Do I Need To Notify Anyone If Im Delaying Medicare

You don’t need to provide notice that you’d like to delay enrolling unless you’re receiving Social Security or Railroad Retirement Board benefits. If you are receiving either, you’ll be automatically enrolled in Medicare Parts A & B when you turn 65, and you’ll need to let Social Security know you wish to delay Part B. By law though, if you receive Social Security benefits and are eligible for Medicare, you must also have Medicare Part A.

Choose Your Medicare Coverage

Most first-time Medicare enrollees can choose between 2 main ways to get coverage:

Before choosing, take the time to research each plans coverage options including the network, costs, and list of covered drugs. Learn more about the and to find the best plan for your healthcare needs.

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Don’t Miss: Do All Medicare Part D Plans Have A Donut Hole

When To Sign Up For Medicare

If youre not enrolled automatically, you should sign up in the three months before your 65th birthday. That way, coverage will start on the first day of your birthday month .

You technically have seven months around your 65th birthday to enroll: the three months before your birthday month, your birthday month and the three months after. This is called your initial enrollment period. If your birthday is the first of the month, your initial enrollment period includes the four months before your birthday month and two months after.

Your coverage could be delayed if you wait until your birthday month or the three months afterward to apply for Medicare. And if you miss your initial window, you may need to sign up during Medicare’s general enrollment period. However, you may be subject to a permanent penalty unless you have continuous coverage from a large employer group health insurance plan.

Should I Sign Up For Part B

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can opt out of that coverage.

If youre eligible at age 65, your Initial Enrollment Period begins 3 months before your 65th birthday, includes the month you turn age 65, and ends 3 months after that birthday.

If you accept the automatic enrollment in Medicare Part B or if you sign up during the first 3 months of your IEP, your coverage will start the month youre first eligible. If you sign up during the month you turn 65 or during the last 3 months of your IEP, your coverage starts the 1st day of the month after you sign up.

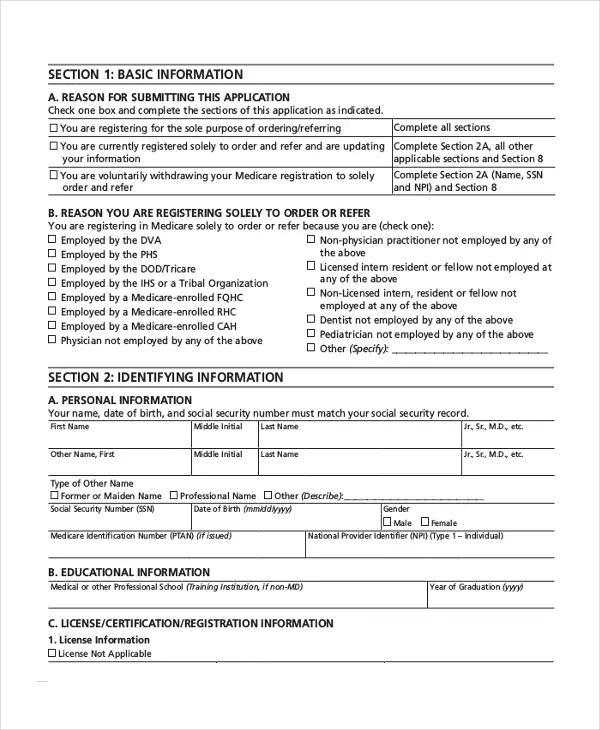

The following chart shows when your Medicare Part B becomes effective in 2023:

| If you enroll in this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| 1 to 3 months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65, or 1 to 3 months after you reach age 65 | The 1st day of the month after you sign up. |

If you choose not to sign up for Medicare Part B but then decide to do so later, your coverage could be delayed. You may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10% for each 12-month period you were eligible for Part B but didnt sign up for it. This does not apply if you qualify for a “Special Enrollment Period” .

Also Check: What To Do For Medicare Before Turning 65

And Still Working: Should You Enroll In Medicare

Dear Carrie,

I’m planning to continue to work past age 65, and wondering if I should stick with my employer’s health insurance or move over to Medicare. How do I decide?

A Reader

Dear Reader,

This is becoming a common question as more and more people decide to work past age 65. In fact, according to the Bureau of Labor Statistics, in 2020, 26.6 percent of people aged 65-74 remained in the workforceand those numbers are projected to continue to grow. This can be seen as a positive since it means we’re redefining aging. At the same time, though, adequate health insurance remains essential.

So it’s an important questionand the answer largely depends on the size of your employer, as well as the cost and coverage of your current plan as compared to Medicare. You’ll need to familiarize yourself with the pertinent Medicare regulations and deadlines to ensure the most seamless transitionwhether that happens at age 65 or later.

Also realize that once you file for Social Security, you’re automatically enrolled in Medicare Parts A and B when you turn 65. However, you have the option to opt out of Part B, which you may want to do if you are covered by an employer plan.

If you haven’t filed for Social Security, you can choose to enroll in just Medicare Part A or both Parts A and B . Alternatively, you can postpone enrolling until you stop working. Let’s take a look at some Medicare basics as well as some of the factors that can help you decide.

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

You May Like: Which Medicare Plans Cover Silver Sneakers

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Signing Up For Medicare Part D

Signing up for Medicare Part D is simple. Once you enroll in Medicare Part A and Part B, you can enroll in Medicare Part D.

Like other parts of Medicare, unless you have creditable coverage, enrolling during your initial enrollment period is best to avoid future penalties. To enroll, you must apply through Medicare and choose to enroll in any plan in your service area.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Also Check: Does Medicare And Medicaid Pay For Dentures

Applying For Medicare Part A And Part B Online

Applying for Medicare Part A and Part B online is a quick and easy process on the Social Security website, taking approximately ten minutes. After you have applied for Medicare Part A and Part B online, you can check the status of your application and appeal, request a replacement card, and print a benefit verification letter.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part Bit Depends On The Size Of Your Employer

Medicare Part B covers doctors’ services, outpatient care, medical supplies and preventive services. The primary consideration in deciding if you need Part B is how many employees work at your company.

- If your company has 20 or more employees, your company would remain your primary insurer and you can delay enrolling in Part B without worrying about a late-enrollment penalty or lapse of coverage. When you leave your job, you then have eight months to sign up for Part B under a Special Enrollment Period.

- If your company has fewer than 20 employees, Medicare is considered your primary insurer, whether you’ve enrolled in Medicare or not. Your company plan is the secondary, which means that your employer plan won’t pay for anything that’s assumed to be covered by Medicare. If you don’t sign up for Part B as soon as you’re eligible, you may have to pay a penalty, and there could be a delay in coverage.

You May Like: Does Medicare Part D Cover Sildenafil

How Do I Enroll In A Prescription Drug Plan

The Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans.

For assistance with Part D plan comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for prescription drug plans available in your area.

If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

You Can Sign Up For Medicare Part D During Fall Open Enrollment

You can generally sign up for Medicare Part D and make other changes during this period. Sometimes called the Fall Annual Enrollment Period, Part D enrollment happens each year from October 15 to December 7. During this time, you can usually make the following changes during the AEP:

Recommended Reading: Does Medicare Pay For Cialis

Your Plan Options And Premiums Will Change

After you submit proof of Medicare enrollment to STRS Ohio, your STRS Ohio plan options and premiums will change.

Plans for Medicare enrollees include the Aetna Medicare Plan, the Medical Mutual Basic Plan or a regional plan if available in your area.

Premiums for the STRS Ohio Medicare plans are lower than the non-Medicare plans. Also, premiums for benefit recipients enrolled in an STRS Ohio Medicare plan have been reduced by a $30 Medicare Part B premium credit.

You can review your new plan options and premiums in your Online Personal Account or call STRS Ohio for this information.

Note: If you are not currently enrolled in an STRS Ohio plan, initial eligibility for and enrollment in Medicare is a qualifying event that allows you to add STRS Ohio coverage outside of open enrollment. You can enroll in a plan through your Online Personal Account.

Also Check: Social Security And Medicare Benefits

How Employer Coverage And Medicare Part B Work Together

Enrolling in Part B alongside your employers health plan is also an option. If you choose to obtain both health plans, Part B would be the primary payer for your coverage. Your secondary payer would be your employer.

If your employer still offers your insurance plan past the age of 65 and they have good coverage for your needs and lifestyle, putting them as your secondary payer may turn out to be more costly for you.

Read Also: Does Medicare Cover Ice Therapy Machines

You May Like: How Much Does Medicare Part C Cost Per Month

Does Medicare Cover The Costs Of Durable Medical Equipment

Medicare does cover durable medical equipment, which is equipment that serves a medical purpose, is able to withstand repeated use, and is appropriate for use in the home. Original Medicare normally pays 80% of the Medicare-approved amount after you meet your Part B deductible and you are responsible for a 20% coinsurance. Medicare only covers durable medical equipment if your provider says it is medically necessary for use in the home. You must also order the equipment from suppliers who contract with Original Medicare or your Medicare Advantage Plan. If you have a Medicare Advantage Plan, your plan will have its own cost and coverage rules for durable medical equipment. For a more comprehensive list of what is covered, please visit Durable Medical Equipment section in the Medicare and You handbook.

Having Creditable Drug Coverage

Before you officially delay Medicare, make sure you have creditable drug coverage. This means your employer drug coverage is at least as good as the standard Medicare Part D plan coverage. If your employer’s drug coverage isn’t creditable, you will need to enroll in a Part D plan during your Initial Enrollment Period to avoid the Part D late enrollment penalty . Consequently, you’ll also need to get either Part A or Part B in order to get a Part D plan.

Also Check: Are Blood Glucose Test Strips Covered By Medicare

Enrolling In Original Medicare

When it comes to Original Medicare, enrollment could be a piece of cake. If youre already receiving Social Security or Railroad Retirement Board benefits and youre a U.S. resident, the government automatically enrolls you in both Medicare Part A and Medicare Part B at age 65. Three months prior to your 65th birthday, your Medicare card will arrive in the mail with instructions.

At this point, youll have the option to turn down Medicare Part B . But you probably wont want to do that unless you have coverage from your own or your spouses current employer, and the employer has at least 20 employees. Thats a valid reason for delaying your enrollment in Medicare Part B.

If you decide to not enroll in Part B, but plan to enroll at a later date, know that you could end up having to pay a higher premium 10% higher for each year you could have enrolled, but didnt. The penalty doesnt apply, however, if the reason you didnt initially enroll in Part B coverage was that you had employer-sponsored health insurance from your current employer, including TRICARE from current military employment.

If you havent yet enrolled in Social Security but are eligible and want to begin receiving benefits, you can enroll online, or at a local Social Security office. Be sure you understand how your benefits depend on the age at which you start receiving them, and theres no right or wrong answer in terms of when you should activate your benefits.

When Do I Have To Sign Up For Medicare When Can I Add Prescription Drug Coverage

If you delay enrollment in Medicare Part A, Part B, and/or Part D, you might not be able to enroll just anytime. You might have a Special Enrollment Period, which varies depending on your situation. Learn more about Medicare enrollment periods.

Enrollment in a plan may be limited to certain times of the year unless you qualify for a special enrollment period or you are in your Medicare Initial Election Period.

Ready to get started? Find a plan that fits your budget and covers your doctor and prescriptions now

Also Check: When Does Your Medicare Start