What Can I Do If A Medicare Advantage Plan Denies Coverage

If your Medicare Advantage plan denies coverage of a medical service that you think it should cover, you can file an appeal.

If youre not satisfied with how your plan treated you, you can file a complaint, called a grievance. Your state health insurance assistance program can help you.

- You still need to keep paying your Medicare Part B premium, along with any premium the plan may charge.

To compare Medicare Advantage plans with the click of a button, just click the Browse Plans button on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Skilled Nursing Facility Advanced Beneficiary Notice

This letter will notify you about an upcoming service or item at a skilled nursing facility that Medicare will not cover. In this case, Medicare has deemed the service not medically reasonable and necessary. The service might also be deemed custodial , which is not covered.

You may also receive this notice if youre close to meeting or exceeding your allowed days under Medicare Part A.

Use Caution When Ditching Your Advantage Plan For Original Medicare

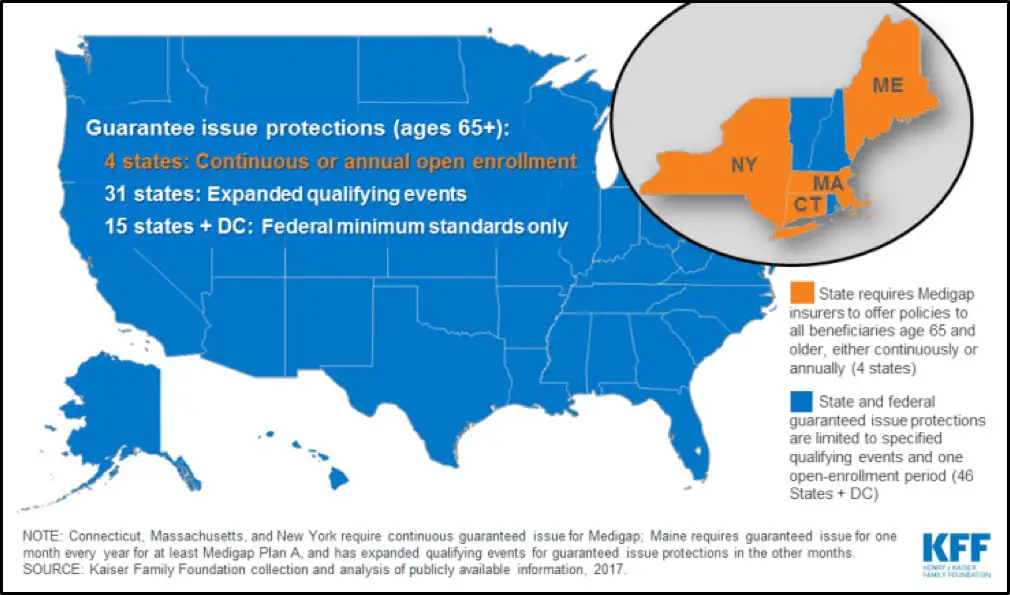

- When you first enroll in Medicare, you get six months when you are guaranteed coverage under a Medigap policy.

- After that, insurers can delay covering a pre-existing condition or deny coverage altogether unless you meet a special exception or live in a state whose rules are different.

- The current annual open enrollment period lasts through Dec. 7. You can make changes to your Medicare coverage until then, including going back on a switch you already made.

If you’re thinking about dropping your Advantage Plan during open enrollment and instead relying on original Medicare, proceed with caution.

Some retirees assume they’ll be able to pair it with a Medigap policy, which helps cover the cost of deductibles, copays and coinsurance. Unless you meet a special exception when you make the switch, however, there’s no guarantee you’ll be extended Medigap coverage immediately, if at all.

“We’re encountering a lot of surprise that Medigap rules allow insurers to exclude coverage for pre-existing conditions,” said Mary Johnson, Social Security and Medicare policy analyst for The Senior Citizens League. “There’s a misconception that the 2010 made it so people would be guaranteed coverage no matter what.

“That’s not true for Medigap, and it can trip people up.”

After that, it can be a different story. In most states, you’ll have to go through medical underwriting.

“They can impose waiting periods for pre-existing conditions, or deny coverage altogether,” she said.

You May Like: Does Medicare Cover Cataract Exams

Preexisting Condition Coverage With Medigap Plans

Medigap plans, also called Medicare Supplement Insurance, are policies sold by private companies that help pay for costs not covered by Original Medicare, such as deductibles, copays, and coinsurance. However, they arent quite as accommodating for people with preexisting conditions.

Enrolling in Part B triggers your 6-month Medigap open enrollment period. insurers can deny you coverage or charge you more for having preexisting conditions. Further, while Medigap insurance providers cant delay your Medigap coverage for a preexisting condition, they can delay covering costs associated with the preexisting condition for up to six months.

You can shorten or avoid preexisting condition waiting periods if youve had at least six months of continuous creditable coverage . However, you cant have had a break in coverage for more than 63 days.

S For Getting Medigap Coverage

In most states, follow these steps for getting Medigap coverage

At no charge, your state health insurance assistance program can help you choose a Medigap policy.

Also Check: Does Medicare Cover Cgm For Type 2 Diabetes

How Do I Register A Complaint Against A Doctor

Since the provinces and territories, rather than the federal government, are primarily responsible for the administration and delivery of health care services and the management of health human resources, you should contact your local provincial/territorial Ministry of Health – the phone numbers and websites are located inside the back cover of the current Canada Health Act Annual Report. You can also contact your province or territory’s College of Physicians and Surgeons, which is the organisation that governs physician licensing and conduct. Links to each provincial and territorial medical regulatory authority can be found on the College of Physicians and Surgeons of Canada website.

Canada Health Act Division

Do Medicare Advantage Plans Cover Pre

Medicare Advantage plans are an alternative to Original Medicare that allow you to receive your Part A and Part B benefits from a private health insurance company.

Most Medicare Advantage plans cover preexisting conditions, unless you have ESRD. If you have ESRD or another chronic condition, you may qualify for a Medicare Special Needs Plan , if one is available in your area.

Medicare Advantage plans can also include additional benefits, such as dental, vision and prescription drug coverage.

Your Medicare Advantage plan may also include out-of-pocket expenses such as copayments and deductibles. You cannot have a Medigap plan and a Medicare Advantage plan at the same time.

Also Check: How To Apply For Medicare By Phone

When Are The Medicare Enrollment Deadlines

For people who are receiving or eligible to receive Social Security benefits, Social Security will send you instructions for signing up three months before the month you turn 65. People who are receiving Social Security benefits will not be charged for Part A which covers hospital visits and services. Part A also covers hospice and skilled-nursing services as well as some home health care.

Part B is similar to traditional health insurance and comes with a base monthly premium that generally changes each year. Individuals who are considered high-income earners will pay more than the base rate depending on their annual income.

Folks who are living outside the United States or are traveling abroad should contact the closest Embassy or consulate to request enrollment forms.

The actual enrollment period for Original Medicare begins three months before you turn 65 and continues for an additional three months thereafter.

Do Medicare Supplement Plans Cover Preexisting Conditions

Medicare supplement plans are offered by private companies approved by Medicare. Medigap plans cover some of the costs not covered by original Medicare, such as deductibles, coinsurance, and copayments.

If you purchase a Medigap plan during your open enrollment period, even if you have a preexisting condition, you can get any Medigap policy sold in your state. You cannot be denied coverage and you will pay the same price as people without a preexisting condition.

Your open enrollment period for Medigapcoverage starts the month you are 65 and/or enrolled in Medicare Part B.

Recommended Reading: Does Medicare Pay For Physical Therapy After Knee Surgery

Level 5 Appeal: Federal District Court Civil Lawsuit

If you disagree with the MAC’s Level 4 decision and the amount in controversy is at least $1,350 , you may file a civil action in your local federal district court. The MAC’s Notice of Decision will give you information about filing a civil action. Your lawsuit must be filed within 60 days of receiving the unfavorable MAC Decision. As this is a formal court proceeding, you’ll need to hire a Medicare or Social Security lawyer before filing a lawsuit.

This is the last level of appeal available to you.

Medicare Doesn’t Cover Most Dental Care

Medicare doesnt provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500. You could also get coverage from a separate dental insurance policy or a dental discount plan. An alternative is to build up money in a health savings account before you enroll in Medicare you can use the money tax-free for medical, dental and other out-of-pocket costs at any age .

Don’t Miss: Does Medicare Have Silver Sneakers

Do I Need Private Health Care Coverage When Travelling Outside Canada

While travelling within Canada, the portability criterion of the Canada Health Act requires that insured hospital and physician services are covered at host-province/territory rates. When outside the country, coverage is required to be at home-province/territory rates. As a result, health care services received abroad may not be fully covered by a provincial or territorial health insurance plan. For that reason, it is highly recommended that you purchase private insurance before departing Canada, to ensure adequate coverage.

Before You Buy Medigap

Here are some things to keep in mind before you purchase your Medigap policy:

Recommended Reading: What Age Do You Apply For Medicare

When To Enroll In Medigap

Wondering when is the best time to enroll in Medigap? Heres a look at your Medigap enrollment options:

- Medigap open enrollment period: This six-month period starts automatically the month youre enrolled in Part B and are at least 65 years old. During this one-time enrollment period, you can buy any policy sold by a Medigap provider in your state for the same price as someone without preexisting or other health conditions. That said, you may have to wait up to six months for coverage associated with your preexisting conditions.

- After the Medigap open enrollment period: If you enroll after the six-month open enrollment period, you will be subject to medical underwriting by the Medigap policy provider. As a result, they can deny you coverage or charge you more based on your preexisting conditions.

- You have a guaranteed issue right: If you have a guaranteed issue right, such as if you move out of the service area for your Medicare Advantage plan, insurance companies cant refuse your application for a Medigap policy or charge you more for one. And they must cover your preexisting health conditions. These are also referred to as Medigap Protections.

- Before turning 65: If you arent yet 65, federal law doesnt require companies to sell you a Medigap policy. However, some state laws do. If youre able to buy a Medigap Plan before you turn 65 in your state, it may cost you more than if you wait.

Level 2 Appeal: Request For Reconsideration

If you are not satisfied with the Level 1 decision because it is not in your favor, you may file a Request for Reconsideration by a Qualified Independent Contractor . The QIC conducts a new and independent on-the-record review of your claim.

There is no minimum amount in controversy required for a Level 2 appeal. You must, however, file a written Request for Reconsideration within 180 days of receiving the Level 1 Redetermination Decision. You must send your Request for Reconsideration and any material you want the QIC to consider to the QIC location identified in the Level 1 Redetermination Decision.

Don’t Miss: Does Medicare Cover Aba Therapy

If You Have Certain Health Issues

You cant be denied or charged more for coverage if you apply during your Medigap open enrollment period. But after that six-month period ends, insurers are allowed to collect information about your health and use it to decide whether to accept or deny your application. Many companies will deny Medigap coverage for conditions such as chronic lung, kidney or heart conditions, AIDS, and cancer. Some companies may consider each case for how acute conditions such as diabetes are for the applicant before making their decision.

Even if an insurer offers you a policy after Medigap open enrollment ends, it may increase your rate due to health issues and attach waiting periods for coverage for preexisting conditions.

When Can I Get Medicare Coverage

In most cases, you can get Medicare when you turn 65 years old. An initial enrollment period will start three months before you turn 65 and will end three months after your birth month. During those seven months, you should sign up to avoid lifetime late enrollment penalties, especially if you dont have other health insurance coverage. If you miss your initial enrollment period, you may qualify for a special enrollment period, such as if you lose your health insurance. There is also a general enrollment period between Jan. 1 and March 31 each year, though you may face late enrollment penalties and a gap in coverage if you enroll then.

You May Like: Will Medicare Pay For Cialis

Can You Appeal If Medicare Refuses To Cover Care You Received

Absolutely. Sometimes Medicare will decide that a particular treatment or service is not covered and will deny a beneficiary’s claim. Many of these decisions are highly subjective and involve determining, for example, what is “medically and reasonably necessary” or what constitutes “custodial care.” If a beneficiary disagrees with a decision, there are reconsideration and appeals procedures within the Medicare program.

While the federal government makes the rules about Medicare, the day-to-day administration and operation of the Medicare program are handled by private insurance companies that have contracted with the government. In the case of Medicare Part A, these insurers are called “intermediaries,” and in the case of Medicare Part B they are referred to as “carriers.” In addition, the government contracts with committees of physicians — quality improvement organizations — to decide the appropriateness of care received by most Medicare beneficiaries who are inpatients in hospitals.

Local Elder Law Attorneys in Your City

City, State

For more about Medicare, .

My Part D Plan Denied Coverage Of My Drug How Do I Find Out Why I Was Denied Coverage

To find out why your prescription was not filled:

- You could ask the pharmacist for an explanation.

The pharmacist may or may not be able to explain the reason why you were denied coverage. Depending on the reason for the denial, you may be entitled to request an Exception to obtain your drug. If your Coverage Determination is denied, you have the right to Appeal the denial.

There are several reasons why your Medicare Part D plan might refuse to cover your drug. Use the links at the bottom of this page to find out what to do next.

- If the pharmacist does not give you a reason for the denial, or if you want an official denial so you can start the Appeal Process, you, or your representative or your doctor, should contact your Medicare Part D plan and request a “Coverage Determination.“

A “Coverage Determination” is your Medicare Part D plan’s official decision about the prescription drug benefits you are entitled to receive.

If you need assistance requesting a “Coverage Determination,” you can ask your prescribing doctor or someone you trust to request a “Coverage Determination” for you.

Don’t Miss: Can You Get Dental On Medicare

When Cant A Medicare Plan Deny Coverage

The services included in Medicare Advantage plans are usually covered without the risk of denial. There are also specific circumstances in which denial is explicitly prohibited.

Treatment under these Medicare plans cant be denied if:

- It was pre-approved

- There is no express justification given for denial

- Necessary care must be performed by an out-of-network provider when no in-network provider is available

- Necessary treatments are expressly included in a plan, even if they relate to pre-existing conditions

Apply During Your Medigap Open Enrollment Period

To qualify for a Medigap policy, you must first enroll in Original Medicare, which includes both Medicare Part A and Part B. Once youre enrolled in Part B and are at least 65 years old, your Medigap Open Enrollment Period begins.

Your Medigap Open Enrollment period starts on the first day of the month that you enroll in Part B and are at least 65, and it lasts for six months. During this six-month period, you cant be denied a Medicare Supplement plan from insurance companies, and they cant charge higher premium rates due to your health history or pre-existing medical conditions. That means that even those with existing health problems can purchase any Medigap policy that a particular insurance company sells where they live for the same price as people with good health, as long as it is purchased during their Medigap open enrollment period.

It is important to know that your OEP for Medicare supplemental insurance lasts for only six months, and it cant be repeated or changed. Once your Medigap OEP ends, you won’t get another one. There may be other times when you can have guaranteed issue rights, however, which. means you may be able to apply for a Medicare Supplement plan without being denied coverage even if you miss your Medigap OEP.

You May Like: Does Medicare Pay For Hearing Aids