Medicare Part D: Key Takeaways

- The only source of prescription drug plans is through private insurance companies.

- Most Medicare Advantage plans include prescription drug coverage.

- You can also purchase a stand-alone prescription drug plan if youre enrolled in a PFFS or MSA plan that doesnt include prescription coverage.

- Your first opportunity to enroll in Part D is when youre initially eligible for Medicare.

- You have the option of selecting an Advantage plan and using that in place of Medicare A, B, and D.

- In most cases, enrollment outside of your initial enrollment period is limited to an annual enrollment period.

- If you dont enroll in prescription drug coverage during your initial open enrollment and then enroll during a subsequent annual enrollment period, a late enrollment penalty will be added to your premium.

As of September 2021, more than 49 million Medicare beneficiaries had prescription drug coverage through Medicare Part D. The total is split nearly equally between those who have Part D coverage in conjunction with a Medicare Advantage plan , and those who have stand-alone Part D prescription drug plans , most of which are purchased to supplement Original Medicare.

But the balance has started to shift towards MAPD coverage, and it has recently surpassed the number of people with stand-alone PDP coverage .

Joining A Medicare Drug Plan May Affect Your Medicare Advantage Plan

If you join a Medicare Advantage Plan, youll usually get drug coverage through that plan. In certain types of plans that cant offer drug coverage or choose not to offer drug coverage , you can join a separate Medicare drug plan. If youre in a Health Maintenance Organization, HMO Point-of-Service plan, or Preferred Provider Organization, and you join a separate drug plan, youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare.

You can only join a separate Medicare drug plan without losing your current health coverage when youre in a:

- Private Fee-for-Service Plan

Are You Automatically Reenrolled In Medicare

In most circumstances, you will be automatically reenrolled in your Medicare plan. The only reason why that might not be the case is if your plan is ending, the company your plan goes through is no longer in business, or if you have missed more than three months of payments in a row.

Even though it is automatic, you should still review your plan information annually. In September every year, you will receive an Annual Notice of Change that will cover all the changes your plan will have in the next calendar year.

Read Also: How To Apply For Help Paying Medicare Premiums

Can I Cancel Medicare Part D Anytime

Since Medicare Part D is not mandatory, youre under no obligation in keeping the coverage. If you wish to discontinue your prescription drug coverage, you will need to do so during the Annual Enrollment Period which runs from October 15 December 7 each year. This is the only time in which you can disenroll or make changes to your prescription drug plan unless you qualify for a specific special circumstance. According to Medicare.gov, these specific situations include:

Moving from plans coverage areaLosing current coverageChance to get other coverageCurrent Medicare health plan changes its contract with MedicareOther special situations

Need More Help Check Out These Resources:

The State Health Insurance Assistance Program offers free, independent counseling services and local workshops to help with your health care benefit decisions.

Visit medicare.gov, or talk to a Medicare expert, like an agent, broker or health plan sales rep.

Our monthly Medicare newsletter delivers helpful tips straight to your inbox.

Connect with experts

Read Also: Does Medicare Pay For Mobility Scooters

There Are Two Types Of Plans

Plans come in two basic types. The most simple is a prescription drug plan , which covers only drugs and can be used with your traditional Medicare and/or a Medicare supplement plan. The other type combines a prescription drug plan with a Medicare Advantage plan and includes medical coverage for doctor visits and hospital expenses. This kind of plan is called Medicare Advantage plus Prescription Drug, or MA-PD.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Don’t Miss: When Is The Medicare Supplement Open Enrollment Period

Can A Consumer Who Qualifies For Low Income Subsidy Receive Financial Assistance For Medicare Part D

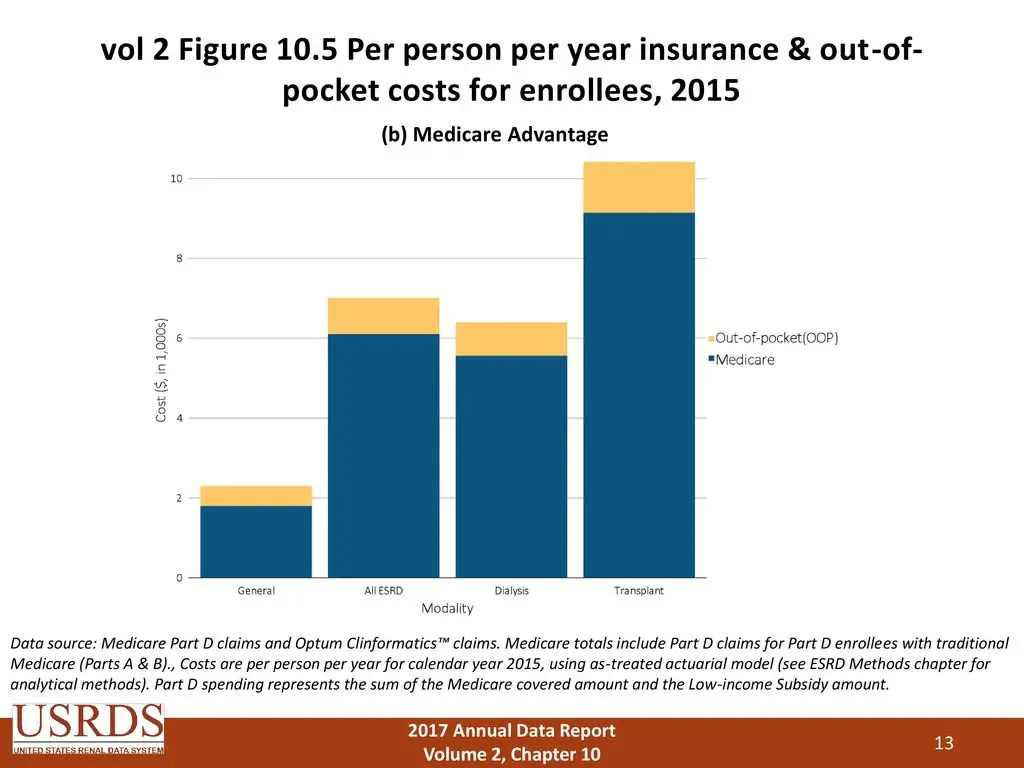

Eligible beneficiaries who have limited income may qualify for a government program that helps pay for Medicare Part D prescription drug costs. Medicare beneficiaries receiving the low-income subsidy get assistance in paying for their Part D monthly premium, annual deductible, coinsurance, and copayments.

Tips For Choosing Medicare Drug Coverage

If youre wondering how to choose a Medicare drug plan that works for you, the best way is to start by looking at your priorities. See if any of these apply to you:

- I take specific drugs.

-

Look at drug plans that include your prescription drugs on their

formulary

. Then, compare costs.

- I want extra protection from high prescription drug costs.

-

Look at drug plans offering coverage in the

coverage gap

, and then check with those plans to make sure they cover your drugs in the gap.

- I want my drug expenses to be balanced throughout the year.

-

Look at drug plans with no or a low

deductible

, or with additional coverage in the

coverage gap

- I take a lot of generic prescriptions.

-

Look at Medicare drug plans with

tiers

that charge you nothing or low copayments for generic prescriptions.

- I don’t have many drug costs now, but I want coverage for peace of mind and to avoid future penalties.

-

Look at Medicare drug plans with a low monthly

premium

for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

- I like the extra benefits and lower costs available by getting my health care and prescription drug coverage from one plan, and Im willing to pick a drug plan with restrictions on what doctors, hospitals, and other health care providers I can use.

-

Look for a

Recommended Reading: Does Part B Medicare Cover Dental

What Is Medicare Part D

There are four parts to the Medicare program:

- Part A, which is your hospital insurance

- Part B, which covers outpatient services and durable medical equipment

- Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare

- Part D, which is your prescription drug coverage

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

Getting Prescriptions With Part D Id

Throughout the nation, each enrolled beneficiary has a Medicare ID card, provided by Social Security.

Upon enrolling in a Part D plan, each beneficiary gets a prescription drug plan ID card from the plans insurance company. On this card, members get a member number that identifies them to the pharmacists and doctors that provide medications.

Primarily, the prescription plan uses the Medicare ID number in record keeping by checking the Medicare ID number the Part D plan will show on system records. Often, beneficiaries can use the Part D benefits before they receive a member card by simply using their Medicare ID.

Read Also: What Does Medicare Plan F Pay For

How Much Does Medicare Part D Cost

What you pay for a Medicare Part D plan will vary based on your specific plan, what state you live in, and your income. There are a few costs you should understand because most plans have them:

-

a premium that you pay each month to keep your plan active

-

a deductible, which is the amount you need to spend before insurance starts covering your costs

-

copays and coinsurance that you pay each time you fill a prescription

Most Medicare drug plans also have a coverage gap , which is a temporary limit on what the drug plan will pay for drugs. Low-income individuals can avoid the coverage gap if they receive Medicare Extra Help. Extra Help covers most or all of your premiums, copays, coinsurance, and deductible.

Read more about the cost of Medicare.

What Are The Benefits Of Extra Help And Epic

Those approved for full Extra Help, a Medicare Savings Program or a Medicaid Spenddown do not have to pay any EPIC fees. EPIC will continue to pay Medicare Part D plan premiums for LIS members, and those with Full LIS in enhanced plans or Medicare Advantage plans up to the basic amount after Medicare premium subsidization.

Don’t Miss: What Is The Medicare Part A

Whats Medicare Part D

Medicare Part D is the Medicare prescription drug coverage program. Medicare Part D is optional coverage and you can get it from private, Medicare-approved insurance companies in a couple of different ways.

- If youre enrolled in Original Medicare, Part A and/or Part B, you can sign up for a stand-alone Medicare Part D prescription drug plan.

- If youd rather enroll in a Medicare Advantage plan , chances are you can get Medicare Part D coverage through your Medicare Advantage plan.

I Have Medicare Part A And Part B Ive Heard About Part C And Part D But I Dont Know What Those Are Do I Need To Sign Up For Those During The Medicare Open Enrollment Period

Medicare Part C plans, also known as Medicare Advantage plans, are private health insurance plans, mainly HMOs and PPOs, for people enrolled in Medicare. If you enroll in a Medicare Advantage plan, you still have Medicare, but you get all of your Medicare-covered benefits through a private plan. Most Medicare Advantage plans also cover prescription drugs and may cover other services, such as vision, dental, and hearing benefits. If you have Part A and Part B already, and are covered under the traditional Medicare program, you do not need to sign up for a Medicare Advantage plan during Open Enrollment unless you want to get your Medicare benefits through a private plan.

Medicare Part D is the Medicare prescription drug benefit which is offered by private stand-alone prescription drug plans, sometimes called PDPs, and Medicare Advantage plans that cover drugs. If you are covered under traditional Medicare and you want drug coverage, you can enroll in a stand-alone drug plan during the Medicare Open Enrollment period. If you did not sign up for a Part D plan when you got your Part A and Part B coverage and you do not have another source of drug coverage that is at least as good as Part D coverage, be aware that you may be charged a late enrollment penalty. Once you are enrolled in a Part D plan, you can switch drug plans during the Medicare Open Enrollment period.

Read Also: What Urgent Care Takes Medicare

Medicare Part D: Prescription Drugs

Prescription drug coverage, known as Part D, is also administered by private insurance companies. Part D is optional and is normally included in any Medicare Advantage plan. Depending on your plan, you may have to meet a yearly deductible before your plan begins covering your eligible drug costs. Some Part D plans have a co-pay.

Medicare prescription drug plans have a coverage gapa temporary limit on what the drug plan will cover. The coverage gap is often called the “doughnut hole,” and this gap kicks in after you and your plan have spent a certain amount in combined costs. For example, in 2022 the donut hole occurs once you and your insurer combined have spent $4,430 on prescriptions.

Once you have paid $7,050 in out-of-pocket costs for covered drugs, you have reached the level of “catastrophic coverage,” for 2022 in out-of-pocket costs for covered drugs. This means you are out of the prescription drug “donut hole” and your prescription drug coverage begins paying for most of your drug expenses again.

Many states have insurance options that will close the coverage gap, but these may require paying an additional premium.

What Is Part D

Medicare Part D is prescription drug coverage available to individuals enrolled in Medicare Part A and/or Part B. People with a Part D plan must pay a monthly premium for this coverage. If you are a Medicare beneficiary with Part A and/or B, considering a Part D prescription drug plan is the logical next step.

Farm Bureau Health Plans offers two Part D prescription drug plans that provide added layers of protection from the high cost of prescription drug needs. This coverage is available in all counties in Tennessee.

A Part D plan may help lower your prescription drug expenses, as well as protect you against higher costs in the future. You should consider enrolling when you first become eligible for Medicare even if you don’t currently take any medications.

Why should you consider joining a Medicare Prescription Drug Plan?

Farm Bureau Health Plans is proud to offer two Medicare Part D prescription drug plans at an affordable cost.

Get started by calling

Recommended Reading: How Many Parts Medicare Has

Is Part D A Requirement

Part D is a voluntary/optional part of Medicare it is not a requirement to have a Part D plan. You can certainly choose to not enroll in a Part D plan. If you dont have a Part D plan, you should understand that you would be responsible for any prescription medication costs that you incur. In addition to being responsible for all prescription costs, there are other implications that you should be aware of if you choose to not sign up for a Medicare Part D plan.

Do You Need Medicare Part B

Ever wonder if you really need Medicare Part B? For most people over 65 the answer is: Yes, you need to enroll in Part B and you should do so when first eligible. If you miss your Part B deadline, you could be subject to penalties. Check out our Medicare deadline Calculator here

When to enroll in Medicare Part B largely depends on whether you has qualifying job-based or retirement insurance that can act in place of Part B. If so you may be able to waive Part B due since you have credible coverage through work. If you dont have access to credible coverage from a work or spouse, it is usually recommended that you enroll in Medicare Part B when first eligible .

Even if you have retirement insurance, you may still have to enroll in Part B. Most retirement programs require it. Check with your HR team and confirm your situation. Make sure that if you waive Medicare Part B due to retirement insurance, that you are not subject to Part B penalties if you enroll later.

For those who have retirement coverage, You have 8 months to enroll in Medicare once you stop working OR your employer coverage ends . If you do not enroll in Part B within 8 months of losing your coverage based on current employment, you may have to pay a lifetime late enrollment penalty and have a gap in coverage.

Don’t Miss: How Old Do I Have To Be For Medicare

When Can I Sign Up For Medicare Part C Or Part D Or Change Plans

- If youre new to Medicare, you can enroll in Medicare Part C or Part D during your Initial Enrollment Period.

- The fall may be a good time to compare plans and see if youre getting the best possible Medicare health or prescription drug plan for your needs. You can change plans during the Annual Election Period.

Is it time to compare plans to see if theres any plan in your area that may be better for you? Just click the button on this page to get started with no obligation. You can also contact eHealth to reach our licensed insurance agent.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Dont Miss: Who Do You Call To Sign Up For Medicare

Medicare Part D Premiums In 2022

Your monthly premium is the amount you need to pay each month in order to continue receiving coverage from your prescription drug plan. Premiums vary by plan but the base monthly premium for a Part D plan in 2022 is $33.37, up from $33.06 in 2021.

If you make more than a certain amount, you will have to pay a higher premium. The extra amount you pay is based on whatâs known as an income-related monthly adjustment amount . The IRMAAs for 2022 were determined by your income on your 2020 tax returns. The table below shows how much you can expect to pay.

You May Like: Can I Change My Medicare Advantage Plan Now

How Do I Choose A Medicare Part D Plan

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. Its important to comparison shop to find the one thats right for you. In addition to monthly premiums and deductibles, you should definitely compare plan formularies, especially if you take daily medications.

Some plans use a pharmacy network. If you have a pharmacy you really like, make sure its part of the plans network. Look for other benefits, such as mail-order pharmacies, that can help save money out-of-pocket.