Medicare Supplement Insurance Enrollment

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan , the best time to sign up is during your six-month Medigap Open Enrollment Period.

- Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

- Insurance companies cannot deny you Medigap coverage or charge you a higher fee for pre-existing health conditions if you apply for Medicare Supplement Insurance during your Medigap Open Enrollment Period.

If you dont sign up for a Medigap plan during your Medigap Open Enrollment Period, you may still be able to buy one at any time.

Insurance companies can take your health into consideration when setting your premiums or deciding whether or not to offer you coverage, however.

You must be enrolled in Medicare Part A and Part B in order to buy a Medigap plan.

Medigap and Medicare Advantage plans are very different, and you cannot be enrolled in a Medigap plan and a Medicare Advantage plan at the same time.

Learn more about the differences between Medicare Advantage vs. Medicare Supplement Insurance.

Request a free, no-obligation Medicare Supplement Insurance quote today by visiting MedicareSupplement.com.

When Is My Effective Date Following The Medicare Advantage Open Enrollment Period

If you use the Medicare Advantage Open Enrollment Period to change your Medicare Advantage plan selection, coverage begins on the first day of the month following your application. For example, applications submitted in January become effective on February 1, and applications in February become effective on March 1.

Enroll In Change Or Drop A Medicare Part D Plan

Healthcare in retirement can be more expensive than anticipated. Prescription drug costs are a big reason why. Medicare Part D plans offer a way to reduce your prescription drug costs.

If you aren’t already covered by a Medicare Part D plan, now is the time to sign up. And if you are in a Medicare Part D plan, you might want to consider your options and potentially move to a different one that offers more attractive benefits and lower costs.

If you’ve moved, make sure you’re still in your current Medicare Part D plan’s service area. If not, you’ll need to change plans.

Finally, if you don’t think you need prescription drug coverage, you can drop your Medicare Part D plan during open enrollment. Just be aware that if you require expensive medications next year, you’ll have to pay for them on your own. You won’t be able to reenroll in Medicare Part D until Oct. 15, 2023, except in special cases.

The Motley Fool has a disclosure policy.

You May Like: What Is Oep In Medicare

Aca Open Enrollment Period 2023

The open enrollment period for insurance offered through the Health Insurance Marketplace, commonly referred to as Obamacare, varies by state. Generally speaking, these plans are for people who don’t get health insurance through their employer or are uninsured for another reason and are below 65.

Eighteen states run their own marketplaces. Those residents can head to the state’s marketplace site for open enrollment information. In the remaining 32 states that use the federal marketplace to offer Affordable Care Act plans, residents have from Nov. 1 to Jan. 15 to pick a plan.

If you get employer-sponsored health insurance, you aren’t eligible for ACA plans. To find out when your open enrollment period is, touch base with your company’s human resources department.

Why Should I Use The Fall Medicare Open Enrollment Period

If you have a Medicare Advantage plan or a Medicare Part D policy, your benefits and costs can change yearly.

The Fall Medicare Open Enrollment Period allows you to change your existing coverage if you are not pleased with those changes. When changing a Medicare Advantage or Part D plan, you will never need to answer underwriting health questions. Therefore, carriers cannot deny you a policy based on your health.

During the Fall Medicare Open Enrollment Period, you can make the following changes for the upcoming year.:

- Change from one Medicare Advantage plan to another

- Switch from Medicare Advantage to Original Medicare

- Enroll in a Medicare Advantage plan for the first time

- Change from one Medicare Part D plan to another

- Enroll in a Medicare Part D plan

- Drop Medicare Part D

You can make multiple changes, but the last change you make will go into effect on January 1.

Recommended Reading: How To Find My Medicare Provider Id Number

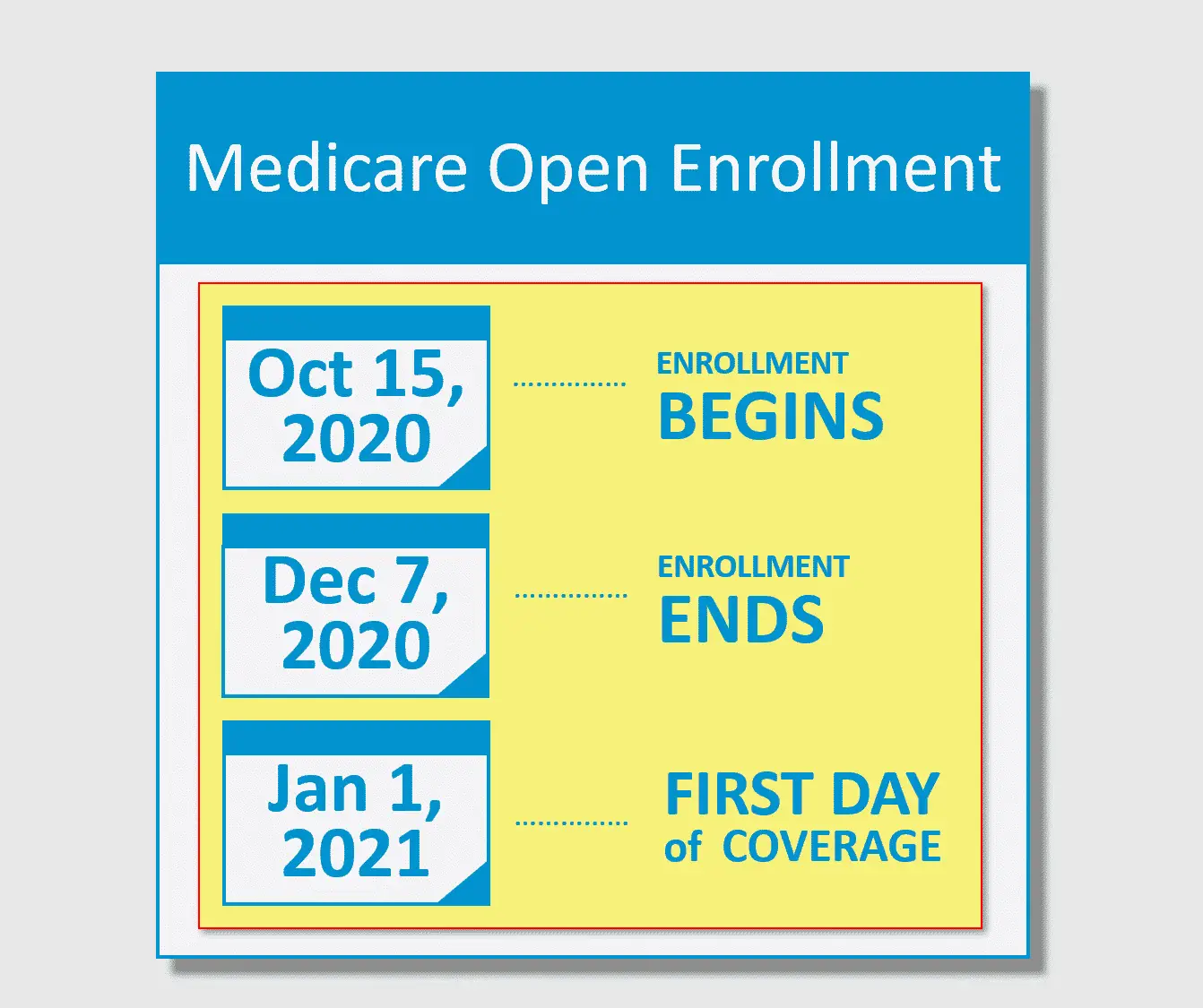

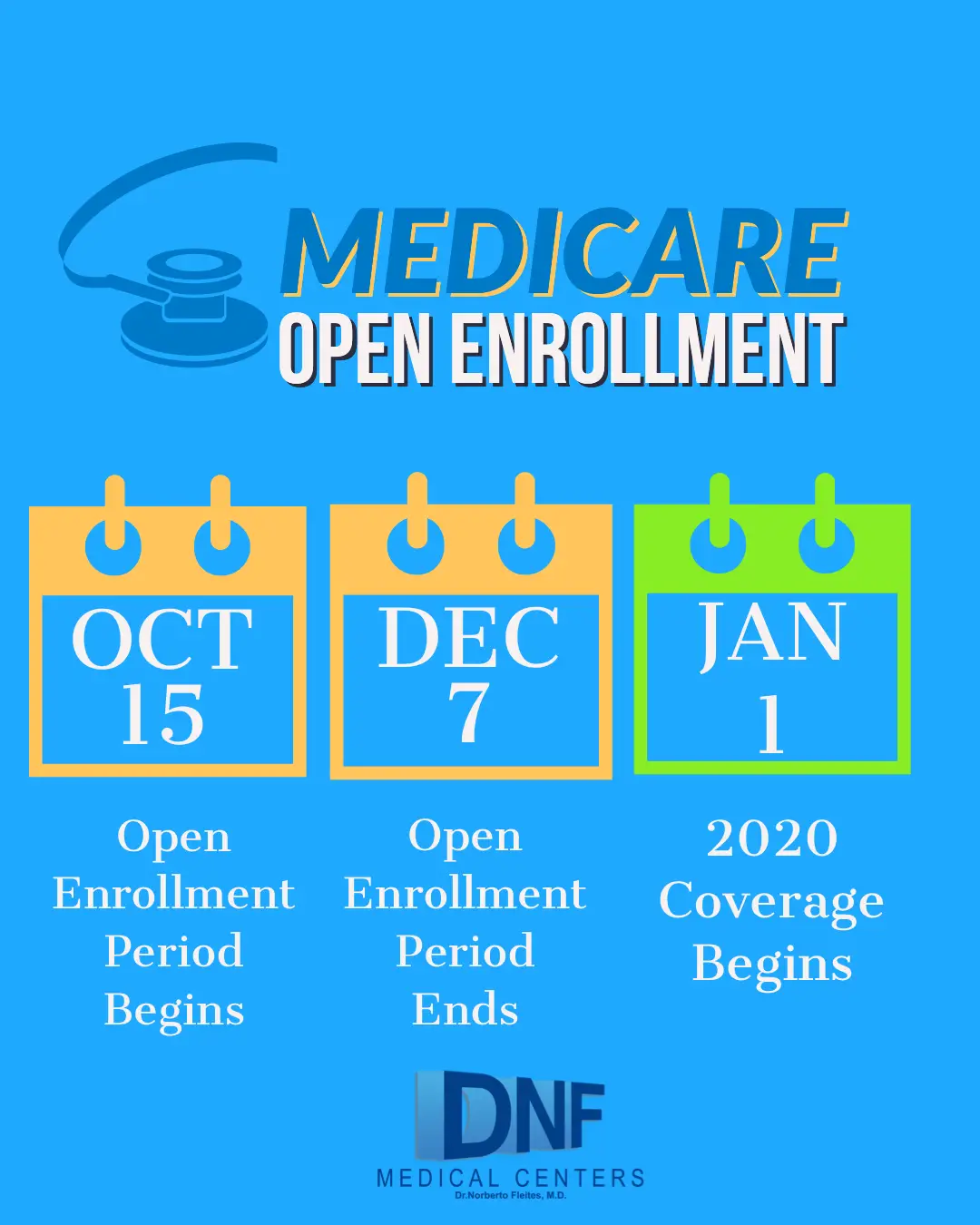

When Is The Open Enrollment Period For Medicare

The Medicare Open Enrollment period runs from October 15 through December 7 each year. During this period, people on Medicare can make a change in their coverage. If you are covered by Medicare, and you are interested in reviewing and comparing your Medicare coverage options, make sure the plans you are considering during the Medicare Open Enrollment period are Medicare plans, not Marketplace plans. Medicare plans are not sold through the federal or state Marketplace websites. You can review and compare your Medicare options on the Medicare Plan Finder, a searchable tool on the Medicare.gov website, or by calling 1-800-MEDICARE . You can also contact the State Health Insurance Assistance Program in your state. SHIPs offer local, personalized counseling and assistance to people with Medicare and their families. You can call 877-839-2675 to get the phone number for the SHIP in your state.

Why Is Medicare Open Enrollment Important

If youre already enrolled in a Medicare plan during Medicare open enrollment, you can make changes to the plan you already have, such as adding Medicare Part B, a Medicare drug plan or a Medicare Advantage Plan. Or you can drop coverage during this period or change to a different Medicare Advantage Plan.

If you turned 65 in 2022 but didnt sign up for Medicare during your Initial Enrollment Period the three months leading up to your 65th birthday, the birthday month and the three following months you can still enroll in Medicare during the annual Medicare open enrollment period.

Before you enroll in Medicare or change your coverage, heres what you need to know about Medicare open enrollment and how to prepare.

Find out: 5 Things to Know About 2020 Health Insurance Open Enrollment

Recommended Reading: Does Medicare Cover The Shingrix Shot

Enrollments And Changes You Can Make During The Annual Open Enrollment Period

Open enrollment is an annual opportunity for Medicare beneficiaries to reevaluate their current plan benefits rather than enrolling for the first time.

You should weigh changes in coverage and out-of-pocket costs including Medicare deductibles, coinsurance, copayments and premiums.

Enroll or Switch During the Annual Medicare Open Enrollment Period

Medicare Advantage Open Enrollment Basics

Medicare Advantage, also known as Part C, is a private insurance alternative to original Medicare that bundles together Parts A, B and D. Think of it as a one-stop-shop option, unlike original Medicare, which requires you to shop around for separate drug coverage and supplemental insurance.

Read your letter. Every September, Medicare Advantage plans are required to send their members a letter called the Annual Notice of Change. This letter will detail changes the plan is making starting in January, such as to benefits, costs or the geographical area the plan covers.

Youll want to use this information as you decide whether to stay with your current MA plan, change to a different MA plan or switch instead to original Medicare.

Special open enrollment period for MA plans. If you are already in an MA plan, youll have some extra time to decide what to do. The special open enrollment period runs from January 1 through March 31. During this window you can switch from one MA plan to another or to original Medicare. If you switch to original Medicare, youll also be able to get a stand-alone Part D prescription drug plan. This special period only applies to people who already have an MA plan.

During open enrollment, you need to check the provider directories of your MA plan to make sure that your doctors are still in the plan. If not, you might want to consider changing plans, depending on how important it is to you that you continue to see specific medical professionals.

Read Also: How To Get Medicare To Pay For Hearing Aids

Medicare Open Enrollment 202: What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare open enrollment is the period from Oct. 15 to Dec. 7 each year when people already enrolled in Medicare can make changes to their coverage

Medicare open enrollment runs from Oct. 15 thru Dec. 7. You can switch from Original Medicare to a Medicare Advantage plan, or vice versa. You can also compare your Part D prescription drug plan coverage to other options.

Its always a good idea to compare coverage and assess your health and prescription drug needs during this time to make sure you have the Medicare coverage thats best for you and your budget, says David Lipschutz, associate director of the Center for Medicare Advocacy.

When Is Open Enrollment For Medicare Supplement Plans

Your initial Medigap open enrollment period is the best time to buy a Medicare Supplement policy. Its the six-month period that begins on the first day of the month in which youre both at least 65 years old and enrolled in Medicare Part B. Some states have additional open enrollment periods, including ones for people under 65.

During this window, insurance companies cannot deny you a Medicare Supplement policy based on your health status or a medical condition, a process known as medical underwriting.

One of the most important things to know about Medigap plans is that you actually dont have many opportunities where youre guaranteed to be issued a policy, says Jacobson. Beyond , your opportunities can be relatively limited depending upon what state you live in.

The Better Medicare Alliance, an advocacy organization, is leading the charge for solutions to streamline the Medicare enrollment process. In a recent report, they note that many health equity gaps arise because of people not fully understanding their coverage options during the short open enrollment period, calling on Congress to make improvements.

Don’t Miss: Do I Need Part C Medicare

Medicare Annual Open Enrollment Period

Medicares annual open enrollment period is October 15 through December 7. During this time, you can select a new Medicare Advantage or Prescription Drug Plan with coverage that will begin January 1. It is also a chance to review and compare your coverage with other available plans and enroll in a new plan.

During the open enrollment period you can:

- Buy a new Medicare Advantage plan if you are enrolled in Original Medicare .

- Switch back to Original Medicare if you currently have a Medicare Advantage plan.

- Change to a new Medicare Advantage or Part D plan if you currently have a Medicare Advantage or Part D plan.

- Buy or cancel a Part D plan if you have, or are signing up for, Original Medicare.

This open enrollment period cannot be used to enroll in Part A and/or Part B for the first time. For information about enrolling in Part A and/or Part B for the first time visit www.medicare.gov or call 800-633-4227.

Note: Each year, insurance companies can make changes to Medicare plans, including changes to the prescription drugs they cover. It is a good idea to review your current Medicare plan every year to make sure it still meets your needs.

For more information about Medicares annual open enrollment period, or assistance with your review and plan comparison, contact the Michigan Medicare/Medicaid Assistance Program at 800-803-7174 or visit their website at mmapinc.org.

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

When Is Open Enrollment For Health Insurance 2023 What To Know About Medicare Aca Plans

‘Tis the season to pick your healthcare plan for the upcoming year.

Open enrollment has begun for Medicare, the Affordable Care Act marketplace and many employer-based health insurance plans. Tempting as it may be to put it off, waiting until the last minute is dangerous especially if you’re new to navigating health insurance plans.

There are free or low-cost services that can help you pick a marketplace plan, but appointments will likely be harder to get the longer you wait.

Don’t Miss: Will Medicare Pay For A Transport Wheelchair

Medicare Open Enrollment Deadline For 2023 Coverage Is Dec 7

Submitted by the Ohio Department of Insurance.

Ohio Department of Insurance director Judith L. French is reminding Ohioans on Medicare that the deadline to select Medicare health insurance coverage for 2023 is Dec. 7 at midnight.

Ohioans on Medicare have the option to select Original Medicare, often paired with a Medicare Part D prescription drug plan, or a Medicare Advantage managed care plan. Medicare Advantage plans provide comprehensive health insurance benefits typically including prescription drug coverage. Medicare information for 2023 can be found at medicare.gov.

Its important that Ohioans on Medicare carefully evaluate their individual health care needs, so they are making informed choices when it comes to selecting suitable health insurance coverage, French said. This should include understanding plan benefits, out-of-pocket costs, covered prescription drugs, in-network physicians, and premiums.

Medicare experts from the departments Ohio Senior Health Insurance Information Program can help. As the states official Medicare assistance program, OSHIIP provides free and unbiased Medicare insight, plan comparison, financial assistance identification, and enrollment facilitation.

OSHIIP staff is available through individual virtual counseling appointments scheduled at insurance.ohio.gov, a toll-free hotline, 800-686-1578, and [email protected].

Ohioans on Medicare can also call 800-MEDICARE for Medicare assistance.

Medicare Supplement Insurance Coverage

Medicare Supplement Insurance, also known as Medigap, helps beneficiaries pay out-of-pocket expenses associated with Original Medicare, including your copays, deductibles, and coinsurance. If youâre struggling with out-of-pocket costs, consider a Medicare supplement plan.

To apply for a Medigap plan, you must already be enrolled in Original Medicare. Once you enroll in Medicare Part B, you will have a six-month period to enroll in Medigap plans. You can also enroll in a Medigap plan during the standard Medicare open enrollment. Itâs possible to cancel and enroll in a new Medigap plan at any time during the year, but insurers arenât required to accept you for a new plan outside of the Medigap enrollment period.

You May Like: Is Ibrance Covered By Medicare

How To Prepare For Medicare Open Enrollment

Keep an eye out for notices in the mail. If youre enrolled in a Medicare plan, the plan will send a Plan Annual Notice of Change each fall, notifying you of any changes in coverage, cost or service areas.

Also review the 2023 Medicare & You handbook online or when you receive it in the mail for information about Medicare coverage. You may be able to find free help with choosing a Medicare plan at your State Health Insurance Assistance Program.

Then compare Medicare Advantage Plans, drug plans or Medigap plans on the Medicare Plan Finder to help you decide on the right one for you.

Now matter what kind of debt you have, Debt.com can help you solve it.

Financial Assistance If You Cant Afford Medicare

If you are having trouble affording your Medicare premiums, copays and other out-of-pocket costs, the federal government has four Medicare Savings Programs that provide help for people with limited incomes. There is also a program called Extra Help that assists beneficiaries with their out-of-pocket costs for prescription drugs. Even if you havent qualified for these programs before, the open enrollment period is a good time to check to see if your financial circumstances now allow you to qualify.

The Inflation Reduction Act also may soon come into play. Beginning in 2024, Medicare beneficiaries with annual incomes of up to 150 percent of the federal poverty limit who also meet the programs resources limit can qualify for full benefits under the Extra Help program. The income threshold for full benefits currently is 135 percent of the federal poverty guidelines .

How to get help picking a Medicare plan

Beneficiaries can compare plans and change their enrollment by going to www.medicare.gov. During the open enrollment period, there is also live chat assistance on the website.

In addition, Medicare has a 24-hour, seven-day-a-week hotline where representatives can answer your open enrollment questions. That toll-free number is 800-633-4227. Also, every state has a State Health Insurance Assistance Program with counselors who can help answer your questions.

More on Medicare

Recommended Reading: What Age Can You Join Medicare

Medicare Supplement Open Enrollment Period

If youre looking to supplement your Original Medicare coverage to help with additional costs, the best time to buy a Medicare Supplement plan is during the six-month enrollment period that starts the first day of the month you turn 65 as long as you have signed up for Medicare Part B.

If you dont sign up for a Medicare Supplement plan during this Open Enrollment Period, you may not be able to buy a Medicare Supplement plan. Unless you have a guaranteed issue right, you may be required to answer medical questions.

Medicare Advantage Open Enrollment

Theres a chance to change Medicare Advantage plans from Jan. 1 to March 31.

Your options are more limited during this specific Medicare Advantage open enrollment period.

You can still switch from one Medicare Advantage plan to another or drop your current Part C plan and return to Original Medicare.

The Medicare Advantage open enrollment period isnt meant for people who already have Original Medicare coverage.

But if you are unhappy with the Medicare Advantage plan you purchased during the annual Medicare open enrollment period Oct. 15 to Dec. 7 then you can switch Medicare Advantage plans again during the Medicare Advantage open enrollment period.

There are a few things you cant do during the Medicare Advantage enrollment period, including:

- Switch from Original Medicare to a Medicare Advantage plan.

- Join a Part D plan if you’re in Original Medicare.

- Switch from one Part D plan to another if you’re enrolled in Original Medicare.

After your plan provider receives your request to join, your new coverage will begin the first day of the following month.

If you want to switch to a Medicare Advantage plan, you must have Part A and Part B first. You must also live in the plans service area.

Most people with end-stage renal disease cannot join a Medicare Advantage plan.

Also Check: How Can Medicare Advantage Be Free