Initial Enrollment Period For Part D

Medicare Part D is prescription drug coverage, available through private insurance companies that are approved by Medicare. You can get this coverage in two ways:

- Medicare Prescription Drug Plans that work alongside your Original Medicare, Part A and Part B, coverage

- Medicare Advantage Prescription Drug plans that include your Medicare Part A, Part B, and Part D benefits under a single plan

Like Medicare Advantage plans, Medicare Part D enrollment also works differently. Youre usually first eligible for Medicare Part D when:

- Youre enrolled in Medicare Part A and/or Part B, and

- You live in the service area of a Medicare plan that covers prescription drugs.

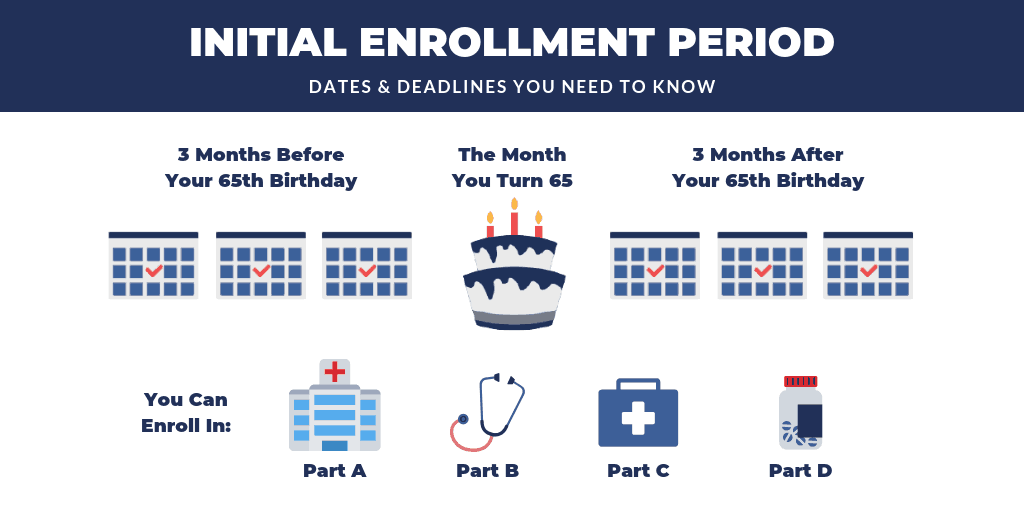

You can enroll in Medicare Part D coverage once you meet both of the above requirements. Your Initial Enrollment Period for Part D is when youre first eligible to sign up for prescription drug benefits, and this period usually coincides with when youre first eligible for Medicare coverage. For most people, their Initial Enrollment Period for Part D takes place at the same time as their seven-month Initial Enrollment Period for Part B, starting three months before they turn 65, including the month they turn 65, and ending three months later. For those who qualify because of disability, theyll be first eligible to enroll in Medicare Part D three months before the 25th month of Social Security or Railroad Retirement Board disability benefits, including the 25th month, and ending three months later.

You Have A Chance To Get Other Coverage

- I have a chance to enroll in other coverage offered by my employer or union.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan to enroll in the private plan offered by your employer or union.

When?

Whenever your employer or union allows you to make changes in your plan.

- I have or am enrolling in other drug coverage as good as Medicare prescription drug coverage .

-

What can I do?

You May Like: Usaa Grace Period Auto Insurance

Through A Private Insurance Company

Different insurance companies and even some pharmacies offer online resources to compare Part D plans. Keep in mind these tools may be tailored to their own plans. You can apply online through the plans website, by contacting the insurance company by phone, or by visiting a local insurance agency.

Remember you will need your Medicare identification number and the starting dates of your Medicare coverage to complete your applications.

You May Like: Is Blood Pressure Monitor Covered By Medicare

When Is The Best Time For Medicare Part D Enrollment

There are different times when you might qualify for Medicare Part D enrollment:

Initial Enrollment Period for Medicare Part D Enrollment

Your Initial Enrollment Period occurs when you first become eligible for Medicare. For most people, eligibility happens when you turn 65. The IEP begins three months before the month you turn 65. It includes your birthday month and the three months following for a total of seven months. During that time, you can enroll in a Part D Prescription Drug plan or a Medicare Part C plan that includes prescription drug coverage.

Fall Open Enrollment Period for Medicare Part D Enrollment

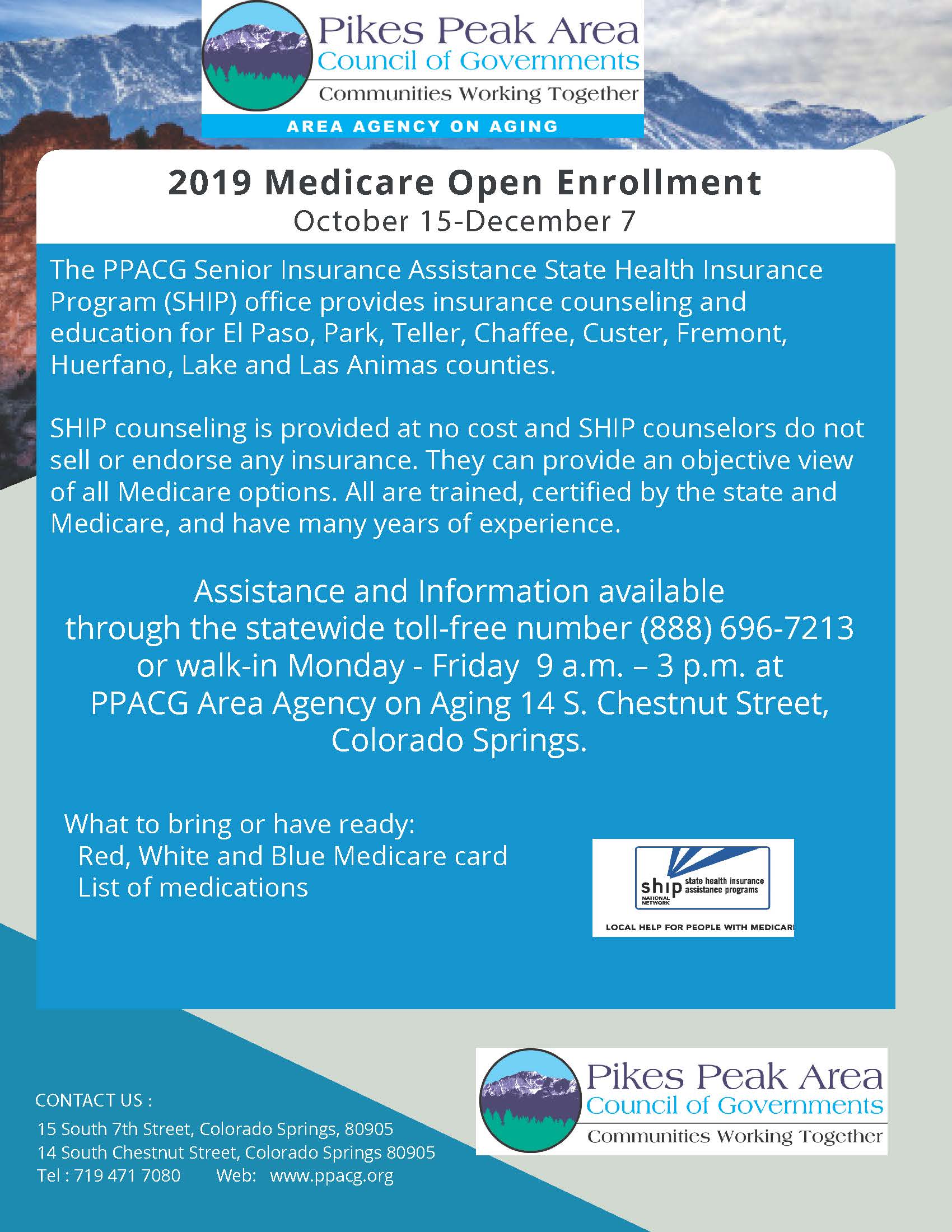

Medicare also offers a Fall Open Enrollment Period every year that runs from October 15 to December 7. This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time.

Special Enrollment Period for Medicare Part D Enrollment

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.

Who Can Enroll In A Medicare Part D

In general, individuals who have Original Medicare, Part A and/or Part B, or a Medicare Advantage plan are eligible to enroll into a Medicare Part D Prescription Drug Plan.

In order to be eligible for Medicare Part D enrollment, you must:

- Have Medicare Part A and/or Part B.

- Live in the service area of a plan that provides prescription drug coverage.

Medicare prescription drug coverage is voluntary, and you will need to enroll. You can receive this coverage through private insurance companies in two ways:

- Medicare Prescription Drug Plan : These stand-alone Prescription Drug Plans can be added on to your Original Medicare coverage, as well as certain Medicare Cost Plans, Medicare Medical Savings Account plans, and Medicare Private Fee-for-Service plans.

- Medicare Advantage Prescription Drug plan: Some Medicare Advantage plans include prescription drug coverage, in addition to providing Medicare Part A and Part B coverage.

Keep in mind that you cannot be enrolled in both types of plans. If you are currently enrolled in a Medicare Advantage plan that includes drug coverage and enroll into a Medicare Prescription Drug Plan, you will be automatically disenrolled from the Medicare Advantage plan and reverted back to Original Medicare.

Recommended Reading: What Is The Best Medicare Supplement Insurance Plan

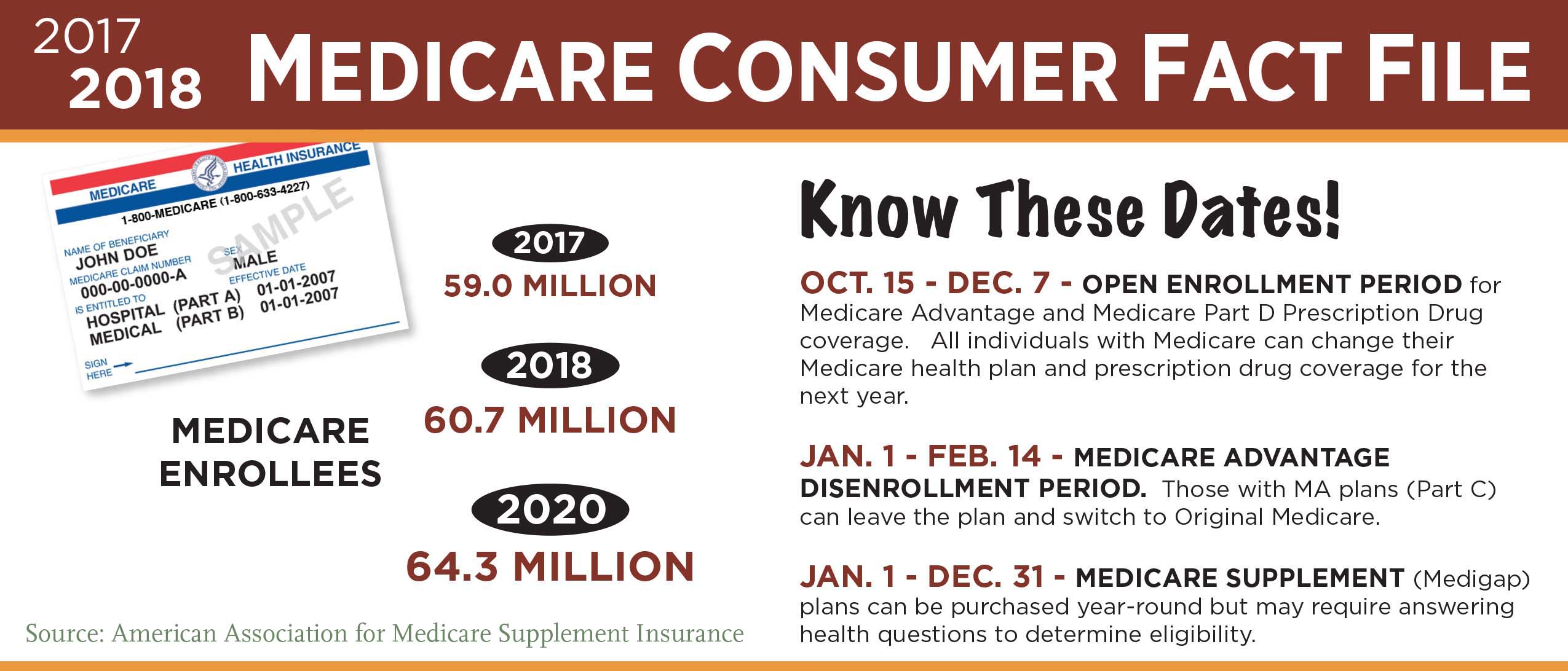

Medicare Supplement Insurance Enrollment

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan , the best time to sign up is during your six-month Medigap Open Enrollment Period.

- Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

- Insurance companies cannot deny you Medigap coverage or charge you a higher fee for pre-existing health conditions if you apply for Medicare Supplement Insurance during your Medigap Open Enrollment Period.

If you dont sign up for a Medigap plan during your Medigap Open Enrollment Period, you may still be able to buy one at any time.

Insurance companies can take your health into consideration when setting your premiums or deciding whether or not to offer you coverage, however.

You must be enrolled in Medicare Part A and Part B in order to buy a Medigap plan.

Medigap and Medicare Advantage plans are very different, and you cannot be enrolled in a Medigap plan and a Medicare Advantage plan at the same time.

Learn more about the differences between Medicare Advantage vs. Medicare Supplement Insurance.

Request a free, no-obligation Medicare Supplement Insurance quote today by visiting MedicareSupplement.com.

Who Is Eligible For Medicare

You are eligible for Medicare Part A and Part B at age 65 if:

- You are a U.S. citizen or permanent legal resident who has lived in the U.S. for five continuous years

- You or your spouse have worked long enough to be eligible for Social Security or Railroad Retirement benefits

- You or your spouse are government employees or retirees who have not paid into Social Security but have paid Medicare payroll taxes

You can meet Medicare eligibility under 65 if you:

- Have been receiving Social Security disability benefits or certain Railroad Retirement Board disability benefits for at least 24 months

- You have ALS

- You have End-Stage Renal Disease and you or your spouse have paid Social Security taxes for a certain length of time

Recommended Reading: Does Medicare Pay For Private Duty Nursing

Enrolling In Medicare Advantage

To join a Medicare Advantage Plan, you will need to have Original Medicare coverage and live in an area where an Advantage plan is offered.

A Medicare Advantage plan will wrap your Medicare Part A and Part B coverage into one plan. But youll still have to pay the government a premium for Part B, in addition to the premium you pay for Medicare Advantage .

You can enroll in a Medicare Advantage plan when youre first eligible for Medicare, or during the annual Medicare open enrollment period in the fall .

In Brief: Medicare Part D Coverage Plans

Medicare Part D coverage plans are designed to help ensure more people have affordable prescription drug coverage. For many, prescription medication can be the difference between life and death, and so having the right coverage in place helps protect us all. And with negotiated drug prices and premiums, coverage can be affordable and accessible, no matter where you live.

Questions?

Read Also: How To Change Primary Doctor On Medicare

Basics Of Medicare Part D

There are two ways to get prescription drug coverage through Medicare Part D.

- Enroll in a stand-alone Medicare prescription drug plan . If you enroll in a stand-alone prescription drug plan, it works alongside your Original Medicare benefits.

- Or, enroll in a Medicare Advantage plan with prescription drug coverage, or an MA-PD. A Medicare Advantage plan is an alternative way to get your Original Medicare benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.

Prescription Drug plans include formularies, which are a list of the medications that are covered under the plan. Some formularies have tiers. Medications in lower tiers may have lower costs. Generic medications are often included in the lower tiers. When you are preparing for Medicare Part D enrollment, it is important to make sure the medications you take are included in the plans formulary.

Enrolling In A Medicare Supplement

During your initial Medigap enrollment period you cant be denied Medigap coverage or be charged more for the coverage because of your medical history.

But after that window ends, Medigap insurers in most states can use medical underwriting to determine your premiums and eligibility for coverage.

If youre under 65 and eligible for Medicare because of a disability, there are 33 states that provide some sort of guaranteed issue period during which you can purchase a Medigap plan. But in the majority of those states, the carriers can charge additional premiums for people under 65. You can click on a state on this map to see how Medigap plans are regulated in the state.

To find out about Medigap policies in your state, contact your State Department of Insurance or your State Health Insurance Assistance Program, or call 1-855-593-5633 to speak with one of our partners, who can help you find a plan in your area.

Don’t Miss: What Age Do You Apply For Medicare

Medicare Advantage Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Advantage plan. You need to enroll in Original Medicare before you enroll in Medicare Advantage. Before enrolling in a plan, it may be a good idea to compare Medicare Advantage quotes.

To be eligible for Medicare Part C, you must already be enrolled in Part A and Part B.

If you are interested in joining a Medicare Advantage plan, you typically can only do so during specific times of the year.

The first time you may be able to enroll is during your Medicare Initial Enrollment Period, as outlined above.

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

Medigap Open Enrollment Period

The Medigap Open EnrollmentIn health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions…. Period is a six-month period to enroll in Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage…. that starts as soon as a beneficiarys Medicare Part B coverage begins. They can enroll in Medigap plans outside of the Medigap OEP, but they only have the benefit of guaranteed-issue rightsGuaranteed-issue is a right granted to Medicare beneficiaries and applies to Medicare Supplement insurance . All states and the federal government enforce this essential right, which protects Medicare beneficiaries from medical underwriting…. when enrolling in a Medigap plan during this one-time enrollment period.Medicare.gov, When can I buy Medigap, Accessed September 25, 2021 Guaranteed-issue rights protect their beneficiary from being denied Medigap coverage or charged extra costs because of their pre-existing health conditionsMedicare.gov, Guaranteed issue rights, Accessed September 25, 2021.

For more information on the Medigap Open Enrollment Period, .

Read Also: Will Medicare Pay For A Power Lift Chair

My Medicare Initial Enrollment Period

You can take advantage of your initial enrollment window as early as three months before you turn 65. For those on disability, your Initial Enrollment Period window will begin after receiving Social Security for 24 months, and then again when you turn 65.

This is one of the only scenarios where you will get two chances of an Initial Enrollment Period. The other scenario is if you retire, go back to work and get employer group coverage, and then retire again later. When you retire again, youll qualify for a Special Enrollment Period.

How Do I Change My Medicare Part D Plan

You can change your Medicare Part D Plan by finding new coverage during the Annual Enrollment Period . The HealthMarkets FitScore® can help you compare plans right now.

If youre currently enrolled in an MAPD and you switch to a standalone PDP during Medicare Part D Open Enrollment 2022, you will be disenrolled from your MAPDwhich includes losing extra coverage such as vision and dental that came with the planand re-enrolled in Original Medicare.

Recommended Reading: Are Cancer Drugs Covered By Medicare

Enrollment Periods For Medicare Advantage/part D

These enrollment periods apply only to Original Medicare, Medicare Advantage plans, and Medicare-approved prescription drug plans. You can enroll in a Medicare Supplement plan anytime, but the best time is during your initial enrollment period because you are guaranteed approval in your initial enrollment period. Most Medicare Supplement plans require underwriting if you are not in a guaranteed issue election period.

You’re eligible for Original Medicare if you or your spouse paid into Social Security for at least 10 years through employment, you are a citizen or permanent resident of the U.S., and you are age 65 or older.

The full Social Security retirement age varies based on the year you were born , but you’re eligible for Medicare at age 65. You do not have to be retired to enroll. If you’ll have employer-provided health coverage at age 65, contact your benefits administrator to find out how Medicare will work with your current coverage.

Plan Satisfaction

Beneficiaries who enroll in a Premera Blue Cross Medicare Advantage plan during the IEP can disenroll at any time within the first 12 months of coverage and return to Original Medicare and enroll in a prescription drug plan. This also allows you to enroll for a Medicare Supplement insurance policy without medical underwriting.

Medicare Enrollment: Switching Medicare Advantage Plans

| You want to do any of these | Medicare Advantage Open Enrollment Period |

|

Medicare Advantage Open Enrollment Period: January 1 March 31 each year |

Don’t Miss: Are Pre Existing Conditions Covered Under Medicare

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

When Can I Join Switch Or Drop A Plan

You can join, switch, or drop a

with or without drug coverage during these times:

- Initial Enrollment Period. When you first become eligible for Medicare, you can join a plan.

- Open Enrollment Period. From October 15 December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 .

- Medicare Advantage Open Enrollment Period. From January 1 March 31 each year, if youre enrolled in a Medicare Advantage Plan, you can switch to a different Medicare Advantage Plan or switch to Original Medicare once during this time.

Learn more below about enrollment periods below.

Don’t Miss: Do I Have Medicare Or Medicaid

When To Get Medicare Part D

You can enroll in a Medicare Part D prescription drug plan when you first sign up for Medicare.

If you have a special enrollment period due to a qualifying life event, you can take that opportunity to sign up for a Medicare Part D prescription drug plan.

During Open Enrollment, which goes from October 15 to December 7 of every year, you can sign up for a Medicare Part D plan.

Get Help With Medicare Part D Open Enrollment

Its important to review your Part D options annually during Medicare Open Enrollment. The cost, pharmacy network, and drug formulary for Medicare Part D plans can vary from plan to plan year to year.

HealthMarkets FitScore can compare your current medications against different standalone Medicare Part D and Medicare Advantage drug plans to find an option that meets your needsall at no cost to you and with no obligation to enroll. Dont get confused by the Medicare Part D Open Enrollment. HealthMarkets makes reviewing and comparing plans easy. See if your current plan is still your best choice by reviewing your options now.

46661-HM-1021

Recommended Reading: What Age Am I Medicare Eligible