Medicare Part B Premium Increase Based On Income : Joint Tax Return

-

$176,000 or less = Increased by $21.60

-

Above $176,000 and up to $222,000 = Increased by $30.20

-

Above $222,000 and up to $276,000 = Increased by $43.20

-

Above $276,000 and up to $330,000 = Increased by $56.20

-

Above $330,000 and less than $750,000 = Increased by $69.10

-

$750,000 and above = Increased by $73.40

Defer Income To Avoid A Premium Surcharge

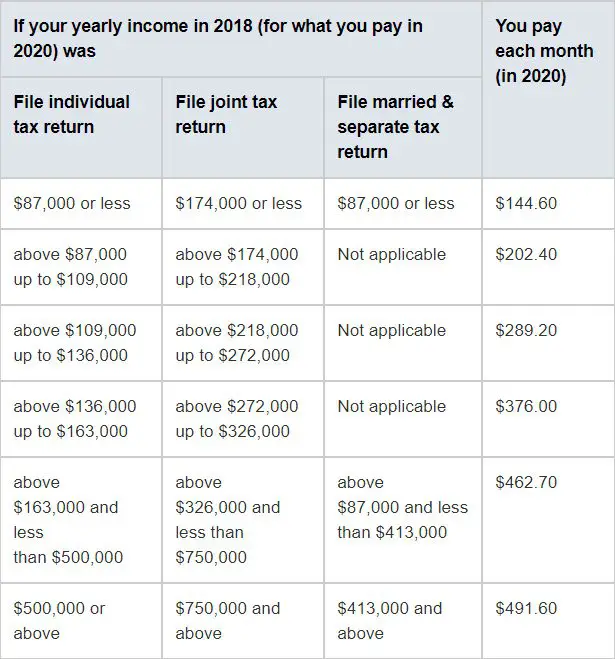

The standard premium for Medicare Part B is $148.50 per month in 2021 but that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2021 heres what youre looking at:

| 2021 Medicare Part B premium costs by income level | ||

|---|---|---|

| Income level: individual tax filer | Income level: joint tax filer | Total monthly premium |

| $750,000 and above | $504.90 |

If youre able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns. For example, your 2019 tax return will determine whether you pay a surcharge in 2021 .

How Your Income May Affect Your Medicare Costs

The federal Medicare program has costs that come with it. There may be premiums, copayments, coinsurance, and deductibles associated with Medicare Part A, Part B, and the optional Part D . If your income is below certain limits, you might qualify for programs that reduce your Medicare costs. On the other hand, if your income is higher than a certain level, you might have to pay a higher Medicare Part B premium and a higher Medicare Part D premium .

Medicare Part A and Medicare Part B make up Original Medicare. If youre automatically enrolled in Medicare, as many Americans are when they turn 65, Original Medicare is the type of insurance you get. You can add to this insurance by enrolling in prescription drug coverage through Medicare Part D and/or buying a Medicare Supplement plan to help with Original Medicare costs or you can get your Medicare coverage through a Medicare Advantage plan.

Don’t Miss: How To Apply For Medicare By Phone

Your Medicare Premium Is Based On Your Tax Return From Two Years Ago

When you decide to sign up for Medicare, the Social Security Administration needs to look at your federal tax return to figure out your MAGI. The way it works is that Social Security routinely checks your federal return from two years ago.

And thats why every 63-year-old needs to get up to speed on things. The federal tax return you file at age 63 is going to determine your Medicare Part B premium at age 65.

This two-year look back happens every year. So when you are 70, your Medicare Part B will be based on the tax return you filed when you were 68. At 75, its going to be based on your age 73 tax return. Etc.

What Does Medicare Part B Cover

If youre enrolled in Medicare Part B, you receive coverage for both medically necessary services and preventive services.

This includes some of the more expensive services you might experience during a hospital stay, such as surgery, radiation, diagnostic imaging, chemotherapy, and dialysis, among others.

Part B covers preventive medical services like ambulance rides, doctor visits, screenings, and diagnostic tests. It also covers a number of preventive care measures such as flu shots, colonoscopies, and mammograms.

Don’t Miss: Who To Talk To About Medicare

How Much Are Part B Irmaa Premiums

If an individual makes $91,000 or more or a jointly filing household makes $182,000 or more then the IRMAA assessment increases the 2022 Part B premium to the amounts shows in Table 1.

| Table 1. Part B 2022 IRMAA |

|---|

| Individual |

Source: CMS

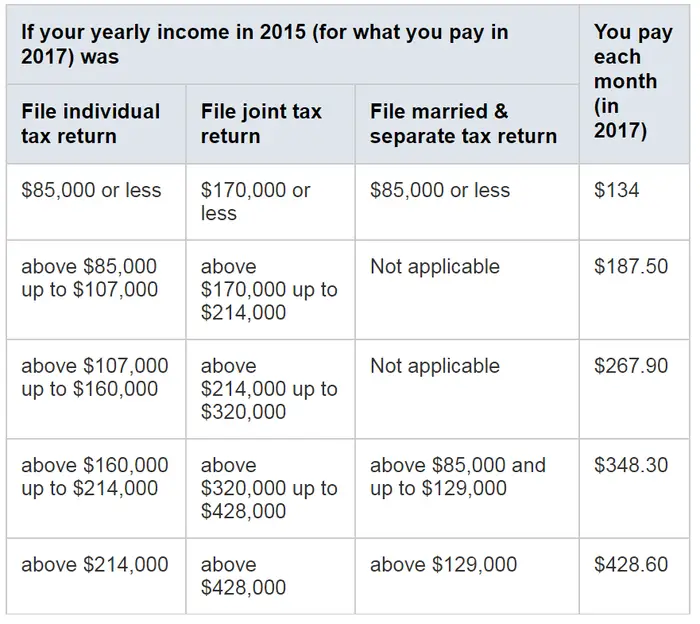

This level has risen from 2019, when the income requirements were $85,000 and $170,000 respectively. 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation .

What Is The Part B Premium Amount For 2022

The standard monthly Part B premium for 2022 is $170.10. This amount has increased by $21.60 from the standard monthly Part B premium for 2021, which was $148.50.

The standard monthly Part B premium amount applies to all enrollees whose annual income does not exceed $91,000 or $182,000 if married and filing jointly.

To determine which income bracket you fall in, Medicare uses the modified adjusted gross income from your 2020 tax return. Most Medicare beneficiaries pay the standard Part B premium amount, but if your annual income exceeds $91,000, then you will pay a higher monthly Part B premium amount.

The Part B premium amounts for higher income brackets are listed below.

You May Like: Does Medicare Cover Breast Prosthesis

What Does Medicaid Cover

- If you have Medicare and full Medicaid coverage, most of your health care costs are covered. You can get your Medicare coverage through Original Medicare or a Medicare Advantage Plan.

- If you have Medicare and/or full Medicaid coverage, Medicare covers your Part D prescription drugs. Medicaid may still cover some drugs that Medicare doesnt cover.

- People with Medicaid may get coverage for services that Medicare doesnt cover or only partially covers, like nursing home care, personal care, transportation to medical services, home- and community-based services, anddental, vision, and hearing services.

PACE is a Medicare and Medicaid program offered in many states that allows people who otherwise need a nursing home-level of care to remain in the community. To qualify for PACE, you must meet these conditions:

- Youre 55 or older.

- You live in the service area of a PACE organization.

- Youre certified by your state as needing a nursing home-level of care.

- At the time you join, youre able to live safely in the community with the help of PACE services.

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

Read Also: What Do The Different Parts Of Medicare Cover

What Does Modified Adjusted Gross Income Include

According to Investopedia, your modified adjusted gross income is “your household’s adjusted gross income with any tax-exempt interest income and certain deductions added back.”

Your adjusted gross income equals your gross income minus allowable deductions, such as health savings account contributions, retirement plan and IRA contributions, and student loan interest. To find your MAGI, you add back some of those deductions. This includes:

- Deductions you claimed for taxable Social Security payments and IRA contributions

- Interest earned on EE saving bonds that went toward higher education costs

- Passive income or losses

Understanding Medicare Part B Premiums

Medicare is a U.S. federal health insurance program that is funded by a wage tax. That is the amount labeled as FICA, for Federal Insurance Contributions Tax, on a standard paycheck.

Medicare Part A, which is free to most of those who are eligible for coverage, covers hospital-related costs as well as costs for treatment at skilled nursing facilities, hospice care, and home health care, It can consist of hospital stays, hospice care, and care at skilled nursing facilities.

There is an annual deductible for Part A. You’ll pay a maximum of $1,484 out of pocket in 2021 and $1,556 in 2022. There is no coinsurance payment unless a hospital stay exceeds 60 days.

Part B is insurance for outpatient medical care such as doctor visits, preventative services, ambulance services, mental health costs, and the cost of durable medical equipment.

The standard monthly fee for Part B is $148.50 in 2021 and $170.10 in 2022. It is higher for Medicare recipients who have higher incomes.

The annual deductible for Part B is $233 for 2021 and $233 in 2022. In addition, the patient pays 20% of the bill as a coinsurance payment.

| Medicare Part B Costs for 2021 |

|---|

| Individuals |

Recommended Reading: Does Medicare Pay For Vascepa

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

The Social Security Administration notifies a beneficiary of his or her Part B insurance premium and any IRMAA with the beneficiarys annual notice of Social Security benefits . SSA is responsible for issuing all initial and reconsideration determinations. It is important to remember that IRMAAs apply for only one year. A beneficiary will be notified by SSA near the end of the current year if he or she has to pay an IRMAA for the upcoming year.

Medicare Premiums And Surcharges Examples

Below are three examples of how Medicare premiums and surcharges are computed. Understanding the calculations will help clients appreciate and understand the strategies to lessen the impact.

Example 1

B is single. He usually reports MAGI of about $75,000 per year. He is enrolled in a Medicare Part D plan. In 2017, when his other income included in MAGI is $77,500, he is considering withdrawing an additional $32,500 from his traditional IRA to purchase a car for cash, for a total MAGI of $110,000. How much more will B need to pay in 2019 for Medicare premiums?

If he makes the withdrawal, B will need to pay total Medicare costs of $3,633.60 in 2019, or $2,007.60 in excess of the base premium cost, if his MAGI is increased by the $32,500 . The excess premium will be incurred only for 2019, provided his MAGI in 2018 dropped back below $85,000. The excess premiums represent an increase in household expenses as a percentage of his 2017 income of 1.83% or 2.59% of his normal income level. In this case, B may want to try to keep his income below the $85,000 surcharge threshold by financing his purchase or leasing the car. He could withdraw enough from his IRA to service the debt and still stay below the threshold.

Example 2 concerns a couple who have not signed up for a Part D plan however, they must still pay Part D surcharges, since a former employer has enrolled them and is paying the basic cost as a fringe benefit.

Effect on premiums of an additional IRA withdrawal

Example 2

Don’t Miss: Is It Too Late To Change Medicare Advantage Plans

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or you may contact your local Social Security office to file your appeal. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services at 1-800-MEDICARE to make a correction. Social Security receives the information about your prescription drug coverage from CMS.

The Medicare Magi Used For Calculating If You Owe Irmaa

Throughout our maddening tax code there are instances where the rules are based on MAGI. There are different MAGI formulas for different programs. For purposes of figuring out your Medicare Part B premium, MAGI is your adjusted gross income plus any tax exempt bond interest . Add the two together and thats your MAGI that will be used to determine if you will owe any IRMAA.

Don’t Miss: How Can I Get My Medicare Card Number

Help With Medicare Part D Costs

If you have a low income, you might qualify for help paying your Medicare Part D costs through Medicares Extra Help program. If you qualify, youll generally pay a maximum of $2.95 per generic drug prescription and $7.40 per brand-name drug prescription. These are 2016 amounts, and they apply only to medications that your Medicare Prescription Drug Plan covers.

If you qualify for certain Medicare Savings Plans described above , youre automatically eligible for Extra Help.

How To Manage Your Magi To Keep Your Part B Premium Lower

- Maybe delay signing up for Medicare. If you are still working at 65, with health insurance, and your employer has at least 20 covered employees, you can delay signing up for Medicare. But be very very careful to confirm you are covered.

- Be careful with Roth conversions. With tax rates near historic lows, a popular tax strategy for people with sizable savings in traditional IRA accounts is to move the money into a Roth IRA. All money converted to a Roth counts as taxable income in the year you do the conversion. The payoff is that there are no required minimum distributions on Roth IRAs. s.) Roth conversions can be a smart move, but once you hit 63, you want to be extra careful deciding how much to convert in any given year. Its not just your tax bill for that year you need to manage. That taxable income is going to play into your age 65 Medicare Part B premium. And any conversions in other years could also impact your premiums. Thats not a reason to avoid conversions, but a reason to consider working with a financial planner to help figure out how best to manage a lot of income-related moving pieces in your 60s.

- Delay Social Security as long as feasible. If you retire in your 60s and can afford to wait until age 70 to start Social Security, academic research shows it pays to wait, assuming you do not have serious health issues.

Don’t Miss: How Much Is Medicare Supplement Plan F

How To Tell If Part B Covers What You Need

1. Consult with your doctor or health care provider to find out if Medicare covers your needed services or supplies.

In some cases, you may require something that is typically covered by Medicare but your provider isnt sure if coverage will extend in your specific situation. If this happens, you can sign a notice that says you may be required to pay for the test, item, or service.

2. You can also always search your Medicare coverage by test, item, or service at this Medicare.gov Coverage Page.

Remember: Your Medicare coverage will be based on federal and state laws, national coverage decisions by Medicare, and local coverage decisions made by Medicare claims processors in each state.

To get a fuller understanding of your Medicare Part B costs, coverage, and more, read our Comprehensive Guide to Medicare Part B.

Helpful Resource:

Medicare Part B Premium For 2022

The standard monthly Part B premium has increased from the past year’s amount.

For Medicare recipients, Part B coverage is known as your medical insurance. It helps to cover costs for doctor services, outpatient therapy, durable medical equipment, and other medically necessary services and preventive services not covered by Part A.

To receive your Medicare Part B coverage, you must pay a monthly premium amount, which is adjusted in accordance with the Social Security Act and correlates with your annual income.

The 2022 Medicare Part B monthly premium amount has increased for each income bracket from the 2021 amounts, which we will outline in greater detail below.

Recommended Reading: Will Medicare Pay For Drug Rehab

Delaying Enrollment In Medicare When You’re Eligible For It Could Result In A Penalty That Will Remain In Effect For The Rest Of Your Life

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month.

While Medicare Part A which covers hospital care is free for most enrollees, Part B which covers doctor visits, diagnostics, and preventive care charges participants a premium. Those premiums are a burden for many seniors, but heres how you can pay less for them.

Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrig’s disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If you’re eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you don’t sign up for Part B when you are first eligible, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didn’t enroll.

However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicare’s website to find out more.

Read Also: Does Medicare Cover House Calls