Will My Medicare Supplement Plan Auto

You may drop a Medicare Supplement Insurance plan at any time. However, you may have trouble being accepted into a new Medigap plan, and you will likely be subject to medical underwriting if you do so.

In many cases, you may be able to take advantage of a 30-day free look period:

- For 30 days, you can carry two Medigap plans: your current plan and the plan you are considering changing to.

- At the end of the 30 day period, you will decide which plan to keep and which one to drop.

- You will need to pay the plan premiums for both plans while you are enrolled in each plan.

New Medicare Advantage Plans Each Year

One of the most important reasons to review your plan options is that new Medicare Advantage plans become available each year. In 2020, there were 3,148 Medicare Advantage plans available nationwide. This includes 855 special needs plans, which cater to people with specific chronic conditions or long-term care needs.

If you have original Medicare, a Medicare Advantage plan may cover additional services, such as vision and dental care. If you already use Medicare Advantage, a different plan might better serve your needs. Reviewing your options can help you select the plan that best fits your current health and financial realities.

Do You Have To Renew Original Medicare Part A

Most people do not have to pay a premium for Part A and are automatically renewed each year without having to do anything.

One exception may be if you do not sign up for Part A when you turn 65 due to having primary insurance from your employer or spouses employer. Once you lose that other primary coverage, you must enroll in Part A to avoid late enrollment penalties.

You are automatically enrolled in Part A if you are already getting Social Security benefits at least four months before you turn 65. If you arent getting Social Security benefits, you can enroll in Part A coverage through Social Security by calling, visiting their website, or going to a local branch.

Recommended Reading: Which Glucometer Is Covered By Medicare

When To Sign Up For Medicare Plans

When you sign up for the various Medicare coverages and when each one comes into effect varies with the different Plans. A general outline follows specific situations or health conditions touch off a number of different enrollment periods. For fuller details see the publications.

Enrolling in Medicare parts A & B:

Part A

For qualified individuals, you should sign up during the Initial Enrollment Period of seven months around the month you turn 65 . Note that this may be before you can or choose to file for Social Security benefits. If you enroll prior to the birthday month, you will start being covered as of your birthday month. If you enroll during the last four months of the period, coverage will start with an additional months delay.

If you didnt sign up for Part A during your Initial Enrollment Period, you can sign up during the General Enrollment Period between January 1 and March 31 each year. Coverage will begin July 1. If you are a qualified individual, there may be a penalty premium for late sign-up, as mentioned above .

In certain cases, if you did not sign up for Plan A when initially eligible because you were covered under a group health plan based on current employment, you can sign up later during a Special Enrollment Period. See Publication 11219 for details.

Part B :

Part C and Part D :

Some addiitonal information on Medicare sign up can be found at the following non-US government links:

Read Also: How To Find Someones Medicare Number

What Happens If You Miss Your Medigap Open Enrollment Period

If you miss your initial open enrollment period, you generally have to wait until the annual Medicare open enrollment period to request coverage. However, if you have a guaranteed issue right as explained above, you can work with a private insurance provider outside your initial open enrollment period to enroll in coverage that suits your needs.

Also Check: Does Medicare Cover Orthotic Shoe Inserts

Delaying Medicare Due To Work: Special Enrollment Period

If you didn’t enroll in Medicare because you were still working, and you were covered under a group health plan based on employment, you have a Special Enrollment Period during which you can sign up for Part A and/or Part B. While you or your spouse are still working and you’re still covered under a group health plan, you can sign up anytime.

After your or your spouse’s employment ends, your Special Enrollment Period lasts eight months, starting the month after the employment or group health plan ends . However, you have only two months after the employment or group health plan ends to sign up for a Medicare Advantage plan or Part D prescription drug plan . You can enroll in a Medicare Advantage plan starting three months before your Medicare Part B enrollment is due to take effect up to the day before your Part B coverage startsbut again, enrollment must take place within two months of your employment or group health plan ending.

Example:

Judy’s last day of work is July 1 and her group health plan ends July 31. She has eight months, until April 30, to sign up for Part B without a penalty. But if she wants to join a Medicare Advantage plan, she needs to do so by September 30 . Instead, on June 15, Judy signs up for Part B coverage to begin on August 1, so that she won’t have a gap in coverage. She has only until July 31 to add a Medicare Advantage plan . Her Medicare Advantage plan will start August 1.

Is It Mandatory To Have Medicare Part B

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

Read Also: How Do I Sign Up For Medicare In Massachusetts

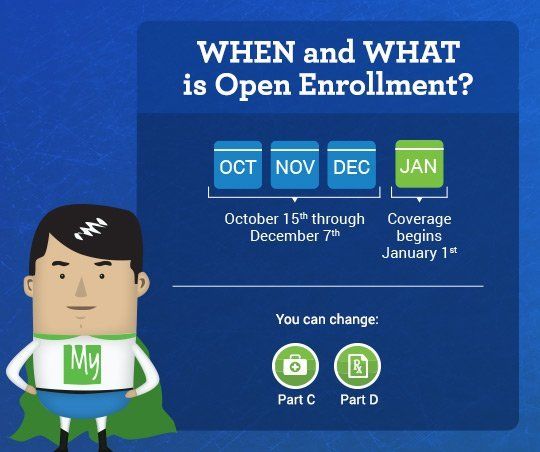

Making Changes To Medicare: Open Enrollment Period

If you already have Medicare Parts A and B, you have an Open Enrollment Period every year between October 15 and December 7. During open enrollment, you can switch from one Medicare Advantage plan to another. You can also switch from traditional Medicare to a Medicare Advantage plan during this time. If you want to switch from a Medicare Advantage Plan back to traditional Medicare, you can do so during open enrollment or during the special Medicare Advantage Disenrollment Period that runs from January 1 through February 14 each year. Once you select a new plan to enroll in, you’ll be disenrolled automatically from your old plan when your new plan’s coverage begins.

When coverage begins. When you switch coverage during the Open Enrollment Period, your new coverage starts January 1. When you switch back to traditional Medicare during the Medicare Advantage Disenrollment Period, your coverage will start on the first day of the month after the month in which you disenroll.

Special trial period for first year you join a Medicare Advantage plan. If you first join a Medicare Advantage plan during your Initial Enrollment Period, you can drop the plan anytime during the first 12 months. But you can only switch to a new Medicare Advantage plan during an Open Enrollment Period .

If Youre Already Enrolled In Medicare Part A & B

After your initial enrollment into Medicare you do not need to enroll in your Medicare A & B every year. However, the annual election period held from October 15 through December 7 is a good time for you to take a look at your current elections. Youll want to decide whether you would like to add to your optional Part D Prescription Coverage or consider a new Medicare Advantage Program.

Also Check: Do I Need An Appointment To Sign Up For Medicare

Your Medicare Advantage Program And Part D Prescription

The Medicare Advantage Program and the Part D Prescription Drug coverage are both provided by private insurance companies. Every year these private companies take a look at changes they would like to make and submit their new plans to Medicare for their approval. If Medicare approves their proposed changes your Medicare options will usually automatically renew.

If their proposed does not meet approval or the insurance company removes the plan from your area, then you will be notified. In the event they are dropped from the program you will receive a Plan Non-Renewal Notice through the mail letting you know that your current plan will no longer be available. The Plan Non-Renewal Notices normally arrive by October of each year so you will know you need to shop for a new plan while the Medicare open enrollment period is open.

Remember You Have A Set Time To Decide

The Medicare Annual Enrollment Period runs October 15 through December 7. This is the only time each year anyone with Medicare coverage can make changes .

Automatic renewal is a great way to go if you feel confident that the coverage you already have will fit your needs going forward. Its easy and convenient but once open enrollment is over on December 7, your chance to change your Medicare coverage for next year is over, too, unless you move or otherwise qualify for a special exception. You get to choose the Medicare coverage that you think best fits your needs each year during this time. You may choose to let your current coverage renew. Or you may choose something different. The important thing is to choose.

You May Like: Does Medicare Pay For Power Chairs

Do I Have To Enroll Or Renew Medicare Part B Every Year

Medicare Part B will continue as long as you are paying your insurance premiums. For most people, these fees are subtracted for your Social Security payments. If you do not receive Social Security, Medicare sends a bill.

If you miss three payments in a row, you will receive a cancellation notice. If you do not pay what is due at that time, your plan will get cancelled, and you will have to wait until the next general enrollment period to get your Part B reinstated. Just be aware that you will likely have a penalty fee at that time.

B Late Enrollment Penalty

If you dont sign up for Part B when youre eligible, you will most likely have to pay a late penalty. This penalty will last for as long as you have Part B.

To calculate the penalty, take your standard monthly premium amount and increase it by 10 percent for each 12-months you could have had Part B but didnt. For example, if you could have had Part B for two years but didnt, youd have to pay a 20 percent penalty. Your monthly premium would be increased by 20 percent for as long as you have Part B.

Don’t Miss: How Many Parts Medicare Has

Applying For Original Medicare

Applying for Medicare requires you to have a few details about yourself and verification documents ready:

- Your date and place of birth, which is usually verified by showing your birth certificate or Permanent Resident Card if you are not a U.S. citizen

- If applicable, your Medicaid number, along with start and end dates for coverage

- If applicable, your current health insurance, including start and end dates for both coverage and your employment if its a group health plan

- Your Social Security number, which is verified by showing your Social Security card

- W-2s or other tax forms

With all of this in hand, you can choose to apply online, by phone, or in person at your local Social Security office. For in-person applications, you may need to call ahead and make an appointment.

Renewing Medicare Part B

Just like Medicare Part A, your Medicare Part B coverage renews at the end of every year. As long as you pay your Part B premiums on time, your plan automatically renews. Your monthly premium may change when the plan renews, but your coverage wont be dropped.

Renewing Medicare Advantage

Medicare Advantage replaces Original Medicare coverage with a plan from a private insurance company. When you switch to a Medicare Advantage plan or Part C plan, it will replace the Part A and Part B coverage provided by Original Medicare. These plans also renew automatically, so you dont have to re-enroll in Medicare every year.

Medicare Advantage plans may change their coverage each year, or make changes to their network of providers. They can also reduce the service area or even end the plan altogether. If youre no longer happy with your coverage or your plan ends, you can enroll in a new Medicare Advantage plan.

Renewing Medicare Part D

Just like Medicare Advantage plans, Medicare Part D plans will automatically renew each year so you dont have to stress about your prescription drug coverage. But if the insurance company stops offering the plan or doesnt offer the plan in your area, youll need to enroll in a new Part D plan.

Renewing Original Medicare with a Medigap Policy

Your Medigap coverage automatically renews every year. In most cases, your Medigap policy will continue even if your insurance provider stops offering the plan to new Medicare beneficiaries.

Recommended Reading: Is Chantix Covered By Medicare

Enrollment Periods For Original Medicare

Medicare Part A and Part B are also known as Original Medicare. There are set time frames for initial enrollment in Original Medicare, as well as for making changes to your plan, including adding or dropping a plan. However, there are exceptions, which you can learn more about below.

Initial Enrollment Period

This is 3 months before and 3 months after your 65th birthday, for a total of 7 months. It is the standard timeframe for enrolling in Medicare. If you sign up in the months before your birthday, your coverage starts on your birthday. If you wait until your birthday month, coverage will begin the following month. The same goes for the 3 months after your birthday coverage begins the month after you enroll. For example, if your birthday is in June, but you did not enroll until July, your coverage will begin in August.

General Enrollment Period

This is from every year. When you sign up during this period, your coverage begins July 1. If you missed signing up for Original Medicare during your initial enrollment period, this could be another chance to sign up. However, you cannot make changes to your existing Medicare coverage during this period.

Annual Enrollment Period

Special Enrollment Period

During a Special Enrollment Period, you cannot sign up for free Medicare Part A, but you may be eligible to sign up for a premium-based Part A and Part B, or a Medicare Advantage Plan. Enrolling in this period would also prevent a late enrollment penalty.

I Turn 65 In A Few Months When Should I Sign Up For Medicare

En español | If you already receive Social Security benefits, Social Security will automatically sign you up for Medicare Part A and Part B though you can decline Part B enrollment if you want to. Otherwise, you need to apply for Medicare. The best time to do that depends entirely on your own situation. Broadly, there are two options:

Recommended Reading: Does Medicare Cover Dr Visits

Do I Really Need Supplemental Insurance With Medicare

The degree to which you can benefit from Medicare Supplement insurance depends on your budget, your health status, the medical services you use and how frequently you use them. Generally, Medicare Supplement beneficiaries enjoy the extra layer of financial protection Medicare Supplement plans provide, as they often cover a percentage of copays, coinsurance and deductibles not covered by Original Medicare. Should you experience a health emergency or serious illness, the extra coverage can help minimize out-of-pocket costs associated with receiving the care you need.

How Does Medicare Enrollment Work

With multiple enrollment periods each year, figuring out how to sign up for Medicare can be complicated. You might be wondering: How often do I have to go through this process? Do I need to apply for Medicare every year? Will I lose my coverage if I dont?

The short answer is no.You do not need to renew Medicare coverage each year.Once you apply for Medicare, your plan will be renewed each year with no action required on your part, provided you keep up with your premium payments. However, there are some rare circumstances where a renewal may be necessary.

You May Like: Can Non Citizens Get Medicare

Medicare General Enrollment Period

If you dont sign up for Medicare Part A and/or Part B when youre eligible, you can apply for Medicare for the first time during the General Enrollment Period from Jan. 1 through March 31 every year. Coverage begins July 1.

This enrollment period is only available to people who didnt sign up during their Initial Enrollment Period and who arent eligible for a Special Enrollment Period.

Note: You may have to pay a higher premium for Part A and/or Part B due to late enrollment.

How Medicare Defines A Preexisting Condition

A preexisting condition is any health issue you may have hadand received documented diagnosis or treatment forbefore your new insurance policy is due to start. However, it may still be possible for a condition to be classified as preexisting by Medicare even if its undiagnosed or untreated.

Lets say, for example, youre about to turn 65 and have diabetes requiring insulin and continuous glucose monitoring. You also have sleep apnea and use a CPAP, or continuous positive airway pressure, at night. Both would be classified as preexisting conditions by Medicare because you have a documented diagnosis in your medical record and have been receiving ongoing treatment.

Each state regulates the coverage rules for preexisting conditions under Medigap differently. Check with your states Medicare office to verify eligibility rulesespecially if youre interested in getting a policy outside of your initial enrollment period.

Recommended Reading: Will Medicare Part B Pay For Shingrix