Medicare, but youll probably have to pay for Part A benefits.

Three MSPs help you pay for Original Medicare and Part B costs. They are:

Don’t Miss: How To Order Another Medicare Card