You Move Outside Your Private Plans Coverage Area

If youre enrolled in Medicare Advantage or Medicare Part D, you may lose your current private coverage if you move to a new address that is located outside of the plans service area.

These plans are sold by private insurance companies and may be designed for use only in specific locations with plan-approved provider networks. If you move outside of your plans network area, you may no longer be covered by that plan.

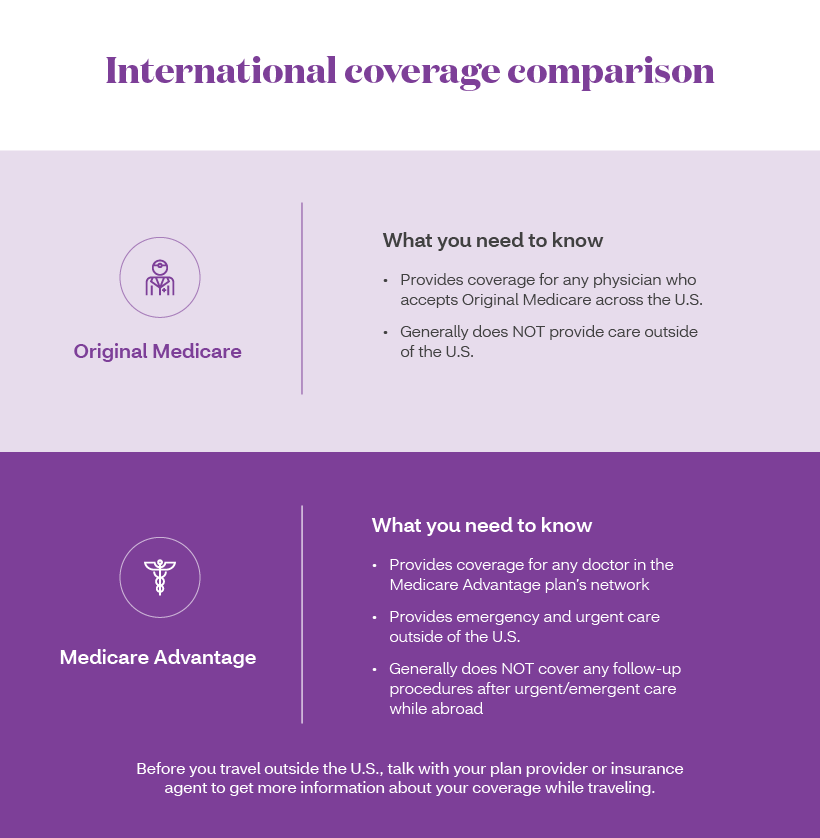

Because Medicare Part A and Part B do not have provider networks or service areas within the United States, moving should not affect your enrollment in either. Original Medicare is accepted by any medical provider who accepts Medicare.

If you lose your Medicare coverage because you relocate, you may be granted a Special Enrollment Period to enroll in a different plan offered in your new location.

Medicare Advantage Plans Often Deny Needed Care Federal Report Finds

Investigators urged increased oversight of the program, saying that insurers deny tens of thousands of authorization requests annually.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

By Reed Abelson

Every year, tens of thousands of people enrolled in private Medicare Advantage plans are denied necessary care that should be covered under the program, federal investigators concluded in a report published on Thursday.

The investigators urged Medicare officials to strengthen oversight of these private insurance plans, which provide benefits to 28 million older Americans, and called for increased enforcement against plans with a pattern of inappropriate denials.

Advantage plans have become an increasingly popular option among older Americans, offering privatized versions of Medicare that are frequently less expensive and provide a wider array of benefits than the traditional government-run program offers.

Enrollment in Advantage plans has more than doubled over the last decade, and half of Medicare beneficiaries are expected to choose a private insurer over the traditional government program in the next few years.

Were also concerned that beneficiaries may not be aware of the greater barriers, she said.

The agency is committed to ensuring that people with Medicare Advantage have timely access to medically necessary care, officials said.

Quality Of Care Could Get Better

The Affordable Care Act put an incentive system in place for Medicare Advantage plans. Beginning in 2012, plans that provide high-quality care will receive a bonus or rebate. By law, the bonus money must be reinvested in additional plan benefits.

Going forward, Medicare Advantage plan providers will no doubt continue to adapt and improve the quality of the plans they offer in order to meet these bonus requirements.

In addition to the bonus program, Medicare issues star ratings for all Medicare Advantage plans each year, and these Medicare Star Ratings can be a large point of emphasis for shoppers.2Medicare offers a Special Enrollment Period for anyone who is not enrolled in a five-star Medicare Advantage plan and wants to switch to one. The continued emphasis on star ratings by Medicare Advantage consumers could help keep plan quality in check for years to come.

Also Check: Does Medicare Part B Cover Home Health Care Services

Can I Change Medicare Advantage Plans At Any Time

No, you cant switch Medicare Advantage plans whenever you want. But you do have options if youre unhappy with your plan.

You can jump to another plan or drop your Medicare Advantage plan and change to original Medicare during certain times each year. You may be eligible to change plans at other times, too. Keep these periods in mind if you want to see doctors or use medications that arent covered under your Medicare Advantage plan.

Everyone with Medicare Advantage has two opportunities to change plans each year.

You have many options to change coverage during this annual open enrollment period. You can switch to a different Medicare Advantage plan, change from a Medicare Advantage plan to original Medicare and vice versa, or switch from one Part D drug plan to another. Coverage in the new plan begins Jan. 1.

If you have a Medicare Advantage plan, you can switch to another Medicare Advantage plan, or change from Medicare Advantage to original Medicare and join a Part D plan during this Medicare Advantage open enrollment period. Coverage begins the first day of the month after you switch.

Can I Still Buy Medigap Plans C And F

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 , Medigap plans C and F are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020. People who became Medicare-eligible prior to 2020 can keep Plan C or F if they already have it, or apply for those plans at a later date, including for 2023 coverage.

Medigap Plans C and F cover the Part B deductible in full. But other Medigap plans require enrollees to pay the Part B deductible themselves. The idea behind the change is to discourage overutilization of services by ensuring that enrollees have to pay at least something when they receive outpatient care, as opposed to having all costs covered by a combination of Medicare Part B and a Medigap plan.

Because the high-deductible Plan F was discontinued for newly-eligible enrollees as of 2020, there is a high-deductible Plan G available instead.

Read Also: Does Medicare Pay For Maintenance Chiropractic Care

What Is Driving High Disenrollment In Medicare Advantage

Medicare Advantage plans with the highest disenrollment rates are more likely to be for-profit , have high out-of-pocket costs, and service small areas. These plans also have disproportionate numbers of low-income and disabled enrollees.

To find the right Medicare Advantage plan, you need to do extensive research before deciding on a policy. You will need to understand the deductibles, copays, and benefits.Also, take into account the network and service area. If you travel often, a Medicare Advantage plan may not be right for you and you could benefit from exploring Medicare Advantage vs. Medicare Supplement plan options instead.

Why Is Medicare Plan F No Longer An Option For Most People

In short, Medicare Plan F is being phased out because of the first dollar coverage that made it so popular. As federal lawmakers saw it, that kind of coverage has the potential to be overused at the expense of the Medicare program. By requiring a deductible, the insured has a stake in making sure their visit to the doctor justifies the cost.

So, as part of the Medicare Access and CHIP Reauthorization Act of 2015, the limited offering of Plan F was set into motion on Jan. 1, 2020. But just because the clock is ticking doesnt necessarily mean that you cant join either Plan F or another Medicare Supplement plan.

Read Also: Is Keystone First Medicare Or Medicaid

Rules For Ma Promoters

According to Medicare.gov, people promoting Medicare Advantage plans are restricted in what they may and may not do. For example, they are not allowed to visit beneficiaries homes uninvited to sell or endorse anything. They also may not call you unless youre already a member of their plan. If you do belong to the plan, the agent who helped you join may call you.

They also may not offer you cash or gifts worth more than $15 to get you to join their plan or provide you with free meals during a sales pitch.

Furthermore, they cannot sell you a product not related to health, such as an annuity or a life insurance policy, while they are delivering a sales pitch for a Medicare plan.

In addition, they must send you a bill and not ask you to pay over the phone or online.

If you agree to meet with them, they are restricted in what they may do during a meeting. According to Medicare, they may not:

During the meeting, Medicare plans and people who work with Medicare can’t:

If you need help with Medicare enrollment or want to report potential enrollment fraud, you can call 1-800-MEDICARE or your states Senior Medicare Patrol. The Senior Medicare Patrol can help you identify and report fraud schemes, including illegal marketing and billing for services that werent provided.

Achieving Ma’s Promise 2010 And Beyond

The ACA, signed into law by President Obama in March 2010, included another major restructuring of the MA program and significant cuts in MA plan payments. Specifically, for 2011, the payment benchmarks against which plans bid are frozen at 2010 levels. Starting in 2012 the legislation reduces some plan payments while preserving broad access to plans across areas and rewarding plans that provide high-quality care. These changes in payments are scheduled to be phased in over three to six years. More specifically, the legislation changes the plan payment formula so that the benchmarks against which plans bid vary according to how a county’s TM spending compares with that of other counties. Plans operating in the quartile of counties with the highest TM spending face a benchmark equal to 95 percent of risk-adjusted TM costs in that area plans in the next highest quartile face a benchmark equal to 100 percent of that area’s TM costs plans in the third highest quartile of counties face a benchmark equal to 107.5 percent of the county’s TM costs and plans in the lowest quartile of counties face a benchmark equal to 115 percent of the county’s TM costs. Because the plans are concentrated in areas with high TM spending, this amounts to a considerable cut in Medicare spending. Plans also will be eligible for bonuses and rebates that depend on quality performance.

Read Also: Does Medicare Offer Gym Memberships

How To Avoid Being Misled

The key, Turner said, is for beneficiaries to educate themselves before enrolling in a MA plan. Get any promises in writing and confirm with your doctors that they are part of the plans network.

Each state has a State Health Insurance Assistance Program, or SHIP, that provides free help for people considering their Medicare options, including during open enrollment. Beneficiaries are encouraged to consult their states SHIP when making these decisions.

And even though states dont have oversight of Medicare Advantage marketing practices, Navarro noted that many of the insurance companies also have plans that do fall under state regulation, making the companies amenable to responding to concerns raised by state officials. So if you run into a problem, you should report it to your state insurance department.

Medicare open enrollment runs from Oct. 15 through Dec. 7. But if you get locked into a Medicare Advantage plan you want to change, you do have a chance to address that as there is a second open enrollment for Medicare Advantage that runs from Jan. 1 through March 31.

However, if you switch from a medigap plan to Medicare Advantage, you may have trouble re-enrolling in medigap.

Did The Medicare Part B Standard Premium Increase For 2023

The standard premium for Medicare Part B is $170.10/month in 2022, but its decreasing to $164.90/month in 2023. This is the first year-over-year decrease since 2012. Medicare Part B spending was lower than expected in 2022, leaving a surplus that is being used to decrease premiums for 2023.

This is partly due to Medicares lower-than-expected spending on Aduhelm, the new Alzheimers drug that drove a significant portion of the Part B rate increase in 2022.

For 2023, the Social Security COLA is 8.7%, which is the largest its been in decades. And unlike 2022, when a chunk of seniors COLA had to be used to cover the additional Part B premiums , the Part B premium is decreasing in 2023. So the COLA will be fully available for retirees to use to cover other living expenses, which have increased sharply in 2022.

Looking for Medicare coverage with lower costs? Talk with a licensed advisor now. Call .

Also Check: How To Enroll In Medicare Online

Is Medicare Supplement Plan F Being Discontinued

Yes. Medicare Supplement insurance plans that pay the Medicare Part B deductible are not available to you if you became eligible for Medicare on January 1, 2020 or later. This change is part of the Medicare Access and CHIP Reauthorization Act of 2015 . It affects Medicare Supplement Plans C and F.

- If you already have Medicare Supplement Plan F , you can generally keep it.

- If you were eligible for Medicare before January 1, 2020, you might be able to buy Medicare Supplement Plan F or Plan C.

- If you qualified for Medicare on January 1, 2020 or later, you wonât be able to buy Medicare Supplement Plan F or Plan C.

Some Plan Promoters Accused Of Hiding Truth

Trinidad Navarro, the state of Delawares insurance commissioner said there are real problems with MA marketing tactics. Navarro chairs the anti-fraud task force of NAIC. While there have been instances of outright fraud, often, Navarro said, MA plans just fail to tell consumers the entire truth. Thats not necessarily fraud, he said, but is misleading and extremely confusing for consumers.

One source of confusion is that television commercials can be broadcast into broad media markets, but , the benefits they tout might be available only to people living in certain states. For example, Delaware residents might watch programs broadcast from Philadelphia. They will want the benefits of a plan described in a commercial thats not available in Delaware. They also may be overly influenced by the fact that a celebrity is promoting a particular plan.

Theres just a lot of problems with the way its been marketed, Navarro said. If state regulators had the authority to regulate those commercials, we would change them significantly. Theres so much more to these Medicare Advantage plans that are not being conveyed to the consumers.

Amy Nofziger, director of fraud victim support with AARP, said AARPs helpline gets a lot of calls about deceptive practices involving mailers, phone calls, emails and even in-person visits from people promoting Medicare Advantage plans.

You May Like: Does Medicare Pay For Mens Diapers

Consider Your Other Costs

Out-of-pocket costs can quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

Do I Need To Do Anything After I Enroll In A Medicare Advantage Plan

Once you enroll in a Medicare Advantage plan during Annual Enrollment, the plan will work with Medicare to transfer your benefits. You dont have to contact Medicare yourself. Your new plan will begin covering you on January 1.

If you have a stand-alone Part D prescription drug plan or other private Medicare plan, youll need to contact the plan provider directly to dis-enroll. Simply call the number on the back of your insurance member ID card.

When deciding to change to a Medicare Advantage plan, keep the following in mind:

- You may choose a different Medicare Advantage plan or return to Original Medicare during the Medicare Advantage Open Enrollment Period, January 1 March 31.

Don’t Miss: How Do I Change My Primary Care Physician With Medicare

Medicare Advantage Coverage Tactics Slammed

At the same time, some of the insurers have come under criticism for allegedly aggressive and misleading sales tactics and failing to provide adequate coverage for beneficiaries. In 2021 the Senior Medicare Patrol program saw a 24% increase in marketing complaints last year over the prior year, according to the programs director, Nicole Liebau. In addition, the complaints received thus far in 2022 are comparable to the complaints received in 2021. We expect the complaints to spike, like they always do during open enrollment.

More than 30 members of Congress recently wrote to the Centers for Medicare and Medicaid Services alleging that taxpayers spend an average of $1,538 more per beneficiary in Medicare Advantage than for people enrolled in traditional Medicare, adding up to $12 billion in overpayments in a single year.

And yet, the legislators said, regulators have received numerous complaints regarding access to care and quality of coverage under MA.

In announcing the letter to CMS, House Ways and Means Chair. Lloyd Doggett, D-Texas, said, For roughly two decades, Medicare Advantage has misled consumers, imposed medically unnecessary and sometimes dangerous obstacles to receiving care, and endangered Medicares fiscal future.

What Is The Future Of Medicare Advantage

The three biggest changes to MA plans in 2021 are: The expansion of telehealth services and coverage. Data indicates that in 2021, more than 94% of Medicare Advantage plans will offer additional telemedicine benefits reaching 20.7 million beneficiaries, up from about 58% of plans offering telehealth benefits in 2020.

You May Like: Can I Change Medicare Plans Anytime

Can You Have A Medicare Advantage Plan And A Medicare Supplement Plan

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Learn more about Medicare Supplement

What Will Replace Medicare Plan F

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including:

- Part A coinsurance and hospital costs

- Part B copays/coinsurance

- Three initial pints of blood

- Part A deductible

- Part B excess charges

Plan G also covers 80% of foreign travel emergency healthcare after you meet a $250 yearly deductible. The only difference between Plan F and Plan G is that Plan G does not cover a Part B deductible.

Also Check: Can You Use Medicare Out Of State