Open Enrollment: Your Time To Join Switch Or Drop A Plan

There is an open enrollment period every year when you can join, switch, or drop a Medicare plan. From October 15 through December 7, 2022, Medicare beneficiaries can review how they receive their Medicare coverage for 2023, says Judith A. Stein, executive director at the Center for Medicare Advocacy in Willimantic, Connecticut.

According to Medicare.gov, you can do any of the following during open enrollment:

- Change from Original Medicare to a Medicare Advantage Plan

- Change from a Medicare Advantage Plan back to Original Medicare

- Switch from one Medicare Advantage Plan to another Medicare Advantage Plan

- Switch from a Medicare Advantage Plan that doesnt offer drug coverage to a Medicare Advantage Plan that offers drug coverage

- Switch from a Medicare Advantage Plan that offers drug coverage to a Medicare Advantage Plan that doesnt offer drug coverage

- Join a Medicare drug plan

- Switch from one Medicare drug plan to another Medicare drug plan

- Drop your Medicare drug coverage completely

Whether you are in Original Medicare with a Part D prescription drug plan, or enrolled in a private Medicare Advantage plan, all beneficiaries should make sure their current plan will meet their needs in the coming year.

Medigap & Medicare Advantage Plans

Medigap policies can’t work with Medicare Advantage Plans. If you have a Medigap policy and join a

, you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

If you want to cancel your Medigap policy, contact your insurance company. If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a “trial right.“

If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to

. Contact your State Insurance Department if this happens to you.

If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you’re able to disenroll.

If you join a Medicare Advantage Plan for the first time and you arent happy with the plan, you have a trial right under federal law to buy a Medigap policy and a separate Medicare drug plan if you return to Original Medicare within 12 months of joining the Medicare Advantage Plan.

What Are The Benefits Of A Medicare Supplement Plan

A Medicare Supplement plan makes your out-of-pocket costs more predictable and easier to budget.

From a cost-sharing perspective, many people like it because you dont need to worry about how much is owed every time you go to the doctor or are hospitalized, said Jacobson. You can literally see any doctor around the country that you would like to see. For example, if you live in Arizona, you can fly to Minnesota to go to the Mayo Clinic.

Unfortunately, Jacobson says having this benefit tends to be much more important for people when theyre sicker. When people first go on Medicare, theyre usually relatively healthy and not thinking necessarily about when theyre sick and what type of plan would be best for them in that situation. The inability to easily switch back and forth between Medicare Advantage and Medicare Supplement makes it pretty complicated for people, she says.

For example, if you join a Medicare Advantage plan for the first time and arent happy with it, federal law grants you special rights if you return to Original Medicare within the first 12 months. After that, you can only disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy.

At the end of the day, the decision often comes down to whether you can afford a Medigap plan, as they can be more expensive.

Read Also: Do I Need To Apply For Medicare Every Year

Should I Get A Medigap Plan

For many people, the choice between these two plans comes down to price. Ask yourself questions like:

- Do I need the stability of a higher monthly cost with little-to-no money spent out of pocket?

- Can I afford to pay some costs out of pocket, as long as they are less costly and more predictable than with Medicare Part B alone?

A Medigap plan might be right for you if you:

- Don’t mind paying a higher monthly premium but paying lessor nothingwhen you get medical care

- Live outside of Michigan for more than a month each year and want to seek routine health services when you’re away

- Don’t want to worry about staying in-network for your services to be covered, because Medigap plans dont use networks

- Dont mind having a stand-alone Part D prescription drug plan

Who Qualifies For Medicare Advantage

Generally, Medicare Advantage is available for:

- Seniors age 65 or older

- Younger people with disabilities

- People with end-stage renal disease

With Medicare Advantage plans, you must also be enrolled in Medicare Part A and Part B and reside in the plans service area.

Enrollment only occurs during certain periods, but you cannot be denied coverage due to a preexisting condition. Specifically, you can join or switch to a Medicare Advantage plan with or without drug coverage during the following three windows:

- Initial Medicare Enrollment Period: Begins three months before you turn 65 and ends three months after you turn 65

- Open Enrollment Period: From Oct. 15 to Dec. 7

- Medicare Advantage Open Enrollment Period: Jan. 1 to March 31 annually

Don’t Miss: Does Medicare Cover Long Term Health Care

Best Overall Runner Up: Aetna

-

Offers additional drug coverage in the gap

-

Well-priced plans

-

Home health visits with all MA plans

-

$0 PCP and specialist copays

-

Better-than-average Medicare star rating

-

MA plans unavailable in Alaska, Hawaii, Minnesota, Montana, and Vermont

-

No PFFS MA plans

Aetna offers more plans with additional drug coverage in the Medicare donut hole than any of the largest MA plan providers nationwide. This is important because once you and your plan spend $4,660 on drugs in 2023, youâll pay up to 25% on brand-name drugs and generics until you spend $7,400 out of pocket on drugs and leave the donut hole. For example, some Aetna plans have $0 copays for generic drugs in the gap.

In a measure of plan value across the largest MA providers, Aetna was in the top 5%. âPlan valueâ weighs plan costs, such as monthly premiums, deductibles, and copays, against plan benefits, such as maximum out-of-pocket amounts, extra perks, and Medicare and NCQA star ratings.

Some Aetna plans feature $0 copays on primary care doctors and specialists, and all plans offer a concierge service to help you find services like home health care or pet and yard care. But if you live in Alaska, Hawaii, Minnesota, Montana, or Vermont, or want a PFFS plan , youâll need to consider another provider.

Read more in our Aetna Medicare review.

Best Medicare Supplement Companies

Unlike with traditional health insurance, where policies differ among providers, Medicare Supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare Supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for its Medicare Supplement plans. It’s important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

Cigna offers a limited number of Medigap plans in 48 states with overall higher rates than competitors.

- Medigap plans offered: A, F, G, N and high-deductible F

- Average cost of Plan G: $179

Recommended Reading: Does Medicare Pay For Freestyle Libre

Medigap With Nontraditional Benefits: Vision Dental And Hearing

A recently released analysis from The CommonWealth Fund looks at Medigap plans offering nontraditional benefits like vision, dental and hearing services that arent covered by Original MedicareAli R, Hellow L. Small Share of Medicare Supplement Plans Offer Access to Dental, Vision, and Other Benefits Not Covered by Traditional Medicare. The Commonwealth Fund. Accessed 9/4/2021. . Our research showed a relatively small share of plansonly 7%offering these benefits, said Jacobson. I think most people dont realize there are these plans out there with benefits comparable to Medicare Advantage.

At the federal level, there are tradeoffs in terms of policies encouraging or discouraging these benefits being offered. The American Dental Association, for example, is currently advocating for a distinct program to provide comprehensive dental care for low-income older adultsnot the Medicare Part B program that has been part of past and current proposals.

We need comprehensive oral health coverage in Medicare, as well as hearing and vision, said Amber Christ, directing attorney at Justice in Aging, an advocacy organization protecting the rights of low-income older adults. Nearly half of Medicare enrollees have no dental coverage at allthats 24 million older adults and people with disabilities who have no coverage.

Review Your Personalized Medicare Options With A Dedicated Advisor

Your one stop shop for navigating Medicare and finding the benefits you are looking for.

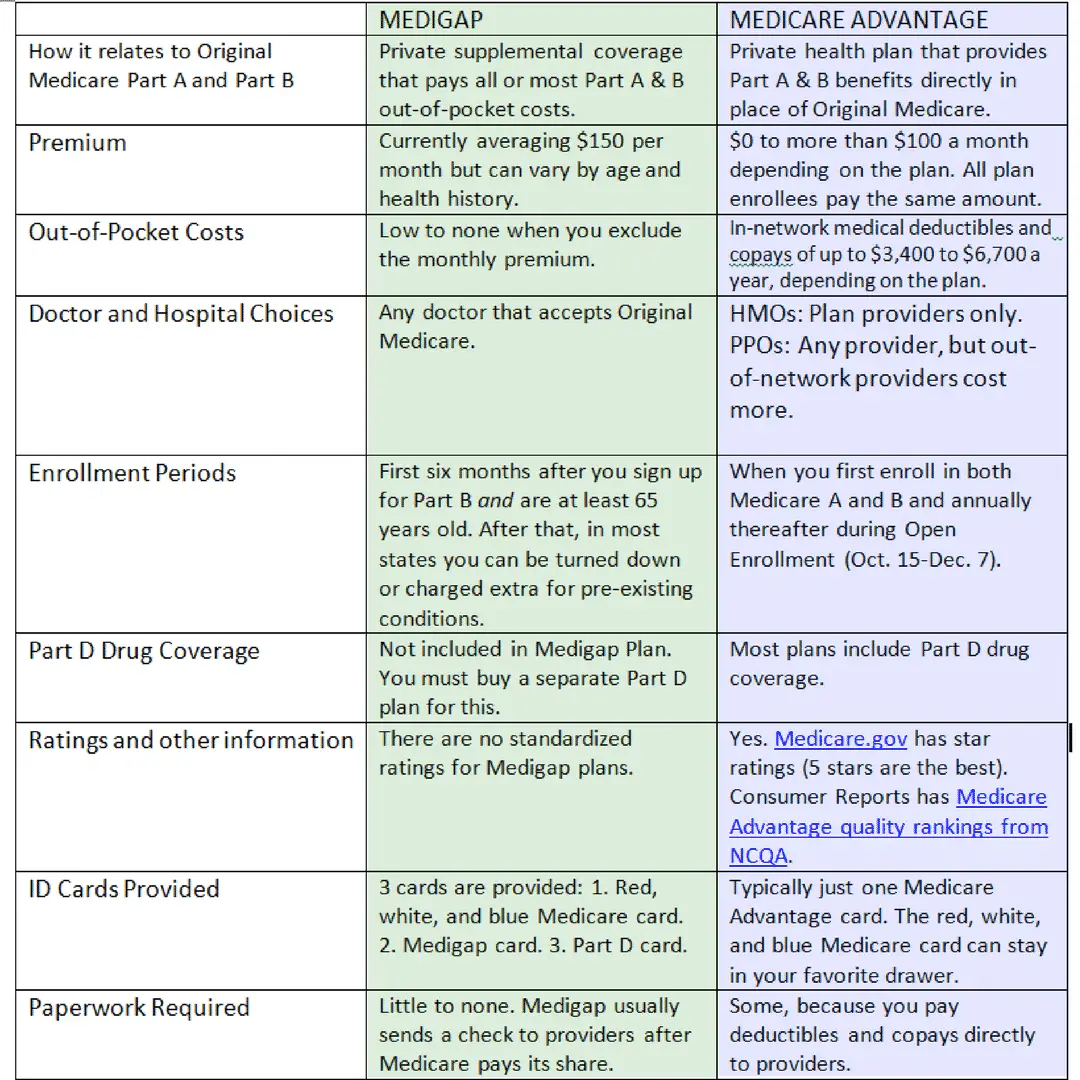

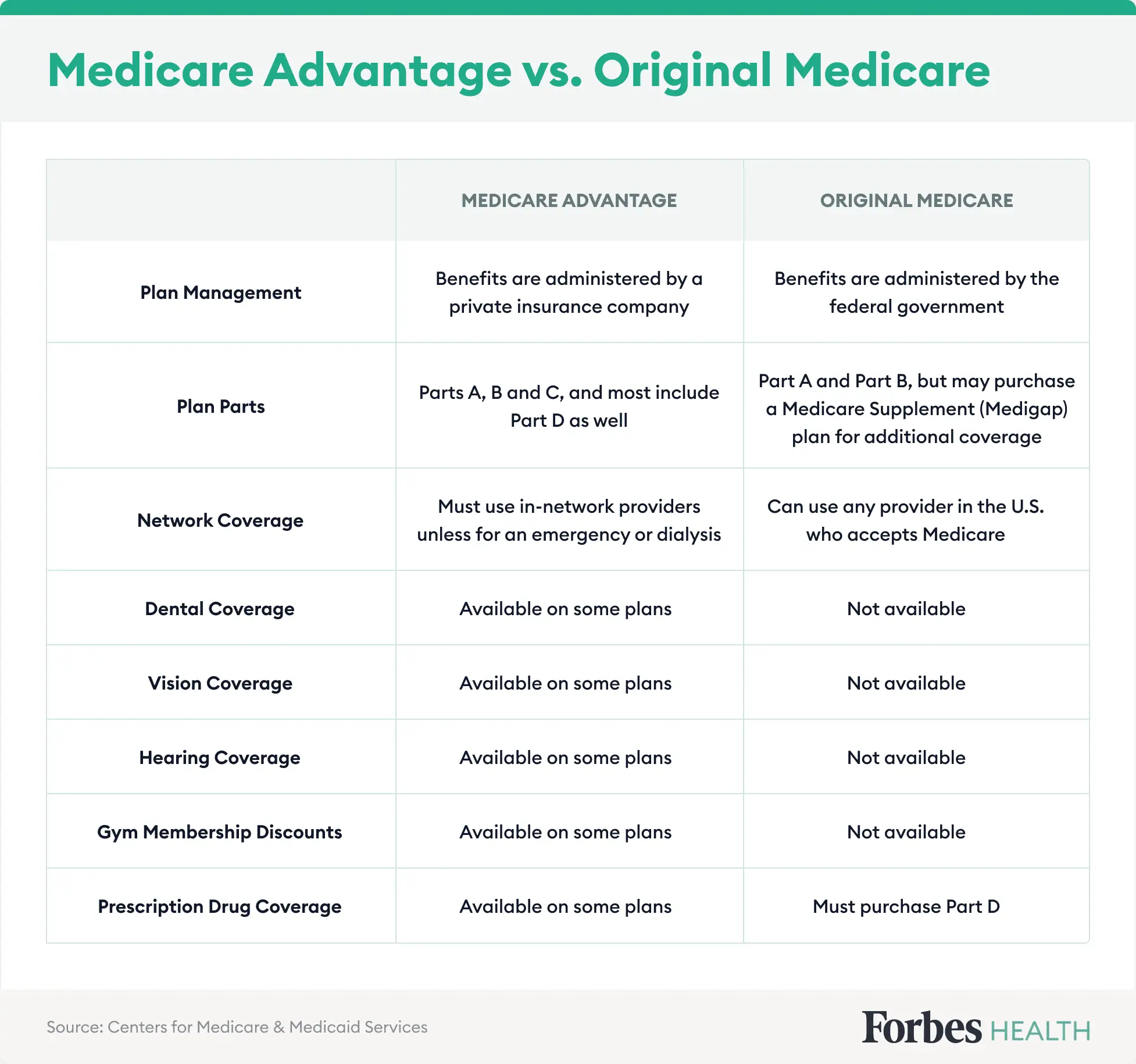

A Review Of Medicare Advantage Vs Original Medicare And Medigap

One of the best ways weve discovered to figure out if a Medicare Advantage plan is right for you is to compare them directly with Original Medicare and a Medigap plan. So, lets do that by digging into the pros and cons of Medicare Advantage plans so we can figure out what is real and what isnt, and help you find the best Medicare plan for your personal situation.

Only then can you understand if Medicare Advantage plans are good for you. Well also answer these popular questions:

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it costs more up-front. For a complete breakdown of the differences between Medicare Advantage plans and Medigap plans, read: Medicare Advantage vs Medigap: Which is Best for You?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death. To discover all of the pros and cons of Medicare Advantage, read: What are the Advantages and Disadvantages of Medicare Advantage Plans?

MA Plan ProsLearn more in this article.

Read Also: Is Trump Trying To Get Rid Of Medicare

How Do Medigap Plans Work

Medigap is intended simply to cover some of the gaps that Original Medicare doesnt pay for coinsurance, copayments and deductibles, for instance.

Original Medicare only pays 80% for Medicare-covered services such as your doctors services and any outpatient medical services and supplies. A Medigap plan can help cover some or all of that 20% gap that you have to pay for out-of-pocket.

Medigap cannot be used to pay for anything that Medicare Part A and Part B does not cover. This means you cant use Medigap to cover prescription drugs or the hearing, vision and dental services that Original Medicare does not cover.

If you have Original Medicare and a Medigap policy, you may also benefit from a Medicare Part D prescription drug plan to help cover prescription drug costs.

Can You Change From A Medicare Advantage Plan To A Medicare Supplement Plan

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period.4

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage youre seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Read Also: How To Pay Medicare Bill Online

Medicare Supplement Plan L

Plan L covers only 75 percent of a number of out-of-pocket Medicare costs, but it can come with one potential advantage over other Medicare Supplement Insurance plans: Plan L includes an annual out-of-pocket spending limit of $3,310 in 2022.

This means that once a beneficiary spends $3,310 on Original Medicare costs in 2022, Medigap Plan L will cover 100 percent of all additional Medicare costs for the remainder of the year. With its out-of-pocket limit, Plan L can help protect beneficiaries from potentially high health care costs.

The only other Medicare Supplement Insurance plan to include an out-of-pocket limit is Medigap Plan K, which features a limit of $6,620 in 2022.

Explore Our Plans And Policies

Back to Knowledge Center

View state disclosures, exclusions, and limitations

1Original Medicare coverage is required in order to purchase a Medicare Supplement plan.

2 These programs are NOT insurance and do not provide reimbursement for financial losses. Some restrictions may apply. Programs and services may be added or discontinued at any time. Customers are required to pay the entire discounted charge for any discounted products or services available through these programs. The Healthy Rewards program is provided by Cigna Health and Life Insurance Company. Programs are provided through third party vendors who are solely responsible for their products and services. Program availability may vary by location, and are not available where prohibited by law.

3 Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company, or Cigna National Health Insurance Company. In Kansas, insured by Cigna National Life Insurance Company, Cigna Health and Life Insurance Company and Loyal American Life Insurance Company. American Retirement Life Insurance Company is not available to residents of Kansas. In Pennsylvania, Maryland North Carolina and Utah, insured by Cigna National Health Insurance Company domiciled in Ohio. In New Mexico, Idaho and Ohio, insured by Cigna Health and Life Insurance Company.

4 Medicare Supplement plans may be subject to medical underwriting, and coverage may be denied.

MS-SITE-Compare2022

Also Check: Who Regulates Medicare Advantage Plans

Great For Nationwide Coverage: Humana

-

Ranked 2nd by J.D. Power for customer satisfaction

-

Benefits for over-the-counter drugs

-

Wide range of plan types available

-

Few plans offer additional drug coverage in the gap

Humana is the second-largest provider of Medicare Advantage plans nationwide, with 18% of the market in 2022. It also stands out as the second-best company for customer satisfaction, according to J.D. Powerâs 2022 U.S. Medicare Advantage Study . HMO, PPO, and PFFS plans are available, depending on where you live, and Humana offers perks like an over-the-counter drug benefit.

The reason Humana doesnât score higher is that few of its Medicare Advantage plans with drug coverage offer any additional coverage in the coverage gap. Fewer than one third, in fact. If you rely on prescription drugs and they cost more than $4,660 in 2023, you could be on the hook for 25% of their cost in the coverage gap.

Plans are available in all states except for Alaska, Rhode Island, and Wyoming.

Read more in our Humana Medicare review.

Can You Switch Between Original Medicare And Medicare Advantage

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

Footnote

Don’t Miss: Which Glucose Meters Are Covered By Medicare

Best Medicare Advantage Provider For Low Out

Medicare Advantage plans can be relatively low-cost, many with zero premiums. But the trade-off can come in the form of higher out-of-pocket costs. When evaluating the price of a plan, consider all the costs, not just the .

Pay special attention to the maximum out-of-pocket cost, which sets the cap on how much youll have to pay for covered services in a given year. To find the best plan with lower MOOPs, MoneyGeek looked at highly rated national carriers offering Medicare Advantage plans in at least 25 states and MOOPs in the bottom 75th percentile.

Based on those criteria, MoneyGeek identified Aetna Medicare as the best option.

Aetna Medicare

Aetna Medicare earns an average of 4.3 stars out of 5.0 in Medicare Star Ratings. More than two-thirds of Aetnas low MOOP plans have no monthly premium. Virtually all cover dental and vision care, and 100% offer hearing benefits.

Copayments, coinsurance and any other costs you pay before you satisfy your deductible all count toward the MOOP. But monthly premiums, drug costs and the cost of services provided by providers who dont participate with your health plan do not.

A low MOOP plan protects you from out-of-pocket costs, which can be high even with a $0 premium plan. Low premiums are often offset with higher deductibles, copayments and coinsurance. A lower MOOP will set the ceiling on your out-of-pocket costs.

Best Network Freedom: Medicare Advantage Ppo

A Medicare Advantage PPO plan will offer a larger network of preferred providers and will not require referrals. People also will not have to choose a primary care physician and can get care from out-of-network providers at a higher cost. The premiums for a PPO plan can range from $0 to $100 per month. While there are a few PPO plans offering $0 premiums, an increasing number are charging monthly premiums. These premiums must be paid in addition to the monthly premium you pay for Part B.

Also Check: What Is Earliest Age For Medicare

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.