Medicare Plus Medigap Supplemental Insurance Policies

About two-thirds of the 61 million seniors and disabled Medicare beneficiaries choose Original Medicare, Parts A and B, which cover hospitals, doctors, and medical procedures. About 81% of these beneficiaries supplement their insurance with Medigap , Medicaid, or employer-sponsored insurance, and more than 25 million also pay for a stand-alone Medicare Part D prescription drug policy.

Medicare Supplement Insurance, or Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program.

While this may be the more expensive option, it has a few advantages. Both Medicare and Medigap insurance plans cover you for any hospital or doctor in the U.S. that accepts Medicare, and the great majority do. There is no need for prior authorization or a referral from a primary care doctor. Coverage includes the entire U.S., which may be important for anyone who travels frequently or spends part of the year in a different locale. This option is also attractive to those who have particular physicians and hospitals they want to use.

Medicare Plans Are Changing

Make sure your plan still has all of your needs covered and learn about new benefits.

Yes, you can switch from Medicare Advantage to Medigap or vice versa if you decide that one fits your needs better than the other after enrolling. However, you cannot be enrolled in both Medigap and Medicare Advantage at the same time.

Why switch?

What Are Medicare Supplement Plans

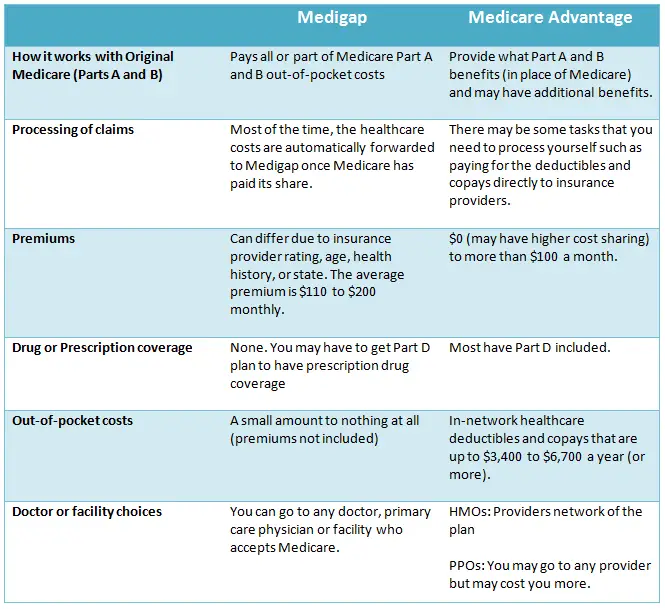

Medicare supplement plans, which are also called Medigap plans, provide protection against the additional costs that an Original Medicare beneficiary might pay for healthcare services, such as copays, coinsurance and deductibles. For those who have Original Medicare and a Medicare supplement plan, Medicare pays out its share for a covered healthcare cost, and then the supplement plan pays its portion.

Medicare supplement plans are provided by private insurance companies and must follow state and federal laws. In most states, excluding Massachusetts, Minnesota and Wisconsin, insurance companies can only sell standardized plans, which are identified by the letters A through N. Each standardized plan must provide the exact same benefits, regardless of which health insurance company sells it or what premium they charge. For example, all Medicare supplement plans are required to cover Medicare Part As coinsurance and hospital costs at 100%. Most plans cover Part Bs coinsurance or copayment at 100%, except for Plan K, which provides 50% coverage, and Plan L, which provides 75% coverage.

Recommended Reading: Must I Take Medicare At 65

Having Medicaid Or A Medicare Savings Program

Medicare covers many services, but it doesnt cover long-term care benefits and can leave its enrollees with large cost-sharing expenses. Medicaid pays for some services that Medicare doesnt cover for enrollees whose incomes and assets make them eligible. If you have Medicaid or a Medicare Savings Program a program where Medicaid pays for Medicare premiums and cost-sharing then your enrollment options are different than if you only had Medicare.

Some Medicare Advantage plans specialize in covering low-income Medicare beneficiaries. These are known as Dual Eligible Special Needs Plans , and are available in every state. If you have Medicare and Medicaid, you should have few out-of-pocket expenses if you see providers enrolled in both programs regardless of whether you enroll in a D-SNP. Receiving coverage through a D-SNP requires you to see only providers who participate with the D-SNP insurer.

Some D-SNPs offer additional services, such as home care, dental or vision benefits. D-SNPs can also help coordinate all of the health services you receive. But low-income Medicare beneficiaries are better off with Original Medicare paired with regular Medicaid as secondary coverage if their providers accept those programs, but not D-SNP plans. In many states, the fee-for-service Medicaid benefit also covers dental or vision care.

Here is more information about programs available to Medicare beneficiaries with limited incomes and assets.

Prior Authorization In Medicare Advantage Ppo Vs Medicare Supplement

Although you can technically see any out-of-network doctor with a Medicare Advantage PPO plan, you might not be able to get the procedure or service you want.

On a Medicare Advantage PPO, you can be subject to pre-authorization. This means that there is someone other than your doctor deciding whether you can get a procedure. This does not happen on a Medicare Supplement Plan. As long as your doctor thinks you need a Medicare-approved service, youll be able to get that service under original Medicare and your Medigap plan.

Recommended Reading: How To Sign Up For Aetna Medicare Advantage

Your Plan And Coverage Travel With You

Your Original Medicare coverage remains consistent no matter where you are or where you travel in the United States of America and her territories. We all get the same benefits and coverage. This is true with Medicare supplement insurance, too. But, did you know that many Medicare supplements also cover you when you travel outside of the USA, too? Coverage has its limits, but its there.

This isnt true with Medicare Advantage plans. How could it be when healthcare is delivered through a network of local providers? However, Medicare made sure that plan members are covered in emergency situations when they are away from home .

For those of us that travel frequently, particularly snowbirds, Medicare Advantage simply does not work. Can you imagine needing to fly back home every time you have a doctors appointment?

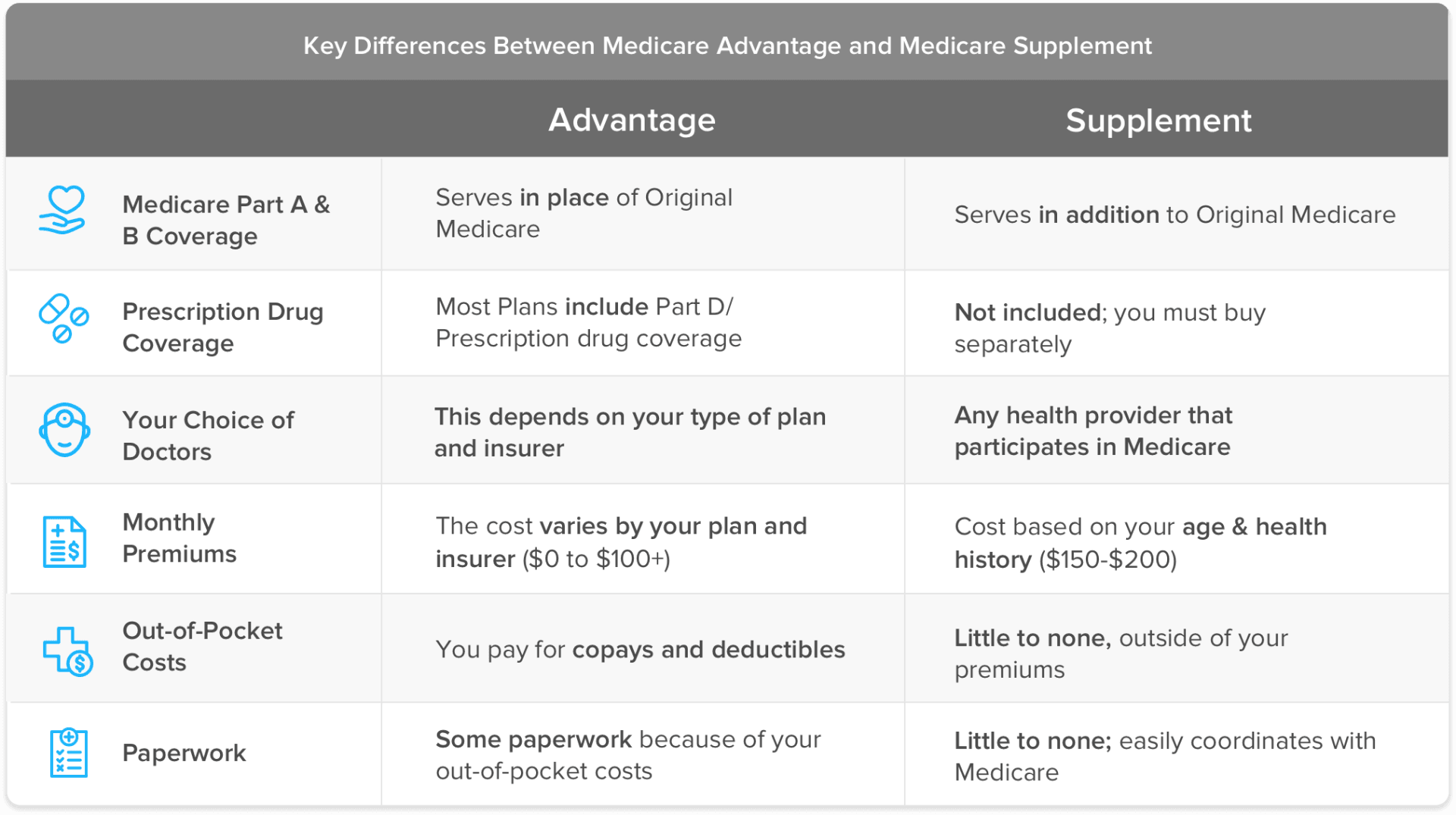

Comparing Medicare Supplement Vs Medicare Advantage

There is a lot of information on the internet about Medicare Advantage vs Medicare Supplement plans. Wading through it all can be confusing and very time-consuming. With so much information out there, that typically means there is some misinformation, too. I follow a lot of news sources on Medicare and read articles on the web every day. While gathering information for this article, the first two articles I ran across had glaring mistakes about what these two plans do and how they compare.

Ill get into those later, but the fact is that you do need to know at least a little about how these plans work and how they compare. Making the wrong decision could cost you thousands of dollars down the road if dont have the coverage you need when the time comes. My daddy always taught me it is better to have something and not need it than to need something and not have it. Those are wise words I have lived by, especially when it comes to my personal coverages on me and my family.

Check out this video and then we will get into the nuts and bolts:

Recommended Reading: Do I Qualify For Medicare If I Am Disabled

How To Shop & Compare Medicare Supplement Plans

Researching the plan thats right for you is key to getting the coverage you need. Each plan offers specific benefits depending on your state, which benefits you desire, and the costs.

Step 1: Determine if You Are Eligible to Enroll

In general, if you’re approaching your 65th birthday, but you haven’t started taking Social Security benefits yet, you are eligible for Medicare. For more information, please visit Medicare.gov.

Step 2: Find a List of Medicare Supplement Plans Available in Your State or ZIP Code

Using the tool available on Medicares website, you can search for coverage plans based on your location.

If you live in Massachusetts, Minnesota, or Wisconsin, Medicare Supplement policies have different rules. You have guaranteed issue rights to buy a Medicare Supplement policy, but the policies are different.

Step 3: Determine Which Aspects of Coverage Are Most Important to You

Perhaps you are concerned about out-of-pocket copays or high deductibles or you have a preexisting condition and want to know if there is a waiting period for coverage for it. Be sure to check each plan for the details that matter most to you.

Step 4: Compare the Difference in Cost Among Medicare Supplement Plans

Step 5: Consider Talking to a Broker or Consultant

Step 6: Sign Up

Once youve found a plan that works for you, contact that insurance company directly to enroll.

Why Is Medicare Supplement Insurance Is Better

Unlike Medicare Advantage plans, which can bundle services that are not covered by Original Medicare, supplemental Medicare insurance cant. Medicare supplements are in lock-step with Medicare. So, if Medicare does not cover it, your Medigap plan cant cover it, either. This is what makes a Medigap each to buy.

Also See:Are Medicare Supplement Plans Worth It?

Here are the coverage gaps that are built into Original Medicare:

You May Like: How To Get Replacement Medicare Id Card

Next Steps In Deciding Which Plan To Enroll In

There are several other factors to consider when determining the best Medicare option for you. These include your financial situation, lifestyle, and the current and future condition of your health. The bottom line is that your Medicare choices are based on you as an individual. Once you have the proper information and resources, only you can decide what is the best option for your specific health care needs.

The Medicare Advantage Maximum Out Of Pocket Limit Is $7550 In 2021

Cancer is not something you ever want to face. But being saddled with a lot of out of pocket costs on top of it could make it even worse. All you want to think about at that time is getting better, not having to worry about how you are going to pay for it. Many cancer patients will meet that out-of-pocket maximum of $7,550 two years in a row as ongoing treatments take place. That is $15,100 that could hit your budget in a matter of weeks if a diagnosis comes late in the year.

Ive had people tell me that they will not get cancer because they are living a healthy lifestyle. Do you know how many otherwise healthy children are diagnosed with cancer every year? And a new study out recently shows that 2/3 of cancers are unavoidable even if you lead a healthy lifestyle. Your healthcare costs are not something to gamble with. Unexpected healthcare costs can quickly deplete savings and retirement accounts, leaving many seniors in poverty. It is a chance you dont have to take.

But its not just cancer. A stroke, heart attack the list is endless of the diagnoses that can cause those out of pocket costs to hit the maximum every year.

Enrollment/Disenrollment Issues

It is important to note that if your doctor or hospital drops out of the network mid-year, this will not constitute a special exception for you to move to a different plan. You will be stuck in that plan until the end of the year unless you qualify for another Special Enrollment Period such as moving to a different area.

Read Also: Which Medicare Plan Covers Hearing Aids

Best User Experience: Humana

-

Relatively limited educational information available on website

-

Unable to make payments via app

-

Several different types of plans can be overwhelming

Humana has an A- ranking from AM Best, indicating its strong financial state. We chose Humana for the Best User Experience because when you are comparing plans, Humana gives you the opportunity to choose what kind of plans you want to see whether its medical coverage only, prescription drugs only, or a plan that includes both. Once youve decided that, you can select the type of plan: HMOs, which are often offered without a premium but apply only for in-network providers PPOs or Private Fee-for-Service plans that offer in- and out-of-network coverage but with higher costs or the option to see all plans you qualify for.

The process is streamlined and straightforward, giving you the choice to enter your doctors name or prescription medication information to get an accurate estimate, all without having to register for an account, wait for an email, or input a lot of personal information. Humana provides recommended plans based on your situation, including listing coverage, premiums, specialists, and prescription costs.

What Are The Benefits Of A Medicare Supplement Plan

A Medicare Supplement plan makes your out-of-pocket costs more predictable and easier to budget.

From a cost-sharing perspective, many people like it because you dont need to worry about how much is owed every time you go to the doctor or are hospitalized, said Jacobson. You can literally see any doctor around the country that you would like to see. For example, if you live in Arizona, you can fly to Minnesota to go to the Mayo Clinic.

Unfortunately, Jacobson says having this benefit tends to be much more important for people when theyre sicker. When people first go on Medicare, theyre usually relatively healthy and not thinking necessarily about when theyre sick and what type of plan would be best for them in that situation. The inability to easily switch back and forth between Medicare Advantage and Medicare Supplement makes it pretty complicated for people, she says.

For example, if you join a Medicare Advantage plan for the first time and arent happy with it, federal law grants you special rights if you return to Original Medicare within the first 12 months. After that, you can only disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy.

At the end of the day, the decision often comes down to whether you can afford a Medigap plan, as they can be more expensive.

Recommended Reading: Can You Only Have Medicare Part B

Which Is Better: Medicare Advantage Vs Medicare Supplement

Tuesday, May 5th, 2020

Youre probably already aware that there are two ways to help reduce the huge mandated out-of-pocket costs typically related to Medicare Parts A & B . Medicare may strike some folks as confusing but, alongside one another, the basics of the program arent that difficult to grasp. As the old adage goes the devils in the details.

Medicare has four basic parts: taken altogether

The issue at hand in this article is the huge out-of-pocket costs of Medicare Part A & B.

While Medicare Advantage and Medicare Supplement plans help cover expenses NOT completely covered by Original Medicare , which could wipe-out someones savings should they become chronically ill, or suffer a serious accident, the reality is, theyre not the same.

What Are The Advantages And Disadvantages Of Buying A Medicare Advantage Plan

The biggest benefit of buying a Medicare Advantage plan is the “bundling” concept. You get Part A and Part B, as well as in most cases Part D, which is coverage for prescription drugs. Some plans also allow for further coverage, such as dental or vision. There are some disadvantages of Medicare Advantage Plans to keep in mind before rushing into a Medicare Advantage plan. With Medicare Advantage, youll trade some of the flexibility you have when you piece together supplemental coverage and youll have to live by the insurance companys rules. So make sure you do your research and think about whether convenience and cost are more important to you than flexibility.

Read Also: Who Pays The Premium For Medicare Advantage Plans

Things To Keep In Mind About Medigap

- It has an additional monthly premium.

- Prices can fluctuate largely by provider based on different criteria. Some Medigap plans have flat rates, while others vary by state, age, gender, overall health, and even time of year.

- Certain providers do not accept or cover preexisting conditions after the initial six-month Medigap enrollment window has passed.

- It does not cover all expenses .

Selecting A Medicare Supplement Insurance Company That Works For You

After youve researched and compared companies, you will select a supplemental insurance company that works best for you. You will want to consider things like the reputation and reviews of the insurance company as well as how easy it is to navigate their website and apply for coverage. Additional factors to consider include types of plans available, pricing, and deductibles. You may also want to select a company that has an app so you can manage your policy on the go.

Read Also: How To Get Medicare For Free

How Medicare Advantage Plans Are Structured

Medicare Advantage replaces your Medicare Part A and Part B services. Most of the time it replaces your Part D as well. A Medicare Advantage plan combines them into one coverage with a private insurance company. This is what is known as Part C of Medicare. If you have a Medicare Advantage plan, you do not even have to carry your Medicare card around with you because all your care is determined by and paid for by the insurance company you choose to go with. You must still pay the Part B premium .

Here is a very important note. If you enroll in a Medicare Advantage plan, you are giving up your rights as a Medicare beneficiary and handing them over to an HMO or PPO.