Medicare Part B Eligibility Requirements

Medicare Part B is a health insurance option that becomes available for people in the United States once they reach age 65. However, there are some special circumstances under which you may qualify to enroll in Medicare Part B before the age of 65.

Below, you will find the eligibility requirements for enrolling in Medicare Part B.

Who Is Eligible For Part A

In order to receive premium-free Part A, you must of course be eligible for Part A generally. The eligibility for Part A is simple: if you are 65 or older, have been receiving disability benefits for 25 months or longer, and have ESRD or ALS , then you are eligible to receive Medicare Part A insurance.

Structure Your Income To Avoid A Premium Surcharge

The standard premium for Medicare Part B is $170.10 per month in 2022, and dropping to $164.90/month in 2023. But that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2022 heres what youll pay for Part B if your income falls into the level that triggers a surcharge:

| 2022 Medicare Part B premium costs by income level | ||

|---|---|---|

| Income level: individual tax filer | Income level: joint tax filer | Total monthly premium |

| $750,000 and above | $560.50 |

If youre able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns. For example, your 2022 tax return will determine whether you pay a surcharge in 2024 .

Read Also: What Is The Best Supplemental Insurance To Medicare

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

How Much Does Medicare Part B Cost

Unlike Part A, which is free for most Americans, Part B comes with a cost. The standard monthly premium for Medicare Part B is $164.90 for 2023, though this amount can change from year to year.

If you collect Social Security or Railroad Retirement Board benefits, your Medicare Part B premium can be automatically deducted from these benefits. If you donât collect these benefits, youâll get a bill for Part B every three months.

Read Also: What Is Medicare Chronic Care Management

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

You May Like: Do I Need Medicare If My Spouse Has Insurance

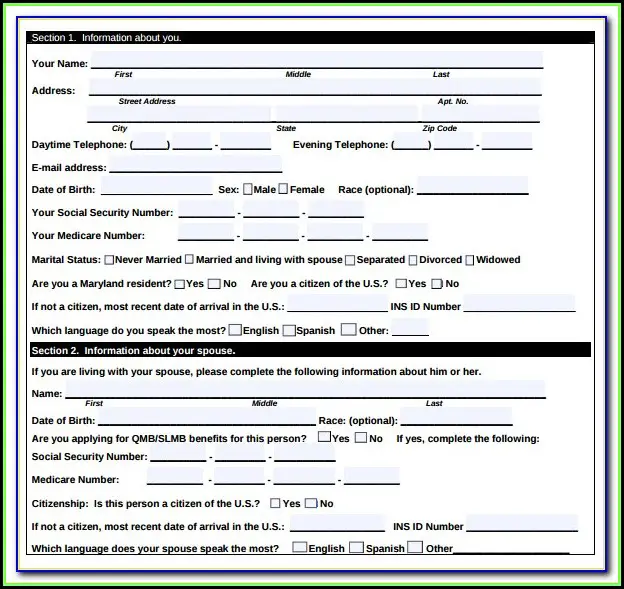

Applying To These Programs

These programs require you to file a separate application than your general Medicare application, usually with your local Department of Social Services. You will need to bring documentation that prove your income which can include your income tax returns, Social Security benefits information, or pay stubs.

Additionally, it can be helpful to bring any documentation that proves your financial assets, your car registration if applicable, your social security card, your spouses financial information, if applicable, and any medical bills that may be relevant. The employee that handles your case may request additional paperwork from you.

What Is Part A

Medicare Part A is often referred to as your hospital insurance. However, its more accurately described as inpatient insurance: it covers the health care you receive while you are an inpatient. This includes things like hospice care, skilled nursing facility care, and home care in some instances.

Part A is part of Original Medicare, which means that you may be enrolled in it automatically when you become eligible at age 65.

Read Also: How Do Medicare Insurance Brokers Get Paid

Does Medicare Cover The Costs Of Durable Medical Equipment

Medicare does cover durable medical equipment, which is equipment that serves a medical purpose, is able to withstand repeated use, and is appropriate for use in the home. Original Medicare normally pays 80% of the Medicare-approved amount after you meet your Part B deductible and you are responsible for a 20% coinsurance. Medicare only covers durable medical equipment if your provider says it is medically necessary for use in the home. You must also order the equipment from suppliers who contract with Original Medicare or your Medicare Advantage Plan. If you have a Medicare Advantage Plan, your plan will have its own cost and coverage rules for durable medical equipment. For a more comprehensive list of what is covered, please visit Durable Medical Equipment section in the Medicare and You handbook.

What Counts As An Asset

Medicare Savings Programs are only open to people who qualify based on income and asset requirements. So, what counts as an asset when it comes to qualifying?

- The house you live in

- One vehicle like a car, motor home or motorcycle

- Household items

- Burial funds up to $1,500 per person

There are four types of Medicare Savings Programs designed to help with paying costs for Original Medicare or Medicare Part B. They are distinguished by their income limits and what costs they help pay for. The programs include:

- Qualified Medicare Beneficiary Program

- This program helps to pay Part A and Part B premiums and copayments. It also helps to pay deductibles and coinsurance for both Part A and Part B.

- Asingle person can qualify for the program in 2022 with an income up to $1,153 per month.

- A couple can qualify with a combined income of $1,546 per month.

- The asset limits are $8,400 for an individual and $12,600 for a couple.

- Specified Low-Income Medicare Beneficiary Program

- This program helps to pay premiums for Part B.

- A single person can qualify in 2022 with an income up to $1,379 per month.

- A couple can qualify with a combined income of $1,851 per month.

- The asset limits are $8,400 for an individual and $12,600 for a couple.

It is important to note that income limits to qualify for these programs are slightly different in Alaska and Hawaii. To learn more about the income limits in those states, see details on the Social Security Administration website.

Recommended Reading: Is New Shingles Vaccine Covered By Medicare

Why Did Medicare Part B Go Up So Much For 2022

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

How Do I Qualify For The Part B Premium Giveback Benefit

You may qualify for a premium reduction if you:

- Are enrolled in Medicare Part A and Part B

- Do not already receive government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Read Also: Does Medicare Cover Laser Surgery

What Is The Cost Of Medicare Part B For 2022

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount .

Am I Eligible For Medicare Part B

âMedicare isnât just available for everyone,â says Donovan. Specifically, youâre eligible for Medicare Part B if:

- Youâre 65 or older

- You have certain disabilities

- You have end-stage renal disease

If youâre eligible to receive Social Security Disability Insurance benefits, youâll be eligible to join Medicare after a 24-month waiting period, and youâll be enrolled automatically.

If you have amyotrophic lateral sclerosis , also known as Lou Gehrigâs disease, youâll be automatically signed up for Medicare when your Social Security disability benefits start.

You May Like: How Does Medicare Differ From Medicaid

What Is The Difference Between Extra Help And The Medicare Savings Program

When investigating affordable Medicare options, you’ve likely come across the names Extra Help and Medicare Savings Progam.

Though Extra Help is a great resource, it is only going to help with Medicare Part D prescription drug costs.

If you’re looking for help with your Original Medicare-related costs, look for a Medicare Savings Program. There are four kinds:

- Qualified Medicare Beneficiary program

- Specified Low-income Medicare Beneficiary program

- Qualifying Individual program

- Qualified Disabled and Working Individuals program

Bonus Tip: If you qualify for the QMB program, SLMB program, or QI program, you automatically qualify for Extra Help to assist with your Medicare prescription drug coverage costs.

How Does Social Security Fit In

When you read about Medicare enrollment, you will often see Social Security mentioned. The reason for this is that your Social Security benefits can work in tandem with your Part A and Part B coverage.

Basically, if you already receive Social Security or Railroad Retirement Board benefits, then youll be able to enroll automatically and have your monthly premiums if you have any, taken out of your benefits check automatically.

Don’t Miss: How Do I Sign Up For Medicare Part C

What Medicare Part B Will Pay For

For the most part, Medicare Part B will only help pay for the above services in certain situations. Medicares general rule is that it will only pay for things that it finds medically necessary.

Medicares general rule is that it will only pay for things that it finds medically necessary.Part B may only pay for some things if you have certain risk factors, or it might only help pay for a certain number of things in a given time period . Other services are offered every year.

The equipment and supplies must be bought through a certified Medicare supplier.

Some services are only covered in very specific situations. For example, Medicare Part B will pay for eyeglasses only if you need them after a specific type of cataract surgery.

How To Save On Medicare Costs

Even though you may not be able to get Medicare for free, there are some steps you can take to avoid paying more than you need to.

- Make sure you’re getting all of the discounts you’re eligible for

- Avoid late-enrollment penalties when enrolling in Medicare

- Look for Medicare Advantage plans with rewards programs for healthy activities

- See if there are local plans with the Medicare giveback program to reduce how much you pay for Part B

- Work with a financial advisor to limit the high-income Medicare surcharge

An estimated 30% to 45% of those who are eligible for low-income discount programs are not enrolled, showing how important it is to check your eligibility for each savings program.

Read Also: How Can I Become A Medicare Provider

Does My Medicare Cover Dental

Medicare doesnt cover most dental care, dental procedures, or supplies, like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices. Part A can pay for inpatient hospital care if you need to have emergency or complicated dental procedures, even though it doesnt cover dental care.

As Long As You Or Your Spouse Paid The Medicare Tax For At Least 10 Years You Qualify For Premium

When it comes to Original Medicare , most people end up paying relatively little in monthly premiums. One of the main reasons for this is that Medicare Part A health insurance is offered to most beneficiaries with no premiums at all.

The way that this works can be a bit complex, and most people never have to deal with it: they automatically receive medical insurance and never pay a premium. However, understanding who qualifies for this premium-free version of Part A, as well as what exactly it entails, is essential if youre going to be enrolling in Medicare soon.

Well run through the full set of details regarding how premium-free Part A works, including some misconceptions about what you will pay as well as exactly what you need to know to find out if you qualify.

Don’t Miss: How Old To Collect Medicare

Four Ways To Save Money On Your Medicare Part B Premiums

Delaying enrollment in Medicare when you’re eligible for it could result in a penalty that will remain in effect for the rest of your life.

If you were penalized for delayed Medicare Part B enrollment, you may have the penalty waived if you were advised to delay Part B, and now find you were given bad advice. Asking for the correction is known as requesting equitable relief.

Learn about Medicare Part A coverage of inpatient medical care from hospital beds to skilled nursing facilities and hospice care.

How Long Can You Stay In A Nursing Home With Medicare

Medicare covers up to 100 days of care in a skilled nursing facility each benefit period. If you need more than 100 days of SNF care in a benefit period, you will need to pay out of pocket. If your care is ending because you are running out of days, the facility is not required to provide written notice.

Read Also: Does Medicare Cover Home Health Care After Surgery

Also Check: What Is The Annual Deductible For Medicare Part A

What Is Covered By Medicare Part B

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

The medically necessary coverage encompasses a variety of tests, procedures, and care options. A medical service or supply must be a requirement for treating or diagnosing a medical condition for Medicare to consider them medically necessary. Each situation is different, so a medical supply or medically necessary service for one person may not be for another.

It is easy to keep up with your general health needs through Medicares outpatient insurance by utilizing annual wellness visits.

Medicare Part B covers the following preventive care services:

- Mental Health Counseling

You can receive many preventive services and more at your annual wellness visit.

Alongside preventive care services, Medicare Part B covers certain outpatient services you receive in the hospital. These include:

If you are given drugs while at the hospital, Medicare Part B will also provide coverage for these services.

Help Paying Medicare Prescription Drug Premiums

You may be able to get help with Medicare premiums for your prescription drug coverage through the Part D Low-Income Subsidy program, also called Extra Help. You are automatically eligible for LIS if you qualify for the QMB, SLMB, or QI program. You will most likely receive 100% assistance in paying your Part D premiums if you qualify for Extra Help, according to My Medicare Matters. The LIS program offers three levels of help based on your income and resources. The fewer income and resources you have, the more assistance you can get. You may qualify if your income and resources are equal to or less than these limits.

Recommended Reading: What Is Statement Of Understanding Medicare