Applying For Medicare Part D With Medicares Plan Finder

Before going to Medicares site, be sure youve finished all the prep work described in Enrolling in Medicare Part D: What youll need .

Capping Insulin Costs In 2023

The Inflation Reduction Act did have a section modifying how Medicare Part D drug plans work. Some aspects of the IRA will take effect in 2023. Cost-sharing on covered insulins will be capped at $35. This change will help lower costs for many Medicare beneficiaries who must choose between putting food on their table or taking their recommended insulin dosages.

Open To Anyone With Medicare

Medicare Part D plans are open to everyone eligible for Medicare in the U.S. and U.S. territories. Generally, that means anyone 65 years old or older and some younger people with certain disabilities. You cannot be denied coverage for health reasons. Participation is voluntary, which means you get to decide if you want to enroll or not. If you have Medicare and Medicaid, you will be enrolled automatically, so there is no lapse in your Medicaid prescription drug coverage. The annual open enrollment period is October 15 to December 7, for coverage beginning January 1. If you decide to join later, your monthly premiums may be higher because there’s an additional fee for late enrollment.

You May Like: Does Blue Cross Blue Shield Offer A Medicare Advantage Plan

What If I Dont Agree With The Late Enrollment Penalty

You may be able to ask for a âreconsideration.â Your drug plan will send information about how to request a reconsideration.

Complete the form, and return it to the address or fax number listed on the form. You must do this within 60 days from the date on the letter telling you that you have to pay a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

What Does It Mean If My Prescription Drug Has A Requirement Or Limit

Plans have rules that limit how and when they cover certain drugs. These rules are called requirements or limits. You need to follow the rules to avoid paying the full cost of the drug out-of-pocket. If you do not get approval from the plan for a drug with a requirement or limit before using it, you may be responsible for paying the full cost of the drug. If needed, you and your doctor can also ask the plan for an exception.

Here are the requirements and limits you may see on a drug list:

PA Prior Authorization

If a plan requires you or your doctor to get prior approval for a drug, it means the plan needs more information from your doctor to make sure the drug is being used and covered correctly by Medicare for your medical condition. Certain drugs may be covered by either Medicare Part B or Medicare Part D depending on how they are used. If you don’t get prior approval, the plan may not cover the drug.

QL Quantity Limits

The plan will cover only a certain amount of a drug for one copay or over a certain number of days.

ST Step Therapy

The plan wants you to try one or more lower-cost alternative drugs before it will cover the drug that costs more.

B/D Medicare Part B or Medicare Part D Coverage Determination

Depending on how they’re used, some drugs may be covered by either Medicare Part B or Medicare Part D . The plan needs more information about how a drug will be used to make sure it’s correctly covered by Medicare.

LA Limited Access

7D 7-Day Limit

Read Also: A Medicare Supplement Policies Outline Of Coverage Must Include

When To Apply For Medicare Part D

If you dont have or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period to avoid penalties.

Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month. For example, if you turn 65 in May, your open enrollment would start on February 1 and last until August 31.

You may also qualify for a special enrollment period under certain circumstances, like if you dont enroll in Part B during your IEP. Typically a SEP lasts for 63 days.

If you miss your deadline during your IEP or SEP, youll have to wait for the Annual Open Enrollment Period in the Fall .

Learn more about enrollment periods and the circumstances surrounding them.

How Much Does A Medicare Prescription Drug Plan Cost

These plans are private plans, which means each insurance company determines costs for its plans. Generally, you will pay a combination of the following out-of-pocket costs for your Medicare Part D coverage:

- Monthly premiums

- Annual deductible

Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically wont pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage. You may, however, have a separate Part D deductible.

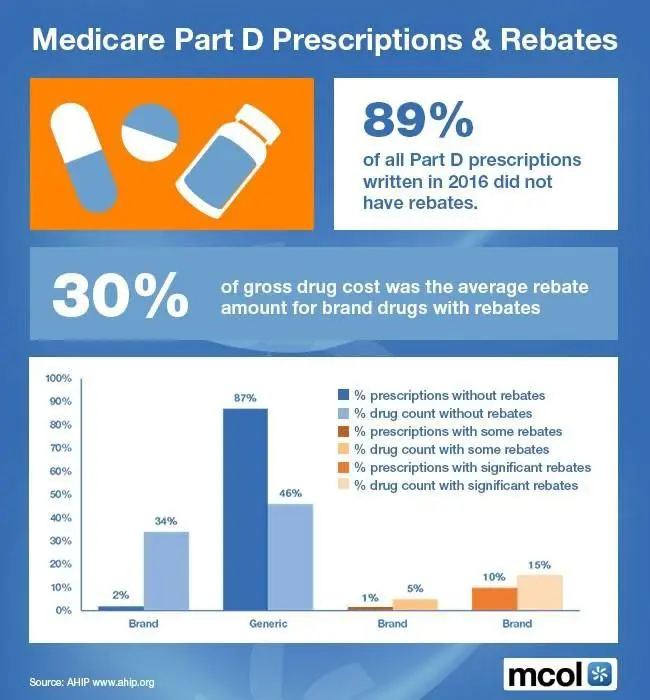

Plans set their own copayment amounts, which range between $0 and $10 for generic medications according to the Kaiser Family Foundation. Coinsurance amounts for expensive brand-name and specialty medications range between 25% and 50% of the actual medication costs.

If you and your plan spend more than $4,130 on prescription medications in 2021, special coverage rules kick in. Youll pay a percentage of your medication costs or a small copayment, whichever is higher, for covered medications for the rest of the year.

One thing to keep in mind: Medicare Supplement insurance plans sold today wont pay any Part D prescription drug costs.

Also Check: How To Find Your Medicare Number

Are You Turning 65 Medicare And Healthcare For Seniors

Medicare is the taxpayer-funded health insurance program for people who are 65 or older. It is also available to people who are younger than 65 if they have certain disabilities, such as permanent kidney failure. More than 62 million seniors in the United States are dependent on Medicare. Its a critical part of their healthcare coverage, but what exactly does it cover and what else do seniors need to make sure they are properly insured?

Medicare Part B Costs Will Decrease In 2023

Medicares Part B standard monthly premium will fall to $164.90 in 2023, a $5.20 decrease from 2022, the Centers for Medicare & Medicaid Services announced on Sept. 27. The open enrollment period to make any changes to next years Medicare coverage begins on Oct. 15 and goes through Dec. 7.The premium drop comes in the wake of the big 2022 increase, the largest dollar increase in the history of the program. Part B covers doctor visits, diagnostic tests, and other outpatient services. Most Medicare beneficiaries have Part B premiums deducted directly from their monthly Social Security payments.

Next years premium decrease makes good on statements this year by Health and Human Services Secretary Xavier Becerra that the money Medicare was saving because spending on Aduhelm, a new Alzheimers drug, was not going to be as high as expected would be passed on to beneficiaries in 2023. Spending on other Part B services is also projected to be less than anticipated.

AARP had called on CMS to lower the Part B premium for 2022 after Aduhelms manufacturer lowered the price and the agency approved the medication on a limited basis.

Most Medicare enrollees must pay the Part B premium whether they have original Medicare or a private Medicare Advantage plan. Some Advantage plans offer a giveback benefit where the insurer covers part or all of a members Part B monthly premium. Consumers can find those plans on the Medicare plan finder. Deductibles in Medicare Advantage vary by plan.

Read Also: How To Find A Medicare Doctor

Tips For Choosing Medicare Drug Coverage

If youre wondering how to choose a Medicare drug plan that works for you, the best way is to start by looking at your priorities. See if any of these apply to you:

- I take specific drugs.

-

Look at drug plans that include your prescription drugs on their

formulary

. Then, compare costs.

- I want extra protection from high prescription drug costs.

-

Look at drug plans offering coverage in the

coverage gap

, and then check with those plans to make sure they cover your drugs in the gap.

- I want my drug expenses to be balanced throughout the year.

-

Look at drug plans with no or a low

deductible

, or with additional coverage in the

coverage gap

- I take a lot of generic prescriptions.

-

Look at Medicare drug plans with

tiers

that charge you nothing or low copayments for generic prescriptions.

- I don’t have many drug costs now, but I want coverage for peace of mind and to avoid future penalties.

-

Look at Medicare drug plans with a low monthly

premium

for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

- I like the extra benefits and lower costs available by getting my health care and prescription drug coverage from one plan, and Im willing to pick a drug plan with restrictions on what doctors, hospitals, and other health care providers I can use.

-

Look for a

Medicare Part D Drug Tiers

Part D coverage varies for different types of prescription drugs, which are grouped into tiers. In general, drugs in lower tiers have lower costs, and drugs in higher tiers have higher costs.

For example, HealthPartners plans have five tiers:

- Tier 1: Preferred generic drugs This is the lowest tier. Lower-cost, commonly used generic drugs are in this tier.

- Tier 2: Generic drugs High-cost, commonly used generic drugs are in this tier.

- Tier 3: Preferred brand drugs Brand-name drugs without a lower-cost generic therapeutic equivalent are in this tier.

- Tier 4: Non-preferred drugs Higher-cost generic drugs and brand-name drugs with a lower-cost generic therapeutic equivalent are in this tier.

- Tier 5: Specialty drugs This is the highest tier. Unique and/or very high-cost generic and brand-name drugs are in this tier.

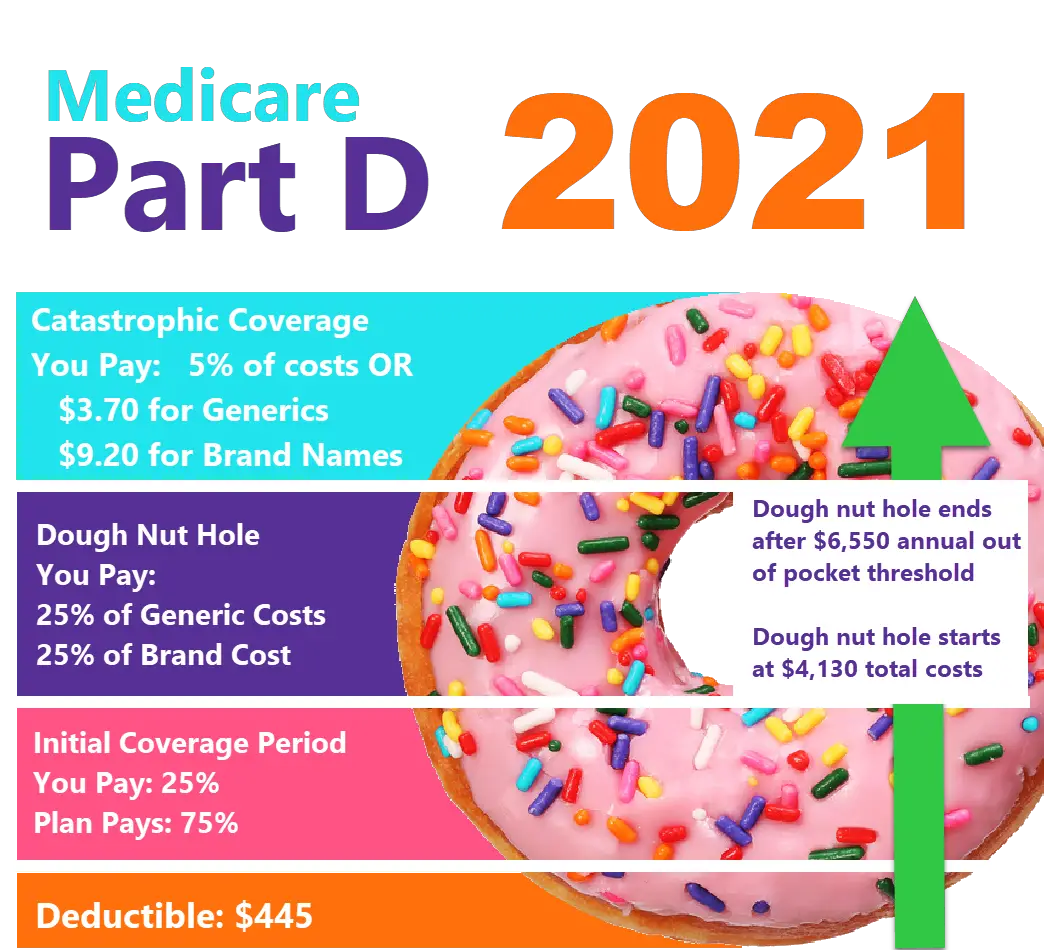

Part D has four stages of coverage, and you pay a different amount for your prescriptions in each stage. The coverage cycle begins on January 1 of each year. The cost of the prescription drugs you use will determine the number of stages youll reach throughout the year its important to understand how the coverage stages work so youre prepared for any changing costs.

In this stage, you pay 100% of your prescription drug costs until you meet your plans annual prescription deductible. Some plans call this the pharmacy deductible or prescription drug deductible.

In the initial coverage stage:

You May Like: Is The Whooping Cough Vaccine Covered By Medicare

Medicare Part D Drug Plan Coverage Phases And Costs

The Centers for Medicare & Medicaid Services set the standard Part D model and remain the same, except for increased Medicare costs to reach each coverage phase. The average 2023 Medicare Part D Drug plan premium has risen to $31.50.

The Part D deductible phase is $505. Once youve met the Part D deductible, you move from the deductible phase to the initial coverage phase. In the initial coverage phase, youll pay the plan copay or coinsurance outlined until the retail drug costs reach $4,660. Once your retail drug costs reach this amount, youll move to the coverage gap phase.

To complete the coverage gap phase this year, youll need to reach $7,400 of out-of-pocket costs toward your drug coverage. Once this is complete, youll move to the final stage, the catastrophic coverage phase. In this final phase, youll pay the greater of 5% or a small copay for your drug costs for the remainder of the year.

Each Plan Has A Drug Formulary

Each Part D drug plan will have its own government-approved list of the drugs it covers, called a formulary or preferred-drug list. The formulary may vary from plan to plan, but you and your doctor will have choices. Before you choose a plan, you’ll probably want to compare plan formularies to see which one best fits your needs.

Read Also: Is The Watchman Device Covered By Medicare

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

What A Standard Part D Plan Covers

No matter your Medicare Part D provider, the Department of Health and Human Services requires that your plan covers six protected classes of drugs, which include:

- Anticonvulsants. These drugs are commonly used to treat epillectic seizures.

- Antidepressants. These medications help treat depression, some anxiety disorders and some chronic pain conditions, as well as substance use disorders.

- Antineoplastics. These drugs are used to treat cancer.

- Antipsychotics. These medications help treat bipolar disorder, schizophrenia and other mental illnesses.

- Antiretrovirals. These drugs treat human immunodeficiency virus .

- Immunosuppressants. These medications treat a variety of conditions, such as rheumatoid arthritis and Crohns disease, as well as prevent organ rejection in transplant patients.

Medicare Part D plans come with a formulary, which is a list of specific medications that they will cover. Providers maintain the right to add or remove approved medications and change these formularies annually.

The most significant changes for formulariesas well as premiums and copaysare seen each new calendar year, says Reese. Thats why its imperative that you review your Part D plan yearly, especially if your medications have changed.

Compare Top Medicare Plans From Major Carriers

To compare Medicare plans available in your area, click Compare Plans or call 888-349-0361 to speak with a licensed insurance agent.

Recommended Reading: How Do Providers Verify Medicare Eligibility

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

What Will It Cost

- Part D requires a monthly premium for most people. The average premium is about $33 per month.

- You may also have copays and out-of-pocket costs.

- Your prescription drugs.

- If you have a Part C plan, it may already include prescription drug coverage.

- To find out which plans cover your drugs, go to the Medicare.gov Plan Finder . Enter your ZIP code and your prescription drugs.

If you already have drug coverage thats as good as Part D, you wont have any penalty if you decide to enroll in Part D later.

If youre covered by employer or retiree insurance and enroll in Part D, you risk permanently losing your coverage. Check with your current plan administrator before you make any decisions.

Important: If you don’t have drug coverage, avoid lifelong penalties by enrolling in a Part D plan or a Part C plan with drug coverage during your Initial Enrollment Period. Even if you dont have prescribed medications now, enrolling may save you money in the long run. If you suddenly need prescriptions, you might have to wait to sign up for coverage and you’ll probably pay more.

Read Also: What Age Do You File For Medicare