Drug Coverage In Medigap Vs Medicare Advantage Ppo

If you are on a Medicare Advantage PPO, you cannot purchase a stand-alone drug plan. What that means is that if the PPO that works best for your medical needs for you doesnt have the drug coverage youd like, you are out of luck.

If the plan you want doesnt offer prescription coverage, you are out of luck.

Even if you dont take any medications, youll need either a drug plan or creditable coverage to avoid future penalties. With a Medicare Supplement plan, you can purchase the drug plan that saves you the most money. But it will be at an added expense. Heres how to find the prescription drug plan that saves you the most money.

Part B Medications in Medicare Advantage PPO vs Medicare Supplement

Medicare Advantage PPOs handle Part B medications differently than original Medicare and a Medicare Supplement Plan.

For example, if you are diabetic and use a pump, Medicare and Plan F covers your insulin at 100%. With Medicare Advantage PPOs, you could have a co-pay ranging up to 20 50% of the cost of the drug.

The same thing applies to chemotherapy drugs and other doctor provided shots such as Lupron. The Medicare Advantage PPO could require you to pay a co-insurance amount where-as with a Medigap Plan you could have a smaller amount to pay.

Durable Medical Equipment in Medicare Supplement vs Medicare Advantage PPO

Medical Conditions in Medigap vs Medicare Advantage PPO

The good news about Medicare Advantage PPOs is that they MUST accept you into their plan as long as you:

Which Medicare Advantage Plan Has The Best Dental Coverage

Medicare Advantage plans from AARP/UnitedHealthcare have some of the best dental benefits. Youll get coverage for a wide network of dentists. Plus, routine or preventive services are free if you stay in-network. However, comprehensive dental coverage varies for the $0 plans. Some plans may cap their dental benefits, only paying $1,000 per policy year. Others dont have a cap but instead have lower cost-sharing benefits, meaning youll spend more for each dental service.

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Read Also: Is Doctor On Demand Covered By Medicare

Health Care Costs Vary Based On Your Medical Care

An important downside is that your total costs will fluctuate based on how much health care you need.

Many beneficiaries assume that Medicare Advantage plans are cheaper alternatives because their monthly premiums are often low or even nonexistent. But most of the costs with Medicare Advantage plans come from copays, coinsurance, deductibles and other out-of-pocket costs that emerge as part of the overall care process.

And these costs can quickly escalate. If you need expensive medical care, you could end up paying more out of pocket than you would with Original Medicare.

Example of how medical expenses compare for a hospitalization

A hospitalized beneficiary covered under a traditional Medicare plan will have to meet a Plan A deductible of $1,480. But after that deductible is met, there are no more costs until the 60th day of hospitalization.

Most Medicare Advantage plans have their own policy deductible. But the plans start charging copays on the first day of hospitalization. This means a beneficiary could spend more for a five-day hospital stay under Medicare Advantage than Original Medicare.

Pros Of Original Medicare

More than 59 million people were on Medicare in 2018. Forty million of those beneficiaries chose Original Medicare for their healthcare needs.

Access to a broader network of providers: Original Medicare has a nationwide network of providers. Best of all, that network is not restricted based on where you live like it is with Medicare Advantage. All you need to do is pick a healthcare provider that takes Medicare. If you find a healthcare provider that accepts assignment too, meaning they also agree to the Medicare Fee Schedule that is released every year, even better. That means they can offer you preventive services for free and cannot charge you more than what Medicare recommends.

Keep in mind there will be healthcare providers that take Medicare but that do not accept assignment. They can charge you a limiting charge for certain services up to 15% more than Medicare recommends. To find a Medicare provider in your area, you can check Physician Compare, a search engine provided by the Centers for Medicare and Medicaid Services.

Ability to supplement with a Medigap plan: While most people get Part A premiums for free , everyone is charged a Part B premium based on their annual income. There are also deductibles, coinsurance, and copays to consider. For each hospitalization, Part A charges a coinsurance and for non-hospital care, Part B only pays 80% for each service, leaving you to pay 20% out of pocket.

Also Check: Do Any Medicare Supplement Plans Cover Hearing Aids

If Youre 65 Or Older:

If you apply for Medigap coverage after your open enrollment period, theres no guarantee an insurance company will sell you a policy. Insurers can:

- Request your medical history as part of the conditions of issuing you a plan

- Refuse to sell you a policy

- Make you wait for coverage to start

- Charge you more

Consider How Often You Leave Home

Original Medicare covers care you receive from any provider who accepts Medicare throughout the country. With most Medicare Advantage plans, you need to see providers who are in the plan network in order to avoid added costs. Network providers agree to the plans negotiated prices so you get to take advantage of the cost savings. If you travel a lot, consider how your Medicare coverage may work with this.

Don’t Miss: What Does Original Medicare Mean

Think About What Your Total Costs Could Be

Your total costs will vary based on the coverage you choose and the health services you use. But consider the below specifically when comparing which option fits your financial situation best.

- You get built-in financial protection with Medicare Advantage. The annual out-of-pocket limit provided can help keep your costs under control.

- Your premiums may be higher with Original Medicare. You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan or other additional coverage.

- You may pay more copays with Medicare Advantage than with Original Medicare. Depending on the health care services and providers you use, your copays could be more with a Medicare Advantage plan if costs vary in-network versus out-of-network.

- Medicare Advantage provides financial protection with an annual out-of-pocket limit. You can add protection to Original Medicare by buying a Medicare supplement plan.

- You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan and/or a Medicare supplement plan.

How To Choose A Medicare Plan Type

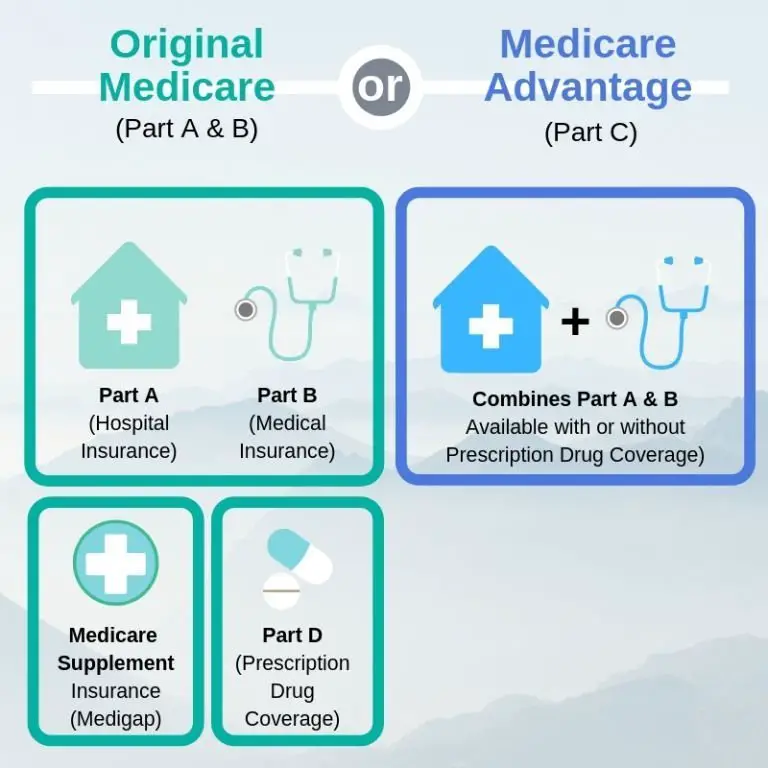

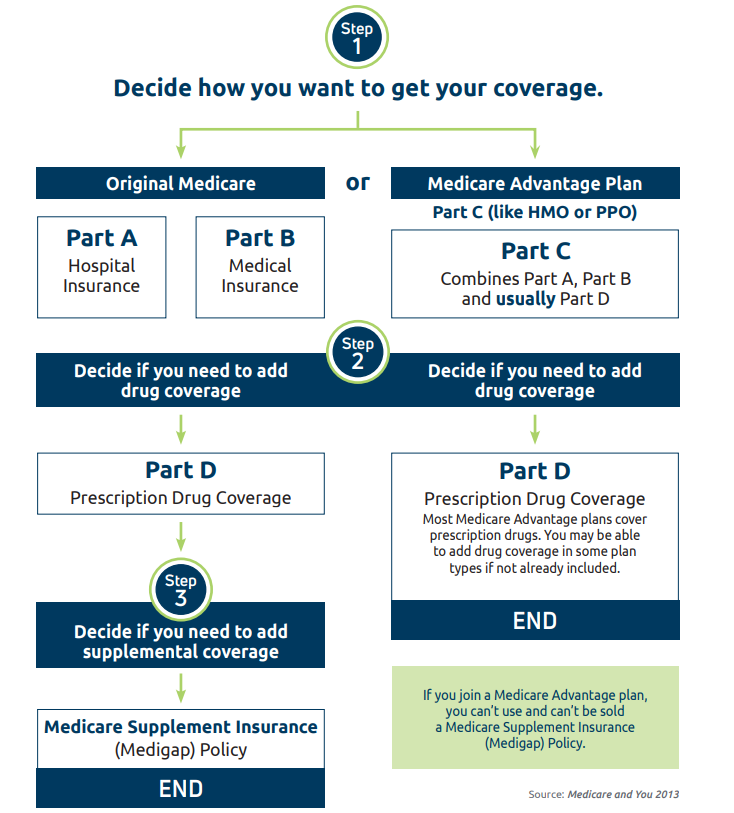

There are a few considerations to keep in mind as you begin searching for Medicare Supplemental insurance. First and foremost, there are two types of Medicare plans. You need to understand the difference between a Medicare Supplement and a Medicare Advantage plan.

They are not the same in fact, they work very differently. Once you understand how each plan works ask yourself some of these questions to help you filter down to which kind of plan might best suit you:

- Do your important physicians participate in any Medicare Advantage plans, or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? If so, you might find Original Medicare with a Medicare Supplement to be a good fit for you since you can use it for any doctor or hospital in the nation that accepts Medicare.

- What is your risk tolerance? If you have a year of heavy health spending, do you have enough savings to spend the possible out-of-pocket maximum that a Medicare Advantage plan might require?

- How about peace of mind? Are you a person who will sleep better at night if you have a lower premium and just pay for services as you go? If so, you might be a good candidate for a Medicare Advantage plan. By contrast, if you tend to worry about unexpected expenses, a Medicare Supplement could give you the peace of mind of knowing exactly what medical spending you will incur regardless of your health.

You May Like: Does Blue Cross Offer Medicare Advantage

Pros Of Medicare Advantage

Nearly 20 million Americans, one-third of all Medicare beneficiaries, were enrolled in a Medicare Advantage plan in 2018.

Expanded coverage options: It often surprises people that Original Medicare may not pay for everything you need. Common items and services that many people need as they get older, i.e., corrective lenses, dentures, hearing aids, and long-term nursing home care, are not covered. Medicare Advantage plans, on the other hand, are allowed to add supplemental benefits to their plans. Traditionally, that has included services that are directly health-related. In 2020, the Centers for Medicare and Medicaid Services will extend those benefits to include items that may not be directly health-related but that could impact someone’s health. For example, some Medicare Advantage plans may offer rideshare services to get people to healthcare provider appointments or may extend meal delivery services at home. These newer benefits will apply to people with certain chronic medical conditions.

Medicare Vs Medicare Advantage: Which Should I Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When its time to sign up for Medicare, one of the first and most substantial decisions you face is whether to choose Original Medicare or Medicare Advantage. In 2022, 45% of Medicare beneficiaries have a Medicare Advantage plan, according to data from The Chartis Group. The decision will depend on several factors, including where you live, your current and potential health care needs and your financial situation.

Both options provide coverage for your major medical needs. But your out-of-pocket costs and choices for doctors and hospitals will depend on the program you choose.

Don’t Miss: Does Medicare Pay For Glucose Meters And Test Strips

Most Popular Medicare Advantage Company: Aarp/unitedhealthcare

- Customer satisfaction is below average

- 22% more complaints than a typical company

- Those who need expensive or ongoing medical care should be careful to avoid plans with a high out-of-pocket maximum

Full details about AARP/UHC Medicare Advantage

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with 27% of all enrollment. Plans are well rated and have affordable premiums and add-on benefits, a valuable combination that could account for the companys popularity.

The plans may not be as highly rated as those from Kaiser Permanente, but they are still rated above average while also being priced affordably at about $21 per month.

AARP Medicare Advantage plans are administered by UnitedHealthcare , which offers good benefits and a wide network of providers. Theres also the option to get a PPO plan for better access to out-of-network care.

The company stands out for its broad range of add-on programs and discounts including vision, dental, free gym memberships, mental fitness and a credit toward over-the-counter products. These programs can be especially useful for those who want to stay healthy on a budget.

Great For Nationwide Coverage: Humana

-

Ranked 2nd by J.D. Power for customer satisfaction

-

Benefits for over-the-counter drugs

-

Wide range of plan types available

-

Few plans offer additional drug coverage in the gap

Humana is the second-largest provider of Medicare Advantage plans nationwide, with 18% of the market in 2022. It also stands out as the second-best company for customer satisfaction, according to J.D. Powerâs 2022 U.S. Medicare Advantage Study . HMO, PPO, and PFFS plans are available, depending on where you live, and Humana offers perks like an over-the-counter drug benefit.

The reason Humana doesnât score higher is that few of its Medicare Advantage plans with drug coverage offer any additional coverage in the coverage gap. Fewer than one third, in fact. If you rely on prescription drugs and they cost more than $4,660 in 2023, you could be on the hook for 25% of their cost in the coverage gap.

Plans are available in all states except for Alaska, Rhode Island, and Wyoming.

Read more in our Humana Medicare review.

Don’t Miss: Does Medicare Pay For Inogen Oxygen Concentrator

Beneficiaries Enrolled In Medicare Advantage And Traditional Medicare Look Similar After Separating Out Snps

After excluding beneficiaries in SNPs, beneficiaries enrolled in traditional Medicare do not differ significantly from Medicare Advantage enrollees on age, income, or receipt of a Part D low-income subsidy , which helps low-income individuals pay for prescription drugs . However, beneficiaries in traditional Medicare are significantly more likely than Medicare Advantage enrollees to reside in a nonmetropolitan area, as well as more likely to live in a long-term-care or residential facility.

Beneficiaries in SNPs are different. Given the eligibility criteria for these plans, it is not surprising that enrollees tend to have significantly lower incomes and a greater likelihood of receiving Medicaid benefits or LIS than other Medicare beneficiaries. Enrollment in SNPs for people who require an institutional level of care has been growing rapidly, leading to a similar share of SNP enrollees and beneficiaries in traditional Medicare living in a long-term-care facility.8

Racial/ethnic distribution of enrollees. The racial and ethnic distribution of beneficiaries in traditional Medicare and Medicare Advantage is similar, after separating SNPs from other Medicare Advantage plans . Most beneficiaries in traditional Medicare and Medicare Advantage plans identify as white. However, SNP enrollees are significantly more likely to identify as Hispanic or Black.

Medicare Supplement Vs Medicare Advantage: 6 Facts You Should Know

Knowing the difference between Medicare Supplement and Medicare Advantage is not as hard as it seems. The main issue is that âOriginal Medicareâ provides incomplete health coverage, leaving you exposed to many out-of-pocket expenses. There are two different solutions to this coverage problem: Medicare Supplement and Medicare Advantage. You can have one or the other, but not both. Here are the facts you should know about Medicare Supplement vs. Medicare Advantage, according to the official U.S. government website for Medicare.

You May Like: Is Eecp Covered By Medicare

The Four Main Types Of Medicare Advantage Plans In Maryland For 2023 Are:

- SNPs Special Needs Plans

Medicare Advantage plans in Maryland had an average monthly premium to pay of approximately $45 in 2022. There are several plans offered at a $0 monthly premium as well.

Enter your zip code on our website to begin comparing Medicare Advantage plans in your area to see whats available.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Read Also: What Is The Medicare Savings Program In Texas

How Much Does Medicare Advantage Cost

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

- Does the plan have a monthly premium?

- Most have a $0 premium.

- Some pay your Part B premium.

- If you choose a plan with a premium, it will be paid separately from your Part B premium.

Once youre enrolled in a Medicare Advantage plan, it becomes your primary insurance. The provider handles paying all your claims, and the cost of your plan is likely to change every year. The plan provider sets the amounts charged for premiums, deductibles and services. An Annual Notice of Change is mailed to you each September, which goes into effect the following January 1.

Factors like location play a major role in determining the cost of a Medicare Advantage plan. Costs are typically lower when you use providers in your plans network and service area. To find the specific cost of a Medicare Advantage plan in your zip code, visit Medicare.gov.

Medigap With Nontraditional Benefits: Vision Dental And Hearing

A recently released analysis from The CommonWealth Fund looks at Medigap plans offering nontraditional benefits like vision, dental and hearing services that arent covered by Original MedicareAli R, Hellow L. Small Share of Medicare Supplement Plans Offer Access to Dental, Vision, and Other Benefits Not Covered by Traditional Medicare. The Commonwealth Fund. Accessed 9/4/2021. . Our research showed a relatively small share of plansonly 7%offering these benefits, said Jacobson. I think most people dont realize there are these plans out there with benefits comparable to Medicare Advantage.

At the federal level, there are tradeoffs in terms of policies encouraging or discouraging these benefits being offered. The American Dental Association, for example, is currently advocating for a distinct program to provide comprehensive dental care for low-income older adultsnot the Medicare Part B program that has been part of past and current proposals.

We need comprehensive oral health coverage in Medicare, as well as hearing and vision, said Amber Christ, directing attorney at Justice in Aging, an advocacy organization protecting the rights of low-income older adults. Nearly half of Medicare enrollees have no dental coverage at allthats 24 million older adults and people with disabilities who have no coverage.

Review Your Personalized Medicare Options With A Dedicated Advisor

Your one stop shop for navigating Medicare and finding the benefits you are looking for.

Recommended Reading: What Is Medicaid Vs Medicare