D Plan Premiums And Benefits In 2022

Premiums

The 2022 Part D base beneficiary premium â which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment â is $33.37, a modest increase from 2021. But actual premiums paid by Part D enrollees vary considerably. For 2022, PDP monthly premiums range from a low of $5.50 for a PDP in Colorado to a high of $207.20 for a PDP in South Carolina . Even within a state, PDP premiums can vary for example, in Florida, monthly premiums range from $7.70 to $174.30. In addition to the monthly premium, Part D enrollees with higher incomes pay an income-related premium surcharge, ranging from $12.30 to $77.10 per month in 2021 .

Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it does not have a hard cap on out-of-pocket spending. Between 2021 and 2022, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, as they have in prior years, and will have to pay more out-of-pocket before qualifying for catastrophic coverage .

- The standard deductible is increasing from $445 in 2021 to $480 in 2022

- The initial coverage limit is increasing from $4,130 to $4,430, and

- The out-of-pocket spending threshold is increasing from $6,550 to $7,050 .

Figure 6: Medicare Part D Standard Benefit Parameters Will Increase in 2022â

Humana Medicare Part D Plans

- Walmart Value Rx Plan

- Basic Rx Plan

- Premier Rx Plan

The Humana Walmart Value Rx Plan offers the cheapest Medicare Part D plan premium in 47 states plus D.C. Humanas Walmart plan is excellent for someone with no medications or a couple of generics.

Although it depends on your collection of medications, some people with Brand name medications could find the Humana Walmart plan is still the most suitable.

But, if you take a plethora of brand name prescriptions, the Premier Plan is likely more suitable.

Humana Network Pharmacies

The Humana Walmart plan preferred pharmacy isnt hard to remember Walmart, Neighborhood Walmart, and Sams Club.

Humana Pharmacy is a mail-order program that saves you time and money.

Humana Part D Reviews

Many generics with Humana have a $0 deductible. Further, they have a variety of plan options, something for everyone.

The high deductible on brand name medications isnt that great, and you have to go to Walmart to get the best savings.

Overall? If Humana can save you the most money during 2022, we suggest giving them a chance.

Cutting Part B Reimbursement

Medicare pays for medications administered in the healthcare provider’s office a bit differently than the ones you get from the pharmacy. Your practitioner purchases these medications in advance. Because their office is responsible for storing these medications and preparing them for use, medical professionals are paid 6% above the wholesale acquisition cost of the drug. They are paid separately to actually administer the medication.

Concerns have been raised that some healthcare providers may have been abusing the system, ordering the most expensive drugs in order to make a profit. Because patients are still required to pay 20% of the treatment cost, this also increases out-of-pocket expenses for patients.

Medications covered by the Centers for Medicare and Medicaid Services are paid at a 6% rate, while there’s a 3% add-on cost for new prescription drugs.

Don’t Miss: How To Qualify For Extra Help With Medicare Part D

Medicare Part D Prescription Drug Plans Costs

Because Medicare plans set their own monthly premiums and other out-of-pocket expenses, your Medicare Part D costs may differ by plan, insurance company, and location. In general, each Medicare Prescription Drug Plan and Medicare Advantage Prescription Drug plan requires a monthly premium. Keep in mind that the premium for your Medicare Part D coverage is separate from any monthly premiums you may owe for Medicare Part A or Part B. Youll need to keep paying your Medicare Part B premium, in addition to any monthly premium required by your Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan. If youre enrolled in a Medicare Advantage plan that includes prescription drug coverage, your plan premium may include the cost for your Medicare Part D coverage.

You may pay an extra cost if your income falls above a certain threshold. Also known as the Part D Income-Related Monthly Adjustment Amount , this cost is separate from the monthly premium you may pay for your Part D coverage and may change from year to year. Unlike your Part D monthly premium, youll pay the Part D-IRMAA directly to Medicare, not your Medicare plan.

Social Security will notify you if you need to pay the Part D-IRMAA. For more information, contact Social Security at 1-800-772-1213 , Monday through Friday, from 7AM to 7PM. If you worked for a railroad, contact the Railroad Retirement Board for more information at 1-877-772-5772 , Monday through Friday, from 9AM to 3:30PM.

Signing Up For Part D

Seniors who become eligible for Medicare may have the option to enroll in a Part D plan immediately after their benefits become active.

The initial enrollment period for Part D plans begins at the same time as a beneficiarys initial enrollment period for Medicare Part A and/or Part B coverage. This is a 7-month period that begins on the first day of the month, three months before a beneficiarys 65th birthday. The enrollment period closes on the last day of the third month after.

Thus, a senior who turns 65 on June 10 has an initial enrollment period that starts on March 1 of that year and ends on September 30. Seniors who enroll in Medicare Part D plans are encouraged to do so as early in this window as possible, as there can be a 3-month delay in benefits after a switch, and late enrollment could result in a coverage gap.

Enrolling in a Part D plan outside of your initial enrollment periods can potentially result in a lifetime late-enrollment penalty fee.

Seniors who need Part D coverage may be able to sign up during the fall Medicare Open Enrollment Period for Medicare Advantage and Prescription Drug plans, also called the Annual Enrollment Period . Medicare AEP begins on October 15 of each year and ends on December 7.

During AEP, beneficiaries can join a Medicare Part D plan, switch from one Part D plan to another or join a Medicare Advantage plan that includes prescription drug coverage. These plans are often called Medicare Advantage Prescription Drug Plans .

You May Like: What Age Do You Register For Medicare

What Does A Medicare Part D Plan Cost

Like Original Medicare, Medicare Prescription Drug plans share the cost of care through deductibles, co-payments and co-insurance. Your actual PDP costs will vary depending on the plan chosen, prescription drugs you use, whether the drugs you use are on your plan’s formulary, and whether you go to an in-network preferred or standard pharmacy.

What Is A Formulary

Medicare requires that each Part D plan provides a standard level of coverage.

Different insurers provide lists of covered medications that a person can view many refer to each list as a formulary.

Insurance companies have different formularies, and each can decide which medications it covers, the tiers a medication falls under, and the categories that a medication belongs.

Part D plans include both brand name and generic prescription medications, and a formulary must consist of at least two common prescription medications from each category. The insurer can decide which two medications to offer.

If the formulary does not include a particular prescription medication, a similar medicine may be available. A person may wish to discuss options with their prescribing doctor.

If a physician prescribes a medication that is not on the formulary or believes that the available medicines may not be suitable, an individual can:

- request an exception

- pay for the drug out of pocket

- file an appeal with the plan provider or insurer

Drug plans may change their formulary at any time, as long as they follow Medicare guidelines.

A drug plans formulary may change because of:

- a change in drug therapy

- the release of a new drug

- new medical information becoming available

Sometimes, a person is notified of a change after it has already happened, but notice is generally in writing and provided a minimum of 30 days before a change occurs.

Don’t Miss: Does Medicare Cover Aba Therapy

Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.17

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.

Medicare Advantage Plans Negotiate Costs

The anti-kickback statute prohibits manufacturers from giving or offering to give anything of value to someone to induce the purchase of any item or service for which payment may be made by a federal healthcare program. This includes medications from Medicare Part B and Part D. This is the reason you cannot use coupons, rebates, or vouchers to keep your drug costs down when you are on Medicare.

Although you cannot negotiate with the pharmaceutical companies yourself, your Medicare Advantage plan may be able to do so on your behalf. Until recently, only Medicaid and the Veteran’s Health Administration have been able to do so. Now CMS will allow Medicare Advantage plans to negotiate prices of medicines covered under Medicare Part B. This took into effect in 2019.

Medicare Advantage plans will do so by using step therapy to keep costs down. In this scenario, your plan may require that you try a less expensive medication before moving you up to a more expensive alternative if the first treatment is not effective. Private insurance plans that have used this model have achieved discounts of 15-20% whereas Medicare has paid full price.

You May Like: Does Medicare Cover Bladder Control Pads

How Does A Tiered Formulary Work

Many plans have a tiered formulary where the plan’s list of drugs are divided into groups based on cost. In general, drugs in low tiers cost less than drugs in high tiers. Additionally, plans may charge a deductible for certain drug tiers and not for others, or the deductible amount may differ based on the tier.

Formulary tiers:

Consider All Your Drug Coverage Choices

Before you make a decision, learn how prescription drug coverage works with your other drug coverage. For example, you may have drug coverage from an employer or union, TRICARE, the Department of Veterans Affairs , the Indian Health Service, or a Medicare Supplement Insurance policy. Compare your current coverage to Medicare drug coverage. The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options.

If you have other types of drug coverage, read all the materials you get from your insurer or plan provider. Talk to your benefits administrator, insurer, or plan provider before you make any changes to your current coverage.

Recommended Reading: Will Medicare Pay For Liposuction

Who Is Eligible For A Medicare Part D Prescription Drug Plan

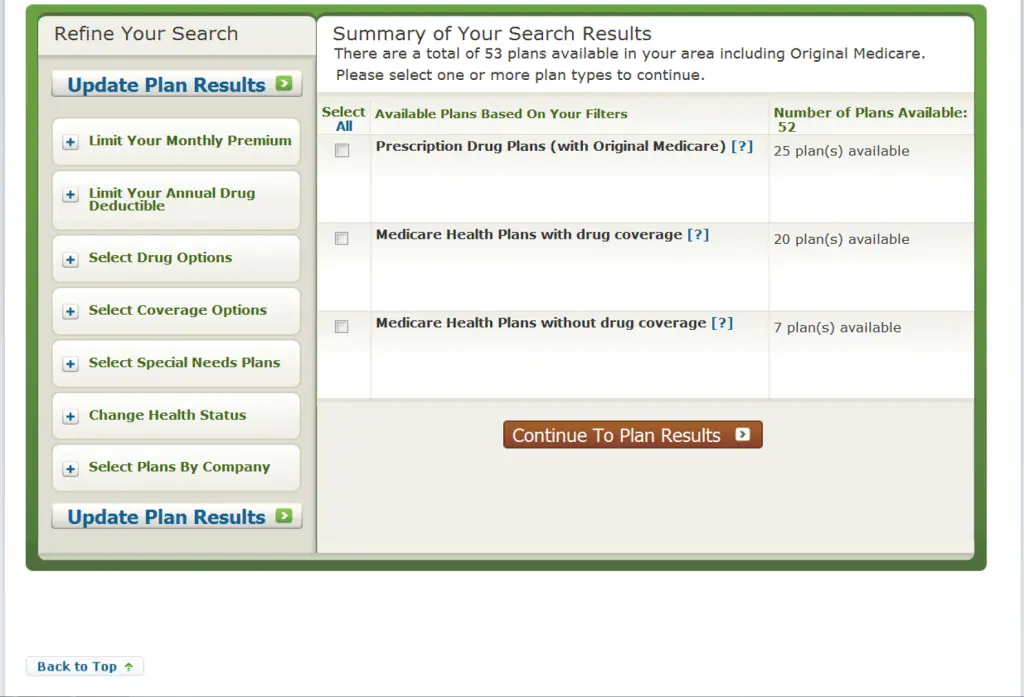

Youre eligible for a standalone Medicare Part D Prescription Drug Plan if you are enrolled in Part A and/or Part B, and you are a U.S. citizen or lawfully present. Youre eligible for Part D prescription drug coverage as part of a Medicare Advantage Plan if you are enrolled in both Parts A and B. You can only enroll in a plan that is available in your area.

If you have a PPO or HMO Medicare Advantage Plan, you cannot purchase a standalone drug plan. You can purchase a standalone drug plan if you have a PFFS or MSA Medicare Advantage Plan.

How To Read A Formulary

Your formulary will include a table similar to the one below. Its the key to helping you understand.

The drug covered by your plan

The tier level or pricing category drugs in different tiers may have different costs

Any special rules for a drug that youll need to follow, like prior authorization, quantity limit or step therapy

There are two ways to find drugs in the formulary:

Read Also: Does Kaiser Medicare Cover Dental

Do I Need A Medicare Drug Plan

Before you look at a Medicare prescription medication plan, take stock of any healthcare insurance you already have or are eligible for because it could affect your decision to get Medicare drug coverage.

Some types of insurance offer very similar prescription medication coverage to Medicare and may be worth keeping instead of enrolling in a Medicare drug plan right away. Examples include:

-

Federal Employee Health Benefits programs

-

Veterans Benefits

-

TRICARE

-

Indian Health Services

These types of insurance plans are considered creditable. You can keep them and avoid paying a penalty if you decide to sign up for a Medicare drug plan in the future. Medicare may charge you a penalty on your monthly premium if you dont enroll when youre first eligible.

Some employer- and union-provided health plans may also be considered creditable. Check with the contact person for your plan.

Annual Medicare Plan Review And Your Prescription Drug Coverage

If there is one thing certain in our lifetimes, its change. Medicare understands your needs and budget can change during the year, so you have the opportunity to address your medical needs and budget during the Annual Enrollment Period, which happens each year from October 15th through December 7th. In our experience, the Medicare Part D drug coverage is the part of Medicare that typically has the most change, so annually reviewing your Part D benefits can help you maintain benefits and control your out-of-pocket costs.

Also Check: Does Medicare Pay For Someone To Sit With Elderly

Mutual Of Omaha Medicare Part D Plans

There are two Mutual of Omaha Part D plans. They are the MOO Rx Value PDP and the MOO Rx Plus PDP.

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $480 deductible on all other tiers.

The Plus Plan has a deductible of $480 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

Mutual of Omaha Network Pharmacies

The Value plan allows you to get your tier 1 generics for $0 through mail order or a preferred pharmacy.

Further, this carrier includes an extensive pharmacy network like CVS, Walmart, and various local shops.

Mutual of Omaha Part D Reviews

Mutual of Omaha has been in the Supplement industry since Medicare began. Those looking for a reliable company could find benefits here.

While theyre new to the Part D sector, we dont doubt the quality of coverage. The top-rated insurance carrier helps many people each day, by incorporating Part D into their business plan, theyre able to assist even more.

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

Also Check: When Can Medicare Plans Be Changed

What Medicare Drug Plans Cost

Medicare drug coverage carries premiums beyond what you pay for original Medicare.

Part D premiums vary by plan. In 2020 the average base monthly premium is $32.74 a month, according to the Centers for Medicare & Medicaid Services.

The base rate is what most enrollees pay for their Part D plan. But if you earn more than a certain amount, you are subject to a rate adjustment that Medicare sets.

In 2020, this adjustment starts at $12.20 a month above your regular Plan D premium if the gross income reported on your tax return is more than $87,000 for a single filer or $174,000 for a married couple filing jointly. It rises in steps to $76.40 a month above the base rate for incomes of more than $500,000 for singles or $750,000 for couples.

Copayments or coinsurance will have to be paid on most prescriptions, in addition to premiums. Your plan also may carry an annual deductible.

Youll pay in full for prescriptions until you hit that deductible, after which Medicare starts paying its share. Deductibles vary among plans but by law cannot exceed $435 in 2020.

Medicares Extra Help program offers financial assistance to people with low incomes or limited resources to meet their Medicare prescription drug costs.

Editor’s note: This article was originally published on July 15, 2015. It has been updated with the latest information regarding Medicare coverage in 2020.