Average Cost Of Medicare Supplement Plan G

Medicare Plan G is a very popular Medicare Supplement plan among the newly eligible for Medicare. Not surprising since Plan G carries the most comprehensive coverage .

Plan G is also one of the more expensive plans, so it makes sense to consider your health needs and budget before choosing a Medicare Supplement plan. Here are the facts about Medicare Plan G and tips on how to decide if its the right plan for you.

- Medicare Plan G is the most comprehensive coverage you can buy if you become eligible for Medicare after December 31, 2019.

- Plan G has the same benefits as Plan F, except for the Part B deductible.

- Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000.

- Some insurance companies offer extra perks and benefits for vision and dental care with Medicare Plan G.

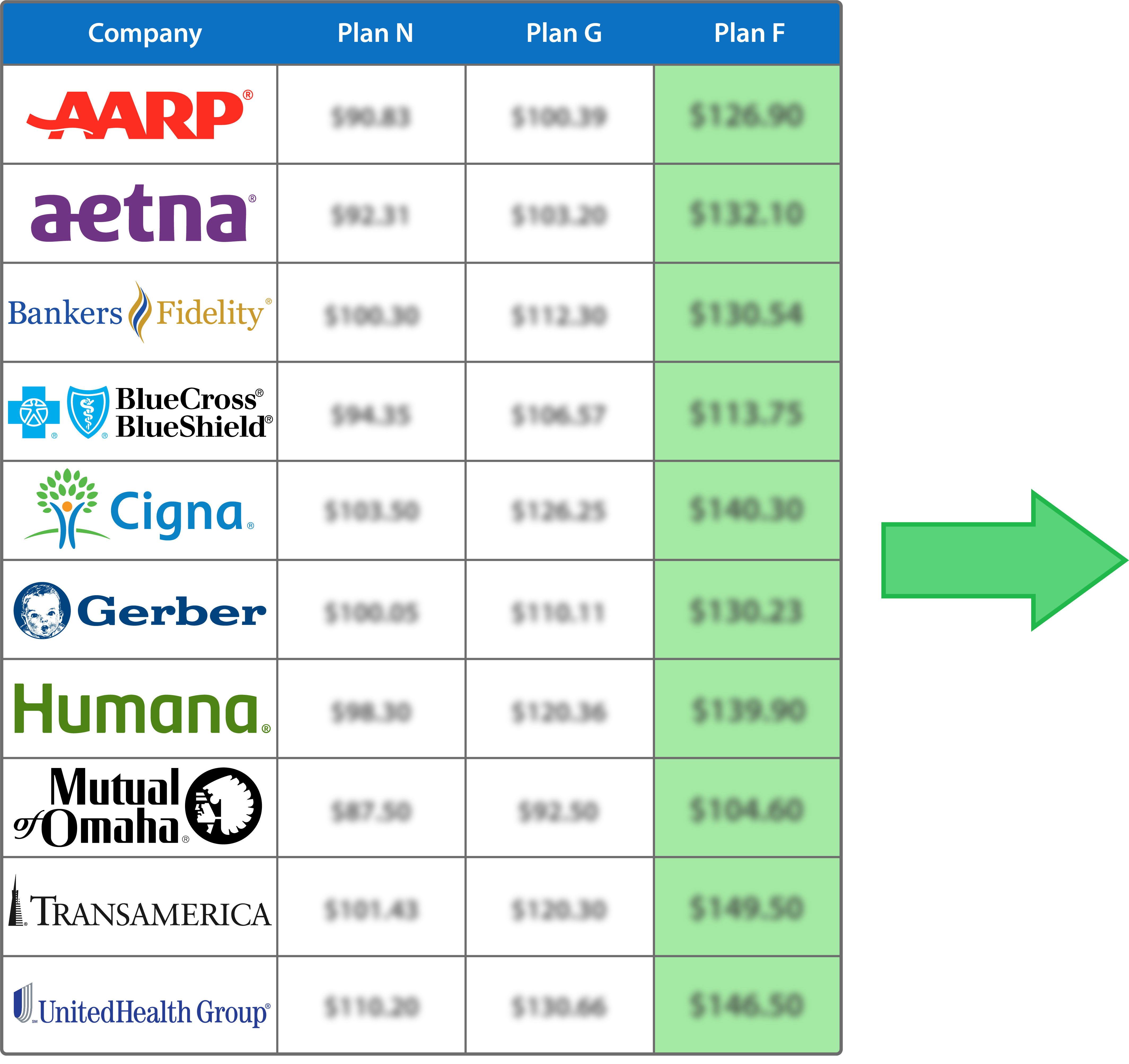

The average premium for Medicare Supplement Insurance Plan G in 2022 is $132 per month, or $1594 per year.

What’s The Most Popular Medicare Supplement Plan

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan. Plan G has 22% of the market, making it the most popular choice for those who are newly eligible for Medicare.

Standard Medicare Supplement Coverage

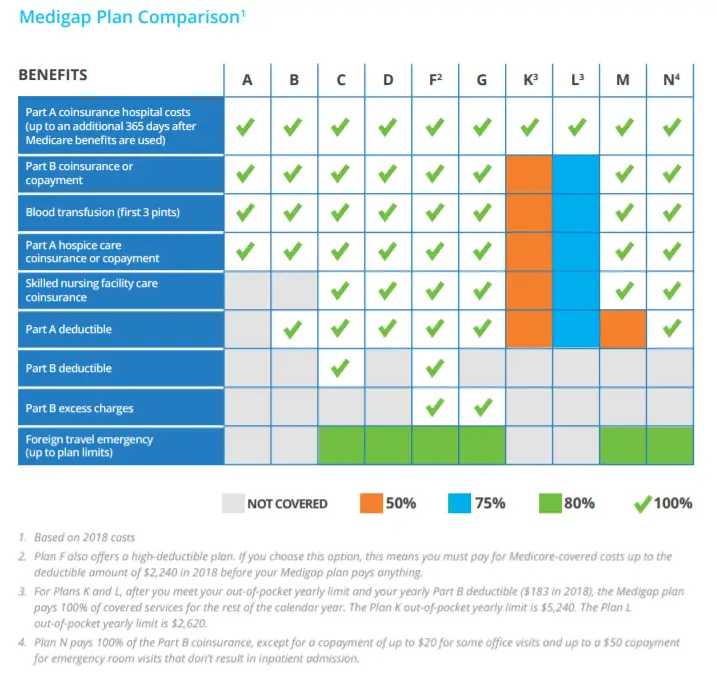

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

Recommended Reading: How Much Will Medicare Pay For Physical Therapy

Which Medicare Supplement Plan Is The Best

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give you comprehensive medical coverage from a well-rated company. However, all Supplement plans have standardized benefits that will help protect you from out-of-pocket medical expenses you’d have with Original Medicare .

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Don’t Miss: Does Medicare Pay For Telephone Psychotherapy

Determine Which Medicare Plan F Plans Are Available In Your Area

Different providers may have different plans, pricing, and coverage available if they still offer Plan F. Most providers have the ability to see estimated coverage and costs on their websites by entering your ZIP code. In some cases, they may require slightly more information to provide you with accurate results.

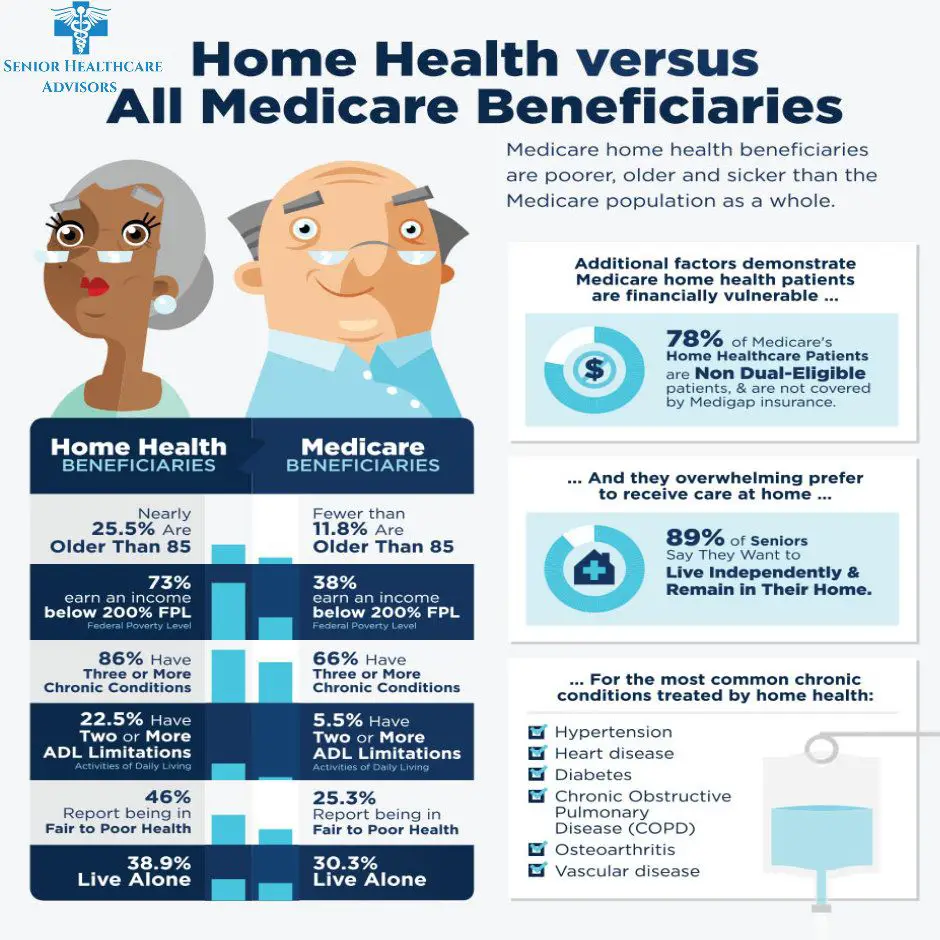

Do You Really Need Medicare Supplemental Insurance

The answer to this question really depends on your specific situation. If you typically visit the doctor often and are required to pay numerous copays throughout the year, then Medicare Supplemental insurance might be a good idea. Similarly, if you receive regular medical treatments that require out-of-pocket costs like coinsurance amounts, then a Medigap policy might be right for you. However, if you rarely visit the doctor, then the monthly premiums associated with a Medigap plan might cost you more than your normal medical expenses would cost.

You can always check with a licensed insurance agent in your local area who can help you explore plan options and determine whether this coverage is right for you. Remember that you might also decide to enroll in a Part C Medicare Advantage plan instead. Many of these plans have low or no premium and an out-of-pocket limit for your medical insurance. Advantage plans are also managed by private insurance companies, so they can set their own rules for costs and coverage, as long as they provide at least the same coverage as Original Medicare.

Don’t Miss: Does Medicare Become Your Primary Insurance

What Happened To Plan C And Plan F In 2020

Medigap Plan F and Plan C are not available to anyone who became eligible for Medicare on or after .

If you already had Plan C or Plan F before 2020, you will be able to keep your plan.

If you became eligible for Medicare before 2020, you may still be able to buy either Plan C or Plan F after January 1, 2020, if either is available where you live.

Are You Considering A Medicare Supplement Plan

SHIIP’s interactive tool allows you to compare Medicare supplement by entering your age, gender the Medicare supplement plan you want to compare and whether or note you use tobacco products to receive a list of companies offering that plan along with their estimated premiums.

You will not be auto enrolled into a Medicare supplement policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy that you wish to purchase, or you may contact an agent who sells the specific policy you want. We recommend that you apply at least 30 days before you want the policy to start. If you do not have thirty days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

Read Also: How To Call Medicare Gov

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increased flexibility for Medicare to cover telehealth services.

- Increased Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarified that non-expansion states can use the Medicaid program to cover COVID-19-related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Do not pay a Medicare broker directly for their assistance. They are paid by the insurance company to sell their insurance. If you suspect Medicare Advantage fraud, please call the Medicare Drug Integrity Contractor at 1-877-772-3379.

Also Check: Do I Have To Have Part D Medicare

Best Alternative To Medicare Supplement Plan G: Plan N

Plan N is a good option for individuals who want coverage that’s nearly as good as Plan G but at a cheaper price.

The only difference between the two plans is that Plan N doesn’t have coverage for Medicare Part B excess charges. This is an extra cost that your doctor or medical provider could charge you if they don’t accept the Medicare-approved amount of payment for health care services. You can protect yourself from this cost by either getting Plan G or double-checking that your medical providers accept the Medicare-approved amount for services.

If you’re willing to make this trade-off, you’ll pay about $152 per month for Plan N, a $38 savings versus Plan G.

Remember that neither Original Medicare nor a Medicare Supplement plan covers prescription drugs. For that, you’ll need a separate Medicare Part D plan.

See If You Are Eligible To Enroll

The first step to enrolling in Medicare Plan F is to enroll in Original Medicare. Thenif you were eligible for Medicare before January 1, 2020you can still apply for Plan F. If you became eligible after January 1, 2020, you’re ineligible to apply for Plan F because the Medicare Access and CHIP Reauthorization Act went into effect, phasing out Plan F for new enrollees.

If you already have Plan F, you can keep your coverage.

Recommended Reading: Does Medicare Pay For Entresto

The 2022 Average Cost Of Medigap Plan F And Plan G By Age

by Christian Worstell | Published February 03, 2022 | Reviewed by John Krahnert

Age is one factor that Medicare Supplement Insurance companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan.

Medicare Supplement Insurance premiums tend to increase with age. As you compare Medigap quotes, it may be helpful to consider how your age could affect your Medigap premium costs over time.

In this guide, we break down the average monthly premiums of Medigap Plan G and Plan F by age, from age 65 to age 85.

What Is The Difference Between Plan F And Plan G Medicare Supplement

Medicare Supplement Plan F is by far the least expensive Medicare Supplement Plan that offers the most coverage. This means it isor wasthe most popular supplement for Original Medicare, especially because Plan F covers the Part B deductible.

However, as of January 1, 2020, Plan F was phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020.

If youre new, you can enroll in Plan G instead.

The only real difference between Plan F and Plan G is that Plan F covers the deductible for Part B, which is $170.10 in 2022. Plan G does not. Dont panic its not a huge difference, but it can add up. Plan G can make up for this difference by having lower monthly premiums than Part F because its covering slightly less, which can save you some money in the long term.

Don’t Miss: Is Medicare Plus Blue A Medicare Advantage Plan

Tips For Insurance In Retirement

- Picking the right Medicare supplement insurance policy can be a challenge. Working with a financial advisor can help you calculate those costs and plan accordingly with your retirement savings. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Medical insurance can be a significant expense in retirement. Understanding what those costs are will help you plan for these costs in your budget. Our retirement calculator helps you figure out your projected income and expense in retirement.

How Much Do Medicare Supplement Plans Usually Cost

A Medicare Supplement plan costs about $163 per month for 2022. However, the range of costs is especially wide because of the variety of plans available and pricing factors such as age and location. Some people enrolled in a Supplement plan can pay as little as $50 per month, while others can pay more than $400.

Recommended Reading: Can You Get Medicare If You Work Full Time

What Is The Average Cost Of Medicare Part D In 2022 By State

The chart below lists the average monthly premiums for Medicare Part D prescription drug plans by state.1

- The lowest average Part D premiums were for plans in Mississippi, Kentucky, Indiana and Oklahoma, with average premiums around $41 or less per month.

- California, Florida, Pennsylvania and West Virginia had Part D plans with the highest average premiums, around $52 or more per month.

| State |

|---|

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Finding Part D Drug Insurance

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings .

If you dont take many prescription drugs, look for a plan with a low monthly premium. All plans must still cover most drugs used by people with Medicare. If, on the other hand, you have high prescription drug costs, check into plans that cover your drugs in the donut hole, the coverage gap period that kicks in after you and the plan have spent $4,430 on covered drugs in 2022.

You May Like: Is Medicare Available For Green Card Holders

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

How Much Do Medicare Supplement Insurance Plans Cost

by Christian Worstell | Published January 21, 2022 | Reviewed by John Krahnert

The average cost of Medicare Supplement Insurance plans sold in 2018 was $125.93 per month.1

The average cost of a Medicare Supplement Insurance plan can vary based on a number of factors, such as age, gender, smoking status, health and where you live.

It’s also important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Don’t Miss: Do I Need Medicare If My Spouse Has Insurance

Best Overall Medicare Supplement Plan For New Enrollees: Plan G

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible â $233 for 2022 â before insurance benefits will begin to pay for your health care.

Plan G is the most popular Medicare Supplement for new enrollees. However, rates can be expensive, averaging $190 per month. Therefore, you should weigh the cost of this monthly premium with your potential medical expenses for the year.

Medicare Supplemental Insurance Exclusions

Some Medigap policies include prescription drug benefits as part of their plan. When a plan does not include prescription drug coverage, then you can buy a standalone Medicare Part D insurance policy.

Medicare supplemental insurance provides additional benefits and reduces your out-of-pocket expense for covered services. However, some services are excluded from these policies, including:

- Private-duty nursing

Recommended Reading: How To Change Medicare Plans When You Move

Best In Educational Information: Cigna

Cigna

The best thing about Cigna’s Medicare Supplement Plan F is how it breaks down the costs and benefits of the program. Nothing requires reading multiple pages or an in-depth understanding of health careall the services Medicare and Plan F cover are broken into three categories of cost: what Medicare pays, what Plan F pays, and what you pay.

In most cases, you don’t pay anything. For example, for hospitalization up through the first 60 days, Medicare covers everything except $1,556. Plan F then covers that $1,556, so you pay nothing. Cigna makes it easy to see exactly which gaps Plan F pays for.

-

Easily understandable breakdown of costs

-

Plan information is explained in simple terms

-

Only additional benefit is a 24-hour health hotline staffed by nurses

-

Long process to get estimates, requiring contact information and agreement to be contacted by Cigna representatives

Cigna wants all of its customers to be knowledgeable about and comfortable with what exactly they’re signing up for with a Medicare Plan F plan, whether it’s a regular or a high-deductible option. The differences between the two plansthe deductible costs and the difference in premiumsand what each cover are clearly laid out, so you can make an informed decision.