Who Qualifies For Medicare Part C

Medicare Part C is an alternative way to get your Medicare Part A and Part B benefits. Medicare Advantage plans are available through Medicare-approved private insurance companies. To be eligible for Medicare Part C, you must already be enrolled in Medicare Part A and Part B, and you must reside within the service area of the Medicare Advantage plan you want. You can get more information about and enroll in a Medicare Advantage plan by contacting a licensed health insurance agent or broker, such as eHealth.

The Medicare Advantage plan Initial Coverage Election Period is generally the same as the Initial Enrollment Period for Medicare Part A and Part B . Or, you can sign up during the Annual Election Period from October 15 to December 7 for coverage effective January 1 of the following year. You can also enroll during a Special Election Period , if you qualify.

Please note: If you have end-stage renal disease , hereâs a change you may want to know about. Starting in 2021, you may qualify for a Medicare Advantage plan if you have end-stage renal disease and meet the usual requirements listed below.

Medicare Part C is optional, and there is no penalty for not signing up. But you must have Medicare Part A and Part B to get Part C, and live in the service area of a Medicare Advantage plan.

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

Medicare Supplement Plan Eligibility

Like Medicare Advantage, Medicare supplemental insurance often called Medigap because it fills in the out-of-pocket coverage gaps in Medicare Parts A and B is also purchased from private insurers.

Medigap helps cover copayments, coinsurance and deductibles from Medicare Part A and Part B.

You must meet one of these qualifications to be eligible for Medigap coverage:

- You must be 65 or older.

- You have been diagnosed with Lou Gehrigs disease.

- You have been entitled to Social Security or U.S. Railroad Retirement Board disability payments for at least 24 months.

- You have been diagnosed with end-stage renal disease, requiring regular dialysis or a kidney transplant.

Also Check: Does Medicare Cover Vitamin D Testing

When Do I Use My Medicare Cards

Everyone who enrolls in Medicare receives a red, white, and blue Medicare card. This card lists your name and the dates that your Original Medicare hospital insurance and medical insurance began. It will also show your Medicare number, which serves as an identification number in the Medicare system.

If you have Original Medicare, make sure you always bring this card with you when you visit doctors and hospitals so that they can submit bills to Medicare for payment. If you have a supplemental insurance plan, like a Medicare Supplement Plan, retiree, or union plan, make sure to show that plans card to your doctor or hospital, too, so that they can bill the plan for your out-of-pocket costs.

Note: Medicare has finished mailing new Medicare cards to all beneficiaries. You can still use your old card to get your care covered until January 1, 2020. However, if you have not received your new card, you should call 1-800-MEDICARE and speak to a representative.

If you are enrolled in a Part D plan , you will use the Part D plans card at the pharmacy.

Remember: Do not give your Medicare or Social Security numbers or personal data to strangers. Medicare will never ask for this information over the phone. If you believe you have been the target of Medicare marketing or billing fraud, contact your local Senior Medicare Patrol.

Medicare Eligibility: Key Takeaways

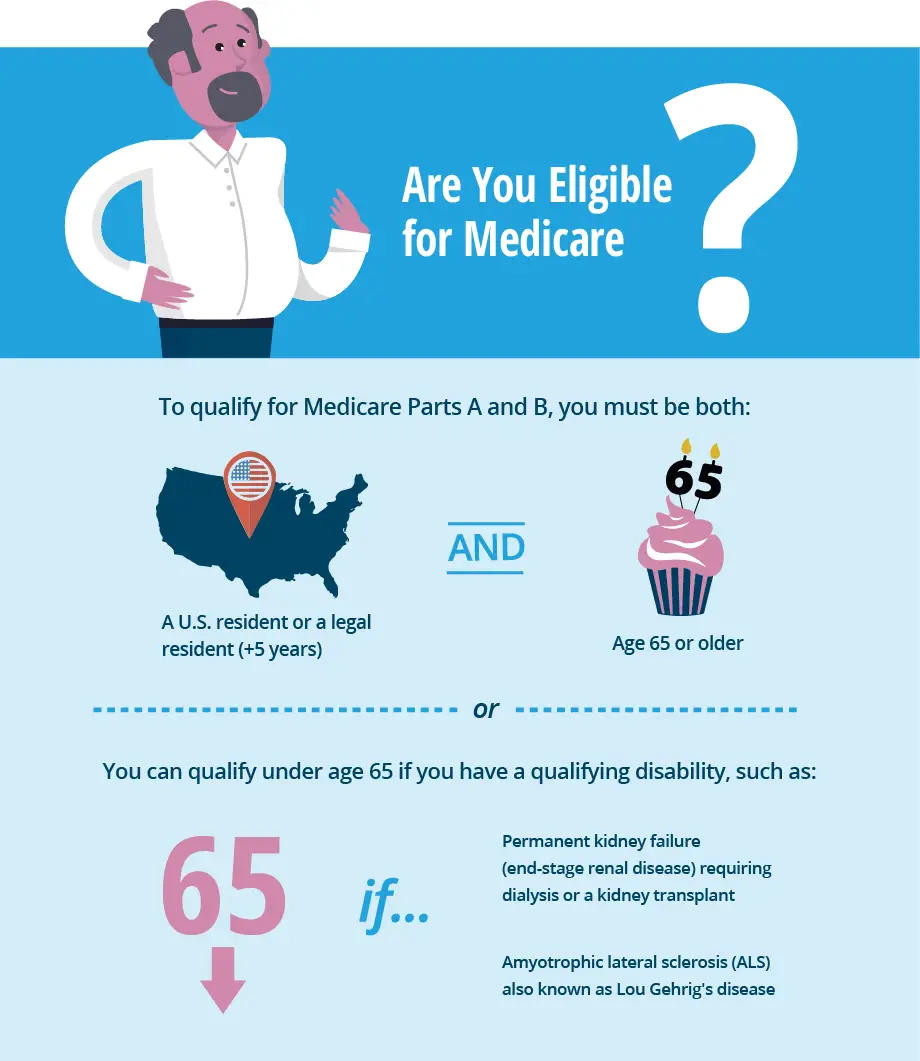

- Generally, youre eligible for Medicare Part A if youre 65 and have been a U.S. resident for at least five years.

- When youre notified youre eligible for Part A, youll be notified that youre eligible for Medicare Part B.

- You need to be eligible for both Medicare Part A and B in order to enroll in Medicare Advantage.

- To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both.

- If youre enrolled in both Medicare Part A and B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy.

For the vast majority of Americans who look forward to receiving Medicare health benefits, eligibility is as uncomplicated as celebrating your 65th birthday.

But your eligibility to receive Medicare coverage without having to pay a premium and your eligibility for other Medicare plans depends on such factors as your work history and your health status. Heres what you need to know:

Don’t Miss: Can You Change Your Medicare Supplement Insurance Anytime

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Medicares Extra Help Program

At Humana Pharmacy®, we understand paying for your prescription medicines can add up quickly throughout the year. This is why we work hard to keep the cost of your medicines affordable by offering $0 copays on most generic 90-day prescriptions and finding low-cost alternatives for costly medicines.

However, for some, we understand that you need more help to stay on track with your care. So, we wanted to make sure you knew about Medicares Extra Help program. The Extra Help program provides added financial support to people with limited income and resources, as well as the following benefits:1

- $0 or reduced drug coverage premiums and lower out-of-pocket costs

- No coverage gap

- No late enrollment penalty for Medicare prescription drug coverage

Read Also: Does Cigna Have A Medicare Supplement Plan

If I Retire At Age 62 Will I Be Eligible For Medicare At That Time

Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with end-stage kidney disease. Most commonly, you are eligible for Medicare when you turn 65, but there are other health insurance options if you are younger and do not have coverage through you or your spouses employer.

What you should know

| 1. The typical age requirement for Medicare is 65, unless you qualify because you have a disability. | 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare. |

| 3. You have options for health insurance if you are too young for Medicare. You may obtain it through your employer, or you can purchase from private-sector insurance companies through the health insurance exchange. You may be eligible for Medicaid, which is based on income. | 4. If you retire before you are 65, you may be eligible for employer-provided group health insurance under the Consolidated Omnibus Budget Reconciliation Act . |

Medicare was established in 1965 in order to provide health coverage for seniors who would otherwise not be covered by employer-sponsored health insurance plans. If you retire at the age of 62, you may be eligible for retirement benefits through social security, but early retirement will not make you eligible for Medicare.

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

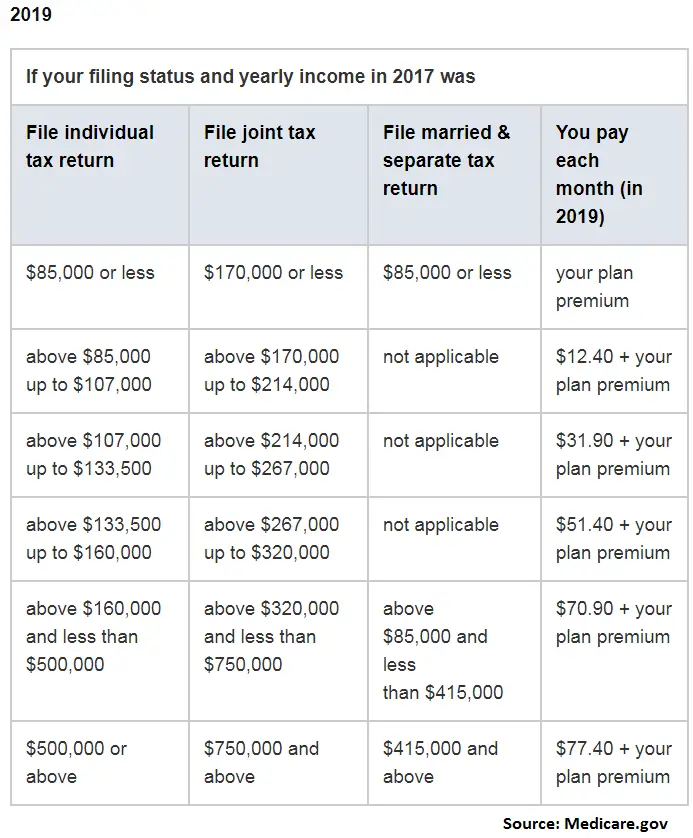

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Recommended Reading: Are Cancer Drugs Covered By Medicare

Medicare Eligibility Who Qualifies For Medicare Benefits

Summary:

To be eligible for Medicare Part A and Part B, you must be a U.S. citizen or a permanent legal resident for at least five continuous years. In most cases, you have to be age 65 or older, and in other cases you might qualify for Medicare before age 65 if you qualify by disability. This page will help to explain Medicare eligibility in further detail.

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: Does Part B Medicare Cover Dental

How Can I Get Assistance Paying My Health Care Costs

If you have a limited income, you may be able to get assistance with your health care costs through certain programs:

- Medicaid: If you have a low monthly income and minimal assets, you may be eligible for coverage through Medicaid to pay Medicare costs, like copays and deductibles, and for health care not covered by Medicare, such as dental care and transportation to medical appointments.

- Medicare Savings Programs : If you do not qualify for Medicaid but still have problems paying for health care, you may qualify for an MSP, a government-run program that helps cover Medicare costs. There are three types of MSP, and all of them pay the monthly Medicare Part B premium. The Qualified Medicare Beneficiary program covers deductibles and coinsurances as well.

- Extra Help: Also known as the Part D Low-Income Subsidy , this is a federal program that helps pay for some to most of the costs of Medicare Part D prescription drug coverage. You may be eligible for Extra Help if you meet the income and asset limits. Also, in many cases, enrollment in an MSP automatically leads to enrollment in Extra Help.

- State Pharmaceutical Assistance Programs: SPAPs are offered in some states to help eligible individuals pay for prescriptions. Most SPAPs have income guidelines. Many also require you to enroll in a Medicare Part D plan and to apply for Extra Help.

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

You May Like: How Long To Process Medicare Part B Application

What Are The Parts Of Medicare

The different parts of Medicare help cover specific services:

- Medicare Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Medicare Part D Helps cover the cost of prescription drugs .

When Can I Enroll In Medicare Part D

To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both. You can sign up for Medicare Part D at the same time that you enroll in Medicare Part A and B.

As mentioned above, most people who select Medicare Advantage must receive their Part D prescription benefits as part of that same Medicare Advantage plan . Medicare Savings Account plans do not include Part D coverage, nor do some Private Fee-for-Service Medicare plans. If you have an MSA or a PFFS and it doesnt have Part D coverage included, youre allowed to purchase a stand-alone Part D plan to supplement it.

As with Part B, you are still eligible for Part D prescription drug coverage if you dont enroll when youre first eligible, but you may pay higher premiums if you enroll later on, unless you had during the time that you delayed enrollment in Part D.

Recommended Reading: How Medicare Works With Other Coverage

Spouse Eligibility For Part A

A person who is 65 or older may qualify for Medicare Part A benefits if their spouse has paid Medicare taxes for 40 quarters of employment. This would entitle them to a premium-free Part A plan.

If a person is younger than their spouse and has not yet reached 65 years of age, they cannot qualify for Medicare earlier based on their spouses eligibility, unless they have a qualifying disability.

For example, if a person is 62 and their spouse is 65, they cannot obtain Part A benefits until reaching 65 themselves.

How Do I Enroll In A Medicare Advantage Plan

Medicare Advantage Plans are health care options provided under Medicare Part C of the Medicare program. These plans are approved by Medicare but sold and serviced by private companies. There are several plan options available under Medicare Advantage such as managed care plans that involve a provider network to those that are specially designed for people with certain chronic diseases and other specialized health needs and some that may or may not have a provider network requirement. Most Medicare Advantage plans include Medicare prescription drug coverage.

For assistance with Medicare Advantage Plans comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for Medicare Advantage Plans available in your area.

To enroll in any Medicare Advantage plan option you must have both Medicare Part A and Medicare Part B. Once you enroll into a Medicare Advantage plan, you will not use your Original Medicare card as your Medicare Advantage plan will replace Original Medicare. Instead the Medicare Advantage plan will provide you with a member ID card to use when visiting your medical provider. Please note, you will continue to pay the Medicare Part B premium, and you might also have to pay an additional monthly premium charged by the Medicare Advantage plan.

Read Also: Does Medicare Cover Keloid Removal

What If I Havent Worked Long Enough Or At All

The answer to the question can you get Medicare if you never worked? is actually quite simple. However, if youre wondering, is everyone eligible for Medicare? things can get a little more complicated. Allow us to explain who gets Medicare and answer the question, do you have to take Medicare?

If you havent worked enough in your lifetime to earn the necessary 40 credits, it may be possible to qualify for Medicare Part A benefits based on your spouses work history and spouse Medicare eligibility.

In order to qualify for this provision, you must be 65 or older. When it comes to Medicare for spouses under 65, you will likely be pleased to know that the rules state that your spouse only needs to be least 62 or older for them to qualify. In some cases, you can still receive the benefits if you are 65 and divorced or if you are a widow, so no more frantically searching terms like Medicare for spouse or can my wife get Medicare if I am on disability?

If you are currently married and your spouse qualifies for social security benefits and Medicare Part A premiums, you can apply as long as you have been married for at least a year prior to submitting the application.

If you are divorced, you may be eligible if your former spouse is, as long as you were married for at least ten years. You must also be currently single.

Help Paying Your Medicare Costs

To let you know you automatically quality for Extra Help, Medicare will mail you a purple letter that you should keep for your records. You dont need to apply for Extra Help if you get this letter.

- If you arent already in a Medicare drug plan, you must join one to use this Extra Help.

- If youre not enrolled in a Medicare drug plan, Medicare may enroll you in one so that youll be able to use the Extra Help. If Medicare enrolls you in a plan, youll get a yellow or green letter letting you know when your coverage begins, and youll have a Special Enrollment Period to change plans.

- Different plans cover different drugs. Check to see if the plan youre enrolled in covers the drugs you use and if you can go to the pharmacies you want.

- If you have Medicaid and live in certain institutions or get home and community based services, you pay nothing for your prescription drugs.

Drug costs in 2022 for people who qualify for Extra Help will be no more than $3.95 for each generic drug and $9.85 for each brand-name drug. Look on the Extra Help letters you get, or contact your plan to find out your exact costs.

NOTE: When you apply for Extra Help, you can also start your application process for the Medicare Savings Programs. These state programs provide help with other Medicare costs. Social Security will send information to your state unless you tell them not to on the Extra Help application.

There are 4 kinds of Medicare Savings Programs:

Dont Miss: Does Medicare Cover Laser Surgery

Recommended Reading: Is Medicare A And B Free