Some People Have The Option Of Long

Long-term care insurance can work as a way to pay for nursing home care if you can afford the hefty premiums for years or even decades into retirement. You can get insurance that covers a large portion of the cost of care in a nursing facility, assisted living facility, or at your home.

Make sure you read all terms and conditions of any long-term insurance policy that you are considering. Also, dont forget to seek professional advice if there is a potential for your insurance to be misused. Some people who have long-term policies for care have seen their rates rise unexpectedly after years of paying premiums.

What Are The Requirements For Medicare Nursing Home Coverage

Before Medicare covers skilled nursing home costs, you must have a qualifying hospital stay of at least three inpatient days prior to your nursing home admission. You must have inpatient status for at least three days time spent in the emergency department or observation unit doesnt count toward the three-day requirement.

If you refuse nursing care or medical therapies recommended by your doctor while you are in a skilled nursing facility, you may lose your Medicare nursing home coverage.

Can A Nursing Home Kick You Out For A Non

A nursing home can kick you out for non-payment or refusal to apply for Medicaid when you receive adequate notice. However, there are reports of people in Medicare rehab who reach the end of insurance coverage and continue to need care. In those cases, the facility can discharge the patient if they are not a Medicaid-certified facility.

The resident or authorized family member must receive notification of discharge in writing 30 days before the discharge date. The notification or discharge letter must also include the reasons for discharge. Residents of nursing homes have the right to appeal a discharge and do so through the long-term care ombudsman or department of health. The nursing facility is required to provide a discharge plan that includes appropriate placement.

There are reports of nursing homes across the country sending a resident to the hospital and refusing to take them back into the facility. Some states prohibit this practice. Knowing your rights is the first step to protecting your loved one from being kicked out illegally for failure to pay.

You May Like: Do I Need Health Insurance With Medicare

Requirements For Medicare To Cover Skilled Nursing Facilities

You must meet two requirements before Medicare will pay for any nursing facility care. You must have recently stayed in a hospital, and your doctor must verify that you require daily skilled nursing care.

Medicare used to require that your condition be expected to improve, but now Medicare will pay for skilled nursing care if it’s needed to maintain your condition or to slow deterioration of your condition.

When Does Medicare Cover Nursing Home Costs At A Skilled Nursing Facility

While Medicare wont cover long-term care at a nursinghome, it does cover short-term stays at a skilled nursing facility . Youmay have coverage at an SNF if you meet the following criteria:

- Youre entering the SNF within 30 days after beingadmitted as in inpatient at the hospital for at least 3 days

- Youre entering the SNF for the same reason that youwere hospitalized

- You need a skilled level of care that cant beprovided at home or in an outpatient setting

Servicescovered in a skilled nursing facility include:

- Intravenous injections

- Medication management

Also Check: Does Medicare Cover Transportation To Physical Therapy

Medicaid Covers Some Nursing Home Costs For Those Who Qualify

Medicaid covers some costs of long-term custodial nursing home care and home health care for individuals with little savings and income. People who exhaust their financial resources while in a nursing home often eventually qualify for Medicaid.

Because it’s a joint federal and state program, Medicaid benefits vary. Contact your states Medicaid office for coverage details.

Even if you financially qualify for Medicaid, there may be copays for some services that youll need in long-term care. Especially when it comes to nursing home coverage, its important to understand the differences between Medicare and Medicaid.

Patient Criteria For Medicare Rehab Coverage

In addition to the benefit period rules above, a beneficiary must meet all the following requirements:

Read Also: What Nursing Homes Take Medicare

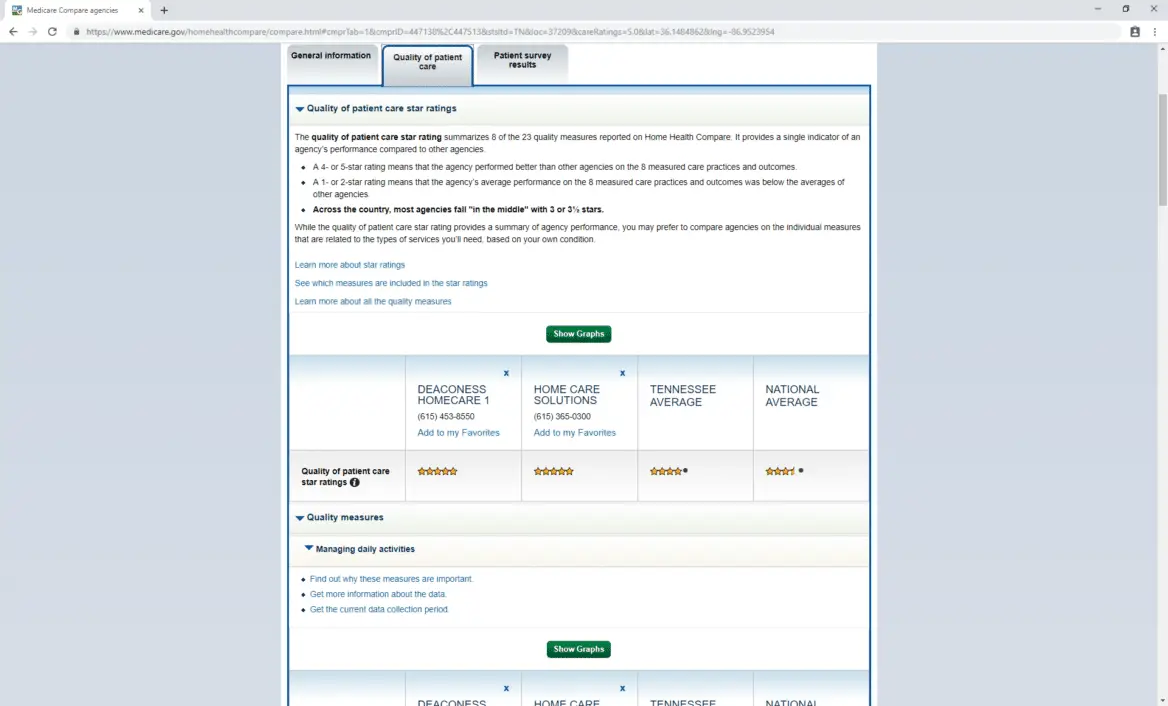

Medicare & Nursing Homes

Information in this section refers to original Medicare. If you have a Medicare Advantage Plan, you must check with your particular plan.

If you need help with understanding your health insurance, contact the Virginia Insurance Counseling & Assistance Program to find a counselor near you.

Helpful Information

- Center for Medicare Advocacy, Inc. -CMA is a national non-profit group with a special focus on Medicare beneficiaries and their needs. Providing an array of information throughout the site, you may find the âTopicâ section particularly helpful.

- Medicare Rights Center – The Center is a national, nonprofit service organization focused on access to quality care for elders and individuals with disabilities. They provide counseling, advocacy, and educational programs. If you have questions about Medicare, you may find their national Helpline helpful.

- Medicare.gov – The Official U.S. Government Site for Medicare

- KePro â Handles complaints and appeals concerning services paid for by Medicare.

Terms to Know

Original Medicare Conditions to be Met

Original Medicare helps pay for nursing home care when the following are met:

Limits to Medicare Part A Coverage of Skilled Care

Medicare Part A coverage of skilled care in a Medicare certified skilled nursing facility is limited to 100 days and only the first 20 days are covered in full by Medicare. Here is how it works:

Possible Problems & What You Need to Know

What About Inpatient Rehabilitation Care

Medicare will also cover rehabilitation services. These services are similar to those for skilled nursing, but offer intensive rehabilitation, ongoing medical care, and coordinated care from doctors and therapists.

The same types of items and services are covered by Medicare in a rehabilitation facility as with a skilled nursing facility. The same exclusions apply as well.

You may require inpatient rehabilitation for a brain injury that requires both neurological and physical therapies. It could also be another type of traumatic injury that affects multiple systems within the body.

The amount of coverage for inpatient rehabilitation is a little different than skilled nursing. Medicare Part A costs for each benefit period are:

- Days 1 through 60: A deductible applies for the first 60 days of care, which is is $1,364 for rehabilitation services.

- Days 61 through 90: You will pay a daily coinsurance of $341.

- Days 91 and on: After day 90 for each benefit period, there is a daily coinsurance of $682 per lifetime reserve day .

- After lifetime reserve days: You must pay all costs of care after your lifetime reserve days have been used.

Don’t Miss: How To Apply For Medicare Without Claiming Social Security

What Types Of Care Does Medicare Cover

- Skilled nursing care. Medicare helps to pay for your recovery in a skilled nursing care facility after a three-day hospital stay. Medicare will cover the total cost of skilled nursing care for the first 20 days, after which youll pay $185.50 coinsurance per day . After 100 days, Medicare will stop paying.

- Home health care. If you are homebound by an illness or injury, and your doctor says you need short-term skilled care, Medicare will pay for nurses and therapists to provide services in your home. This is not round-the-clock care. Generally, it’s for no more than 28 hours per week. With your doctor’s recommendation, you may qualify for more.

- Hospice. Medicare covers hospice care. Hospice is care you get to make you more comfortable when you are in the last stage of life with a terminal illness. You’re eligible if you are not being treated for your terminal illness, and your doctor certifies that you probably will live no longer than six months. You can get care for longer than that, as long as your doctor says you are still terminally ill.

What Else Should I Be Aware Of

Check if you were admitted as an inpatient. If the hospital classified you as Observation Status, which is an outpatient category, the hospital should have given you a Medicare Outpatient Observation Notice and orally explained the status and how it might affect the cost of your stay. Whether you were an inpatient or outpatient in the hospital affects whether Medicare will cover your nursing home stay.

Also Check: Does Aarp Medicare Supplement Insurance Cover Hearing Aids

What Is Custodial Care Vs Skilled Nursing Care

Nursing homes mostly offer custodial care. You receive help with daily activities, such as bathing, eating, and dressing. Activities of Daily Living is the term used in the industry to refer to such activities, and help with ADLs can be provided by informal caregivers, such as family and friends, or formal caregivers who are associated with a formal service system, like a home health agency. Help with ADLs is not provided by doctors and nurses.

Medicare does not cover custodial care. But Medicare Part A will cover medically necessary care that requires skilled nursing care or therapy. You must receive it at one of the over 15,000 Medicare-certified nursing facilities in the U.S.2A beneficiary can also receive skilled nursing care or therapy at home, as home health care, discussed later.

A skilled nursing facility offers more medical services than a traditional nursing home or assisted living facility. A facility may provide both skilled nursing care and custodial care. You will receive care from a qualified technician or health professional. For example, a registered nurse may inject medicine into your body intravenously.

- Physical, occupational or speech therapy

- Medications, supplies, and equipment

How It Works: Out Of The Nursing Home For At Least 60 Days

Your grandmother received 20 days of Medicare-covered nursing home care after she’s hospitalized for back surgery. Her Medicare coverage ended when she no longer needed skilled care. She chose to go home rather than pay for custodial care.

After 65 days, she’s hospitalized for 3 days due to a fall. Afterwards, she’s admitted to a skilled nursing facility because she needed skilled care.

Since she was out of a skilled nursing facility for more than 60 days, her benefit period ended. Her new 3-day qualifying hospital stay starts a new benefit period. Medicare now covers up to 100 days of skilled nursing home care in this new benefit period.

Read Also: How To Get A Lift Chair From Medicare

Whats The Difference Between Nursing Home Care Long

Its important to understand the different types or nursing care Medicare may cover, as well as the ones it doesnt, so you arent unexpectedly stuck paying your nursing home costs.

Nursing home care can be either skilled or custodial. Skilled nursing home care covered by Medicare is short-term and expected to help improve your condition. If you have hip replacement, for example, your doctor may recommend a couple of weeks in a skilled nursing facility for physical therapy to help you learn to walk with your new hip and recover your mobility more quickly.

Long-term care, on the other hand, is generally custodial carehelp with things such as eating, bathing, toileting, and dressing. As the name suggests, it may last a period of weeks, months, or years. It is usually not covered by Medicare.

Home care nursing is generally home health care provided by a credentialed medical professional. It can be short-term while you recover from an illness or injury, or long-term if you have a serious chronic condition or have chosen hospice care. Medicare may cover home care nursing under certain situations.

What Medicare Nursing Home Coverage Am I Eligible For If I Need Long

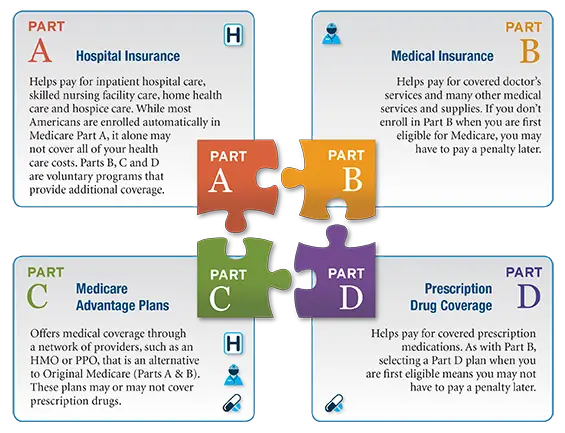

Medicare wont pay your nursing home costs, but you still have your Part A and Part B benefits while youre in a nursing home. For example, Part B covers your doctor visits and medical therapy visits, and if you need hospital care, Part A benefits apply. If you have a Part D Prescription Drug Plan, the medications you take in the nursing home are usually covered. You may have to enroll in a plan that works with your nursing home pharmacy, but the facility should help you choose the right coverage.

If you live in a nursing home, you may be able to enroll in a Medicare Advantage Special Needs Plan, which has benefits designed to best serve residents of a long-term care facility. These plans include Part D prescription drug coverage and may be more affordable than other Medicare plans. You may also qualify for a Special Needs Plan if you are on both Medicare and Medicaid.

Don’t Miss: Does Medicare Medicaid Cover Dentures

Medicare Advantage May Offer More Comprehensive Coverage

Private insurance companies run Medicare Advantage. Those companies are regulated by Medicare and must provide the same basic level of coverage as Original Medicare. However, they also offer additional coverage known as supplemental health care benefits.

These benefits can be used to cover the cost of health care or medical equipment that could reduce the risk of injury, reduce the impact of lost mobility or injury or help a person maintain their health and independence.

Medicare Advantage covers many services that are excluded from original Medicare. Individual insurers are permitted to exercise discretion when deciding what services to offer under supplemental benefits, so Medicare Advantage customers should contact their insurers to discuss their options before deciding on a care plan.

Medicare’s Limited Nursing Home Coverage

Many people believe that Medicare covers nursing home stays. In fact Medicare’s coverage of nursing home care is quite limited. Medicare covers up to 100 days of “skilled nursing care” per illness, but there are a number of requirements that must be met before the nursing home stay will be covered. The result of these requirements is that Medicare recipients are often discharged from a nursing home before they are ready.

Local Elder Law Attorneys in Your City

City, State

In order for a nursing home stay to be covered by Medicare, you have to meet the following requirements:

Note that if you need skilled nursing care to maintain your status , then the care should be provided and is covered by Medicare. In addition, patients often receive an array of treatments that don’t need to be carried out by a skilled nurse but which may, in combination, require skilled supervision. For example, the potential for adverse interactions among multiple treatments may require that a skilled nurse monitor the patient’s care and status. In such cases, Medicare should continue to provide coverage.

You cannot rely on Medicare to pay for your long-term care. Contact your attorney to create a long-term care plan. To find a qualified elder law attorney, .

For more information on Medicare, .

Related Articles

Don’t Miss: How Do I Pay Medicare Premiums

How Medicare Measures Skilled Nursing Care Coverage

Medicare measures the use and coverage of skilled nursing care in benefit periods. This is a complicated concept that often trips up seniors and family caregivers. Each benefit period begins on the day that a Medicare beneficiary is admitted to the hospital on an inpatient basis. Time spent at the hospital on an outpatient or observation basis does not trigger the beginning of a benefit period.

Once a benefit period begins, a beneficiary must then have a qualifying three-day inpatient hospital stay in order be eligible for any coverage of rehab care in a skilled nursing facility. A benefit period ends when the beneficiary has not received inpatient hospital or SNF care for 60 consecutive days. Once a benefit period ends, a new one can begin the next time the beneficiary is admitted to the hospital. There is no limit to the number of benefit periods a beneficiary can have.

What About Medigap Supplements

Medigap supplement plans are sold by private insurance companies and help to cover additional costs, such as deductibles.

Some Medigap plans may help to pay for skilled nursing facility co-insurance. These include plans C, D, F, G, M, and N. Plan K pays for about 50 percent of the coinsurance and Plan L pays for 75 percent of coinsurance.

However, Medigap supplement plans dont pay for long-term nursing home care.

Recommended Reading: How Do You File For Medicare

Va Benefits For Nursing Home Care

The Department of Veterans Affairs can also help provide long-term nursing home care and other support services. The VA has its own nursing homes that can be contracted out to other community and state organizations. In some places, the VA may manage their own nursing homes.

There is another VA sponsored program that includes medical foster homes that contract with the VA to care for veterans. A medical foster home is defined as a VA-approved residential home that houses one or more veterans. This same medical foster home will also be under the care and responsibility of a VA medical team, which will provide services on-site as needed.

With these types of programs, veterans have to meet the criteria of physical or mental ailments that require nursing home care. This is determined by the VA when you apply to a VA nursing home.

Here are some other requirements:

- Veterans with a service-connected disability of at least 60 percent or are considered disabled according to VA guidelines.

- Veterans can also qualify for nursing home care without a service-connected disability who meet VA criteria for income and asset levels, like with Medicaid.

The VA may pay all or a portion of care in a VA contracted nursing home. It is advisable to apply for VA nursing home care as soon as you think you may qualify, as beds may be limited with other patients on a waiting list.