When Do I Have To Sign Up For Medicare

If youre collecting Social Security, youll automatically be enrolled in both Part A and Part B. If youre not receiving Social Security, then youll want to sign up manually during your Initial Enrollment Period.

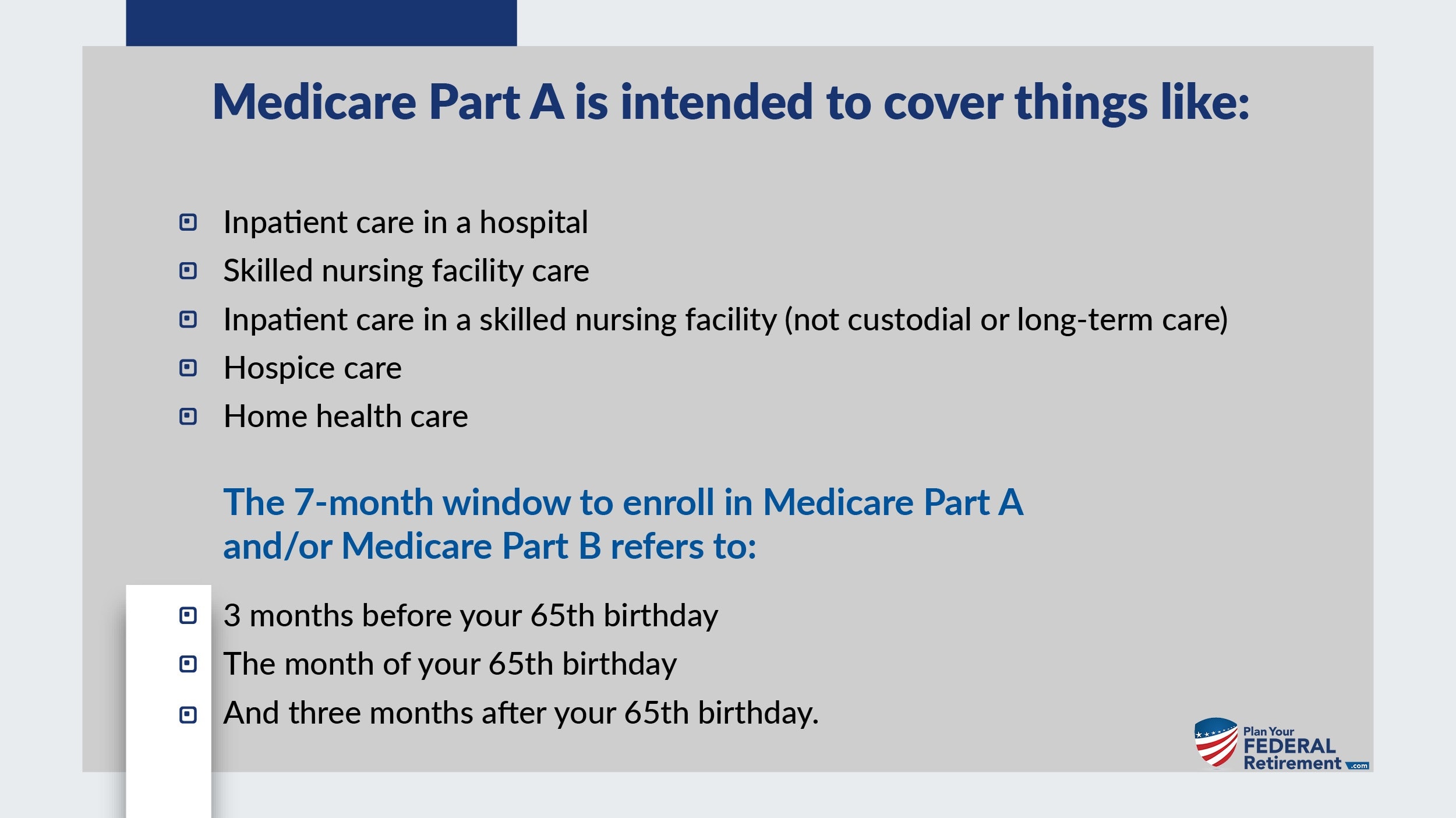

Three months before your 65th birthday, your Initial Enrollment Period window will start. Your IEP is a once-in-a-lifetime enrollment window that you dont want to miss.

If you do happen to miss it, youll have another opportunity to enroll during another enrollment period. However, you could get a penalty for not signing up when you first become eligible. The only way around the penalty is if you have creditable coverage.

What Will Medicare Part B Cost

Medicare Part B requires a monthly premium,4 which will be automatically deducted from any benefit youre receiving from Social Security, the Railroad Retirement Board or the Office of Personnel Management. Otherwise, youll get a bill.

Youll generally pay a standard premium amount unless your modified adjusted gross income is over a certain amount. For this calculation, Medicare uses your IRS tax return from two years prior to identify whether youre a higher-income beneficiary. If you are, youll pay an income-related monthly adjustment amount . Heres how it works.

If your yearly income in 2020 was:

| File taxes as an individual | File taxes as married filing jointly | File taxes as married, filing separately | Youll pay each month in 2022* |

|---|---|---|---|

| $91,000 or less | |||

| $578.30 |

In addition to your monthly premiums, Medicare Part B has a deductible of $233 in 2022. Once you hit your deductible during the year, youll usually be responsible for 20% of Medicare charges for all Part B services .

Although the costs above are standard, if you dont enroll in Part B when youre first eligible and you didnt have a valid reason to delay enrollment your premium may go up 10% for each 12-month period you couldve had it .5 In most cases, youll pay this late enrollment penalty for as long as you have Part B, so dont miss your window.

When To Enroll In Medicare If I Dont Want Medicare Part B

If youre automatically enrolled in Medicare Part B, but do not wish to keep it you have a few options to drop the coverage. If your Medicare coverage hasnt started yet and you were sent a red, white, and blue Medicare card, you can follow the instructions that come with your card and send the card back. If you keep the Medicare card, you keep Part B and will need to pay Part B premiums. If you signed up for Medicare through Social Security, then you will need to contact them to drop Part B coverage. If your Medicare coverage has started and you want to drop Part B, contact Social Security for instructions on how to submit a signed request. Your coverage will end the first day of the month after Social Security gets your request.

If you have health coverage through current employment , you may decide to delay Medicare Part B enrollment. You should speak with your employers health benefits administrator so that you understand how your current coverage works with Medicare and what the consequences would be if you drop Medicare Part B.

You May Like: What Does Medicare Supplement Cost

Applying For Medicare With Employer Coverage

Can you still enroll in Medicare coverage, even if youre not yet seeking retirement? The answer is yes! Medicare coverage can coincide with your group coverage through your employer. If your employer has more than 20 employees, your group coverage will work as your primary insurance, and Medicare will be your secondary insurance.

You can choose to apply for Part B, or you can wait until leaving your employer group coverage. For more information on the benefits of obtaining Medicare while receiving group coverage through work, give our team a call, and we can review the pros and cons.

Sometimes beneficiaries dont want to apply for Part B when they initially become eligible because of employer health coverage. Should you lose your health insurance through your employer, or if you prefer to switch over to Medicare, you can apply any time while receiving coverage through your employer.

Do You Have To Sign Up For Medicare If You Are Still Working

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because theyre still working, theyre likely covered under their employers health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Being covered under your employer-provided health insurance plan has no bearing on your Medicare eligibility. Medicare works in conjunction with several other types of health insurance including health insurance provided by employers or unions and wont prevent you from enrolling.

However, if you are not collecting Social Security retirement benefits at least four months before you turn 65, you will not be automatically enrolled in Medicare when you turn 65. In this case, you will have to manually sign up for Medicare when youre ready to enroll.

Many people choose to delay their Social Security retirement benefits until a later age when they can collect the full amount. If you choose to delay your retirement benefits, you must still sign up for Medicare manually once youre eligible in order to avoid any late enrollment penalties .

Some people who are still working sign up for Medicare anyway, because Medicare can work as extra insurance along with an employer group health insurance plan. Some people may decide that Medicare is more affordable than their employers insurance, so they may continue working but disenroll from their group plan and enroll in Medicare instead.

You May Like: What Is Medicare On My Paycheck

How To Choose A Medicare Advantage Plan

If youre interested in a Medicare Advantage plan, rather than Original Medicare, you can choose from one of the following:

- Private Fee-for-Service plans

- Special Needs Plans

Less common types of Medicare Advantage plans include HMO Point of Service plans and Medicare Medical Savings Accounts plans. The main difference between all these plans is in whether youre able to see out-of-network providers, whether a referral is required to see a specialist, and how much youll pay.

When comparing Medicare Advantage plans, youll want to consider what doctors are available, how much youll pay out of pocket, and what benefits are included. Medicare offers a plan finder tool that can help you search for and compare Part C plans.

Recommended Reading: What Is Retirement Age For Medicare

Exact Answer: Up To 30 Days

The Medicare application can be applied to online websites. The application process is quite easy. The process of application will not ask for many documents in major steps. The applicants may not have to sign in any documents while applying for the Medicare part B. The application doesnt charge any fees from the applicant.

The process of the applicant will not take a lot of time, but you have to fill in the details correctly. After the application is completed, then the applicant would be able to check the application status anytime.

Recommended Reading: Is Medicare Automatically Deducted From Social Security

How Much Does Medicare Part B Cost

There is a monthly premium for both Medicare Part A and Medicare Part B. However, most people dont have to pay a Part A premium because they paid Medicare taxes while working. All enrollees, however, pay a monthly Part B premium, and the premium amount may depend upon your income.5 If you need assistance affording Part B premiums, there are federal and state programs that can help.6

Medicare Special Enrollment Period

Special situations may come up that give you the chance to sign up for or change your Medicare plan outside of your Initial Enrollment Period or the Annual Enrollment Period.

There are several special cases that make you eligible for a Special Enrollment Period.

Here are some common situations:

- You move: If you move to an address outside your plans service area, into a nursing home, or you have different plan options at your new address, youll be able to apply for a new plan.

- You want to switch to a 5-star Medicare plan: Every year, Medicare evaluates plans based on a 5-star rating system. Medicare considers these plans excellent. You can make the switch once to a 5-star plan anytime from Dec. 8 through Nov. 30 if one is available in your area.

- You lose your current coverage: This applies if you or your spouse will retire or change to a job that doesnt offer coverage. It doesnt apply if your insurance company cancels your coverage because you didnt pay your monthly premiums.

- Your plan changes its contract with Medicare: Enrollment in a plan depends on the plans contract with Medicare, and for various reasons these contracts could change.

Your new coverage begins on the first day of the month after you sign up.

Recommended Reading: Does Medicare Come Out Of Your Social Security

When To Enroll In Medicare If I Am Receiving Disability Benefits:

If you are under 65 and receiving certain disability benefits from Social Security or the Railroad Retirement Board, you will be automatically enrolled in Original Medicare, Part A and Part B, after 24 months of disability benefits. The exception to this is if you have end-stage renal disease . If you have ESRD and had a kidney transplant or need regular kidney dialysis, you can apply for Medicare. If you have amyotrophic lateral sclerosis , you will automatically be enrolled in Original Medicare in the same month that your disability benefits start

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

You May Like: Is Viberzi Covered By Medicare

What Medicare Part B Covers

First, lets take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications: medically necessary services and preventive services. What qualifies something as medically necessary? In general, medically necessary services must be medical treatments that are required to treat a recognized medical condition or illness. Necessary services and items might include the following:

- Diagnostic equipment

- Supplies, such as walkers or wheelchairs

- Surgeries

For example, diabetics need regular doctor visits to ensure appropriate blood levels, as well as appropriate diagnostic coverage to ensure accurate readings.

Medicare Part B beneficiaries also gain access to preventive services, like yearly screenings for the flu or certain cancers. In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

As of the 2019 plan year, the Centers for Medicare and Medicaid Services has lifted coverage caps on critical services covered under Medicare Part B. These include physical therapy, speech language pathology and occupational therapy.

But original Medicare doesnt cover everything. You may need to obtain supplemental insurance, such as Medigap, if you need coverage for the following:

When You Should Consider Enrolling In Medicare Part B

If you qualify to delay enrolling in Medicare, deciding to do so is a personal choice.

Some may choose to delay, and for others, it may still be a good fit for your health and lifestyle to enroll in Part B. Consider the following when trying to decide whether to enroll in Part B or delay while still working:

- Is Medicare less expensive than your current health insurance?

- Does Medicare offer better coverage than your current health insurance?

- Do you want to keep your current insurance but also take advantage of Medicare benefits

- Do you want to enroll in either a Medigap or Medicare Advantage plan?

- Is your prescription drug coverage considered creditable by Medicare?

Answering the above questions can help you decide whether or not to delay enrollment. Its important to carefully consider the last item regarding prescription drug coverage. While most employer coverage is considered creditable, you should still verify if it is or could end up facing a late enrollment penalty for Medicare Part D.

Also Check: When Do Medicare Benefits Start

Q My Husband Turns 65 This Month We Have Chosen Not To Participate In Medicare Part B We Have Full Coverage Insurance Through His Retirement Program From The Federal Government We Are Curious As To Whether Or Not This Was The Right Decision I Am Not Yet 65 So We Have To Keep This Coverage Until I Receive Medicare What Are The Consequences If We Dont Take Part B Confused

A. Were glad you asked.

Its very important to understand the consequences of not taking Part B, which you do not have to take.

The first thing that you need to find out is if Medicare is primary on your husbands retirement plan, said Jeanne Kane, a certified financial planner with JFL Total Wealth Management in Boonton.

If it is, he must sign up for Medicare Part B to avoid coverage gaps, she said.

In almost all circumstances, if you are Medicare eligible and participating in a retirement program, then Medicare becomes primary to the retirement plan, she said. This means Medicare is responsible for its portion before the retirement plan contributes towards any medical bills.

For example, she said, Medicare covers the first 80% of Medicare-approved medical expenses, such as doctors, other providers, tests, durable medical equipment, and more, so you have significant exposure, she said.

So if you dont have Medicare Part B and have a $10,000 medical event, you would be responsible for $8,000 before his retirement program kicked in, she said.

She said thats a big risk to take given the cost of healthcare today.

Always make sure to get clarification on your specific situation from your plan administrator. For example, certain federal retirees who receive their health insurance from a plan in the Federal Employee Health Benefits Program arent required to enroll in Part B but may still benefit, she said.

There are three enrollment periods.

Email your questions to

How To Check Your Medicare Application Online

If you applied for Medicare online, you can check the status of your application through your Medicare or Social Security account. You can also visit the Check Enrollment page on Medicare.gov and find information about your enrollment status by entering your:

- ZIP code

- Medicare Part A effective date

You can also check the status of your application by visiting or calling a Social Security office.

You can ask your pharmacy to check the status of your Medicare Part D enrollment by sending a test claim.

You can also call the Member Services department of your Medicare Part D plan.

You May Like: How Do I Get Dental And Vision Coverage With Medicare

Enrolling In Medicare Advantage

To join a Medicare Advantage Plan, you will need to have Original Medicare coverage and live in an area where an Advantage plan is offered.

A Medicare Advantage plan will wrap your Medicare Part A and Part B coverage into one plan. But youll still have to pay the government a premium for Part B, in addition to the premium you pay for Medicare Advantage .

You can enroll in a Medicare Advantage plan when youre first eligible for Medicare, or during the annual Medicare open enrollment period in the fall .

When Can You Enroll In Medicare Advantage

You can enroll in Medicare Advantage during your Initial Enrollment Period. But you must first sign up for Parts A and B during your Initial Enrollment Period.

You can also enroll if you qualify for a Special Enrollment Period. If you lose your health insurance at your job, you can sign up for a plan up to eight months after losing your coverage.

Also Check: How To Get Medicare To Pay For Hearing Aids

How Medicare Affects Your Coverage

Medicare is the federal health insurance program for people who are 65 or older, or otherwise receiving Social Security disability benefits.

Medicare is divided into four different parts, which cover specific services. You will only need to focus on these three if you enroll in a state-sponsored retiree insurance plan:

- Part A

- Part D

Enrolling Into Part B On A Delayed Basis

If you have delayed Part B while you were still working at a large employer, youll still need to enroll in Part B eventually. When you retire and lose your employer coverage, youll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

You should set up Part B to start the very next day after you lose your employer coverage. For example, if you know you will be retiring on June 30th, you should enroll in Medicare Parts A and/or B to begin on July 1st.

When you activate your Part B, you will activate your 6-month Medicare supplement open enrollment window. This is your one opportunity to enroll into any Medigap plan without health questions. Once the 6 month window expires, its gone forever. If Medigap is too expensive and you prefer a Medicare Advantage plan, you have a short window to also enroll into a Medicare Advantage plan using a Special Election Period. These are tricky, so always work with an agent who specializes in Medicare to set that up properly.

Recommended Reading: What Insurance Companies Offer Medicare Supplement Plans