What Is The Medicare Special Enrollment Period

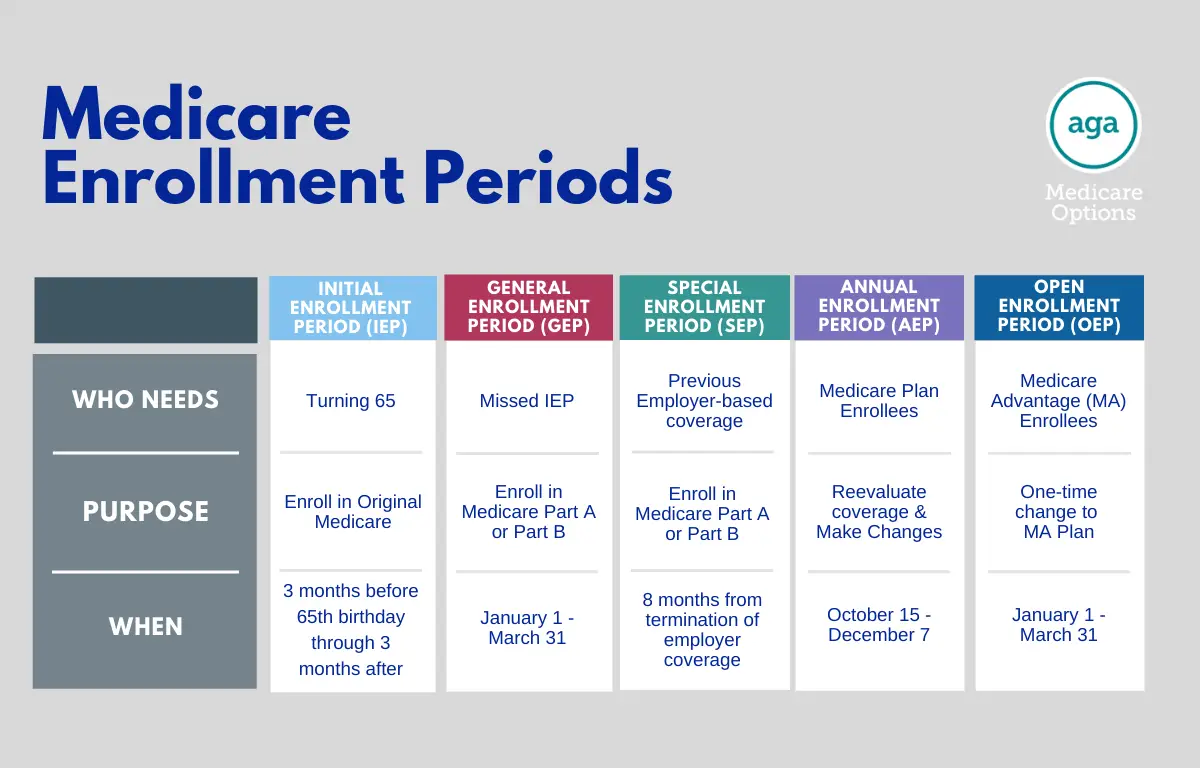

If you meet the criteria for a Medicare special enrollment period , you’ll be able to change your Medicare Advantage, Original Medicare or Medicare Part D plans. Qualifying situations include moving, having other coverage options, becoming eligible for Medicaid and more.

Medicare.gov has very specific rules about special enrollment periods and what Medicare changes you can make during what qualifying event. Below are the guidelines for some of the most common special enrollment circumstances.

| Special enrollment qualification | What Medicare changes you can make |

|---|---|

| Moved to a new address with different plan options | Return to Original Medicare or change coverage with Medicare Advantage or Medicare Part D |

| Changed eligibility for employer, union or COBRA coverage | Join or drop Medicare Advantage or Medicare Part D |

| Youâre eligible to be dual enrolled in Medicare and Medicaid | Enroll, cancel or change Medicare Advantage plan or Medicare Part D |

| You have or recover from a severe or disabling condition | Enroll or cancel a Medicare Chronic Care Special Needs Plan |

| A 5-star Medicare plan becomes available in your area | You can join the 5-star Medicare Advantage or Medicare Part D plan |

| You qualify for Medicaid, State Pharmaceutical Assistance or Medicare Extra Help | You can enroll, cancel or change your Medicare Advantage or Medicare Part D enrollment several times during the year |

Documents Needed If You Sign Up In Person

- An original or certified copy of your birth certificate or other proof of birth

- Proof of United States citizenship or legal residency if not born in the U.S.

- Your Social Security card if you are already receiving benefits

- A copy of your most recent W-2 form and/or self-employment tax return

- U.S. military discharge papers if you served before 1968

- Health insurance information

Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

You May Like: Does Medicare Advantage Cover Shingles Vaccine

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Enrollment Periods For Medicare Advantage And Prescription Drug Plans

Once youre enrolled in Original Medicare , you may have other types of Medicare coverage available to you as well, like Medicare Advantage plans and stand-alone Medicare Part D prescription drug plans.

- Medicare Advantage plans offer an alternative way to get Original Medicare . Many of these plans offer additional benefits like routine vision, dental services, prescription drug coverage, or health wellness programs.

- Stand-alone Medicare Part D prescription drug plans can work with your Original Medicare coverage to help pay for your medications.

Both these types of Medicare plans are available through Medicare-approved private insurance companies. Lets take a look at enrollment periods for them.

Initial Coverage Election Period for Medicare Advantage plans

Youre eligible to enroll in a Medicare Advantage plan if:

- You have Medicare Part A and Part B.

- You live in the service area of a Medicare Advantage plan.

- You dont have end-stage renal disease .

Youre usually first eligible to enroll in a Medicare Advantage plan during your Initial Coverage Election Period . For most people, this period takes place at the same time as their Initial Enrollment Period for Original Medicare, described above. If you delay Medicare Part B enrollment, your ICEP starts three months before you have both Medicare Part A and Part B and ends the last day of the month before your Medicare Part B coverage starts.

Initial Enrollment Period for Medicare Part D

Read Also: Does Medicare Pay For Chiropractic

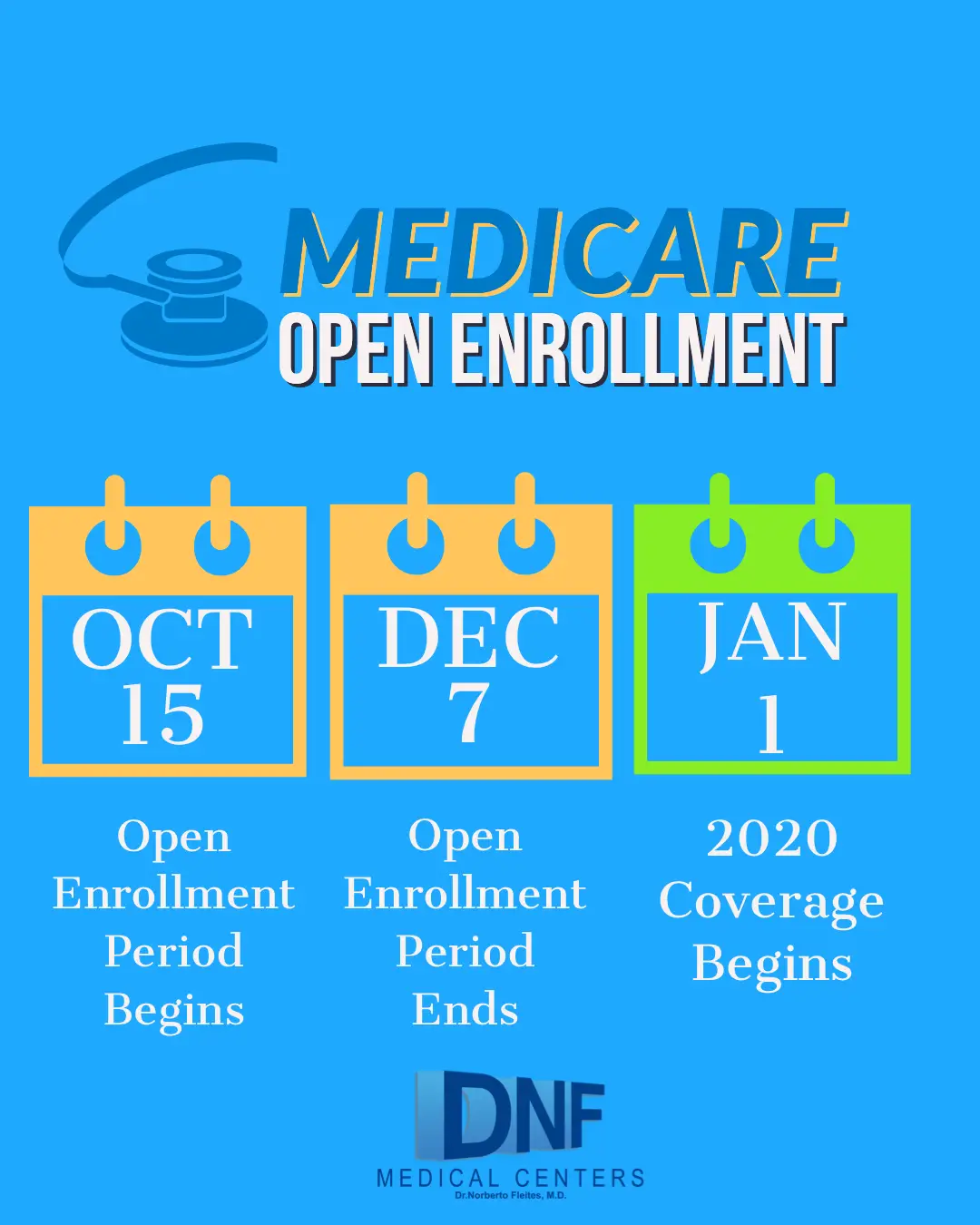

Whats The Medicare Open Enrollment Period

Medicare health and drug plans can make changes each yearthings like cost, coverage, and what providers and pharmacies are in their networks. October 15 to December 7 is when all people with Medicare can change their Medicare health plans and prescription drug coverage for the following year to better meet their needs.

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

Don’t Miss: Does Medicare Cover Oxygen At Home

Medicare Advantage Open Enrollment Period

Medicare Advantage Open Enrollment happens every year from Jan. 1 to March 31. If youre enrolled in a Medicare Advantage plan and want to make changes, you can do one of these:

- Switch to a different Medicare Advantage plan with or without drug coverage

- Go back to Original Medicare and, if needed, also join a Medicare prescription drug plan

Your new coverage begins on the first day of the month following the month you make a change and will be in effect for the rest of the year.

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Don’t Miss: Does Medicare Cover Bed Rails

Medicare Sign Up: What You Cant Do

The annual Medicare open enrollment period does not apply to Medigap plans, which are only guaranteed-issue in most states during a beneficiarys initial enrollment period, and during limited special enrollment periods.

If you didnt enroll in Medicare when you were first eligible, you cannot use the fall open enrollment period to sign up. Instead, youll use the Medicare general enrollment period, which runs from January 1 to March 31.

Medicares general enrollment period is for people who didnt sign up for Medicare Part B when they were first eligible, and who dont have access to a Medicare Part B special enrollment period. Its also for people who have to pay a premium for Medicare Part A and didnt enroll in Part A when they were first eligible.

If you enroll during the general enrollment period, your coverage will take effect July 1.

Learn more about Medicares general enrollment period.

Choosing The Right Medicare Supplement Plan

Many first-time Medicare beneficiaries wonder which Medicare supplement plan is right for them. You can find and compare plans easily usingMedicares plan finder tool. You might also choose to seek the advice of a licensed insurance agent in your area who can help you find the best plan. However, here are the major factors that you need to consider. First, you should know that most Medigap plans are standardized across states. This means that Plan A in one state will provide the same coverage as Plan A in another state. This can help when comparing different plans from different companies.

Next, you should consider your overall health care expenses. The coverage details vary greatly between different supplemental coverage plans. Some cover most of your out-of-pocket expenses like copays and coinsurance payments at 100%, while others cover those expenses at a lower percentage. Some plans provide coverage for foreign medical care, while others do not.

Remember that most people who are enrolled in Original Medicare that purchase a Medicare supplement health insurance plan also purchase a Medicare Part D prescription drug plan. While these plans are not mandatory, they provide many great prescription drug benefits. Your Medigap plan will generally not help cover any prescription drug costs, but most Part D prescription drug coverage plans use a cost-sharing model that can save you a lot of money on your medications.

You May Like: How Much Is Medicare Plan F Cost

What Should I Consider When Choosing Medicare Coverage Annually

- Did my monthly premiums increase?

- Are my medications still listed on my drug formulary?

- What are my predicted annual medical costs going to be?

- Is my doctor still in my plans network of providers?

- Do I plan on traveling this year?

- What ancillary benefits do I have?

- What are my plan ratings?

Did my monthly premiums increase?

Your ANoC explains how your current coverage will change the following yearincluding whether youll see an increase or not in your monthly premiums. Look at the premium for your current plan and compare it with the premium amount shown on your ANoC. A significant increase is a good sign it may be time to shop around for a new plan.

Are my medications still listed on my drug formulary?

A new year can also bring changes to your drug formulary, the pricing tiers that medications are placed in, or the copays required for various types of prescriptions. Find out whether your prescription plan will cover your current medications in the upcoming year, and how much youll pay for them. If you take expensive medications, its a good idea to explore other prescription plans available in your area to see if they have lower copays.

What are my predicted annual medical costs going to be?

Make a list of the doctor visits and procedures you expect for next year. Then estimate what you will pay for them out of pocket with your current Medicare coverage. Add in a years worth of premiums and youll have a good estimate of what your healthcare will cost you next year.

Medicare Supplement Open Enrollment

Millions of Americans are enrolled in Medicare coverage, but you likely already know that Medicare does not pay for everything. Even when you receive a service that is covered by Medicare, you will still owe some money out of your pocket. These out-of-pocket expenses come in the form of deductibles, copays, and coinsurance payments. Many people choose to purchase a Medicare supplement plan to help offset these out-of-pocket costs. Enrolling in the right Medigap plan can save you money on your overall health care expenses, but when should you sign up? The best time to purchase a Medigap insurance plan is during your open enrollment period. Keep reading, and we will tell you when your open enrollment period starts, how long it lasts, and why you should sign up during that time.

Also Check: Is The Cologuard Test Covered By Medicare

A Medicare Advantage Plan That Surrenders Contracts With Providers

If your Medicare Advantage plan ceases contracts with many of its providers and these terminations are considered substantial, you will be granted a one-time opportunity to switch to a different Medicare Advantage plan.

The period given to make the change will begin the month you are notified of the opportunity and will continue for two months thereafter.

If your circumstances do not fit into any of the Special Enrollment Periods described above, you may ask the Centers for Medicare and Medicaid Services for your own Special Enrollment Period based on your situation.

When Is The 2022 Medicare Open Enrollment Period

Medicare open enrollment happens every fall from October 15 through December 7.

This enrollment period is only for existing Medicare enrollees who want to make changes to their coverage. Any changes you make during the 2021 Medicare enrollment period will affect your 2022 Medicare plan, beginning Jan. 1, 2022. Note that the 2022 open enrollment period for health insurance was extended, but the dates for Medicare open enrollment were not extended.

What can you do during Medicare open enrollment?

During Medicare open enrollment, sometimes called the Medicare annual enrollment, you can change Original Medicare, Medicare Advantage or Medicare Part D plans, including changing your coverage, switching between plan types and adding prescription drug benefits.

|

|

|

4 questions to ask during Medicare open enrollment

Participating in open enrollment is an important step to making sure that you have the health benefits you need for the upcoming year. When comparing plans, ask yourself:

Plan availability and the cost of Medicare change each year. We recommend that all enrollees review their options annually to compare rates and make sure they’re getting the best deal. If you want to keep the same coverage, your Annual Notice of Changes will tell you how your current plan is changing.

Read Also: Who Must Apply For Medicare

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

Don’t Miss: How Do I Check On My Medicare Application

During A Special Enrollment Period

This SEP is available only if you have health insurance from an employer for which you or your spouse actively works. It allows you to delay enrolling in Part B until the employment or the coverage ends whichever occurs first.

The SEP actually lasts throughout the time you have coverage from current employment and for up to eight months after it ends. If you enroll at any point during this time frame, your Medicare coverage will begin on the first day of the following month, and you will not be liable for late penalties regardless of how old you are when you finally sign up.

Be aware that an IEP always trumps an SEP if the two should happen to overlap. For example, if your IEP ends on Aug. 31, and you retire on the same date, you will not be entitled to an SEP. Therefore, if you delayed enrollment until after Aug. 31, you would not be able to sign up until the following general enrollment period and your coverage would not begin until July 1 so you would be left for almost a year without coverage. Even if you signed up during the final months of your IEP, your coverage would still be delayed by two or three months. But, to continue this example, if you retired on Sept. 1, under the rules of the SEP, you could enroll in August and receive Medicare starting Sept. 1 with no loss of coverage.

Two other Medicare enrollment scenarios have different rules.

Signing Up For Original Medicare

You can sign up for Medicare one of four ways:

For California residents, CA-Do Not Sell My Personal Info, .

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Recommended Reading: Will Medicare Pay For A Toilet Seat Riser