California Department On Aging

The Department offers HICAP Medicare counseling services to help you navigate the program and Medicare Advantage plans. HICAP counselors are trained in Medi-Cal and Medicare and can help you understand the complex insurance options to find the best fit for you.

Contact information: Website | 434-0222

Medicare Part B Premiums

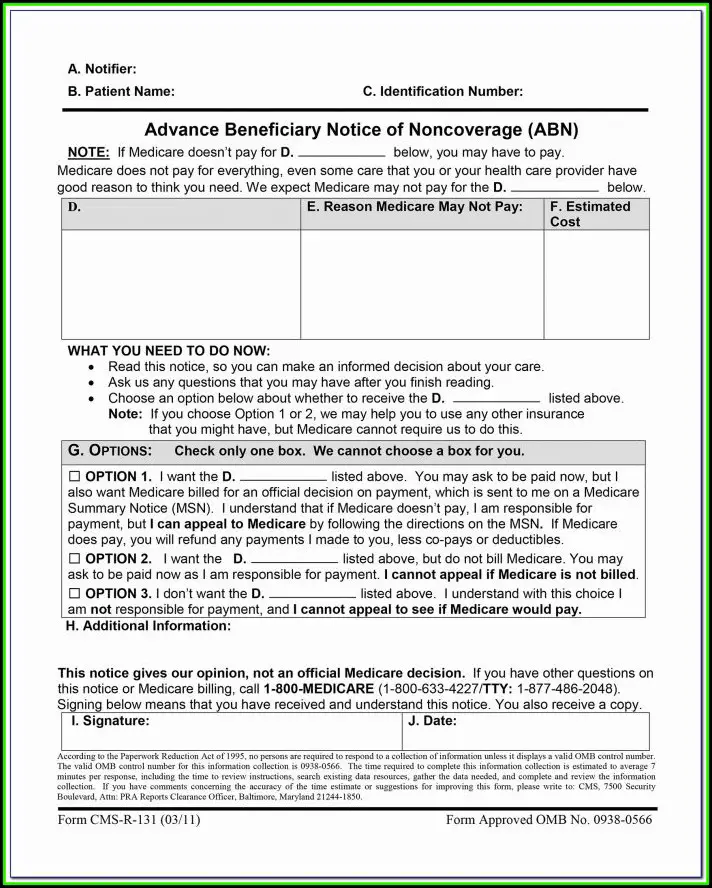

Each year, the Centers for Medicare & Medicaid Services announces the Medicare Part B premium amount. CalPERS sets the standard Medicare Part B premium reimbursement amount on January 1 based on the amount determined by the CMS. According to the CMS, most Medicare beneficiaries will pay the standard Medicare Part B premium amount.

However, if your Modified Adjusted Gross Income as reported on your IRS tax return is above the set threshold established by the CMS, youll pay the standard Medicare Part B premium amount plus an additional Income-Related Monthly Adjustment Amount . If youre required to pay an IRMAA, youll receive a notice from the Social Security Administration advising you of your Medicare Part B premium cost for the following calendar year, and how the cost is calculated.

You may defer Medicare Part B enrollment because you are still working. Contact the SSA at 772-1213 to defer. This will ensure that you avoid a late enrollment penalty when you decide to retire and enroll in Medicare Part B upon retirement.

If you choose to enroll in Medicare Part B while still actively working, youll remain in a CalPERS Basic health benefits plan and your CalPERS Employer Group Health Plan will be the primary payer, and Medicare becomes the secondary payer.

Applying For Medicare Withour Free Assistance

We really do want to help you through the entire process from start to finish. This is not something you have to do alone nor do we want you to feel all alone throughout the process. There are many things that need to be done in the right time and the correct way.

If Medicare will be your primary insurance, and youd like a Medicare Insurance Agent to take you from applying for Medicare all the way through to setting up your Medigap and Part D plan or obtain a Medicare Advantage plan, we are your go-to source for help. And to top it all off, our services are free.

Find out how it feels to have Integrity Now Insurance Brokers on your side. Call 735-3553.

Please feel free to contact our friendly reception

Don’t Miss: Does Medicaid Pay For Part B Medicare

What If I Didnt Enroll In Medicare Part B When I Was Originally Eligible

If you are a retiree, or the domestic partner of an active employee when you turned age 65, but neglected to enroll in Medicare Part B, you may be assessed a penalty by the Social Security Administration for each year in which you failed to enroll when eligible. Nevertheless, you are still required to enroll in Medicare in accordance with the Health Service System Rules.

Veterans Aid & Attendance Pension

The Aid and Attendance Pension benefit is another program available in California that can be used to pay family members to provide care. At the forefront, it should be mentioned that this program is only relevant for war-time veterans or their surviving spouses who require assistance with their activities of daily living. Spouses cannot be paid as caregivers, but adult children and other relatives can be compensated.

The Aid and Attendance Pension is a cash benefit and the amount of financial assistance varies depending on the beneficiarys current income. Annually, the VA sets a maximum amount of income a beneficiary can have and then the VA supplements the veterans income up to the point of the maximum benefit. For example, in 2021, the Maximum Annual Pension Rate for a veteran and their spouse is $27,765.

For more information about this benefit, read our guide on Aid and Attendance eligibility.

Read Also: How To Apply For A Medicare Card Online

Who Is Eligible For California Medicare

To be eligible for Medicare in California, you must be a U.S. citizen or a legal resident for at least 5 years. You must be 65 years old. And you or your spouse must have worked in Medicare-covered employment for at least 10 years.

In addition, people under 65 may qualify if they have received disability payments from Social Security Disability Insurance or Railroad Retirement for 2 years, if they have amyotrophic lateral sclerosis or if they have end-stage renal disease requiring dialysis or kidney transplant.

Make Sure You Understand How Your Uc Medical Plan Works With Medicare

In general, Medicare pays first and UCs retiree plans cover some of the cost Medicare doesnt cover. Depending on the UC plan you choose, you may pay a co-payment or some portion of the cost that neither Medicare nor the UC-sponsored plan pays. If you use services that Medicare doesnt cover, such as hearing aids, your UC plan may cover a portion of the cost. Be sure to verify coverage under your UC plan and follow your UC plan rules when obtaining services not covered by Medicare.

If you and/or your family members are covered under a UC employee plan or enrolled in TRICARE for Life, Medicare will be secondary to your UC medical plan. For domestic partners , Medicare will pay primary to your UC medical plan.

Don’t Miss: Is Medigap Same As Medicare Supplement

When To Enroll In Medicare

7 months

3 months before you turn 65

You can start enrolling in Medicare 3 months before your 65th birthday. Youll need to be eligible for Part A and Part B before you can get Part C . Youll need Part A, Part B, or both before you can get Part D.

Step 1 Learn about your Medicare benefits

As soon as possible, visit SocialSecurity.gov or call Social Security at , 8 a.m. to 7 p.m., Monday through Friday, to learn about your Part A and Part B benefits. The answers to these questions will help you enroll.

- Will I get Part A at no cost? Typically, you can get Part A at no cost if you or your spouse paid into Medicare for at least 10 years. If not, you can buy it.

- Do I need to enroll in Part A and Part B? Find out if youll be automatically enrolled in Part A and Part B, or if you should sign up.

- How will Social Security bill me for my Medicare premiums? The monthly premium is automatically deducted from your Social Security check each month. If youre not collecting Social Security, youll get a bill from the federal government every 3 months.

- When will I get my Medicare card? The federal government will mail your red, white, and blue Medicare card after youre enrolled. You should get it 3 months before your 65th birthday if you’re automatically enrolled. If you need to enroll in Part A and Part B, it can take up to 2 months to get your Medicare card.

Note: You need the information on your Medicare card to sign up for Part C or Part D.

Step 2 Enroll in Part A and Part B

What Verification Is Required

Family When applying for Medi-Cal health care benefits, present or mail the following items that apply to your situation.

- Driver’s License, Photo I.D., Alien Card

- Social Security and Medicare cards

- Pregnancy verification not required to receive pregnancy-related services

- Current Property Tax Statement and proof of balance owed

- Car/Truck/Boat Registrations

- All Current Checking and Savings Account statements

- Stocks or Bonds

- INCOME verifications .

- Free Room and Board statement.

Recommended Reading: Do You Automatically Get Medicare When You Turn 65

How Do I Apply For Medicare In California

You can apply for Medicare coverage in California by reaching out to your local Social Security office, either by phone or online.

Your Initial Medicare Enrollment Period is the first opportunity you have to sign up for Medicare in California. It begins three months before you turn 65, includes the month you turn 65, and ends three months afterward. If you miss out on this seven-month window, you can enroll during the General Enrollment Period from January 1 March 31.4

After determining your Medicare eligibility in California, find out how to maximize your Medicare benefits by getting your free FitScore® with HealthMarkets. After answering a few quick questions, our FitScore can score and rank Medicare plans based on your needs, helping you compare your options.

Medicare In California: Resources For Medicare Beneficiaries And Their Caregivers

Need help with Medicare enrollment in California, or have questions about Medicare eligibility in California?

- HICAP, Californias Health Insurance Counseling and Advocacy Program, is a helpful resource. Access their website or call 1-800-434-0222.

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

With respect to Medicare: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1800 MEDICARE to get information on all of your options.

If you have questions or comments on this service, please contact us.

Don’t Miss: Is Victoza Covered By Medicare

Help For Medicares Beneficiaries In California

Because California is home to so many beneficiaries, there are many programs in the state that offer financial assistance and information about Medicare in California

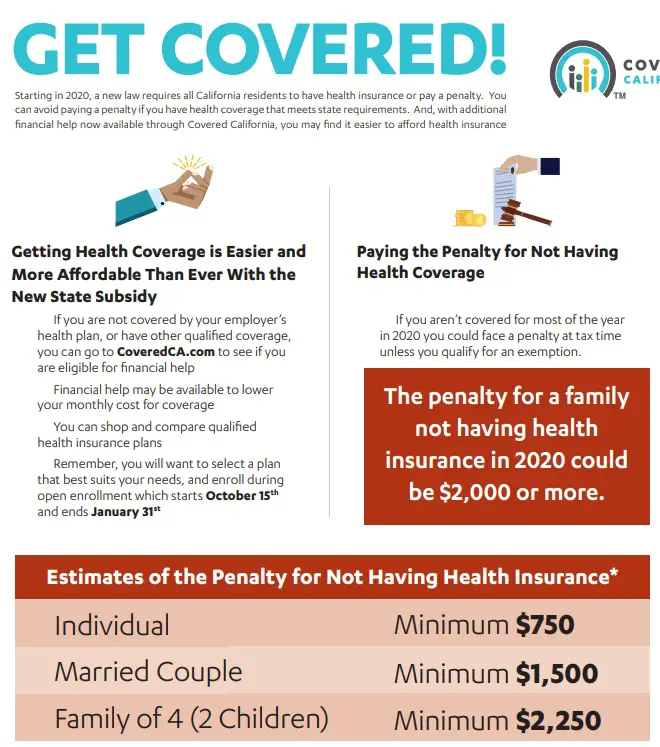

California Medicare Savings Programs: Depending on your income, you may qualify for help paying your Medicare Part A or Part B premiums. There are also programs that help pay for some of your prescription costs. Your income must be below a certain limit to qualify.

California State Health Insurance and Assistance Program : SHIP is a federal grant that provides funding to each state to offer Medicare information and counseling. In California, the SHIP grant supports the Health Insurance Counseling and Advocacy Program . HICAP offers one-on-one counseling for Medicare beneficiaries in California. HICAP also provides information on Medicare plans, benefits, and prescription drug plans in California.

Medigap In California: Birthday Rule Plan Change Window Plus Fairly Strong Protections For Beneficiaries Under Age 65

Original Medicare does not limit out-of-pocket costs, so most enrollees maintain some form of supplemental coverage. More than half of Original Medicare beneficiaries receive their supplemental coverage through an employer-sponsored plan or Medicaid. But for those who dont, Medigap plans are designed to pay some or all of the out-of-pocket costs that Medicare beneficiaries would otherwise have to pay themselves.

There are 30 insurers in California that offer Medigap plans. And as of 2019, there were 599,507 California residents with Medigap coverage. Although California has by far the nations largest Medicare population, there were five states where more people were enrolled in Medigap plans as of 2019. Californias larger-than-average Medicare Advantage enrollment means that fewer people have Original Medicare, and Medigap plans can only be used with Original Medicare.

California does not dictate how Medigap insurers can adjust premiums based on age, so most Medigap insurers in the state use attained-age rating, which means that premiums increase as a person gets older. There are a few insurers in California that use issue-age rating instead, with premiums based on the age the person was when they enrolled. Community rating means that rates do not vary with age at all, but there are no Medigap insurers in California that use community rating .

Don’t Miss: Is Balloon Sinuplasty Covered By Medicare

Signing Up For Medicare

Follow the steps below if you need to actively enroll in Medicare.

If you decide to enroll in Medicare during your Initial Enrollment Period, you can sign up for Parts A and/or B by:

- Visiting your local Social Security office

- Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare

- Or, by applying online at www.ssa.gov

If you are eligible for Railroad Retirement benefits, enroll in Medicare by calling the Railroad Retirement Board or contacting your local RRB field office.

Keep proof of when you tried to enroll in Medicare, to protect yourself from incurring a Part B premium penalty if your application is lost.

- Take down the names of any representatives you speak to, along with the time and date of the conversation.

- If you enroll through the mail, use certified mail and request a return receipt.

- If you enroll at your local Social Security office, ask for a written receipt.

- If you apply online, print out and save your confirmation page.

Related Answers

If You Are Approaching Or At Age 65

If you are approaching age 65 and you already receive Social Security or Railroad Retirement benefits through early retirement, you will be automatically enrolled in Medicare Parts A and B when you turn 65. Approximately 3 months prior to your 65th birthday, Medicare will send you an initial enrollment package containing general information about Medicare, a questionnaire and your red-white-and-blue Medicare card.

If you receive the initial enrollment package and you want both Medicare Part A and Part B , simply sign your Medicare card and keep it in your wallet.

If you are approaching age 65 and youre not receiving early retirement Social Security or Railroad Retirement benefits, you can apply for Medicare during your 7-month initial enrollment period . Your IEP begins 3 months before you turn 65, includes the month of your birthday and ends 3 months later. Note: To apply for Medicare Parts A and B, you must contact the Social Security Administration at ssa.gov or 1-800-772-1213. You will also need to sign up separately for a Part D plan to cover your prescription drug benefits. Learn more about Medicare Part D.

Read Also: How Do I Sign Up For Medicare Part C

Are There Medicare Programs For Those With Low Incomes

Yes there are two. One is the Qualified Medicare Beneficiary, or QMB program. The other is the Specified Low-Income Medicare Beneficiary, or SLMB program. Both are run by the Health Care Financing Administration and the agency in your state that provides medical assistance under the Medicaid program. If you qualify for the QMB program, your state will pay your monthly Medicare premiums, and you will not have to pay the Medicare deductibles and coinsurance. If you qualify for the SLMB program, your state will pay only your medical insurance monthly premium.

Only your state can decide if you qualify for help under the QMB or SLMB programs. To find out if you qualify, contact your Medi-Cal office, social service office, or welfare office. For general information, you can ask Social Security for a copy of the leaflet Medicare: Savings for Qualified Beneficiaries .

Read Also: Does Medicare Cover Dupuytrens Contracture

Keep Your Information Current

Its important to keep your enrollment information up to date. To avoid having your Medicare billing privileges revoked, be sure to report the following changes within 30 days:

- a change in ownership

- an adverse legal action

- a change in practice location

You must report all other changes within 90 days. If you applied online, you can keep your information up to date in PECOS. If you applied using a paper application, youll need to resubmit your form to update information.

Also Check: Is Shingles Shot Covered By Medicare Part D

What If Im Not Eligible For Medicare Part A

Some individuals only qualify for Medicare Part B. In that case, you must submit a statement to SFHSS from the Social Security Administration indicating that youre not eligible for premium-free Medicare Part A coverage. If SFHSS Rules require your Medicare enrollment, you must still you enroll in Medicare Part B, regardless of eligibility status for Medicare Part A.

What If I Dont Enroll In Medicare Despite Sfhss Rules

If an SFHSS member or dependent is eligible for Medicare, and is required to enroll by SFHSS rules, but does not enroll, that individual will lose his or her current medical plan coverage. SFHSS members will automatically be enrolled in the City Health Plan 20 until they provide proof of Medicare enrollment to SFHSS. Under the City Health Plan 20 out-of-pocket costs significantly increase. You will be responsible for paying the 80% that Medicare would have paid for any Medicare eligible claims, plus any amounts above usual and customary fees. In addition, your yearly out-of-pocket limits will increase to $10,950. If a dependent is eligible for Medicare, and required to enroll in Medicare per SFHSS Rules, but does not provide proof of Medicare enrollment to SFHSS, medical plan coverage for that dependent will be terminated.

Recommended Reading: What Is The Penalty For Signing Up For Medicare Late

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Can You Be Enrolled In Both Medi

There are currently 1.6 million beneficiaries in California who qualify for both Medicare and Medi-Cal.

Being dual eligible for both programs is a result of meeting the eligibility criteria for each. For example, you can qualify for Medicare by being older than 65 and qualify for Medi-Cal because of having a low income.

For those enrolled in both programs, Medi-Cal and Medicare work together in coordinating and providing care. With this type of arrangement, Medi-Cal wraps around Medicare coverage, helping to pay for Medicare premiums, copayments and deductibles.

Medi-Cal also provides additional benefits beyond what’s usually included with Medicare Parts A and B, covering prescription drugs, dental, vision care, extended stays in skilled nursing facilities and long-term care in nursing homes.

Please note that those who have a low income may qualify for free or low-cost prescription drug coverage through Medicare’s Extra Help program.

In addition, there are many Medicare Advantage plans offered in California, including Special Needs Plans that are specifically designed for those who are dual eligible for Medicare and Medi-Cal.

Don’t Miss: Can Young People Get Medicare