Social Security And Medicare: Do You Get Back What You Pay In

People who pay into Social Security and Medicare their whole working lives are often told by politicians that theyve earned these retirement benefits. Heres why thats not necessarily so.

Loading

Are Social Security and Medicare earned entitlements, returning benefits for which recipients have already paid?

The question arises because earlier this week House Budget Committee Chairman Paul Ryan of Wisconsin said they are. Appearing on Laura Ingrahams radio show on Jan. 22, Representative Ryan said President Obama had mischaracterized the GOPs attitude toward the nations big social insurance programs.

No one is suggesting that what we call our earned entitlements entitlements you pay for, like payroll taxes for Medicare and Social Security are putting you in a taker category, said Ryan. No one would suggest that whatsoever.

Of course, Ryan is far from the only politician to describe Social Security and Medicare in this manner. The wording may be more common among Democrats, who often imply that these programs are simply keeping folks tax cash warm until they need it so hands off!

Lets quote Mr. Obama himself from an appearance last September before an American Association of Retired Persons audience: I want to emphasize, Medicare and Social Security are not handouts. Youve paid into these programs your whole lives. Youve earned them.

What Is The Texas Health Information Counseling And Advocacy Program

If you are eligible for Medicare, the Texas’ Health Information, Counseling and Advocacy Program can help you enroll, find information and provide counseling about your options. This partnership between the Texas Health and Human Services system, Texas Legal Services Center and the Area Agencies on Aging trains and oversees certified benefits counselors across the state.

What Is The Medicare Part B Premium

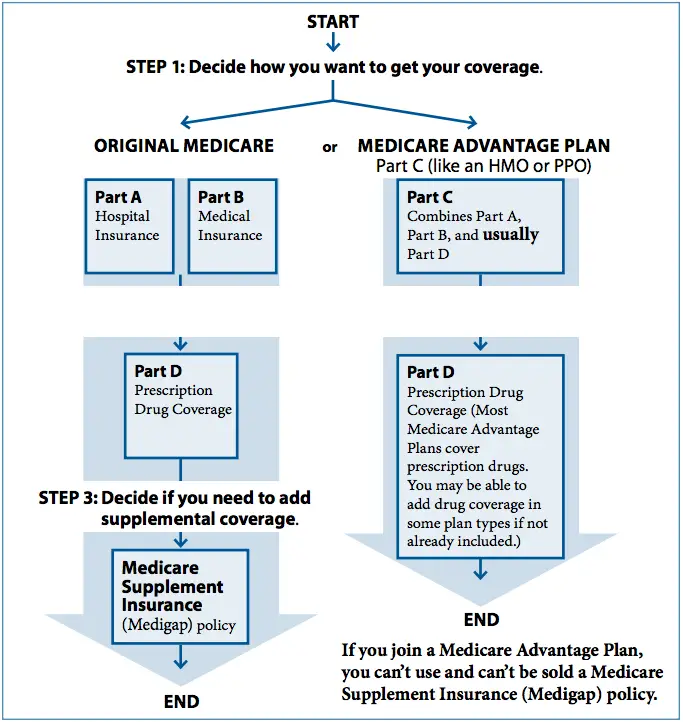

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctors services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

Don’t Miss: Does Medicare Pay For Home Nursing

How Much Does It Cost

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple. Your premium may also be different if youre enrolling in Medicare Part B for the first time, you do not get Social Security benefits, or you are billed directly for your premium.

Dont Miss: How Do I Qualify For Medicare Low Income Subsidy

Delaying Enrollment Could Result In A Permanent Penalty

As described above, you can’t reject premium-free Medicare Part A without also giving up your Social Security benefits. But since your work history is allowing you access to Medicare Part A without any premiums, few people consider rejecting Part A coverage.

The other parts of Medicare, however, do involve premiums that you have to pay in order to keep the coverage in force. That includes Medicare Part B and Part D , as well as supplemental Medigap plans. Medicare Part C, otherwise known as Medicare Advantage, wraps all of the coverage into one plan and includes premiums for Part B as well as the Medicare Advantage plan itself.

So it’s understandable that some Medicare-eligible people, who are healthy and not using much in the way of medical services, might not want to enroll in Part D and/or Part B. Similarly, people who are eligible for Part A but with premiums might want to avoid enrolling in order to save money on premiums. But before deciding to postpone enrollment in any part of Medicare, it’s important to understand the penalties and the enrollment limitations that will apply if you decide to enroll in the future.

There are penalties associated with delaying your Medicare enrollment unless the reason you’re delaying is that you are still working and you’re covered by the employer’s health plan. If that’s the case, you’ll be eligible for a special enrollment period to sign up for Medicare when you eventually retire.

You May Like: How Much Medicare Cost 2020

Is There Financial Help For Medicare Part D Coverage

Medicare offers Extra Help for Medicare enrollees who cant afford their Part D prescription drug coverage. If youre a single person earning less than $1,630 per month , with financial resources that dont exceed $14,790 , you may be eligible for Extra Help . The program will reduce or eliminate your Part D plans premium and deductible, and also lower the cost of prescription drugs to a very small amount.

Heres more information about Extra Help, including details about the type of notice you might receive from Medicare or Social Security, that you can then send to your Part D plan.

Defer Income To Avoid A Premium Surcharge

The standard premium for Medicare Part B is $148.50 per month in 2021 but that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2021 heres what youre looking at:

| 2021 Medicare Part B premium costs by income level | ||

|---|---|---|

| Income level: individual tax filer | Income level: joint tax filer | Total monthly premium |

| $750,000 and above | $504.90 |

If youre able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns. For example, your 2019 tax return will determine whether you pay a surcharge in 2021 .

Dont Miss: How Long Do You Have To Sign Up For Medicare

Don’t Miss: Do I Really Need A Medicare Advantage Plan

What Does Part A Cost

With Medicare Part A, you may have to pay copays and deductibles for hospital stays, but may not have to pay a monthly premium. Copays and deductibles apply to hospital benefit periods, which start when you enter a hospital or skilled nursing facility, and end 60 days after youve left the facility . Its important to note that:

- For each hospital benefit period, you pay a deductible.

- You pay a copay if youve stayed in a hospital for more than 60 days.

- Theres no deductible or copayment for home health care or hospice care.

For many people, Part A comes without a monthly premium. You may have no monthly premium if you paid a certain amount toward Medicare taxes while working. In this case, you are often automatically enrolled in premium-free Part A.

If you dont automatically get premium-free Part A, you may be able to buy it if you :

- Are age 65 or older and allowed to Part B to meet the citizenship and residency requirements.

- Are under age 65 and are disabled but no longer get premium-free Part A because you returned to work.

What Does Medicare Part B Cover

Part B provides coverage for a mixture of outpatient medical services. This includes coverage for preventive vaccines, cancer screenings, annual lab work, and much more.

It will cover preventive services in addition to specialist services. Part B even covers services for mental healthcare, durable medical equipment that your doctor finds medically necessary.

Also, Part B will cover some services you receive while in the hospital. This includes surgeries, diagnostic imaging, chemotherapy, and dialysis if you obtain drugs while at the hospital, it will also provide coverage for those.

Don’t Miss: Is Sonobello Covered By Medicare

How Does It Work

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

The tax is calculated off of whats called Medicare taxable wages, which uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings.

Your employer is required to collect the tax as a part of the IRS Employers Tax Guide , and it sends both the employee and employer version to the IRS through regular electronic deposits.

For example, an individual with an annual salary of $50,000 would have a 1.45% Medicare tax deducted from their paycheck. Thats about $60 each month. The employer would pay an additional $60 each month on their behalf, totaling $120 contributed to Medicare.

Those who are self-employed pay a Medicare tax as a part of the self-employment tax. Rather than being deducted from a paycheck, its paid through quarterly estimated tax payments.

The Medicare tax rate has remained unchanged since 1986. However, the Additional Medicare Tax for high-income earners was implemented in 2013 as a part of the Affordable Care Act.

What Services Does The Partnership Provide

- Medicare and Medicaid information and education

- Help with original Medicare eligibility, enrollment, benefits, complaints, rights and appeals

- Explain Medicare Supplemental insurance policy benefits and comparisons

- Explain Medicare Advantage and provide comparisons and help with enrollment and disenrollment

- Explain Medicare Prescription Drug coverage, help compare plans and search for other prescription help

- Information about long-term care insurance

The partnership also helps with the following programs. Benefit Counselors are specially trained to help you understand all the fine print to find and apply to a plan that works for you. They advocate for you with these programs and help you get the services you need.

Recommended Reading: What Is The Medicare Extra Help Program

How Far Back Does Social Security Check Your Bank Account

As we explain in this blog post, SSI can check your bank accounts anywhere from every one year to six years, or when you experience certain life-changing experiences. The 2022 maximum amount of available financial resources for SSI eligibility remains at $2,000 for individuals and $3,000 for couples.

Retiree Health Plan Part B Reimbursement Options

If youre retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

Don’t Miss: Does Medicare Pay For Any Weight Loss Programs

What To Do Next When You Become Eligible For Medicare

If you currently have a health plan through Covered California:

If you dont currently have a health plan through Covered California:

If youre currently enrolled in Medicare Part A, or eligible for premium-free Medicare Part A, you cant enroll in new coverage through Covered California. This is because Medicare Part A is considered minimum essential coverage under the Affordable Care Act. But depending on your income and assets, you may be eligible for additional coverage through Medi-Cal. Once youre enrolled in Medicare, you can contact your local county office or complete the Covered California application to see if you also qualify for Medi-Cal.

For Insurance Quotes By Phone Tty 711 Mon

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MedicareInsurance.com, DBA of Health Insurance Associates LLC, is privately owned and operated. MedicareInsurance.com is a non-government asset for people on Medicare, providing resources in easy to understand format. The government Medicare site is www.medicare.gov.

This website and its contents are for informational purposes only and should not be a substitute for experienced medical advice. We recommend consulting with your medical provider regarding diagnosis or treatment, including choices about changes to medication, treatments, diets, daily routines, or exercise.

This communications purpose is insurance solicitation. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program.

MULTIPLAN_GHHK5LLEN_2023

You May Like: What Eye Care Does Medicare Cover

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

Does Medicare Part B Cover 100 Percent

Generally speaking, Medicare reimbursement under Part B is 80% of allowable charges for a covered service after you meet your Part B deductible. Unlike Part A, you pay your Part B deductible just once each calendar year. After that, you generally pay 20% of the Medicare-approved amount for your care.

Don’t Miss: How Do I Pay My Medicare Bill

Who Pays The Medicare Tax

Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer. In certain limited situations, you may have to pay the Medicare tax on income earned outside of the United States . If Medicare taxes are withheld from your paycheck in error, you should contact your employer to ask for a refund.

Also Check: What Is The Best Medicare Advantage Plan In Arizona

When Are Medicare Premiums Due

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of billing timeline

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

You May Like: Where Do You Apply For Medicare

Is Medicare Free For Seniors

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Who Does Not Have To Pay A Premium For Medicare Part A

Medicare reimbursement refers to the payments that hospitals and physicians receive in return for services rendered to Medicare beneficiaries. The reimbursement rates for these services are set by Medicare, and are typically less than the amount billed or the amount that a private insurance company would pay.

If you’re like most Medicare enrollees, you probably aren’t planning to make any changes to your existing coverage for the coming year, but like most beneficiaries you should probably at least consider it during Medicare’s open enrollment period. And if you have Medicare Advantage, you also have an opportunity to change your coverage between January and March each year.

Enrollment dates for Medicare are critical. Missing an enrollment date could cost you higher premiums down the line or it could cost you coverage entirely.

Also Check: Can I Have Humana And Medicare

Is Medicare Free For The Disabled

Medicare is not always free for those who qualify through a disability. Enrollees who have a disability can get Medicare Part A for free without meeting the typical work requirement, and those who have a low income are also eligible for the discount programs to reduce or eliminate the cost of Medicare Part B and Part D.

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

You May Like: Is Insulin Pump Covered By Medicare