Medicare Advantage Takeover: Nearly 4k Plans Available Across The Country For 2023

The average Medicare beneficiary has a choice of 43 Medicare Advantage plans and 24 Part D stand-alone plans for coverage in 2023, the Kaiser Family Foundation finds. But another study by the American Medical Association notes that top payers dominate the market, and the lack of competition may spell trouble for enrollees.

Medicare beneficiaries have even more choices in the MA marketplace for 2023, according to a new KFF analysis. A typical beneficiary has a choice of 43 MA plans as an alternative to traditional Medicare, an increase of five plans on average from 2022.

Furthermore, a second KFF study finds that a typical beneficiary has a choice of 24 Medicare Part D stand-alone prescription drug plans for 2023, one more than in 2022.

The two KFF briefs also provide an overview of the MA and Medicare Part D marketplace for 2023, including the latest data and key trends that have emerged during Medicares open enrollment period.

MA marketplace for 2023

More than 28 million Medicare beneficiaries48 percent of all eligible beneficiariesare enrolled in MA plans, which are mostly HMOs and PPOs offered by private insurers. Enrollment is projected to cross the 50 percent threshold as soon as next year.

For 2023, KFF finds that a typical beneficiary has 43 MA plans to choose from in their local market, including 35 plans that offer Part D drug coverage. In total, 3,998 MA plans will be available across the country.

The AMA study found:

Part D marketplace for 2023

Learn More About Medicare Advantage In Ramapo Ny

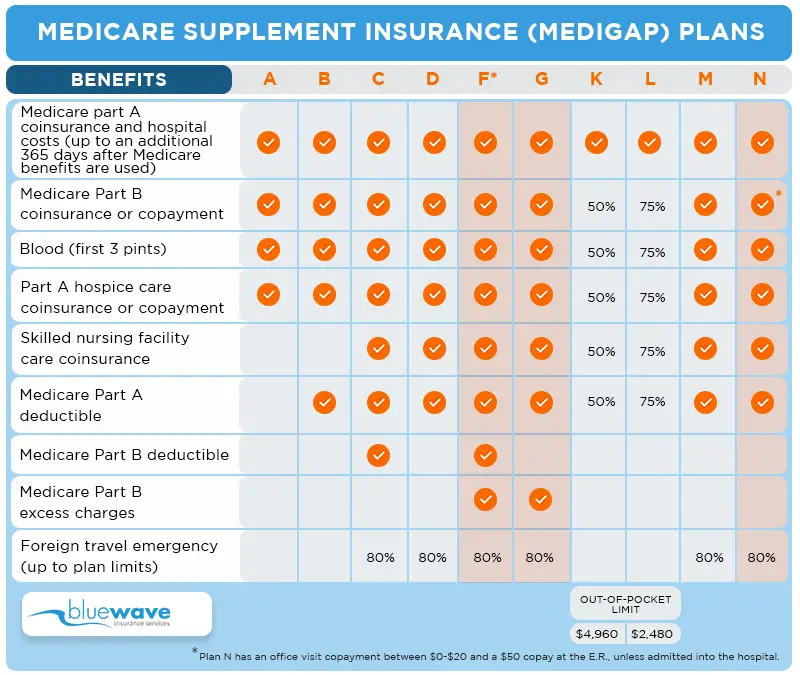

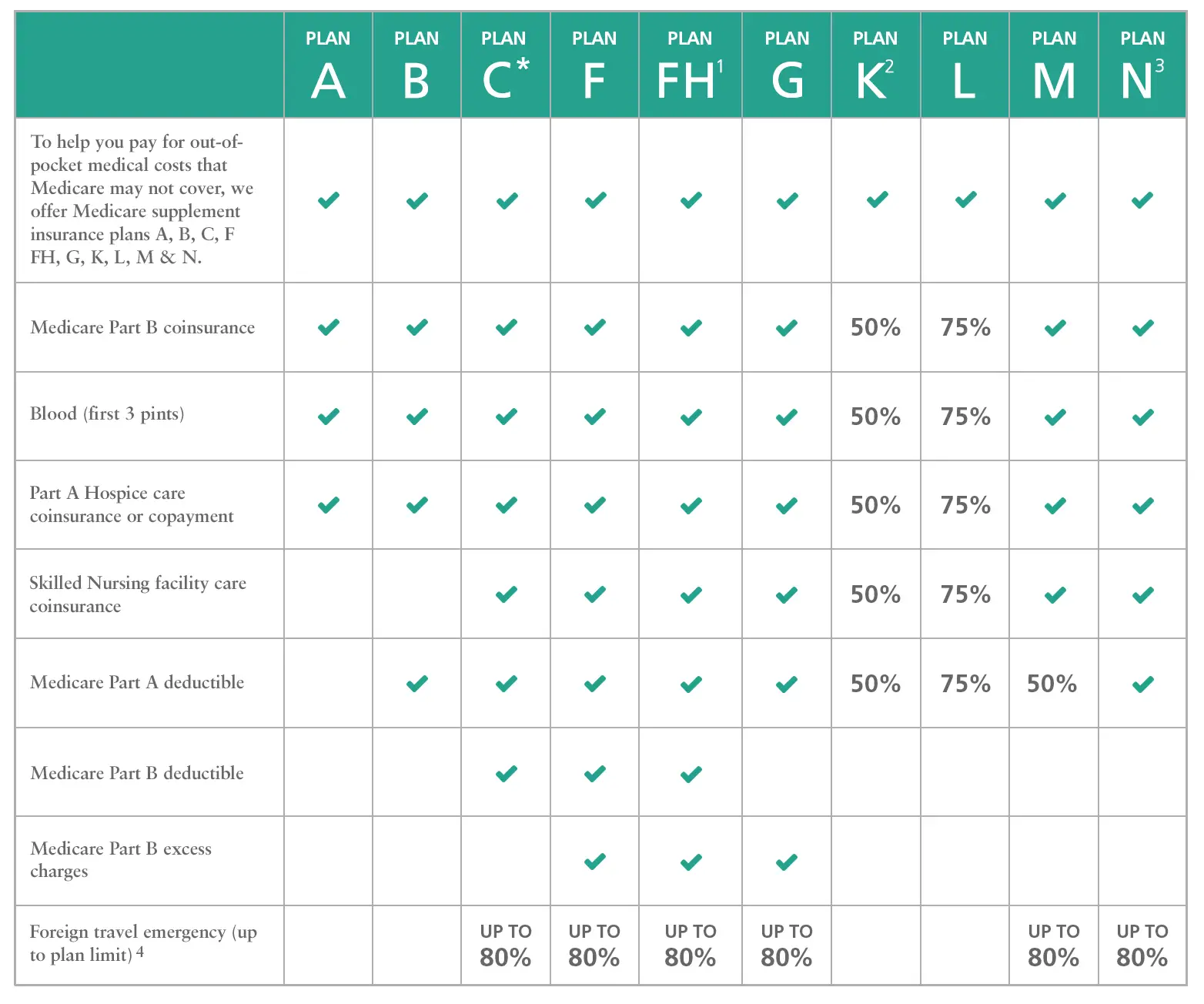

Learning about Medicare and the plans available to you can be difficult. Our licensed agents are here to make the process easier for you to navigate. Even if Medicare Advantage plans arent currently on your radar, our licensed agents may be able to help you find Medicare Part D Prescription Drug coverage or Medigap supplemental plans that can help you cover out-of-pocket medical expenses.

No one should go without quality healthcare coverage. If youre looking for Medicare plans near Ramapo, NY, but you dont know where to start, we can be your guide. Give us a call today at 950-0608 to connect with one of our licensed agents. Whether youre just comparing or actively looking to enroll in a plan, were here to help.

Medicare Advantage Plans Coordinate Care Among Your Health Care Providers

Typically Medicare Advantage plans are managed care and have networks of contracted health care providers. Example would be Health Maintenance Organization Medicare Advantage plans. In most cases, HMO plans require enrollees to select a Primary Care Physician who helps to coordinate their care.

Medicare Advantage plans that include Medicare prescription drug coverage may also have medication therapy management. This care coordination can be a convenience and a valuable aid to your health.

Don’t Miss: When Do You Stop Paying Medicare And Social Security Taxes

Types Of Medicare Advantage Plans

There are different types of Medicare Advantage plans to choose from, including:

- Health Maintenance Organization .HMO plans utilize in-network doctors and require referrals for specialists.

- Preferred Provider Organization .PPO plans charge different rates based on in-network or out-of-network services.

- Private Fee-for-Service .PFFS plans are special payment plans that offer provider flexibility.

- Special Needs Plans .SNPs help with long-term medical costs for chronic conditions.

- Medical Savings Account .MSA plans are medical savings accounts paired with high deductible health plans.

Compared to original Medicare, there may be advantages if you choose a Medicare Advantage plan.

Where Is Part B Giveback Offered

Medicare Advantage giveback rebate adverts air across the U.S., but these plans arent available to everyone. And despite the fact that the majority of the available plans do not include this benefit.

It is important to assess each plan available in your region to see how it meets all their requirements. The plan will cost you an additional $60 per month at the pharmacy or it may not be the most efficient option for your medical care needs.

Recommended Reading: Does Medicare Pay For Recliner Lift Chairs

How Does The Affordable Care Act Affect Medicare Advantage Costs

The Affordable Care Act changed Medicare Advantage plans several times. Almost all of these changes were related to the health insurance market as well. The ACA has reopened the Medicare donut hole, but it does not mean prescriptions for drugs have no limits.

Beneficiaries had to pay some of these expenses. The Medicare plan has a new policy which allows insurers across the country not to charge plan members more for services besides chemotherapy. It may affect the cost of your plans as well.

Why Should I Choose Medicare Advantage

A Medicare Advantage plan covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient’s situation worsens, it might be difficult or expensive to switch plans.

Recommended Reading: Does Medicare Cover Tdap Vaccine

What Is The Most Popular Medicare Advantage Plan

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

How Do Medicare Part B Give Back Plans Work

Part B giveback programs are private health plans that are provided instead of Medicare. Medicare Advantage plan beneficiaries can get original Medicare Part A or Part B insurance benefits along with some additional benefits.

This package of coverage provides complete coverage and helps reduce the out-of-pocket cost of hospital services. Other features include prescription coverage. GivingBack initiatives are a further additional benefit which separate the plans from others.

Read Also: Does Kaiser Permanente Take Medicare

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

Medicare Advantage Plans May Limit Your Freedom Of Choice In Health Care Providers

With the federally administered Medicare program, enrollees can generally go to any doctor or facility that accepts Medicare and receive the same level of Medicare benefits for covered services. In contrast, Medicare Advantage plans may be more restricted in terms of their provider networks. If you go out of network, your plan may not cover the medical costs, or your costs may not apply to your out-of-pocket maximum.

Read Also: Can You Be Denied Medicare Coverage

Disadvantages Of Ma Plans

- MA plans are annual contracts. Plans may decide not to negotiate or renew their contracts.

- Plans may change benefits, increase premiums and increase copayments at the start of each year.

- You may have higher annual out-of-pocket expenses than under Original Medicare with a Medicare supplement plan.

- Your current doctors or hospitals may not be network providers or may not agree to accept the plan’s payment terms.

- In most cases, you cannot keep your stand-alone Medicare Part D plan and the Medicare Advantage plan.

Sponsored: Find The Right Financial Adviser

Finding a financial adviser you can trust doesnt have to be hard. A great place to start is with SmartAssets free financial adviser matching tool, which connects you with up to three qualified financial advisers in five minutes. Each adviser is vetted by SmartAsset and is legally required to act in your best interests.

Read Also: How To Apply For Social Security And Medicare

Medicare Advantage Plans Cover All Medicare Services

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding clinical trials, hospice services, and, for a temporary time, some new benefits that come from legislation or national coverage determinations. Plans must cover all emergency and urgent care and almost all medically necessary services Original Medicare covers. If youre in a Medicare Advantage Plan, Original Medicare will still help cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

The plan can choose not to cover the costs of services that aren’t

under Medicare. If you’re not sure whether a service is covered, check with your provider before you get the service.

With a Medicare Advantage Plan, you may have coverage for things Original Medicare doesn’t cover, like fitness programs and some vision, hearing, and dental services . Plans can also cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs that Part D doesnt cover, and services that promote your health and wellness. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations.

Most plans include

. In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan.

Who Is Eligible For Part B Give Back Benefit

To qualify to receive the benefits of the giveback plan, policies need certain criteria. You have to first enroll into Medicare and pay their own premiums. This does not make the premiums eligible for the program.

In addition, it’s essential you live in service areas with plans that offer premium-reduced rates. There are now 48 countries providing these benefits. Get a free quote Find the best Medicare Plan for you.

You May Like: Do You Apply For Medicare Through Social Security

All Medicare Advantage Plans Feature Out

With Original Medicare, there is no annual limit to how much out-of-pocket health care spending you may have to pay. That means you could potentially face an infinite amount of medical expenses in any given year.

Medicare Advantage plans, however, are required to include an annual out-of-pocket spending limit that caps the amount of money you will be forced to spend in a calendar year. Once you reach that limit, the plan will pay 100% of your expenses for the remainder of the year.

Why Do Medicare Advantage Plans Cost More And How Are They Paid

The government pays Medicare Advantage plans a set rate per person, per year under what is called a risk-based contract.12 That means that each plan agrees to assume the full risk of providing all care for that inclusive amount. This payment arrangement, called capitation, is also intended to provide plans with flexibility to innovate and improve the delivery of care.

But there are layers of complexity built into and on top of that set rate that allow for various adjustments and bonus payments. While those adjustments have proved useful in some ways, they can also be problematic and are the main reason for the extra cost of Medicare Advantage vis-à-vis traditional Medicare.

Benchmarks. Plan benchmarks are the maximum amount the federal government will pay a Medicare Advantage plan. Benchmarks are set in statute as a percentage of traditional Medicare spending in a given county, ranging from 115 percent to 95 percent. For counties with relatively low spending, benchmarks are set higher than average spending for traditional Medicare for counties with relatively high spending, benchmarks are set lower than average traditional Medicare spending . Special Needs Plans and other Medicare Advantage plans are paid in the same manner, with the same benchmarks.

Don’t Miss: Do Most Doctors Accept Medicare

How Can Medicare Part C Plan Have A $0 Premium

Medicare Advantage programs with a zero cost premium are rare. According to the Kaiser Family Foundation, 93 percent of Medicare recipients will get zero-prime plans by 2019. What’d happen if there was no premium? This is an important question.

Then it’s up to you to understand why the benefits are not free, despite having paid zero premiums on Medicare Advantage plans. Part C still requires a Part A deductible copayment and coinsurance.

Tell Me The Monthly Cost Of Part C

Premiums are another form of payment. Your Medicare Part C Medicare Premium is what you pay to your health insurance company.

If you want to learn more about how premium payments work, you can find more information on how you can get Medicare Advantage. Medicare Advantage Plan is private insurance coverage that Medicare approves.

This plan covers all Original Medicare services and costs. Most health coverages also include drugs and some plans offer additional dental, vision, and other coverage options.

Read Also: Is Pneumococcal Vaccine Covered By Medicare

What Are Medicare Advantage Plans And Which Plans Are Available In Iowa

Medicare Advantage plans are offered by private companies which contract with Medicare to provide Medicare Part A, B and sometimes D benefits. When you enroll in a Medicare Advantage plan you do not lose Medicare, you just get your benefits in a different way.

There are four types of Medicare Advantage plans in Iowa: HMO , POS , PPO , PPFS , and SNP . In addition, a special type of health plan called a Cost Plan is offered in some counties.

Before you enroll in a Medicare Advantage plan its important to know the following:

- Do all of your providers accept the plan?

- You must have both Medicare Parts A and B and live in the service area for the plan.

- You must stay in the plan until the end of the calendar year .

- Each year plans can change benefits, premiums, service areas, provider networks , and can terminate their contract with Medicare.

- You do not need a Medicare supplement insurance policy. In fact, Medicare supplements cannot pay benefits when you are enrolled in a Medicare Advantage plan.

For more information on plans available in Iowa, use the link below to view and download our consumer guide.

Plans Can Offer Coverage Under One Plan

Medicare Advantage plans offer all of the hospital and medical care benefits covered by Original Medicare, and many plans can offer coverage for health, dental and prescription drug coverage, all in one plan.

This type of coverage can make it easier for many beneficiaries to get the level of care they want, no matter what their specific health insurance coverage needs may be.

Also Check: What Brand Of Diabetic Supplies Are Covered By Medicare

Are Medicare Part B Give Back Plans Cheaper Than Other Medicare Plans

Providers that waive Part B may have lower premiums than other Medicare Advantage programs, as compared to the other. In some situations, Medicare Part B grant back plan costs may differ from Original Medicare combined with Medicare Supplement plans.

Costs of doctor appointments or medical services are typically far higher for patients out-of-network. Consider the high deductible plans, which offer lower costs than the standard Medicare Advantage plans, and are less costly than Medicare Part D Giveback plans if you’ve made no claim.

Things To Consider Before You Buy A Plan

Ask your medical providers If they’ll take the MA plan.

Ask the plan if It requires a referral for you to see a specialist.

If you live in another state part of the year, find out if the plan will still cover you. Many plans require you to use regular services within the service area , which is usually the county in the state where you live.

Find out if the plan includes:

- Monthly premiums

- Any copayments for various services

- Any out-of-pocket limits

- Costs to use non-network providers

If you have Medicaid or receive long-term care, or live in a nursing home, Special Needs Plans may be available in your area. If you choose other types of MA plans, find out if:

- The plan’s in-network providers you use are certified to accept Medicaid.

- In-network providers bill the plan correctly and/or refer to Medicaid providers as needed.

- The providers’ office knows what Medicaid covers and what the plan covers.

- You’ll have monthly premiums to pay. Medicaid will not cover MA plan premiums.

Read Also: How Much Does Medicare Cover For Home Health Care

What Is Part B Premium Reduction Benefit

If you enroll with Medicare Part B you will be charged an extra yearly fee. Part B rebates can reduce your Medicare benefits if you have received Medicare Advantage Part C coverage. You get a discount of between 1 and 100% on your coverage.

Even a lower monthly premium means you won’t receive any financial back. Instead, you only pay the lower price and you save what you would pay otherwise. If you pay Social Security premiums in your paycheck, your payments will be reduced.

When you are unable to make payment this will be recorded on your annual statement and will be refunded by your company’s taxable income.

Premiums For Medicare Advantage Plans With Prescription Drug Coverage

In 2021, the average monthly cost for plans which offer Medicare Part D prescription drug benefits was $21. The premiums vary based on enrollment. This is why most people choose low-price plan in general.

The following table shows average monthly premium payments for different plans . The Centers for Medicare and Medicaid Services does not review or approve Medicare Supplement plan information.

Read Also: Does Emory Hospital Accept Medicare

Pitfalls Of Medicare Advantage Plans

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

A Medicare Advantage Plan, also called a Part C or an MA Plan, may sound enticing. It combines Medicare Part A , Medicare Part B , and usually Medicare Part D into one plan. These plans cover all Medicare services, and some offer extra coverage for vision, hearing, and dental. They are offered by private companies approved by Medicare.

Still, while many offer low premiumssometimes as low as $0 per monththe devil is in the details. You will find that many plans unexpectedly won’t cover certain expenses when you get sickresulting in unforeseen out-of-pocket costs for youand what they pay can differ depending upon your overall health. Here’s a look at some of the disadvantages of Medicare Advantage Plans.