Medicare Eligibility For People Under 62

There are a few exceptions for Medicare age limits that can allow people younger than 65 and under age 62 to enroll in Medicare.

- If you have ALS , you are immediately eligible for Medicare regardless of your age as soon as your Social Security or Railroad Retirement Board disability benefits begin.

- You may also qualify for Medicare if you have kidney failure that requires dialysis or a kidney transplant, which is known as end-stage renal disease .

- You may also qualify for Medicare at age 62 or any age before 65 if you receive disability benefits from either Social Security or the Railroad Retirement Board for at least 24 months.

If you qualify for Medicare under the age of 65 because of a disability, you might also qualify for a Medicare Advantage Special Needs Plan.

What Are The Basic Qualifications For Medicare Eligibility

Be a United States citizen or resident who has lived in the US for at least 5 years and at least one of the following:

The basic qualifications that make you eligible for health insurance through Medicare are:

- You are a United States citizen or a legal resident who has lived in the U.S. for at least five years, and:

- You are 65 years of age, or

- Have a disability based on the Social Securitys definition of total disability, or

- You worked and paid Medicare taxes for at least 10 years

Cost Increases For Individuals Employers And States Would Far Exceed Federal Savings

Raising the age of eligibility for Medicare would have ramifications far beyond the federal budget. People who lost Medicare would have to seek health coverage from other sources. This would affect not only their own personal budgets but also employers’ costs, state budgets, and the premiums paid by Medicare beneficiaries and participants in the new health insurance exchanges.

Kaiser estimates that raising the eligibility age would save the federal government $5.7 billion in 2014. The savings reflect $24 billion in lower Medicare spending net of beneficiaries’ premiums, largely offset by $18 billion in higher spending for Medicaid and subsidies for low-income participants in the health insurance exchanges. The estimated increase in costs to seniors, employers, states, and others, however, would total $11.4 billion twice the net savings to the federal government.

You May Like: What Is Medicare In Simple Terms

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

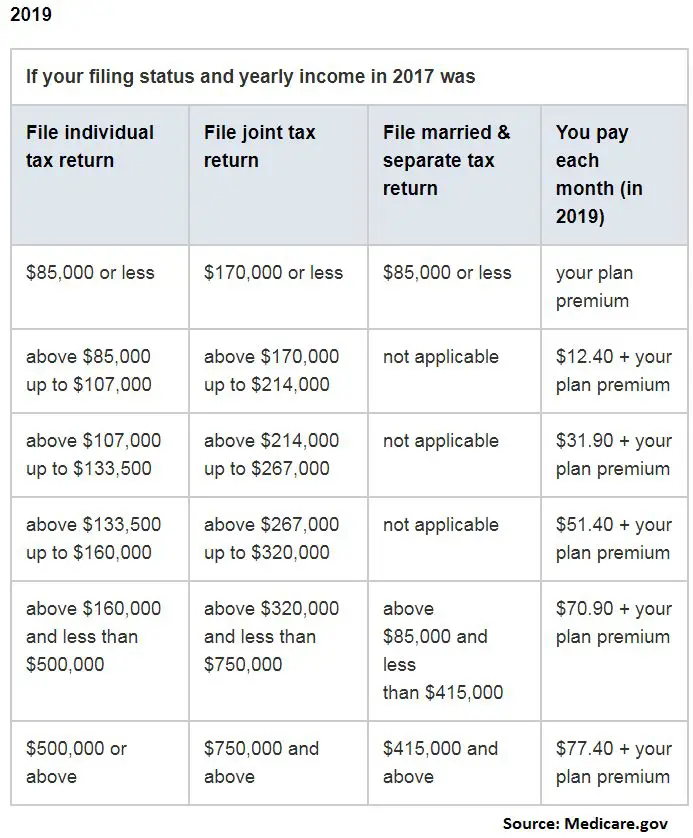

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Medicare Eligibility By Disability

Most Medicare recipients under the age of 65 reach eligibility during their 25th month receiving Social Security disability benefits. If you qualify for Medicare because of a disability, your Initial Enrollment Period will begin during the 22nd month you receive these benefitsthree months before youre eligible for coverage.

Don’t Miss: How Long Does It Take To Get Medicare B

Special Enrollment Periods For Medicare

Medicare special enrollment periods can happen any time during the year due to changes to your personal circumstances.

Examples of Medicare Special Enrollment Qualifying Events

- Moving somewhere outside of the coverage area of your current Medicare Advantage plan

- Phasing out of your employers health insurance plan

- Your current Medicare Advantage provider ending its contract with Medicare

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Recommended Reading: Is It Too Late To Change Medicare Advantage Plans

If My Spouse Is 65 And Im 62 How Will That Affect My Spouses Medicare Costs

Your spouseâs costs will depend on the type of Medicare plan they choose â Original Medicare from the government or Medicare Advantage from a private insurer. And it will depend on the number of years youâve both worked.

Hereâs the lowdown: At the age of 65, your spouse will qualify for traditional Medicare, also called Original Medicare. That includes Medicare Part A, which covers hospital costs, and Medicare Part B, which covers doctor visits, among other things. If they need additional benefits, like coverage for prescription drugs, vision, hearing, or dental care, they must buy either additional Medicare Supplement plans or enroll in a Medicare Advantage plan that bundles those benefits in one policy.

Chances are that your spouse will have to pay a monthly premium for Part B . But they probably wonât have to pay for Part A. The reason: If your spouse has worked for at least 10 years , theyâve paid taxes to Medicare, so they wonât have to pay a premium for Part A.

And if your spouse hasnât worked for at least 10 years? They can still qualify for premium-free Part A if youâve worked for that amount of time and have paid taxes to Medicare.

If, on the other hand, neither you nor your spouse has worked for at least 10 years, you both may need to pay a premium for Part A. That cost can be as much as $499 a month. Part B is at least $170.10.

Can I Get Medicare Early If I Retire Early

If you retire earlier than age 65, you will not be eligible for Medicare. Although Medicare is often thought of as insurance for retired people, the Medicare age requirement is still 65. Some people continue to work past age 65 and have insurance coverage through their employer. Many people retire before they turn 65 and must purchase health insurance or are covered on their spouses insurance plan. Although you may be eligible for social security retirement benefits if you retire early, it does not change your age requirement for Medicare health insurance coverage.

Read Also: Does Medicare Pay For Yearly Physicals

Can You Qualify For Medicare If You Are Under 65

You can qualify for Medicare benefits if you are younger than 65 and one of these situations applies to you. In any case, you are eligible for premium-free Part A hospital insurance:

- You have a disability as defined by Social Security. You will become eligible for Medicare coverage after receiving your monthly social security or the U.S. Railroad Retirement Board for 24 months. If you are disabled but dont receive disability benefits under United States Social Security or qualify for RRB benefits because you are a government employee, the 24 months is extended to 29 months.

- You have ALS. Coverage starts when you are entitled to receive Social Security or RRB disability benefits. There is no waiting period.

- You have kidney disease requiring dialysis or transplant. You must have completed a Medicare application. You or your spouse must have worked long enough under Social Security, the RRB, or as a government employee to be eligible for retirement benefits. Your Medicare coverage start dates work differently if you have end-stage kidney disease. Click here for more details.

Can I Get Medicare As Soon As I Retire

Summary:

If youâre getting ready to retire on the early side â say, at 62 â you may be wondering whether you are eligible for Medicare once you stop receiving your employerâs health insurance. The answer: probably not.

Almost everyone will have to wait until they turn 65 before they qualify for Medicare coverage, says Caitlin Donovan, a spokesperson for the National Patient Advocate Foundation. The exception is if you have a specific disability.

One reason for the common confusion? You can start receiving Social Security benefits as early as age 62. But the rules for enrolling in Medicare differ from those for Social Security.

Whatâs more, even if your spouse is old enough to qualify for Medicare, you canât start receiving it until youâre 65. Thatâs because, unlike the health insurance plans offered by many employers, Medicare isnât a group plan. Itâs an individual one.

The reverse is also true: âYou canât enroll in Medicare and also cover your spouse if they donât qualify on their own,â says Donovan.

eHealth is here to make Medicare easy. Use our PlanPrescriber tool to find plans that fit your budget and cover your doctors.

Here are answers to some other common questions about qualifying for Medicare.

Read Also: When Is Open Enrolment For Medicare

Younger Enrollees Would Primarily Enroll In Part A

Lowering the age of eligibility for Medicare would also shift enrollment across the various components of the program. For example, 82 percent of 65- to 69-year-olds enrolled in both Part A and Part B in 2019. By contrast, CBO estimates that in 2031 only 53 percent of 60- to 64-year-olds would enroll in both programs. That is because 60- to 64-year-olds would be more likely to enroll exclusively in Part A while also maintaining employer-provided coverage or another form of health insurance. That greater emphasis on Part A which is funded by payroll taxes and has a trust fund that is set to become depleted in 2028 could accelerate Medicares financial difficulties.

When Should You Enroll For Medicare

Just because you qualify for something doesnt mean you need to sign up, right? Not always. In the case of Medicare, its actually better to sign up sooner rather than later. While its true that Medicare isnt mandatory, there are fees for signing up outside of your initial eligibility window. Also known as the initial enrollment period , this 7-month window gives you some flexibility in enrolling in Medicare once you qualify.

If you dont get automatic enrollment , then you must sign up for Medicare yourself, and you have seven full months to enroll. The IEP starts three months before the month you turn 65 and ends three months after the month you turn 65.

|

Initial Enrollment Period |

|

Coverage start dates vary based on when you sign up. If you sign up during the first three months of your IEP , then your health insurance will take effect on the first day of your birthday month. If your birthday falls on the first of the month already, then your coverage will start on the first of the previous month. The longer you wait to sign up, the later your coverage will start, which is why its a good idea to check your eligibility and enroll as soon as youre able.

This initial signup period applies to people who dont get automatically enrolled. People who are already enrolled in Social Security and those with disabilities will be automatically enrolled into original Medicare depending on their situation.

Also Check: Does Medicare Cover Freestanding Emergency Rooms

How Do You Enroll In Medicare Supplement Medicare Advantage And Medicare Prescription Plans

Medigap, Medicare Part C, and Medicare Prescription Drug plans are administered by private insurance companies approved and regulated by Medicare. The company you choose or a licensed agent can help with your enrollment. During your time working, you pay medicare taxes through your employer. Medicare taxes allow this health insurance coverage to be available.

As for finding plans, you can view options on Medicare.gov, where there is also a premium calculator and you can learn more about part coverage. An explanation of each:

The Impact If The Medicare Eligibility Age Is Lowered To 60

- There is a proposal to lower the Medicare eligibility age from 65 to 60.

- A new study concludes that the change would not necessarily lower medical costs for all people in that age group.

- Some experts say the lower age would help reduce expenses and premiums for people in lower- and middle-income groups as well as increase their access to healthcare services.

One of President Bidens election promises to lower the Medicare eligibility age from 65 to 60 is beginning to gain traction.

While most healthcare experts are still waiting for more details on how and if the proposed reduction in the minimum age will help, studies are beginning to be published on how it may impact individuals, the government, and private insurance companies.

Those who support the proposal say that expanding Medicare will improve affordable insurance access to more than 20 million people in the United States.

A letter to the president and Congress signed by 45 national advocacy groups states that the proposed change will save lives and prevent suffering and financial hardship for families across the nation.

People ages 60 to 65 are the most expensive folks to insure, said Eagan Kemp, a healthcare policy advisor for Public Citizen and an expert on Medicare and other insurance programs.

A lot of people in that age group, Kemp told Healthline, tend to put off medically necessary care until they reach 65 and can access that care more affordably through Medicare.

Read Also: How Do I Get A Second Opinion With Medicare

Many Who Lost Medicare Coverage Would End Up Uninsured

The Kaiser study assumes for the sake of simplicity that everyone who would lose Medicare coverage would obtain health insurance coverage elsewhere. Under this assumption, Kaiser estimates that 42 percent of 65- and 66-year-olds would obtain coverage from employer-sponsored plans , 38 percent would enroll in the new health insurance exchanges, and 20 percent would become covered under Medicaid.

In reality, however, many of these 65- and 66-year-olds are likely to end up uninsured. Some of those eligible for premium credits in the exchanges would not enroll because they would regard the required premium contribution as too high people with incomes between 300 and 400 percent of the poverty level will have to pay 9.5 percent of their income $3,300 to $4,400 for exchange coverage. Even some of those eligible for more generous premium credits or for Medicaid would likely fail to obtain coverage participation in means-tested programs like Medicaid falls far short of that in social insurance programs like Medicare, in part because of the difficulties navigating the application process.

Medicare Advantage Plan Eligibility For 2023

Heres what you need to know about eligibility for Parts C and D:

| If you | |

| Qualify for Medicare because youre turning 65 | Sign up for Medicare Advantage or Part D during your 7-month initial enrollment period |

| Qualify for Medicare because of a disability but arent 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before your 25th month of disability payments, includes that 25th month, and ends 3 months after the 25th month of disability payments |

| Qualify for Medicare because of a disability and youre 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before the month you turn 65, includes your birthday month, and ends 3 months after your birthday month |

| Dont have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Part D only, from April 1 to June 30 |

| Have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Advantage only, from April 1 to June 30 |

You can also switch to Medicare Advantage or join a Part D drug plan during the Medicare annual open enrollment period, which runs from October 15 through December 7 each year. And if you already have an Advantage plan, you can use the Medicare Advantage Open Enrollment Period to make a one-time change to your coverage.

- A Part D drug plan

- A Medicare Advantage plan with drug coverage

- Another Medicare health plan that covers prescription drugs

- A plan from an employer or union

Also Check: What Is The Advantage Of Medicare Advantage