What Does Medicare Plan F Cover

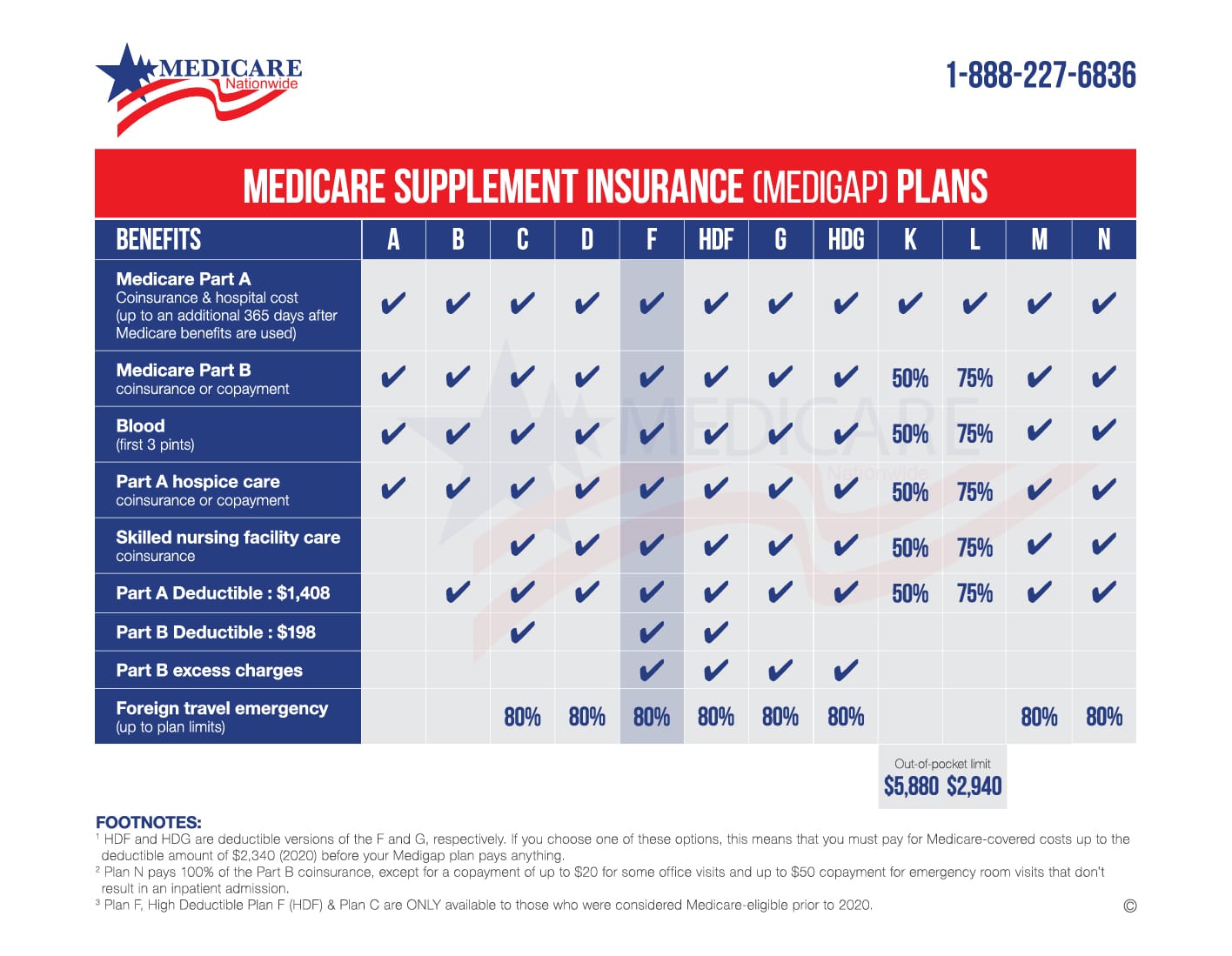

Youll need to investigate the different Medigap plans to determine the right one for you. The comparison chart below will help.

Medicare Plan F provides the same healthcare coverage from state to state. In general, you can use it to cover the copayment for all medical costs and even the Medicare Part B deductible.

Another benefit covered by Plan F is Medicare Part B Excess ChargesA Medicare Part B excess charge is the difference between a health care providers actual charge and Medicares approved amount for payment….. These occur when your doctor or specialist does not accept the standard Medicare payment for a service. Medicare allows healthcare providers that do not accept Medicare assignmentAn agreement by your doctor to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance…. to charge up to 15 percent more. Without Plan F, you will pay these costs out-of-pocket.

Plan F also covers your big costs if you are admitted as an inpatient in the hospital or a skilled nursing facility. Your Medicare benefits cover these costs under Part A, but most people are taken by surprise when they see the per-benefit-period deductible. Plan F is one of these insurance plans that protect enrollees from these high out-of-pocket expenses.

Heres a side-by-side Medigap comparison chart:

How Does Medicare Plan F Work

The main thing you need to know about how this and all other Medicare Supplement plans work is that you have to be enrolled in Original Medicare, or Medicare Parts A and B, before Part F kicks in and starts filling your Medicare payment gaps.

Once thats out of the way, though, and once youre enrolled in Part or Plan F, Medicare pays its share of your approved healthcare costs like it always does and then your MedSup policy follows up by paying its share.

Which Is Better Medicare Supplement Plan G Vs Plan N

When you compare Plan G vs Plan N, youll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

So, if you prefer to pay out less as you use the benefits, then Plan G may be better since you wont have any copays when visiting the doctor or hospital. If you prefer to have a lower premium and pay more out-of-pocket over time, then the Plan N benefits may be better for you.

According to the American Association for Medicare Supplement Insurance, in 2021, almost 55% of 65-year-old applicants chose Plan G and 36.5% chose in Plan N.

Don’t Miss: How To Apply For Medicare Card Replacement

Is Medicare Plan F Going Away What You Need To Know

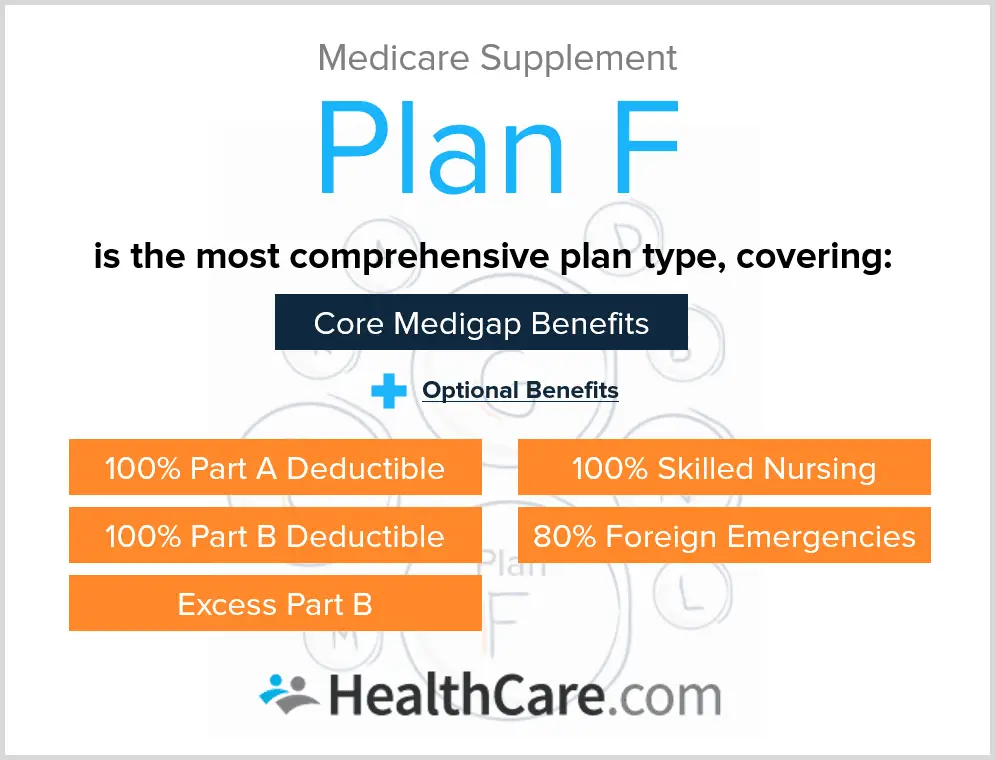

Medicare Plan F is the most comprehensive Medicare Supplement plan, but starting in 2020 the plan will not be available to everyone enrolled in Original Medicare.

Everyday Health may earn a portion of revenue from purchases of featured products.Shutterstock

Comparing Medicare Supplement plans to find the right fit for you? If youre enrolled in Original Medicare Part A and Part B, you might have considered purchasing the common Medicare Supplement insurance plan, Medicare Plan F.

According to AARP, Medicare Supplement Plan F provides the most coverage, and as a result, its the most popular plan among those eligible for Medicare. But with recent changes, Plan F is no longer available to everyone as of January 1, 2020.

Is Medicare Supplement Plan F Being Discontinued

If youre shopping for Medigap plans, you may have asked the question, Is Medicare Plan F going away ? No, Medicare Supplement Plan F has not been discontinued, but the eligibility rules have changed. Because of this, eligibility for Plan F is based on when you were first eligible for Medicare, not when you try to purchase a plan. If you were eligible for Medicare on or before Jan. 1, 2020, you can still purchase Plan F and other Medigap plans that cover the Part B deductible.

Don’t Miss: Can You Get Medicare If You Live Outside The Us

Who Is Still Eligible For Medicare Plan F

Those who were eligible for Medicare on or before January 1, 2020 can still sign up for Medicare Plan F. People who already had or were covered by Medicare Plan F before January 1, 2020 are also able to keep their plan.

Eligible seniors can purchase Medicare Plan F from private health insurance companies, such as Aetna, UnitedHealthcare and Kaiser Permanente, says Price.

Does Plan F Cover Dental

Original Medicare doesnt cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you want dental coverage, you need to purchase a separate dental insurance plan. Also, many Medicare Advantage plans, which private insurance companies offer, provide dental coverage, so thats another option.

Also Check: What Does Medicare Do For You

What Does Medicare Supplement Plan F Cover

Medicare Supplement Plan F is one of the most popular Medicare Supplement Insurance plans because it offers the most comprehensive coverage of the currently available Medicare Supplement insurance plans.

Medicare Supplement Plan F covers the most amount of benefits compared to the other Medicare Gap plans. Plan F covers the gap in coverage associated with Parts A and B. This plan enables someone to be able to visit a doctors office or hospital to receive approved treatment and walk out without paying anything, virtually eliminating all out of pocket costs.

Plan F also includes coverage for other Medicare-approved expenses not associated with Parts A or B. This includes foreign travel emergencies and skilled nursing facility coinsurance. Importantly, Plan F is one of only two plans that include coverage for Medicare Part B excess charges.

When Can I Get Medicare Supplement Plan F

As long as the Part A start date on your Medicare card is before January 1st, 2020, youre eligible to apply for Medicare Supplement Plan F. However, if you currently have a Medicare Advantage plan, you may have to wait for an enrollment period. Unlike Medicare Supplement plans, which you can change at any time during the year, youll most likely have to wait for the Annual Enrollment Period or the Medicare Advantage Open Enrollment Period .

Also Check: How Does Medicare Work For Nursing Homes

Which Is Better: Medicare Plan F Vs Plan G

No Medicare Supplement plan is better than another. It really depends on your needs and budget. However, as of December 31, 2019, Plan F is no longer available for new Medicare enrollees. Here are two things to consider as you evaluate keeping your Medicare Plan F.

Best For Cost And Overall Price Transparency: Aetna

Aetna

-

Highest household discounts

-

Also offers dental, vision, and Part D drug plans

-

Rates available online

-

Cannot enroll online

-

Rates increase based on age

Founded in 1853 as a life insurance company, Aetna entered the healthcare market in 1899. Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 35 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, New York, Washington, Washington D.C., and Wisconsin.

High-Deductible Plan F is also available in 35 states: Alabama, Arizona, Arkansas, California, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, and Wyoming.

Enrolling in Medicare Supplement Plan F is easy, and if you also need to plan for the prescription drug plan, it offers many that rate four stars or higher on the Medicare 5-Star Rating System. To enroll, you must reach out to a representative by phone. Its rate for Plan F was the lowest we found, starting at $142 per month for a 66-year-old man. Rates may vary based on age, preexisting medical conditions, and where you live.

You May Like: What Are Medicare Requirements For Bariatric Surgery

Should I Join Plan F Before It Goes Away

Should you sign up for Plan F or one of the other popular plans like Plan G or Plan N? Medigap Plan G and N are staying, so are they the better option?

These are great questions.

Its always in your best interest to compare multiple plans from multiple companies to see which one is best for your financial situation and goals. Get Medigap quotes from these other plans and get help from an independent agent like REMEDIGAP. We help compare these plans for you and educate you on the pros and cons of each.

We frequently find that Plan N and Plan G turn out to be a better value for most of our clients. Why? The monthly premium savings that you receive is usually greater than the Part B deductible you pay every year. Plan G just makes sense financially.

Get Help From A Medicare Specialist

Medigap plans are nuanced when it comes to pricing. For example, not everyone understands that there is only one Medigap Enrollment Period in your lifetime, not an annual one like other Medicare plans. Signing up late can cause your rates to go up based on preexisting conditions. Your local State Health Insurance Assistance Program or State Insurance Department can help you with issues like this. You can also ask your broker for details.

Also Check: How Much Does Medicare Pay For Urgent Care Visit

Deductible Amount For Medigap High Deductible Options F G & J For Calendar Year 2022

Summary:

Medicare supplemental Plans F and G can be sold with a high deductible option. Before June 1, 2010, Medigap Plan J could also be sold with a high deductible. The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses that a beneficiary must pay before these policies begin paying benefits. CMS updates the deductible amount for plans G, F and J each year, after release of the August Consumer Price Index for all Urban Consumers figures by the Bureau of Labor Statistics, which generally occurs in mid-September.

Calculation of the Deductible:

For Further Information:

Contact: Martha Wagley at 410-786-3778 for actuarial issues or Derrick Claggett at 786-2113 for policy related issues.

Whats Going On With Medicare Supplement Plan F

As of January 1, 2020, people newly eligible for Medicare wont be able to buy Medicare Supplement Plan F. As part of the Medicare Access and CHIP Re-authorization Act of 2015, you may not be able to buy a Medicare Supplement insurance plan that may cover the Part B deductible if you became eligible for Medicare January 1, 2020 or later. This includes Medicare Supplement Plan C, Medicare Supplement Plan F, and the Medicare Supplement High Deductible Plan F. The standard Medicare Part B annual deductible is $203 in 2021.

If you bought a Medicare Supplement Plan F before January 2020, you can generally keep your coverage. Existing Medicare Supplement Plan F policies cannot be cancelled by an insurance company unless you fail to pay your premiums, you gave false information on your application, or the insurance company goes bankrupt.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Recommended Reading: Is Allergy Testing Covered By Medicare

Why You Need A Medigap Plan F Policy

Most people know a little about Medicare Part A and B, often called Original Medicare, but not much about the other options available to them. Medicare Supplement Plan F is also referred to as Medigap Plan F. It is a supplemental policy that you can buy from a private insurance company. It is only available to Original Medicare beneficiaries who want the additional insurance coverage needed to help pay for their share of the costs.

Original Medicare pays for about 80 percent of your major medical costs. A Medigap plan can be used to cover various parts of your 20 percent share . Medicare Supplement Plan F covers all the gaps in Original Medicare.

NOTE: The correct terminology is Medicare Supplement Plan F, not Part F. Here is an easy way to remember. Only Medicare uses Parts . Private insurance companies sell Plans.

How Much Does High

Plan F also offers a high-deductible option. With this Medigap plan option, you typically pay a lower premium in exchange for a higher deductible.

The average premium for high deductible Plan F in 2018 was $57.16 per month, or roughly one-third of the average monthly cost of the traditional Plan F.2

In 2022, high-deductible Plan F offers an annual deductible of $2,940, meaning you are responsible for paying the first $2,940 worth of covered expenses before the plans coverage begins.

Read Also: How Do I Pay Medicare Premiums

Best For Discounts: Blue Cross Blue Shield

Blue Cross Blue Shield

-

Also offers dental, hearing, vision, and Part D plans

-

Few states with High-Deductible Plan F

-

Rates increase based on age

Founded in 1929, Blue Cross Blue Shield was the first insurance company to manage Medicare claims in 1966. BCBS is the umbrella company for Anthem, CareFirst, Highmark, and The Regence Group. Altogether, BCBS offers Plan F in 43 states, excluding Alabama, Arkansas, Hawaii, Massachusetts, Minnesota, North Carolina, and Wisconsin. High-Deductible Plan F is available in 14 states: Alaska, Delaware, Illinois, Maryland, Michigan, Montana, New Mexico, New York, North Dakota, Oklahoma, Pennsylvania, South Carolina, Texas, and West Virginia.

Because several independent companies work under the BCBS name, there is no go-to contact number to call to enroll in Medicare Supplement Plan F. When you enter your ZIP code on its website, BCBS directs you to the appropriate company in your state.

What makes BCBS stand out is its breadth of insurance options. Not only does it offer Plan F, but it also offers dental, hearing, and vision coverage, in addition to 4- to 5-Star Medicare Part D prescription drug plans that can maximize your coverage options under Original Medicare. Like most companies, its pricing for Medigap is based on an attained-age model in which rates increase based on your age.

Will Plan F Rates Go Up In 2022

Each year, Medigap plans are subject to rate increases. The pricing method used partially determines this, as well as your age when you enroll.

When choosing a plan, researching rate increase histories is beneficial. On average over the past five years, Plan F rate increases have been between 3% and 6%.

Ask your agent what the rate increase history is for the carriers with which you are considering enrollment. Youll want to research carrier reviews before making a choice.

Don’t Miss: Who Must Enroll In Medicare

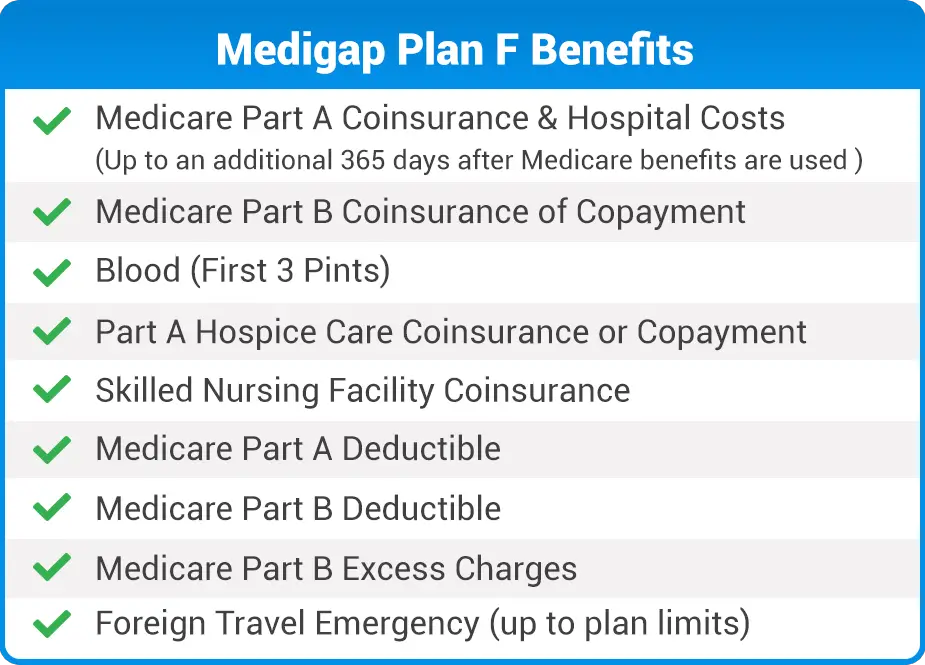

What Benefits Are Covered Under Medicare Supplement Plan F

Plan F basic benefits, like other Medigap plans, are standardized in most states. This means that regardless of where you live or which insurance company you purchase from, youll get the exact same basic benefits for a Plan F sold anywhere in your state . However, keep in mind that even though basic benefits are the same, premiums may vary.

Below is a list of costs and benefits covered by Medicare Supplement Plan F:

- Part A hospital and coinsurance costs up to an additional 356 days after Medicare benefits are exhausted

- Medicare Part A hospice care copayment or coinsurance

- Medicare Part B coinsurance

- Medicare Part B excess charges

- Medicare Part A deductible

- First three pints of blood used in an approved medical procedure

- Skilled nursing facility coinsurance

- Foreign travel emergency coverage

Even though Medicare Supplement Plan F offers the broadest coverage of any of the 10 standard Medigap plans available in most states, it doesnt cover all of the costs you may have in Original Medicare. For example, youll still need to keep paying your Medicare Part B premium payments each month. If you havent worked enough quarters to qualify for premium-free Medicare Part A , you may owe a premium for Part A as well. Medicare Supplement Plan F doesnt cover these out-of-pocket costs.

What Is The Average Cost Of Medigap Plan F By State

The chart below shows the average cost of Medicare Supplement Insurance Plan F for each state in 2018.2

Plan F was less expensive in Iowa, New Mexico and South Carolina in 2018, and more expensive in New York, Connecticut and North Dakota. Massachusetts, Minnesota, and Wisconsin have different Medigap plan standards.

| State | |

|---|---|

| $165.58 | 18 |

Note: Plan cost data was not available for Massachusetts, Minnesota, Rhode Island, Vermont, Wisconsin and Washington D.C.

You May Like: Does Medicare Cover Hepatitis A Vaccine