Original Medicare And Medicare Advantage

Original Medicare, a government program, consists of the combination of Part A hospital insurance with Part B medical insurance.

However, if you sign up for Medicare Part A only, then you do not qualify for other helpful benefits through Medicare health plans, which require having Original Medicare.

A central choice that Medicare beneficiaries make lies between getting health insurance through the government Medicare program, or through a private plan that provides equal or greater coverage than the government program.

Without both Medicare Part A and Part B, a person cannot get any benefits from Part C: Medicare Advantage plans, or the added protection of Medigap.

Medicare Advantage plans can offer more benefits than Original Medicare while possibly costing less. These Part C can even build in the prescription coverage of Part D.

Comparison shopping will help subscribers compare Original Medicare to Medicare Advantage.

Can I Sign Up For Medicare Part A Only

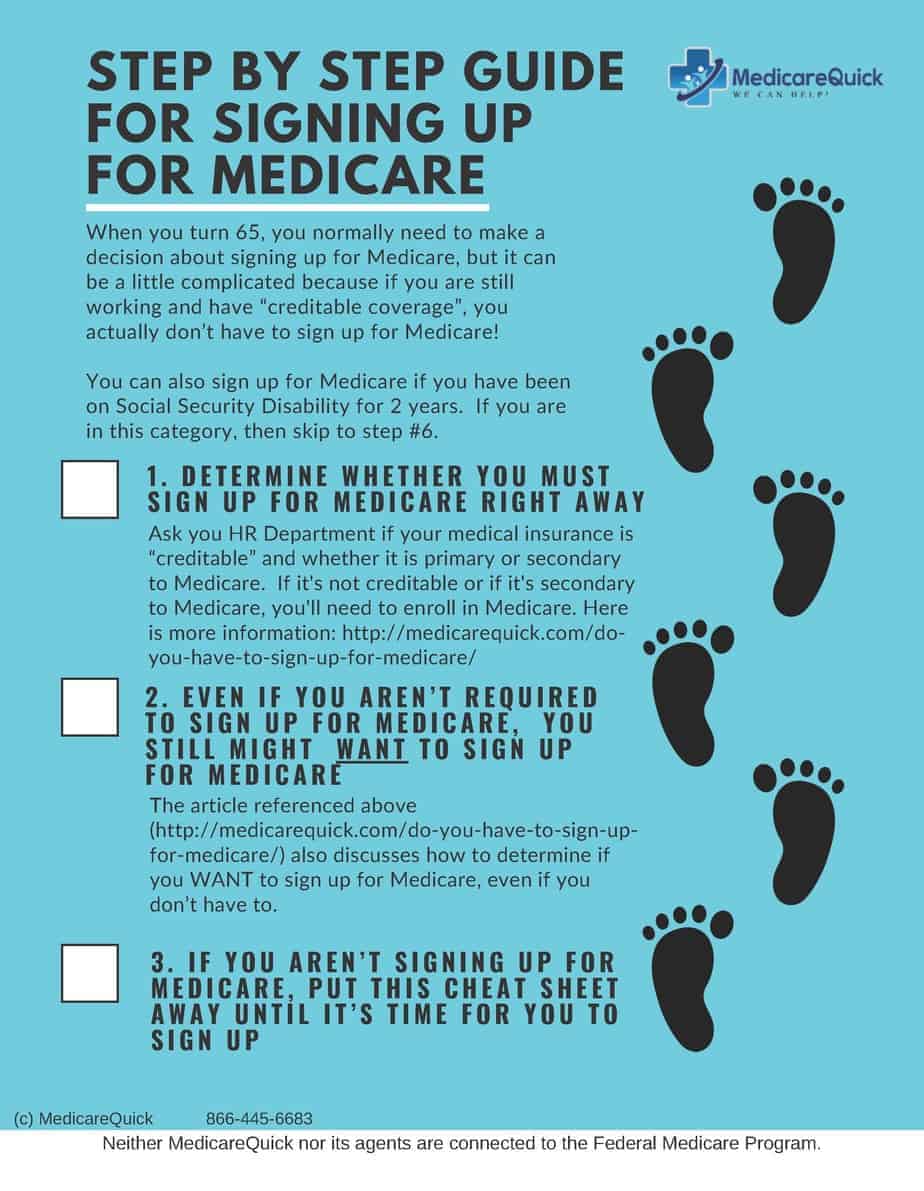

It is not unusual to sign up for Medicare Part A and Part B as soon as you are eligible. However, many people who are still working or have another creditable health coverage source will delay Medicare Part B and sign up for Medicare Part A only.

For most, Medicare Part A has no premium. You qualify for premium-free inpatient coverage when you pay Medicare taxes for 40 quarters .

Once you become eligible for Medicare and receive Social Security benefits, you must complete form CMS-1763 through your local Social Security office to sign up for Medicare Part A only. On this form, you must check the box to request termination of medical insurance .

Those not yet receiving Social Security benefits will need to enroll in Medicare through the Social Security Administration. There are a few options for how to do this, which we describe below. It makes sense to sign up for Medicare Part A when you become eligible, especially if you have all the tax credits you need to receive this coverage with no premium.

Understanding The Different Medicare Plans When To Enroll And How

Healthcare is important, especially as we get older. If you’re approaching 65, you’re eligible to enroll in Medicare.

Medicare provides healthcare for retired folks 65 and older and those with certain disabilities. However, many seniors don’t know what kind of coverage they have or even if they have coverage at all. While 34% of people aren’t familiar with Medicare, 64% don’t know which part of Medicare to enroll in.

Let’s help you navigate Medicare so you can get covered.

Recommended Reading: Does Medicare Cover Smoking Patches

Ways To Apply For Disability Benefits:

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Once your disability benefits start, well mail you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up for Part B and pay a monthly late enrollment penalty.

How Much Is The Medicare Part D Late Enrollment Penalty

The Medicare Part D Late Enrollment Penalty is calculated based on how long you have been without creditable prescription coverage. In other words, your penalty is applied when you enroll in a prescription plan. If you wait longer, the penalty will be higher. The penalty is 1% per month that you dont have a plan. The 1% per month is multiplied by the national base beneficiary premium for 2018, this is $35.02.

For example, if you turned 65 in April of 2015, have no other drug coverage, and enrolled in a Part D plan to start 1/1/18, your penalty would start after your initial election period expired . Your penalty would be for 29 months .29 x $35.02 = $10.16. They round this to the nearest .10, so you would pay $10.20/mo on top of the Part D premium of the plan you select.

It is important to note that the national base beneficiary premium for Part D changes over time. Thus, your Part D late enrollment penalty can also change over time.

Also, the penalty is a permanent penalty. It stays with you as long as you have a Part D plan and does not go away or get reduced over time.

You May Like: Does Humana Medicare Cover Tdap Vaccine

Medigap Open Enrollment Period

Your Medigap Open Enrollment Period is the six-month window that begins the first day of the month you turn 65 and are enrolled in Part B. For example, if you turn 65 and are enrolled in Part B in January, you can buy a Medigap policy between January and June. This enrollment window cant be changed or repeated.

During this open enrollment period, you can buy any Medigap policy sold in your state, even if you have health problems.

But after your open enrollment period, you may not be able to buy a Medigap policy depending on your health status and may be subject to a health review.

Your new coverage begins on the first day of the month after you sign up.

Applying For Medicare When You Have Large Employer Coverage

Medicare can coordinate with your employer insurance even if you or your spouse are still working. If you or your spouse are actively working at an employer with 20+ employees and you are covered by that insurance, Medicare will be secondary to the employer coverage.

In that case, you can choose whether to enroll in Medicare Part B or delay your enrollment into Part B until later. Your group health plan likely has coverage for medical services already built in, so delaying Part B enrollment can save you money until you retire from your job.

When to apply for Medicare varies for each person. Whats worse is that even though these rules exist, there are often workers at Social Security who will get them wrong. This can really affect you, so contact a Medicare insurance broker like Boomer Benefits for help. We have solved Medicare enrollment issues for our clients with plain facts in many conference calls with Social Security.

Lastly, if you are still working at 65, well evaluate the costs of your employer coverage compared to Medicare. If staying at your employer insurance makes more sense, we can help you decide whether to enroll in Parts A or B or both.

Please note, you will qualify for a Special Enrollment Period after 65 and will need to submit documentation when you apply for Medicare due to loss of employer coverage. The two documents include CMS form 40B and CMS form L564 which is your proof that you had creditable coverage during employment.

Recommended Reading: When Do I Apply For Medicare Part B

Sign Up: Within 8 Months After You Or Your Spouse Stopped Working

Your current coverage might not pay for health services if you dont have both Part A and Part B .

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: Will Medicare Pay For A Roho Cushion

Signing Up For Medicare Online Step

Signing up for Medicare online through the Social Security Administration is the fastest way to apply.

Enrollment takes less than 10 minutes online, according to the Social Security Administration.

How to Apply for Medicare Online

You will be asked to provide your current health insurance information or, if you receive Medicaid benefits, your Medicaid number.

You may be required to provide additional documentation if you are:

- Not a U.S. citizen

- Applying under your spouses work record

- Over age 65 and transitioning from your employers health coverage

After youre enrolled, CMS will send you a welcome packet in the mail along with your Medicare card.

If you sign up for Medicare on your own, the packet should arrive about two weeks after you sign up.

You will also receive a Medicare & You handbook, which includes important information about your coverage.

What Are Medigap Plans

Medigap plans are Medicare Supplement Insurance offered by Medicare-approved private insurance companies to help cover cost sharing requirements of Original Medicare Parts A and B.

While Medicare pays for a large percentage of the health care services and supplies you may need, you are still responsible for a portion of the costs in the form of deductibles, copays, and coinsurance. Medigap policies help with these costs and sometimes offer more coverage for excess charges and foreign travel health emergencies.

Medigap plans are standardized by Medicare and regulated by state laws and insurance commissioners. You pay a monthly premium for Medigap. Costs and availability of Medigap plans vary depending on several factors including your age and gender, the insurer, and your state of residence. Learn about Medigap in Alaska so you can determine which plan best meets your needs.

- In 2019, there were over 17,000 Medicare Supplement enrollees in Alaska.

- Plans F and G are the most popular and comprehensive Medigap plan types in Alaska. Plan F is no longer available to people who are eligible for Medicare after December 31, 2019.

- Monthly premiums for Plan G for a 65 year old female who doesnt use tobacco range from $105 to $328.

- Alaska does not require Medigap insurers to offer plans to disabled Medicare beneficiaries under age 65, however one insurer does currently offer a plan to enrollees under 65 at a much higher monthly premium.

You May Like: How To Change Medicare Plans When You Move

Do You Have To Sign Up For Medicare When Youre 65

As long as you have creditable coverage, you dont have to enroll in Medicare when you are 65. Technically, you dont have to sign up for Medicare at all if you dont want to. Medicare is not mandatory, but it is important to be aware that if you choose to sign up later without creditable coverage, youll incur penalties that you may be stuck with for the rest of your life.

The most common reason a new beneficiary may delay enrolling in Medicare is that they have coverage through their employer. However, not all group coverage is creditable coverage. The size of your employer will determine if the coverage is creditable.

Medicare Advantage Open Enrollment Period

Medicare Advantage Open Enrollment happens every year from Jan. 1 to March 31. If youre enrolled in a Medicare Advantage plan and want to make changes, you can do one of these:

- Switch to a different Medicare Advantage plan with or without drug coverage

- Go back to Original Medicare and, if needed, also join a Medicare prescription drug plan

Your new coverage begins on the first day of the month following the month you make a change and will be in effect for the rest of the year.

Also Check: Does Medicare Cover Bariatric Surgery

Applying For Medicare As Your Primary Coverage

If Medicare will be your primary coverage, you should enroll in Medicare in the 3 months before your birth month. Your Medicare will start on the first of the month in which you turn 65. Enrolling prior to your birthday will ensure your benefits begin on the first of your birthday month.

If you register for Medicare in the 3 months after your 65th birthday, then your start date will be later. People unaware of this could end up with a few months of no health coverage. Its important to realize that your application date affects your start date.

Also, if you are leaving employer coverage in the middle of your Medicare Initial Enrollment Period, then your IEP trumps any other election period. Weve seen this a number of times where people assume their Medicare coverage will start immediately after the group coverage ends.

However, if you are in your IEP and your birth month has already passed, this chart demonstrates that you must wait for your coverage.

Its easy to see why applying for Medicare prior to your 65th birthday month is generally in your best interest. Although, it is ultimately your choice on when to apply.

Applying During the General Enrollment Period

Medicare Enrollment and Small Employer Coverage

Medicare Late Enrollment Penalties

If youre not automatically enrolled in Medicare and you dont apply on time, you may face late enrollment fees:

-

Medicare Part A: If you must buy Part A and you dont purchase it during your initial enrollment period, you may owe 10% more than the monthly premium for twice the time period you didnt sign up.

-

Medicare Part B: If you dont sign up for Part B during your initial enrollment period, your monthly premium may see a 10% bump for each 12-month period that you went without Part B coverage. Youll usually pay this penalty as long as you have Part B.

-

Medicare Part D: If you go without Medicare drug coverage or other creditable prescription drug coverage for 63 or more days once your initial enrollment period ends, you may pay a penalty for as long as you have Medicare drug coverage. The penalty is calculated as 1% of the national base beneficiary premium multiplied by the number of full months you werent covered. This is rounded to the nearest 10 cents, and its recalculated each year.

Also Check: How To Get Free Medicare

Do I Have To Join A Medicare Part D Prescription Drug Plan

En español | Part D is voluntary, so you are not forced to sign up. You may not need it anyway if you have drug coverage from elsewhere that is creditable meaning Medicare considers it to be the same or better value than Part D. This coverage could come from an employer or union, retiree benefits, COBRA or the Veterans Affairs health program all of which must by law tell you whether it is creditable

But without such alternative coverage, you need to consider the consequences of failing to join a Part D drug plan when youre first eligible:

- You would have no coverage for prescription drugs, and if you suddenly needed them you wouldnt be able to get Part D immediately. Youd have to wait for the next annual open enrollment period, which runs from Oct. 15 to Dec. 7 each year, with coverage beginning Jan. 1.

- You would be liable for late penalties, based on the number of months you had been without Part D or other creditable drug coverage since you turned 65. These penalties take the form of surcharges that are added to your Part D plan premiums for as long as you remain in the Part D program.

Also Check: Can You Get Medicare If You Are Still Working

How And When Can You Switch Medicare Plans

If you want to make a change to your plan or switch to another plan, such as changing from a Medicare Supplement plan to a Medicare Advantage plan, you can do so during the Annual Election Period 2. The AEP lasts from October 15 to December 7 each year.

Outside of the AEP, if you have certain life events such as moving or your plan changes, you may be eligible for a Special Enrollment Period 1. You may also be able to switch your Medicare Supplement plans if you have guaranteed issue rights3 or are within your 6-month initial enrollment period.

Don’t Miss: Are Blood Glucose Test Strips Covered By Medicare

Do You Need A Medicare Supplement In Alaska

| Should you consider a Medicare supplement? | |

Yes, if you:

|

No, if you:

|