What Is The Difference Between Ppo And Hmo Plans

Medicare PPOs are different from Medicare HMOs because they allow beneficiaries the opportunity to seek services from out-of-network providers.

When you visit out-of-network providers with a PPO plan, you are covered but will pay more for the services. When you use out-of-network providers with an HMO plan, you are generally not covered and will pay the full cost for those services.

Consider Premiumsand Your Other Costs

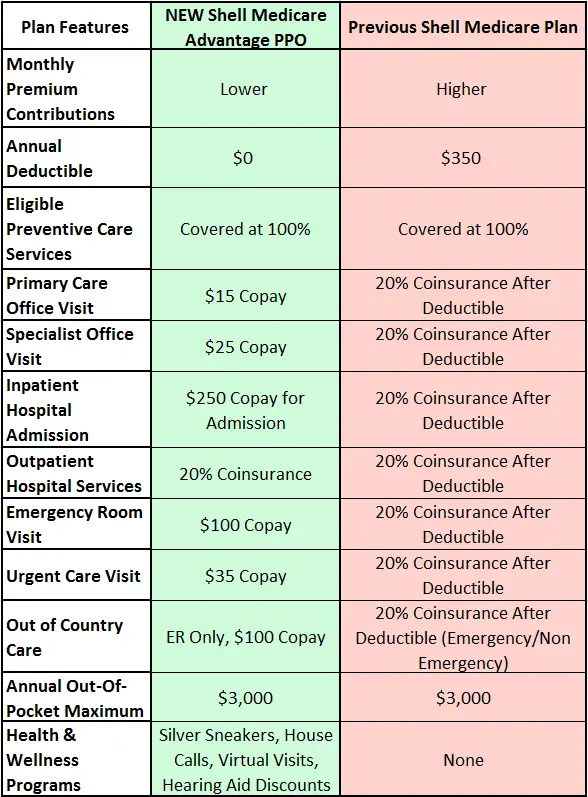

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

- Hospital stay$175 per day for the first 10 days

- Ambulance$300

- Diabetes suppliesup to 20% copay

- Diagnostic radiologyup to $125 copay

- Lab servicesup to $100 copay

- Outpatient x-raysup to $100 copay

- Renal dialysisup to 20% copay

As this non-exhaustive list of copays demonstrates, out-of-pocket costs will quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

What Is The Difference Between Medicare Advantage Hmo And Ppo

Medicare advantage HMO and Medicare advantage PPO plans are similar, but not the same. As Part C of Medicare, those plans are subsidized and regulated by Medicare, but provided by private insurance companies. If you are enrolled in an advantage plan, you still have to pay your monthly Medicare Part B premium, but your health care for Medicare approved services will not be paid by Medicare anymore, but by the plan.

Per law, advantage plan benefits must be equal to or better than Medicare Part A and Part B benefits of original Medicare. As the competition among insurance companies is high, many offer additional benefits for the enrolled, which may include prescription drug coverage, fitness or wellness programs, or even help with eyeglasses or hearing aids. Most Medicare advantage plans are set up as HMO or PPO plans, with a network of providers that have agreed to provide services to the plan members at negotiated rates.

Medicare Advantage HMO Plans

In a HMOs, or Health Maintenance Organization, the insured have to select their primary care physician from the plans list of providers. If is is not an emergency, and you need to go to the hospital or if you must see a specialist, your PCP will have to give you a referral. If you use without an emergency a provider outside of the plans network, or service area, or dont get the referral, neither your Medicare advantage insurance nor original Medicare will pay for it.

Medicare Advantage PPO Plans

Don’t Miss: Does Medicare Cover Continuous Glucose Monitoring Systems

How Much Does A Medicare Advantage Ppo Plan Cost

You can expect to pay the plans monthly premium in addition to your monthly Medicare Part B premium. Many Americans have access to a $0 premium PPO plan with drug coverage. Youre responsible for copayments and coinsurance for each service or drug received, after you have met your deductible. Most PPO plans require copays for services and treatments in network, and coinsurance for services out of network. You pay copays or coinsurance for medications. PPO plans pay for services you receive out of network, but your cost sharing amounts are higher.

See how costs compare for these 2022 PPO plans with drug coverage for a 67 year old female in Chicago, IL

| Plan name |

| $3,450 in network $5,150 in and out of network combined |

Medicare Advantage Hmo Vs Ppo: Which Is Better

There’s no right choice for everyone. Instead, Medicare Advantage beneficiaries should review the terms of specific plans available in their area. HMOs typically have lower monthly premiums, though fewer clinicians will be covered. This can be a problem if you are selective about your doctors or a doctor you like is not in-network.

PPOs generally offer a wider variety of clinician choices, but you may pay a higher monthly premium. And if you choose to seek care out-of-network, you’ll pay more.

Read Also: What Does Medicare Cost Me

Retiree Group Medicare Plans

Our retiree group Medicare plans are Blue Cross Group Medicare Advantage , Blue Cross Group Medicare Advantage Open Access SM and Blue Cross Group MedicareRx SM. BlueStagesSM is a Medicare supplement insurance plan that helps cover some costs beyond what is covered by Original Medicare.

|

Out-of-network Note: If you see Medicare members or accept Medicare assignment and are willing to bill BCBSTX, you may treat Blue Cross Group Medicare Advantage Open Access members. Out-of-network providers will be paid the Medicare-allowed amount less any member cost-sharing. In-network providers will be paid at their contracted rate. BlueStages members also can see providers nationwide who accept Medicare assignment. |

Is A Medicare Advantage Ppo Different From A Regular Ppo

You may have heard the term PPO or used a PPO plan before you became eligible for Medicare. Thats because PPO plans arent limited to Medicare Advantage. PPOs are common types of health plans offered by private insurance companies such as United Healthcare and Aetna.

If youre familiar with using a PPO plan outside of Medicare Advantage, you can rest easy. A Medicare Advantage PPO plan works much the same way. The only difference is that instead of your employer covering part of the insurance cost, the federal government does.

Some Medicare Advantage PPO plans even offer benefits that arent typically included in non-Medicare PPO plans, such as dental care, eyeglasses, and wellness programs.

Recommended Reading: Can A Green Card Holder Apply For Medicare

What Are The Main Differences Between Medicare Hmo And Ppo Plans

Medicare Health Maintenance Organizations and Preferred Provider Organizations plans are both network-based plans. Here’s how they differ:

| Plan type | What it covers |

|---|---|

| Group Medicare Advantage HMO plans | These plans provide coverage for members through a network of locally contracted doctors and hospitals. They generally do not provide out-of-network coverage, except in emergencies. |

| Group Medicare Advantage PPO plans | Group PPOs offer flexibility, with access to providers nationally, in and out of network. |

Switch Your Plan Not Your Doctor

Though you have a new plan option, chances are you may be able to continue seeing your doctors. This is because this plan is the Aetna Medicare Plan with an extended service area . This is a type of Medicare Advantage plan. With this type of plan you pay the same cost for any doctor or hospital, according to the costs listed on the plan benefits summary. The provider must be eligible to receive Medicare payment and accept the Aetna plan.

- Instructions on how to use Aetna Medicare Advantage provider search »

-

- Step 1: After clicking on Find your provider, choose 2022 Medicare plans you through your employer

- Step 2: Enter your home zip code OR city, state then select from the drop-down

- Step 3: Choose select plan to find providers

- Step 4: Choose Medicare Advantage with Prescription Drug plan

- Step 5: Under PPO section Select Aetna Medicare Plan with Extended Service Area *

- Step 6: Then choose medical and click continue to find care at the bottom right of your screen to find providers

*As a member of the Aetna Medicare Plan with an Extended Service Area , you can receive services from any provider that is eligible to receive Medicare payment and is willing to treat you. Your cost share will be the same as in-network care. Out-of-network providers are under no obligation to treat Aetna members, except in emergency situations.

You May Like: How Will Bernie Sanders Pay For Medicare For All

Who Should Get A Medicare Advantage Ppo Plan

A Medicare Advantage PPO plan might be a good fit if you:

- Plan to travel and dont want to be restricted by the more rigid network requirements of an HMO

- Dont want to be bound by specialist referrals from PCPs

- Want more diverse coverage that encompasses extras, such as dental, vision, hearing, and prescription drug coverage

- Have a larger budget to spend on premium Medicare coverage

- Dont want to designate a PCP

- Dont want to pay steep costs associated with out-of-network providers. You pay more for these services with a PPO, but with a HMO, they may not be covered at all.

- Want access to more hospitals and providers

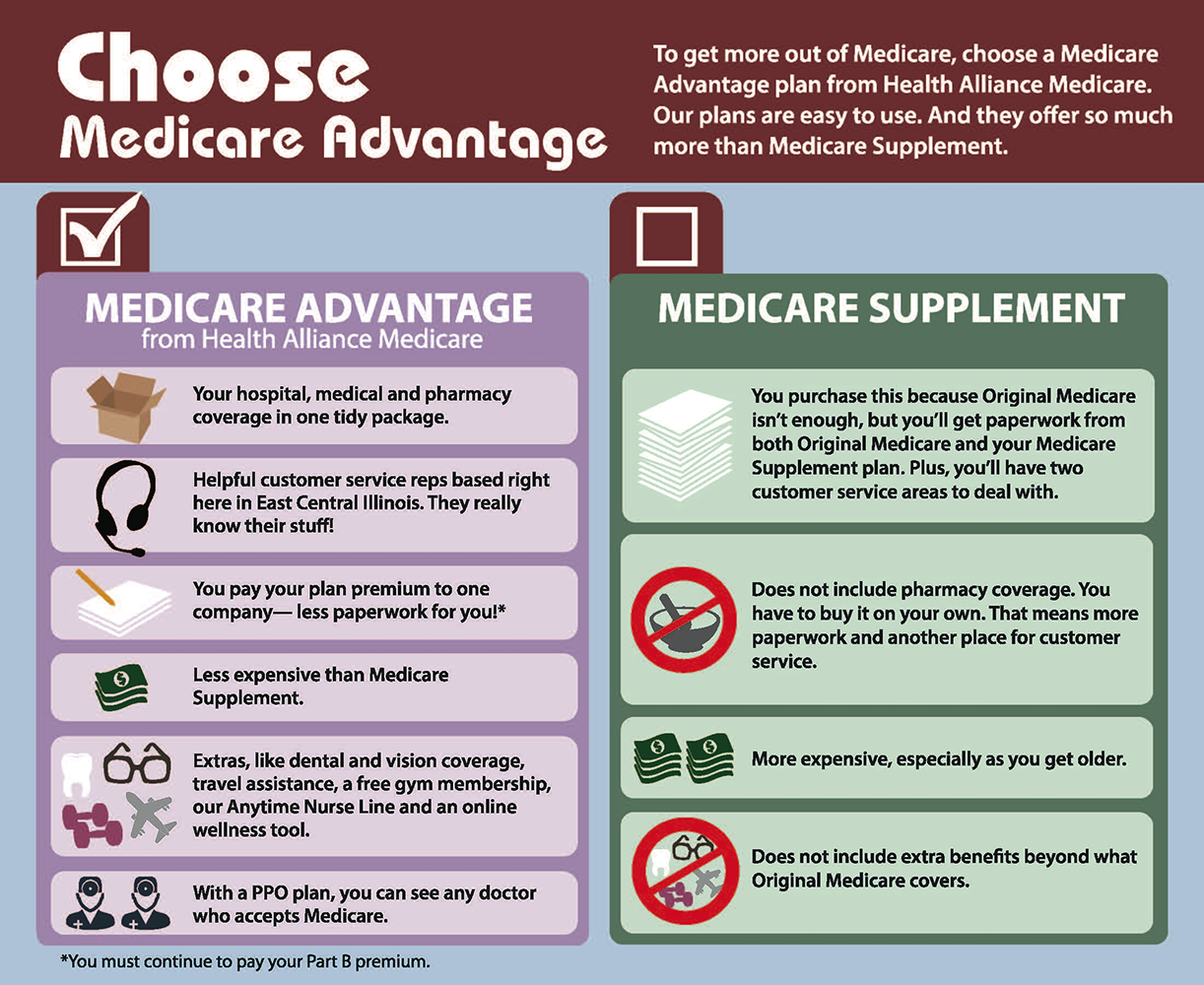

Claims In Medicare Advantage Ppo Vs Medigap

A Medicare Advantage PPO Plan could deny your claim. With original Medicare and a Medicare Supplement Plan, there is no arguing with the insurance company. If Medicare pays its portion, the Medicare Supplement Plan MUST also pay its portion. If Medicare says it wont pay for your service, then your Medigap plan wont cover it either. Its that simple.

Also Check: How Does Bernie Sanders Pay For Medicare For All

Do I Have To Receive Care From A Preferred Provider In My Plan Network

You do not necessarily have to seek out services from a health care provider who is part of your plan network, but doing so can typically help you save money on your covered care. By visiting the PPO plan preferred providers for treatment, you will likely pay less money out of pocket, as the plan will typically provide a higher amount of coverage.

Should you seek care from a provider who is not part of your Medicare PPO plan network, you may be subject to higher costs for your care. However, out-of-network care may still be covered to some extent.

Medicare Ppo Vs Original Medicare

A Medicare Advantage PPO plan must cover the same types of services as Original Medicare. However, the main difference between the two is that Original Medicare runs through the government. On the other hand, Medicare Advantage plans are available through private insurance companies.

This means that the costs for Medicare Advantage PPO plans may vary.

Unlike Medicare Advantage PPO plans, Original Medicare does not have provider networks. You can see whatever health care provider you want, as long as the provider accepts .

So, no matter which doctor you see, you will always pay the same price. However, if a doctor does not accept Medicare, you will need to pay the full cost of services on Original Medicare or a Medicare PPO plan.

When you enroll in Original Medicare, you are eligible to enroll in a Medicare Supplement plan to help cover out-of-pocket costs. However, you cannot get a Medicare Supplement plan if you have a Medicare Advantage PPO plan or any Medicare Advantage plan.

- Was this article helpful ?

Don’t Miss: How Old To Be To Get Medicare

Humana Group Medicare Advantage Ppo Enhanced Plan

State Health Plan Medicare retirees have several options for health plan coverage. One of these options is the Humana Group Medicare Advantage PPO Enhanced Plan *, which includes Medicare prescription drug coverage and a premium for subscribers.

* The Humana Group Medicare Advantage Plans have a benefit value equivalent to a 90/10 plan.

Below are resources for members enrolled in the Humana Enhanced Medicare Advantage Plan.

What Insurance Companies Offer Medicare Advantage Plans

Aetna Aetna offers 2 plans Medicare Advantage:

- Medicare Advantage with Part D: This plan offers an HMO and PPO plan with prescription drug coverage.

- Medicare Advantage Plan with no Part D: This plan is only offered as an HMO plan. In addition to the different versions of Medicare Advantage plans offered, Aetna offers other added benefits. Aetna offers the following benefits to individuals with Medicare Advantage plan : Generic drugs for blood pressure, diabetes, and cholesterol have $ 0 copayment, free memberships to gyms, free annual exams, free hotline to licensed nurses 24 hours a day.

Blue Cross and Blue Shield Under Blue Cross insurance, Medicare Advantage plans are referred to as Medicare Plus Blue plans. Blue cross offer the following Medicare Plus Blue plans:

- Blue Medicare Advantage Plus HMO

- Medicare Plus Blue PPO

- Blue Medicare Advantage Premier HMO

- Medicare Plus Blue PPO Vitality

- Medicare Plus Blue PPO Essential

- Medicare Plus Blue PPO Assure

- Medicare Plus Blue PPO Signature

Under the PPO plans, no referrals are needed to see specialists. In addition, most BCBS plans offer Medication Therapy Management Program, free gym memberships, preventative care for vision and hearing and wellness programs. The only disadvantage to choosing a Medicare Advantage plan under BCBS, is that different plans are offered for different states. It will be beneficial to talk to a BCBS agent in your state to help choose the best plan for your health needs.

You May Like: Can You Get Medicare If You Are Still Working

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur until you can switch plans during the next open season for Medicare. At that time, you can switch to an Original Medicare plan with Medigap. If you do, keep in mind that Medigap may charge you a higher rate than if you had enrolled when you first qualified for Medicare.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

Curious About Our Ppo Plan Coverage

If the security of a broad range of benefits is your highest priority, all of our PPO plans offer all the benefits of Original Medicareand then some. Plans may include:

- Coverage for prescription drugs – most of Humanas PPO plans include coverage for prescription drugs

- Broad network of providers – with a PPO, you have the flexibility to visit providers outside of your network, but visiting an out-of-network provider will usually cost you more

- Dental benefits – unlike Original Medicare, many of our plans include coverage for routine dental care such as cleanings, exams, and X-rays

- Vision benefits – many of our plans also include coverage for eye exams, lenses and frames

- Hearing benefits – many plans include coverage for hearing aid devices, audiologist visits and ongoing fittings and exams

- PPO plans do not require referrals for any services

You May Like: Does Medicare Part B Cover Durable Medical Equipment

What Do Medicare Advantage Ppo Plans Cover

These plans provide the same level of coverage as Medicare Part A and Part B, and more. A Medicare Advantage PPO plan might also cover things like:

- Dental care

- Fitness plans and gym memberships

- Access to 24-hour Nurse Helplines

*If you want Medicare drug coverage, you must join a PPO plan that offers it. If you join a Medicare Advantage PPO plan that doesnt offer prescription drug coverage, you wont be eligible to sign up for a Medicare prescription drug plan .

In most instances, you can use your Medicare Advantage PPO plan with doctors or hospitals in your area. But, if your doctor, specialist, or hospital isnt included on your plan, youll have to pay more. This is why it is important to verify that your preferred healthcare providers and hospital are included in your plan.

How Common Are Medicare Ppo Plans

There were 618 Medicare PPO plans available in 2018, which represented about 28 percent of all available Medicare Advantage plans.1 As of 2018, every state except Alaska, Delaware, Minnesota, New Hampshire, North Dakota and Wyoming offered at least one local or regional Medicare PPO plan.

In 2017, more than 6.2 million people were enrolled in a local or regional Medicare PPO plan, which represented more than a third of all Medicare Advantage plan holders.2

You May Like: Does Medicare Advantage Cover Shingles Vaccine

What Is A Medicare Advantage Ppo Plan

Aug 28, 2017 | Medicare, Medicare Advantage Plans |

A Preferred Provider Organization is a type of Medicare Advantage plan offered by a private insurance company. PPO plans typically require plan members to obtain health care services through one or more of its participating doctors, hospitals, and health care facilities. You pay less if you use providers that belong to the plans network. But unlike the more restrictive HMO plan option, you can still opt to seek care from an out-of-network provider for a higher copay or coinsurance.

Medicare Advantage Hmo Vs Ppo Plans: How Theyre Different

Medicare Advantage HMO plans and PPO plans are probably more alike than different. But there are a few âHMO vs. PPOâ contrasts:

- Although they generally have provider networks, Medicare Advantage PPOs let you see doctors outside the plan network. You might have to pay higher coinsurance or copayments for seeing out-of-network providers.

- You donât have to choose a primary care provider with a Medicare PPO, but you do with an HMO.

- If you want to see a specialist, an HMO generally requires you to get a referral. A PPO typically lets you see a specialist without a referral.

Although Medicare Advantage PPO plans may offer more flexibility, your costs are generally higher under a PPO.

You might need to take a more active role in care coordination in a PPO plan. For example, if you see providers outside the Medicare Advantage PPO planâs network, you may have to give information about the medical care you have received and your prescription drugs to doctors who treat you.

With any type of Medicare Advantage plan, youâll need to keep paying your Medicare Part B monthly premium, as well as any premium the plan might charge.

The pharmacy network, and/or provider network may change at any time. You will receive notice when necessary.

This information is not a complete description of benefits. Contact the plan for more information. Limitations, copayments, and restrictions may apply. Benefits, premiums and/or co-payments/co-insurance may change on January 1 of each year.

Recommended Reading: What’s My Medicare Provider Number