Are All Medicare Supplement Plan F Plans The Same

Medicare Supplement Insurance Plan F is standardized by the federal government. This means that the 9 basic benefits of Plan F will be the same, no matter where you live or what Medicare Supplement Insurance company you buy it from.

Medicare Supplement Insurance is the only plan to provide coverage for each of the following 9 benefit areas.

How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youâre getting or are eligible for federal retirement benefits. Itâs also premium-free if youâre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youâre eligible for Medicare, but not other federal benefits, youâll pay a Part A premium of $274 or $499 each month, depending on how long youâve paid Medicare taxes.

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youâre admitted to a hospital and ends once you havenât received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youâre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Hereâs how much youâll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

Hospice care is free.

Read more about how Medicare Part A covers these costs here.

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

You May Like: How Does Medicare D Work

The Period When You Apply For Medicare Supplement

The best time to buy a Medicare supplement plan is during your open enrollment period. It is the six month period that begins the first month you are enrolled in Medicare part B, and you are already age 65 or older.

During this period, you cant be rejected or be charged with higher premiums because of a pre-existing condition.

If you miss your open enrollment period, youmay have to undergo medical underwriting. The result of medical underwriting will have an effect on the possibility of getting a Medigap plan, be rejected or pay a higher premium for the coverage.

Finding Part D Drug Insurance

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings .

If you dont take many prescription drugs, look for a plan with a low monthly premium. All plans must still cover most drugs used by people with Medicare. If, on the other hand, you have high prescription drug costs, check into plans that cover your drugs in the donut hole, the coverage gap period that kicks in after you and the plan have spent $4,430 on covered drugs in 2022.

Don’t Miss: Who Is Eligible For Medicare Extra Help

Medicare Part C And Part D

If youre divorced or recently widowed, youll need to budget for your Medicare Advantage plan or Medicare Part D plan premiums, deductibles and copays. Shop around for the best plan for your needs and budget, as coverage and premium prices vary between providers.

Plan costs and coverage can also change from one year to the next, so its always good to review your coverage each year. A licensed insurance agent can help you determine your plan options and compare the plans that are available where you live.

Compare Medicare plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelors degree in science from the University of Leeds and a masters degree in public health from the University of Manchester. Her work has appeared in Netdoctor, Medical News Today, Healthline, Business Insider, Cosmopolitan, Yahoo, Harpers Bazaar, Mens Health and more.

When shes not typing madly, Zia enjoys traveling and chasing after her dogs.

Recommended Reading: Does Medicare Pay For Inogen Oxygen Concentrator

How Much Does Supplemental Health Insurance Cost

Since health insurance rarely covers all health-related expenses, insurers offer a variety of supplemental insurance policies. These insurance plans typically provide benefits for specific health needs and are much less expensive than a regular health insurance policy. However, they are not a substitute for having health insurance.

Common types of supplemental insurance and typical premium costs include:

Don’t Miss: Which One Is Better Medicare Or Medicaid

Best For Simplicity: Aetna

There are many Medicare plans to choose from, but Aetna takes all the guesswork out of it by offering exactly what you see advertised: Medicare Supplement Plan F. Theres not much in the way of extras or benefits you might never need, want, or use, though.

-

Covers foreign travel emergencies like hospitalization in your first 60 days of travel

-

Offers household discount

-

No extra benefits, just the baseline coverage required of all Medicare Plan F plans

-

Breakdown of premiums based on gender, location, and age can be overwhelming

Its rare to find a company that does exactly what it says, but Aetnas Medicare Plan F offering does just that. Aetna is a more affordable option than some other plans at $170 per month, with up to a $30 monthly savings. However, it may be lacking a service that you need, so it is important to determine which options best fit your lifestyle. For instance, if you dont travel, then travel emergency coverage wouldnt be as important.

Determining this information can be done in as little as a few minutes, which put Aetna at the top in the simplicity category. This makes it easy to compare Plan prices, so you can determine which plan are right for your situation. Its not the quickest process, but it only requires entering your state, ZIP code, date of birth, and gender.

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Read Also: When You Turn 65 Is Medicare Free

Deductibles Coinsurance And Out

Three critical health care insurance impactors deductibles, coinsurance and out-of-pocket costs also factor into the need to purchase supplemental health insurance. Each of the three impactors is so important it deserves an explanation on why gap insurance is sorely needed for todays health care consumer.

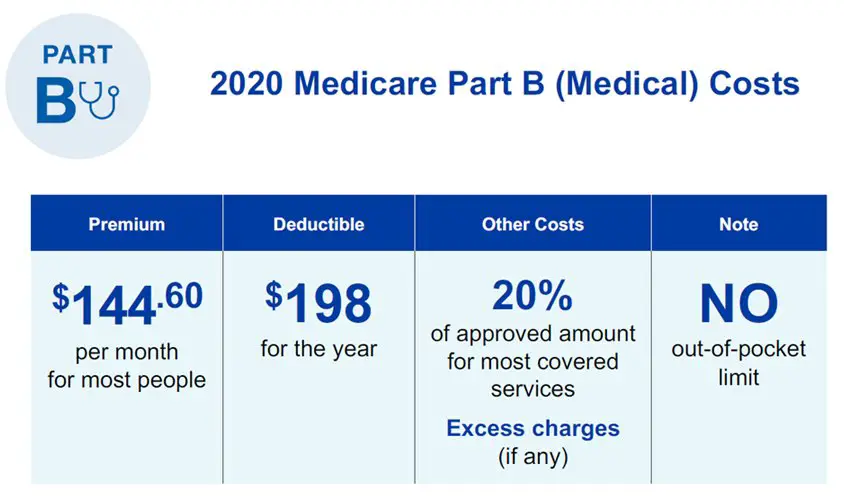

Medicare Is Helping Out A Large Number Of Citizens Every Year To Help Cover Medical Expenses But Will It Cost You Anything If You Pursue It If Yes How Much

Paying for health insurance is an enormous part of the vast majoritys financial plans, and it is anything but an expense that disappears once you reach 65 and can get insurance through Medicare. Realizing the amount you will pay for Medicare is critical to ensuring you have the assets to cover those costs. In any case, since there are many different parts of Medicare, which you can buy independently, the total expense of Medicare can change fundamentally. So how much does Medicare cost? Let us find out.

Recommended Reading: When Can You Change Your Medicare Part D Plan

B Late Penalties: Avoid At All Costs

The Part B late penalty is even more severe than the penalty for Part A because, for most people, it never goes away. For Part B, youll pay a 10 percent increase in your premiums for every 12-month period you could have had Part B but didnt. This means that if you dont have Part B for two years when you could have enrolled, your premiums will go up by 20 percent.

The worst part is that this 20 percent will stay with you the late enrollment premium addition doesnt go away. For this reason, its best to make sure you avoid the Part B late enrollment penalty. There are some situations that allow you to defer coverage without incurring this extra fee, for example, if you are covered by your employer. Make sure to check the details so you dont experience any unhappy surprises.

Need Help Affording Medicare

Medicares out-of-pocket costs premiums, deductibles, copays and coinsurance can easily result in a large tab each year. If youre struggling to meet those expenses, you might be eligible for federal and state assistance.

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as dual eligibles.

Other programs are designed for beneficiaries with incomes that are too high to qualify for Medicaid but who still have trouble paying their health care bills. Each program has specific income and asset limits and eligibility requirements that are adjusted annually.

- The Qualified Medicare Beneficiary program helps pay for Part A and Part B premiums as well as deductibles, coinsurance and copays. If you qualify for this program, you automatically qualify for the Extra Help prescription drug program to help you with the out-of-pocket costs of your medicines. This program has the lowest income threshold of the four.

Coronavirus testing

If you cannot leave your home, Medicare will allow your doctor to order a test to be brought to you and administered there.

Your state Medicaid program or State Health Insurance Program also known as SHIP can provide enrollment assistance and more details on the income caps and other eligibility criteria.

More on Medicare

You May Like: Does Medicare Pay For Dtap Shots

How Do I Buy Medigap

At GoHealth, we have teams of licensed insurance agents to evaluate Medigap plans and shop each states best rates. Of course, there are also several resources to do it yourself. If youre ready to purchase Medigap insurance, or if you have any questions about what it costs or what it covers, contact us. Our licensed insurance agents can evaluate your needs, medical history and current Medicare status to make sure you get the coverage you need, when you need it.

Refer to our Medigap enrollment guide for further information.

What extra benefits and savings do you qualify for?

Adult Dental And Vision Coverage

Dental and vision care are generally not included in health plans for adults in the U.S.

Original Medicare doesn’t cover routine dental and vision and most commercial health insurance plans don’t, either.

To get those covered, you can enroll in a separate plan that covers dental and/or vision care. Employers often offer this as a supplemental coverage option for employees, with the employer paying a portion of the premiums.

If you don’t have the option of employer-sponsored dental and vision coverage, you can purchase coverage through the private insurance market.

Don’t Miss: How Old To Get Medicare Benefits

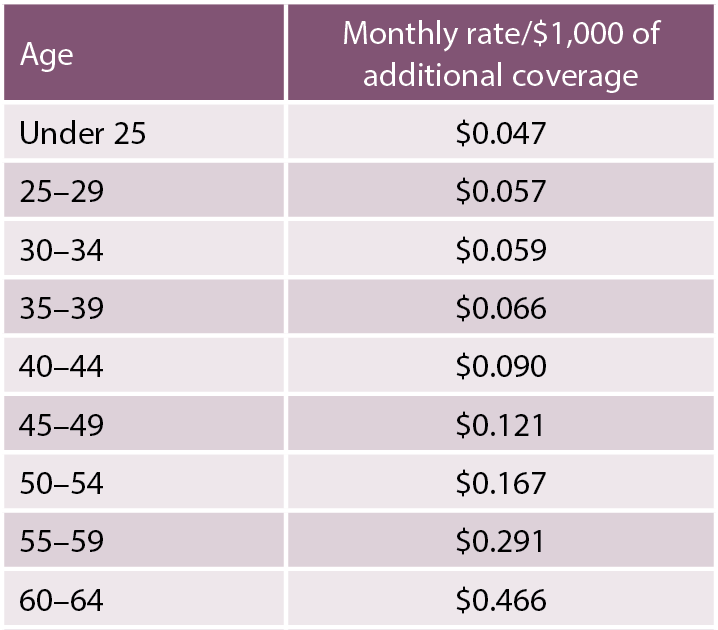

The 2020 Average Cost Of Medigap Plan F And Plan G By Age

by Christian Worstell | Published November 03, 2021 | Reviewed by John Krahnert

Age is one factor that Medicare Supplement Insurance companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan.

Medicare Supplement Insurance premiums tend to increase with age. As you compare Medigap quotes, it may be helpful to consider how your age could affect your Medigap premium costs over time.

In this guide, we break down the average monthly premiums of Medigap Plan G and Plan F by age, from age 65 to age 85.

Can I Buy A Medicare Supplement Insurance Plan At Any Time

You can enroll in a Medigap plan or change Medigap plans at any time of the year. However, you may be subject to medical underwriting as part of the application process.The best time to buy a Medigap plan, however, is during your Medigap Open Enrollment period or during another time when you have a Medigap guaranteed issue right. This can help protect you from potentially paying higher Medicare Supplement Insurance costs due to your health.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Also Check: How To Apply For Medicare Without Claiming Social Security

Best Overall Medicare Supplement For New Enrollees: Plan G

Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible â $203 a year for 2021 â before insurance benefits will begin to pay out.

However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473. Therefore, you should weigh the cost of this monthly premium with your potential medical expenses for the year.

You May Like: How Much Is Health Insurance Usually

How Much Does It Cost For Medigap Plan F

The average premium for Medicare Supplement Insurance Plan F in 2018 was $169.14 per month, or $2,030 per year.1

The average cost of Plan F in 2018 was the fourth highest among the 10 Medigap plans used for analysis.

- Plan M , Plan A and Plan C all had higher average premiums than Plan F in 2018.

- Plan J and Plan D had average monthly premiums that were slightly lower than Plan F in 2018. Medigap Plan J is no longer available for sale. If you bought Plan J before , you may keep the plan.

Here is how the average cost of Plan F compared with that of other Medicare Supplement Insurance plans in 2018.

| Plan |

|---|

| $234.20 | $2,810 |

It’s important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

As you compare Medicare Supplement quotes, keep in mind that other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plan premiums could be more expensive for older beneficiaries for a few reasons, such as:

Medigap premiums can increase over time due to inflation and other factors, regardless of the pricing model your insurance company uses.

Recommended Reading: Does Medicare Cover Dexcom 6

Medicare Part A: How Much Will A Hospitalization Cost You

Lets say youre hospitalized and all you have is Medicare Part A. How much do you owe the hospital?

If the hospitalization lasts 60 days or less, the answer is $1,484 nothing more. This is an important point: For any hospitalization lasting 60 days or less, you will only owe the hospital $1,484 even if your hospital bill exceeds one million dollars! The doctor who see you in the hospital will bill you separately, but those bills are covered by your Part B benefits .

As an example, below you can see a copy of a bill that a patient of mine gave me a few years ago. This bill is for someone who was hospitalized for about four weeks. As you can see, the total amount billed was over $700 thousand and, yet, the patient still only has to pay $1,260 which was the Medicare Part A deductible in 2015.

Figure 1: Hospital Bill

Should you expect to ever be hospitalized for more than 60 days? No!

The average hospital stay in the US is 5-6 days and that number has been going down each year for more than a decade. Even people who need major surgery like a liver transplant or open heart surgery are usually home in about 7 days. I cant say that 60-day hospitalizations never occur in the U.S., but theyre about as rare as jackpot lottery winners.