Enroll In Medicare Supplement Plan G

Some plans will allow you to enroll online on their company website. Others may require you to speak with an agent. Regardless, you will need to gather the necessary information to complete your application. There is no option to sign up on the Medicare website.

Every Medicare Supplement Plan G covers the same items. In that way, choosing the best plan is less about coverage than it is about pricing and customer service. After researching the companies offering Plan G in all 50 states , these six companies stood out for their cost structure, website friendliness, and perks.

Medicare Supplement Plan Enrollment

If you are new to Medicare, you may enroll in a Medicare Supplement plan at any time during the year. Most people do not wait that long because there is only a 6-month window to enroll in a Medigap plan without having to medically qualify.

This period is called the 6-month Medigap enrollment period and begins the same day Medicare Part B goes into effect. From that date, you have six months to enroll in a Medigap plan with no medical questions asked.

If you miss this period, you may still apply for a Medicare supplement plan, however, you will have to answer the medical questions on the application.

Changing Medicare Supplement Plans

If you currently have a Medigap plan and would like to change plans or companies to save money, then you may apply at any time during the year. You will need to answer medical questions on the application and get approved, however, we help people change daily to save them money.

Medicare Supplement Plan N: The Pay

Medicare Supplement Plan N is the most budget-friendly option on our list of the best Medicare Supplement plans. With this, however, comes more out-of-pocket costs. Medicare Supplement Plan N covers the full Medicare Part A deductible and Part B 20% coinsurance.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medigap Plan N leaves you responsible for the Medicare Part B deductible and small copays when visiting the doctor or hospital. Additionally, you are responsible for excess charges on this plan if they apply in the state where you receive care. Remember that these charges are rare, even in states that allow them.

With Medigap Plan N, you will owe $20 copayments at the doctor and $50 for an emergency room visit. However, you will not have copays if you visit one of your local urgent care facilities.

Medicare Supplement Plan N is a fantastic option for those who do not regularly go to the doctor or hospital but want emergency coverage.

Medicare Supplement Plan N may be the best choice for those who:

- Seek a relatively low monthly premium

- Do not mind small copayments

- Are not concerned about excess charges

Although Medicare Supplement Plan N is not as comprehensive as other letter plans, it is one of our clients most popular Medicare Supplement plans. Medigap Plan N makes the list of best Medicare Supplement plans due to its lower premiums and accessibility for relatively healthy people.

Find Medicare Plans in 3 Easy Steps

Recommended Reading: Does Medicare Pay For Assisted Living In California

When Should I Buy Medicare Supplement Insurance

Its best to buy Medicare Supplement insurance within the first six months after you turn 65 and enroll in Medicare. During that time, you can buy any Medigap policy sold in your state, even if you have health problems. After this six-month period, you may not be able to enroll in a Medicare Supplement plan, or you may have to pay more due to pre-existing conditions or current health problems.

How To Choose The Best Medicare Supplement Plan

The average cost of a Medicare Supplement plan is $163 per month in 2022. However, rates can vary widely from $50 to more than $400 per month.

The best Medicare Supplement plan for you will depend on which policy provides the best benefits for your medical needs and fills in the coverage gaps where you expect to spend the most on health care.

For example, if you need skilled nursing coverage or want more protection for foreign travel emergencies, then consider how well each plan covers those categories of care. If you expect to need hospital care, a plan that pays for the Medicare Part A deductible can help protect you from a large hospital bill.

Say you need surgery in the upcoming year. For the 2022 plan year, the Medicare Part A deductible is $1,556. Some Medicare Supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,556 out of pocket before your Original Medicare coverage would kick in.

On the other hand, if you choose Medigap Plan G, the $1,556 deductible would be fully covered by your Supplement policy. This means you would begin having your claims covered immediately, rather than first having out-of-pocket costs for medical care. However, you should also consider the cost of the plan since Plan G can be more expensive than Plan A.

Find Cheap Medicare Plans in Your Area

Read Also: Does Walmart Vision Center Accept Medicare

Medicare Plan N Vs Plan G

If you are new to Medicare, or you enrolled on or after January 1st of 2020, the two Medicare Supplement plans in 2023 that youll be choosing from will likely be Medicare Plan G or Plan N.

These plans have the most coverage for the lowest premiums. Below are the pros and cons of each to help you decide. You can always call us for help at 1-888-891-0229.

Ranking The Best Medicare Supplement Plans Of 2021

A Medicare supplement plan fills the gaps in healthcare coverage left by standard Medicare Parts A and B.

Medicare supplement plans are regulated by the government and issued by private insurance companies. These plans cover the out of pocket expenses that all-too-often create mountains of medical debt and cause people to avoid getting necessary care.

Many insurance companies offer Medicare supplement plans. After exhaustive research, we determined that the following companies offer the best Medicare supplement plans of 2021.

You May Like: Does Medicare Cover Outside Usa

Which Medicare Supplement Is Right For You

Perhaps the better way to word that question is which plan is right for you?

If you have seen a Medicare supplement benefit table, you know there are a lot of plans to choose from. Thankfully, for most of the country there are only a few plans that are priced such that they are a reasonable value for the premium you pay. Those are usually Medicare supplement Plan G and Medicare supplement Plan N. In some states Medicare Supplement Plan G-HD is also a good value.

Let me pause for a moment and note that I am very aware there are some of my competitors that want you to think that one plan is going to increase in price drastically more than the other. No. Its not the plan. Its the insurance company.

Some insurance companies will have high price increases regardless of the plan, some will not.

Plan B: Best Medicare Supplement Plan For Basic Benefits

Some beneficiaries just want a basic Medigap plan with no thrills. Medigap Plan B checks that box, with coverage for three types of out-of-pocket Medicare costs that Medicare beneficiaries may be more likely to face that can add up quickly:

- Medicare Part A deductible

- Medicare Part A coinsurance

- Medicare Part B coinsurance

Having those three areas covered means you will likely avoid some of the biggest potential Medicare charges you could face. This can help many beneficiaries enjoy some peace of mind with a simple plan that has everything they need and nothing they dont.

Also Check: Does Medicaid Help Pay For Medicare Part B Premiums

What If You Buy Outside Of The Enrollment Period

If you apply for Medigap coverage outside your open enrollment period, there’s no guarantee that an insurance company will sell you a Medigap policy if you donât meet the medical underwriting requirements, unless you’re eligible due to one of the situations below:

- Disability: Youâre under 65 and eligible for Medicare because of a disability or end-stage renal disease, and you live in a state that requires insurance companies to offer Medigap policies to people with Medicare under 65.

- Other insurance: If you have group health insurance through an employer or union, your Medigap open enrollment period will start when you sign up for Medicare Part B.

- Guaranteed issue right: In some situations, insurers must offer you Medigap policies that cover all your preexisting conditions and canât charge you more because of health problems. You usually have a guaranteed issue right when you have an existing health plan that somehow changes â like you lose coverage.

Choosing Coverage For Cancer Care

The rule of thumb for cancer coverage is that it is nearly always worth it to invest in a more expensive Medicare plan that has better benefits.

There are usually high costs for cancer treatment such as chemotherapy or radiation, and paying for more robust coverage can usually help you save thousands of dollars per year. For example, if paying an extra $30 per month for coverage gives you better benefits that lower your medical costs by $3,000, then you just saved $2,640 in total spending.

Don’t Miss: Can I Cancel My Medicare Part D Plan Anytime

Questions About Eligibility And Enrollment

Retiring at 65? Not retiring until later? Find out when and how you can enroll, how to switch plans, and when is the ideal time to enroll in a Medicare Supplement policy.

View Medicare Supplement eligibility

View state disclosures, exclusions, and limitations

1 Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company or Cigna National Health Insurance Company. In Kansas, insured by Cigna National Life Insurance Company, Cigna Health and Life Insurance Company and Loyal American Life Insurance Company. American Retirement Life Insurance Company is not available to residents of Kansas. In Pennsylvania, Maryland North Carolina and Utah, insured by Cigna National Health Insurance Company domiciled in Ohio. In New Mexico, Idaho and Ohio, insured by Cigna Health and Life Insurance Company.

2 These programs are NOT insurance and do not provide reimbursement for financial losses. Some restrictions may apply. Programs and services may be added or discontinued at any time. Customers are required to pay the entire discounted charge for any discounted products or services available through these programs. The Healthy Rewards program is provided by Cigna Health and Life Insurance Company. Programs are provided through third party vendors who are solely responsible for their products and services. Program availability may vary by location, and are not available where prohibited by law.

MS-SITE-FindPlan2022

Medigap Policies Are Standardized

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a standardized policy identified in most states by letters.

All policies offer the same basic

but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

You May Like: Does Medicare Pay For Assisted Living In Florida

What’s The Least Expensive Medicare Supplement Plan

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage. Only a few providers offer these plans, and a high-deductible Plan G from Mutual of Omaha costs about $54 per month.

Comparing Medicare Supplement Cost

As we mentioned, the benefits are standardized so a G plan will walk and talk the same regardless of carrier.

It then comes down to the following:

- Cost Cost stability

Cost is easy to compare via our link here .

Ease of use is a little trickier and that’s where our experience with 20+ years comes into play.

Generally, Blue Shield of California, Anthem Blue Cross have dominated the California medicare supplement market.

Health Net has quickly tried to gain access and occasionally, they’re priced well.

United is the current underwriting carrier for AARP and they have lost some of their price advantages from before.

Essentially, AARP would be very inexpensive when you turn 65 and get more expensive relative to the other carriers over time.

This felt a bit “bait and switch” to us since people may not be able to change carriers but it came home to roost in that healthier members will price-shop and switch carriers later when they’re older.

This just accelerates the cost gains as we get older .

For that reason, Shield and Anthem have been the top choices for decades now.

It tends to bounce back and forth between the two of them as they compete for market share.

In general, they’re pretty comparable in cost but this can differ from year to year.

You can quickly compare all the carriers here:

QUOTE

We have to address the next big question.

Don’t Miss: How To Apply For Medicare Through Spouse

Sign Up During Your Medicare Supplement Open Enrollment Period

Of course, there is no one plan that is the âbestâ Medicare Supplement Insurance plan for everyone. However, if you want to have the most options, itâs a good idea to sign up during your Medicare Supplement Open Enrollment Period. This is the six-month period that starts the first month youâre 65 or over, and enrolled in Medicare Part B.

During this time frame, youâll have the best Medicare Supplement Insurance plan availability because:

- You have âguaranteed-issue rights,â meaning you canât be turned down for coverage.

- You canât be charged higher premiums because of pre-existing conditions.

- Insurance companies canât require medical underwriting.

Once this period is over, the insurance company can refuse to sell you a plan, charge you more if you have medical problems, or require medical underwriting. The best Medicare Supplement Insurance plan prices may not be available to you if you have health issues.

Medicare Supplement Plans In Wisconsin

Wisconsin standardizes its Medicare Supplement Insurance very differently. For one thing, there is only one major Medigap policy available, the Basic plan.

This plan covers basic benefits:

-

Part A coinsurance for inpatient hospital services

-

Part B coinsurance for outpatient medical services

-

First three pints of blood

-

Part A coinsurance or copayment for hospice care

It also covers coinsurance for stays in skilled nursing home facilities under Part A, as well as 175 days per lifetime in inpatient mental health care, and 40 visits/year for home health care .

Beneficiaries can add riders to their policy to make it fit their needs better. The riders available are:

-

100% Part A deductible

You May Like: When Can I Switch From Medicare Advantage To Medigap

Understanding Medicare Supplement Plans

Medicare supplement insurance is also known as âMedigapâ because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

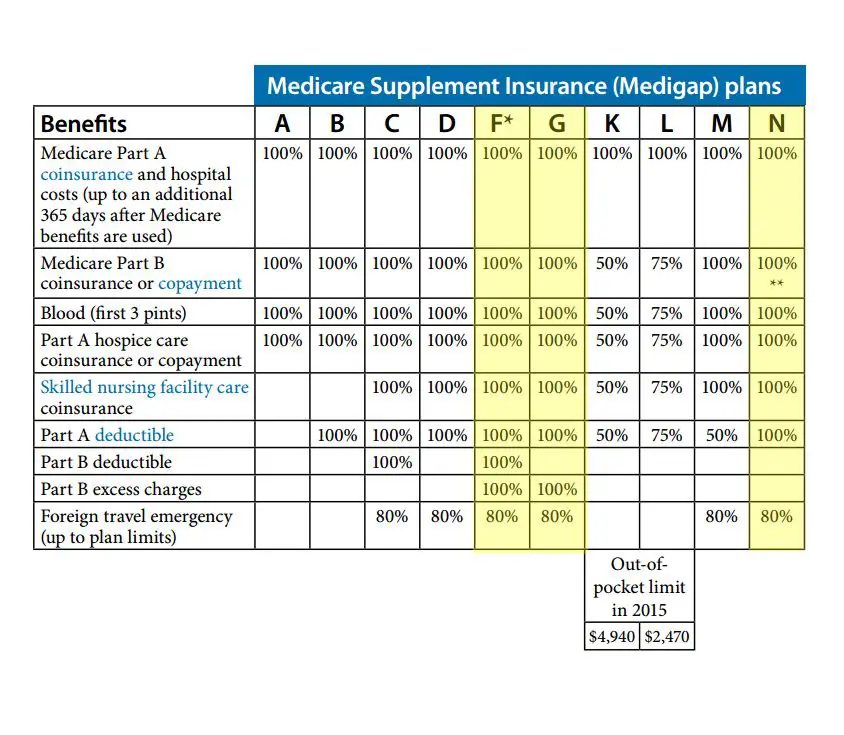

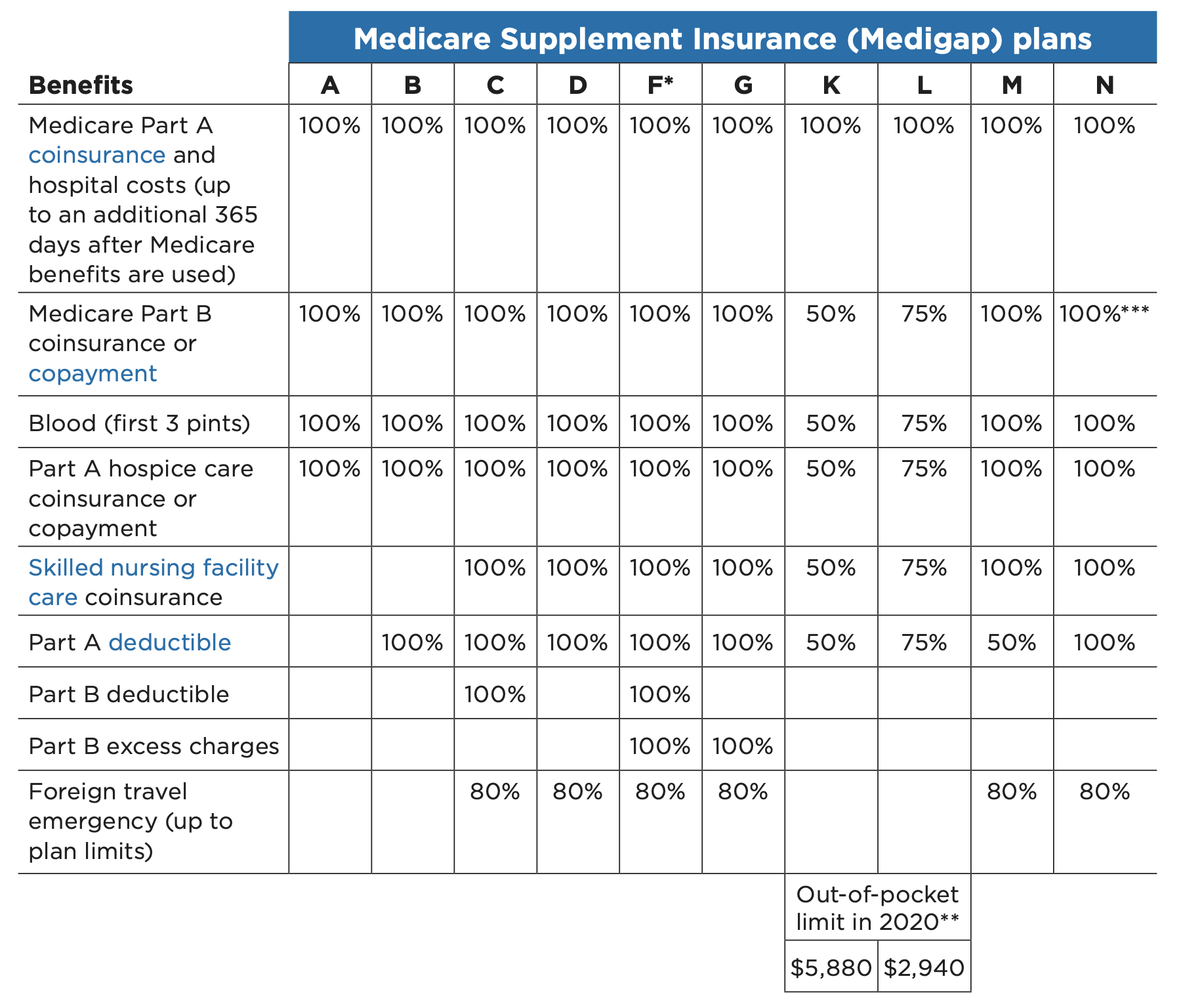

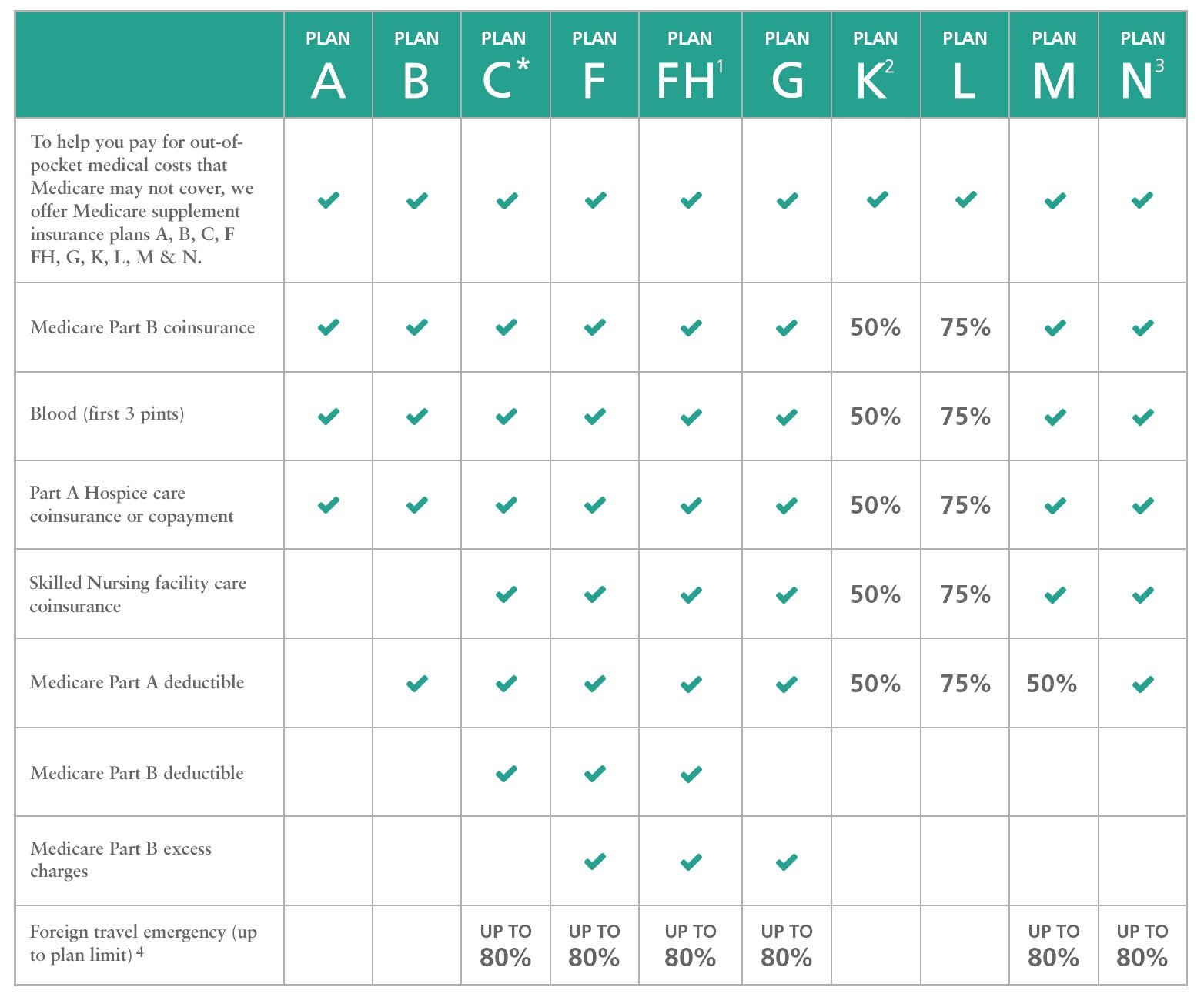

There are 10 plans, each designated by a different letter, and each one covers different things.

As of Jan. 1, 2020, Medicare supplement plans are no longer allowed to cover the Medicare Part B deductible, so Plan C and Plan F are no longer available to newly eligible consumers. Anyone enrolled in either of these plans prior to Jan. 1, 2020, can keep their plans, and anyone eligible for a plan before Jan. 1, 2020 but not yet enrolled may be able to purchase one of these plans.

What Do Medicare Supplement Plans Not Cover

Most Medicare Supplement plans have limits and exclusions to what they cover. For example, Plans C, D, F, G, and N cover 80% of medically necessary emergency care outside the U.S., but each of those four plans has other areas that they dont cover. Medicare.gov offers a detailed explanation of benefits for each plan.

Most common things not covered by Medicare Supplement plans:

- Part B Deductible

- Part B Excess Charge

- Foreign Travel Exchange

Don’t Miss: Does Medicare Help Pay For Hearing Aids

Find A Medicare Supplement Plan That’s Right For You

A Medicare Supplement Insurance plan, also called a Medigap plan, is a separate policy that supplements your coverage from Original Medicare Part A and Part B.

When comparing Medicare Supplement Insurance plans, its important to note that the government decides what benefits each plan offers, so coverage remains the same across all companies. For example, the basic benefits youll receive if you purchase Medicare Supplement Plan G from Cigna are the exact same basic benefits youll receive if you purchase a Medicare Supplement Plan G from a different insurance company.

Before you compare plans, you might find it helpful to review the basics of Medicare Supplement Insurance and .

Pick The Best Medicare Supplement Plan Based On Your Coverage Needs

As youâre thinking about the best Medicare Supplement Insurance plan for your needs, deciding on the level of coverage you want is a good place to start.

Medicare Supplement Insurance plans may help with some out-of-pocket costs that Original Medicare doesnât cover, including copayments, coinsurance, and deductibles.

There are 10 plan types available in most states, and basic benefits are the same across each lettered plan type . For example, Plan N will have the same basic benefits no matter where you buy it.

As you research the best Medicare Supplement Insurance plan for your coverage needs, here are some questions to consider:

- Do I want basic coverage, or more coverage?

- Is there a specific out-of-pocket cost I want help with ?

- Do I want help with Part B excess charges for when I visit doctors who donât accept Medicare payment terms ?

- Do I travel outside of the country often and want overseas coverage?

- Do I want a high-deductible plan?

If youâre looking for minimal coverage, the best Medicare Supplement Insurance plan to consider might be Plan A, which offers the most basic level of coverage.

*Medicare Supplement Insurance Plans C and F may not be available to you if you become eligible for Medicare on January 1, 2020 or later.

This Medicare Supplement Insurance plan benefits chart may be helpful as youâre comparing coverage side by side.

You May Like: Can You Apply For Medicaid If You Have Medicare