Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Should I Apply For Medicare If I Have Veterans Affairs Coverage

The Veterans Administration encourages veterans to enroll in Medicare Parts A and B at age 65, during the initial enrollment period. This gives you more options for the care you may need in the future. VA health care will cover care you receive in VA clinics and hospitals, but it does not generally cover care provided by other doctors and facilities. Even if you are currently satisfied with your VA health care benefits, either your medical needs or the VA health systems coverage and costs could change in the future.

What Do I Need To Claim Guarantee Issue Rights

Now that we know what situations are subjected to the availability of guarantee issue rights lets check the requirements we need to keep in handy.

- A copy of any letters, notices, emails, or denials of claims that bear your name as evidence that your coverage has ended.

- These papers arrive in a postage-paid envelope as evidence that they were mailed.

To demonstrate that you have a guaranteed issue right, you might need to submit a copy of some, all, or all of these documents together with your Medigap application.

Read Also: How To File A Medicare Claim Electronically

Signing Up For Medicare Supplement Or Medicare Advantage Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan at any time. However, the best time to enroll is during your Medicare Supplement Open Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You can enroll in any Medigap plan for which youre eligible, with no health underwriting questions during this time. Thus, you wont face denial due to pre-existing conditions.

If you choose to enroll in a Medicare Advantage plan, it is best to do so during your initial enrollment period. This is the same timeframe as applies to Medicare Part A and Part B enrollment.

You can enroll in any Medicare Advantage plan available in your service area during this window. If you miss this enrollment period, you must wait until the Annual Enrollment Period to enroll in a plan.

Keep in mind, when enrolling in a plan, it is important to note that you are not able to enroll in a Medicare Advantage plan and a Medigap plan at the same time. So, before you enroll, it is essential to compare all options available.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

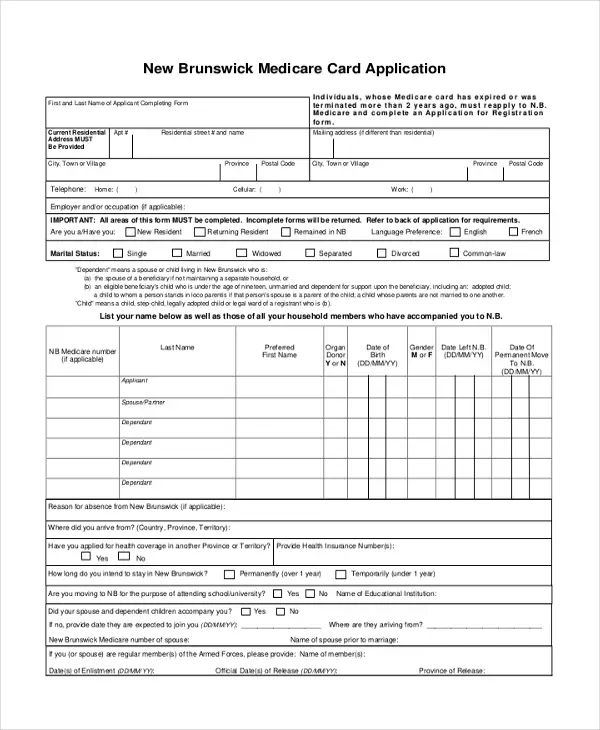

- Canadian citizenship card or certificate , permanent resident card or confirmation document or letter

If these supporting documents are not provided, your application cannot be processed.

Additional supporting documents may be requested to confirm AHCIP eligibility.

Do I Need Medicare Part B If Im A Veteran

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of Medicare are one group. The most common situation, though, is with Veterans.

Not all veterans qualify for VA coverage. Your length of military service and your discharge characterization affect your eligibility. If you plan to use VA healthcare coverage as your only coverage, be sure that you apply for VA coverage before your initial enrollment window for Medicare expires. That window runs 3 months before and after your birth month.

Once enrolled in VA coverage, you can choose to skip Medicare and get all of your care at VA clinics and hospitals only. However, I do not advise this. The VA system has been the subject of considerably negative press for years over long waiting times. I have seen many people personally experience this.

Enrolling in Medicare Parts A and B gives you a civilian option. Medicare will pay for Medicare-covered services or items, and Veterans Affairs will pay for VA-authorized services or items.

Be aware that if you opt-out of Part B and then later decide to join, you will pay a Part B late penalty. Youll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active.

In my opinion, most Veterans should sign up for Part B. You can read more about VA coverage and Medicare here.

Also Check: What Is The Most Expensive Medicare Supplement Plan

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

The Effect Of Having Dental Coverage On Medicare Recipients

The expansion of Medicare dental coverage will have a positive impact on some seniors, while others will not receive any benefit. Because of the language included in the final rule, some seniors will receive savings for dental care if dental work is required to treat qualifying medical conditions. Seniors who do not qualify for the expanded dental care coverage in the final rule are still required to pay a fee for services not covered by Medicare.

Patients with diabetes can expect to continue to pay for dental examinations and surgeries out-of-pocket if Medicare does not cover the procedure.

Also Check: Is Skyrizi Covered By Medicare

When Can You Enroll In A Medicare Supplement Plan Or Medigap Policy

If youre thinking about joining a Medicare Supplement Plan or Medigap policy, figuring out when to enroll can be difficult.

While you can enroll in a Medicare Supplement Insurance at any time, if you enroll at the wrong time it can sometimes limit your choices, cost you more money, and affect your cover.

This article will discuss when you can enroll in a Medicare Supplement Plan and what you should know before you do.

When To Apply For Medicare Part A And Part B

The Initial Enrollment Period is usually the first time you can apply for Medicare. There are a few special circumstances that might allow you to enroll earlier . But in general, people apply for Medicare within their seven-month IEP.

Heres what the Initial Enrollment Period looks like:

- Three full months before your 65th birthday month

- The entire month in which you turn 65

- Three full months after your birthday month

If you miss your sign-up window for Medicare Part A and Part B during your Initial Enrollment Period, there is also a General Enrollment Period every year from January 1 to March 31. And if you defer your Part B coverage , there is a Special Enrollment Period.

As a word of caution, if youre signing up for Medicare outside of your IEP, there are some pitfalls that are easily stepped into. You can read more about enrollment periods here.

Read Also: Do Retired Federal Employees Get Medicare

Also Check: What’s The Best Medicare Supplemental Plan

Should I Sign Up During My Initial Enrollment Period

For most people, the answer is yes. They need to sign up for Medicare during their seven-month initial enrollment period , which starts three months before the month you turn age 65 and ends three months after your birthday month. If your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

If your birthday falls on the first day of a month, the whole initial enrollment period moves forward one month. For example, if your birthday is June 1, your IEP begins Feb. 1 and ends Aug. 31.

If you or your spouse is still working and you have health insurance coverage from that active employer, you may be able to wait. But otherwise, you need to sign up for Medicare during your IEP to avoid late enrollment penalties and delayed coverage.

The phrase active employer is key. If you have other insurance that isnt from your own or your spouses current employer, you will still need to sign up for Medicare during your initial enrollment period. You need to sign up during your IEP in all of these circumstances: If you have

- COBRA health coverage that extends the insurance you or your spouse received from an employer while working

- Health insurance that you bought yourself and no employer provided it

- No health insurance

- Retiree benefits from your own or a spouses former employer

- Veterans benefits from the Department of Veterans Affairs health system but no insurance from a current employer

Apply For Financial Assistance To Make Medicare More Affordable

If you have a low income and are concerned about costs, you can also apply to see if youre eligible for financial assistance.

Applications for financial assistance programs are not automatically included when you apply for Medicare coverage. This means that many people are paying more for Medicare coverage than they need to.

Its estimated that about 30% to 45% of those who are eligible for these programs never apply for the benefits.

For programs administered by the state, the income limits and asset requirements vary. So after applying for Medicare, we recommend checking with your state for the exact eligibility requirements that apply to you.

| Program |

|---|

Read Also: Does Medicare Cover Dexcom G6

Is Medicare Cheaper Than Employer Coverage

Whether Medicare is cheaper than employer coverage can only be answered by conducting a thorough comparison of the costs and coverages offered by both types of insurance. It is always wise to contact the benefits department managing your employee coverage to discuss the ramifications of dis-enrollment. Consider the following:

| Coverage | ||

|

|

|

| Original Medicare and employer plan |

|

|

| Original Medicare without employer plan |

|

|

| Enroll in a MA plan with or without employer plan |

|

|

For more information, read Will My Secondary Insurance Pay For My Medicare Deductible And/Or Coinsurance?

What Should You Consider Before Enrolling In Medicare

Before dropping employer coverage to enroll in Medicare, consider all the options that are or will become available once Medicare is elected. Remember the limitations of Original Medicare and the options available through MA and Medicare Supplement Plans. Consider these questions:

- How much will you pay in monthly premiums for each plan?

- How much will you pay for deductibles, copays, and coinsurance for both medical and pharmaceutical services?

- Are your current doctors, prescriptions, labs, and hospitals covered?

- Do the plans cover potential future needs such as out-of-network hospitals, cancer treatment centers, and specialists?

- What will you pay for dental, vision, and other benefits not covered by Original Medicare?

- Employer plans may have separate coverage for medical and drugs from that of dental and vision coverage. Check with the benefits department to see if you can keep one without the other.

- MA Plans may offer vision, dental, and hearing coverage.

You May Like: Can I Get Medicare At Age 62

Can You Keep Your Health Savings Account With Medicare

A Health Savings Account is used to pay for medical expenses with pretax funds. There are certain requirements you need to meet to be able to contribute to an HSA.

You must be enrolled in a high-deductible health plan and you cant have any other plan. Since Medicare is considered another health plan, you can no longer contribute funds to an HSA once enrolled in Medicare. If your employer was contributing on your behalf, they would also have to cease those additions.

You may receive a tax penalty on funds you contribute to an HSA after you are enrolled in Medicare. However, you dont lose those funds in your HSA account, as you can use them to pay for expenses such as Medicare premiums, copayments, deductibles, and future health care costs.

Michele Dubbert is a licensed independent health insurance agent, working with individuals, families and small businesses. She has been in the Health Insurance industry since 2013. Her passion and specialty prevail in Medicare as she truly enjoys working with this age group.

She takes joy in learning about her clients and their needs. This assists in finding the right plan that fits their lifestyles and most importantly gives them piece of mind. Many of her clients come to her frustrated with the Medicare process, so she helps them from beginning to end.

Documents You Need To Apply For Medicare

To begin the application process, youll need to ensure you have the following documentation to verify your identity:

- A copy of your birth certificate

- Your drivers license or state I.D. card

- Proof of U.S. citizenship or proof of legal residency

You may need additional documents as well. Make sure to have on hand:

- Your Social Security card

- W-2 forms if still active in employment

- Military discharge documents if you previously served in the U.S. military before 1968

- Information about current health insurance types and coverage dates

If you are already enrolled in Medicare Part A and have chosen to delay enrollment in Medicare Part B, you must complete the additional forms .

- 40B form:This allows you to apply for enrollment into Medicare Part B only. The 40B form must be included in your online application or mailed directly to the Social Security office.

- L564 form:Your employer must complete this form if you delayed Medicare Part B due to creditable group coverage through said employer. You must also include the completed L564 form in your online application, or mail it directly to the Social Security office.

Read Also: Does Medicare Cover Outpatient Physical Therapy

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

When To Sign Up For Medicare

How can you make sure that youre adhering to the deadlines? Rest assured that were here to help you sort through the important dates, so that you never fall behind. If youre approaching your 65th birthday, then read on to discover more about the dates and deadlines to keep in mind when it comes to Medicare enrollment.

Recommended Reading: When Can I Buy A Medicare Supplement Plan

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Expanded Dental Coverage Does Not Apply To Patients With Diabetes

Neither the final rule nor the interim rule expanded dental coverage for diabetes patients. The final rule does not cover normal dental examinations for diabetic patients, despite the importance of regular dental checkups for this population. However, coverage could expand over the next several years.

You May Like: Does Medicare Part A And Part B Cover Prescriptions