How To Apply For Medicare

Fortunately, you dont really need to apply for Medicare. Since its public health insurance, all you need to do is qualify. Medicare is for U.S. citizens and legal residents age 65 and older. You may also qualify if youre younger than 65 and:

- Have received disability-based benefits from the Social Security Administration for longer than 24 months.

- Are living with Amyotrophic Lateral Sclerosis , also known as Lou Gehrigs disease.

Examples Of Covered Services

Part B covers a variety of outpatient services and medically-necessary preventive services.

Outpatient Medical Services

- Durable medical equipment

Preventive Services

- Cancer screenings like those for breast, colorectal, and prostate cancers

- Cardiovascular disease screenings

- Screenings for hepatitis B, hepatitis C, HIV, and STIs

- Vaccines

What Does Medicare Part B Cover

Medicare Part B covers 80 percent of the Medicare-approved costs of certain services. Most, though not all, of these services are administered on an outpatient basis. This means you dont receive them as a patient in a hospital.

There are some exceptions to this, such as emergency room visits and the services you receive there, even if youre later admitted to a hospital.

In order to get coverage, your care must be administered by a Medicare-approved supplier, such as an MD, DO, NP, or other medical professionals.

Services that Medicare Part B covers include:

- most doctors visits that are medically necessary or preventive, provided that theyre from a Medicare-approved supplier

- medically necessary outpatient hospital care, such as emergency room services and some same-day surgical procedures

Also Check: How Many Parts Medicare Has

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

Medicare Part B Late Enrollment Fee

It is important to note that if you don’t sign up for Medicare Part B during the initial enrollment period when you are first eligible, you may have to pay a late enrollment fee of up to 10% for each 12-month period that you are not enrolled.

For example, say you’re in the first income bracket and would pay the standard Part B rate of $170.10. But you signed up for Medicare Part B exactly 12 months after your initial enrollment period. You would be required to pay an additional $17.01 each month for Medicare Part B , for a total of $187.11. If you wait two years to enroll, your rate increases by 20% based on the Part B premium in effect that year.

Recommended Reading: Will Medicare Pay For Electric Scooter

Medicare Cost: What Is The Medicare Part B Deductible For 2022

Increased costs for seniors in the new year

Medicare caters to over 60 million US citizens, with the national health insurance program playing an important part in people’s lives on the back of these tough times brought about by COVID-19.

However, certain costs within the program have risen of late, and a higher premium cost comes at an inconvenience to many seniors, who are faced with a higher deductible rate in 2022.

Much of the Social Security raise for 2022, which sees a 5.9 percent increase in the Cost-of-Living Adjustment , will now be consumed by the higher cost for Medicare Part B.

The COLA benefit will increase from 1,565 dollars per month to 1,657 dollars per month, resulting in a 92 dollar increase, yet around one third of that will go towards the added cost of the Medicare Part B deductible in 2022.

This is because seniors on Medicare will have to pay a deductible of 233 dollars in the new year, a 30 dollar increase from 2021, in what is another inconvenience particularly for elderly members of society.

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $170.10 for 2022. It may be higher if your income is more than $91,000.

Youll also be subject to an annual deductible, set at $233 for 2022. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Recommended Reading: Are Medicare Advantage Plans Hmos

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

- Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B.

- Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services.

- Routine dental care

- Routine vision care

- Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting.

- Hearing aids

- 24-hour home health care

- Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesnt generally cover it.

Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

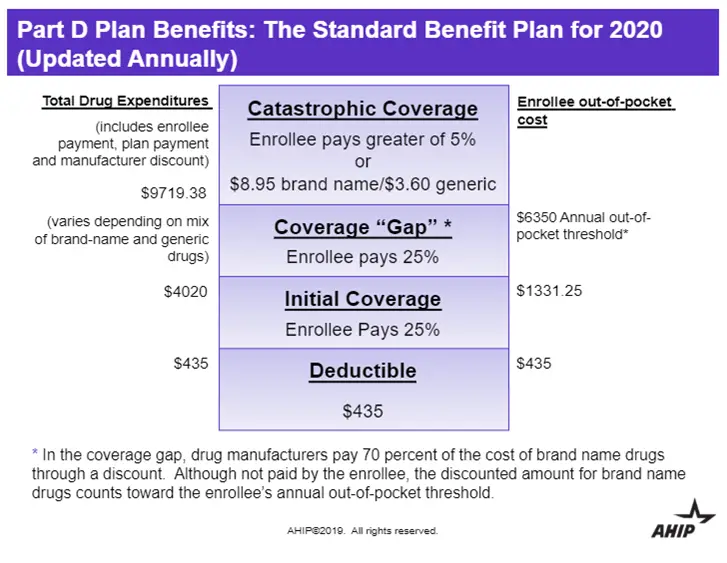

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

You May Like: Does Medicare Cover While Traveling Abroad

Eyesight And Hearing Exams Glasses And Hearing Aids

Medicaremedical insurance does not cover routine eye or hearing examinations. Neitherdoes it cover hearing aids, eyeglasses, or contact lenses, except for lensesrequired following cataract surgery. However, if your eyes or ears are affectedby an illness or injury other than simple loss of strength, the examination andtreatment by an ophthalmologistan eye doctor who is an M.D.or other physicianis covered.

Common Services That Medicare Does And Doesnt Cover

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plans Summary of Benefits to learn whats covered.

Medicare has some coverage for acupuncture and it is limited to treatment of chronic low back pain. Some Medicare Advantage plans have benefits that help pay for acupuncture services beyond Medicare such as treatment of chronic pain in other parts of the body, headaches and nausea.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

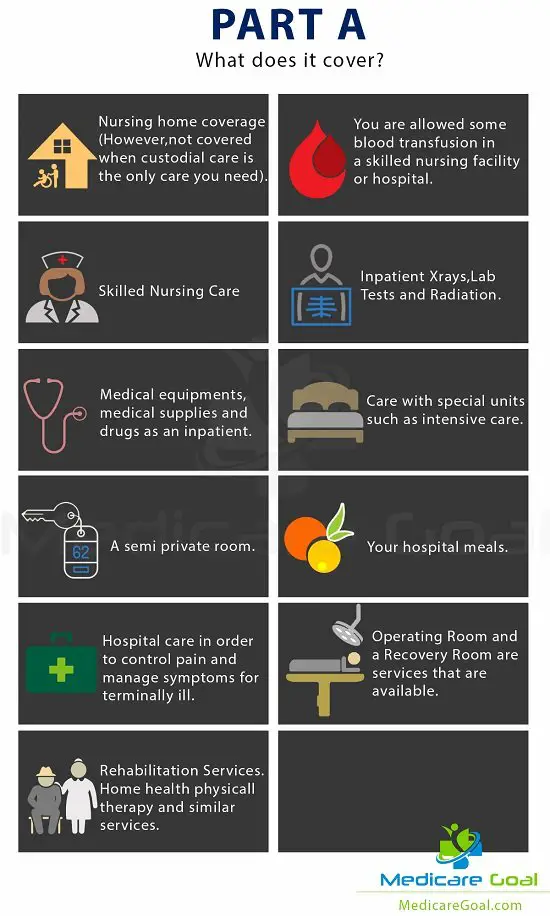

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for corrective lenses if an intraocular lens was implanted. Coverage is one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Also Check: Can You Use Medicare In Any State

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Drawbacks To The Giveback Plan

Though the giveback benefit offers savings, monthly premiums should not be the only consideration when determining what is the best Medicare Advantage plan for you.

- Availability. Plans offering the giveback benefit may not be available in your area.

- Changing amounts. MA plans are offered by private insurance companies that can set their own costs and fees, and they typically change them each year. This means your premium reduction may also change each year.

- Cost. MA plans that offer a premium reduction may have higher costs elsewhere, particularly co-insurance, co-pays, and deductibles. You may also have a higher maximum out-of-pocket . In 2022, the max out-of-pocket for Medicare Advantage is $7,550 for in-network services and $11,300 for out-of-network. Many MA plans have a lower max out-of-pocket. Please note that Original Medicare has no annual out-of-pocket limit.

- Network restrictions. Giveback plans may have a smaller network of providers, as well.

- Givebacks vary. As stated above, it is possible that your giveback benefit could reduce your premium by the full $170.10, but it could also be lower than $1. That reduction may not be worth it based on the other benefits and costs of the plan.

- Possible reduction of benefits. Medicare Advantage plans cover everything Original Medicare does and more, usually including coverage such as routine dental and vision. But some plans that offer a premium reduction benefit eliminate those extra benefits to off-set the lower premium.

Don’t Miss: What Is The Average Cost Of A Medicare Advantage Plan

Supplementing Part B Medical Insurance

Whenyou look at the list of what Medicare medical insurance does not cover, it’seasy to understand why people with Medicare still wind up personallyresponsible for an average of half of their medical bills.

Part BMedicare medical insurance is intended to pay for only a portion of doctorbills, outpatient hospital and clinic charges, laboratory work, some homehealth care, physical and speech therapy, and a very few drugs and medicalsupplies.

PrivateMedicare supplement insurancecalled medigap insurancemay help you make up thedifference. Alternatively, many people fill in the gaps in Medicare by joininga Medicare Advantage health plan . A Medicare Advantageplan often comes in the form of a managed care plan and combines basicMedicare-level coverage with supplemental benefits. If you cannot affordprivate supplement insurance, you may be eligible for Medicaida public programfor people with low income and few assets.

Formore information, see our articles on medigap insurance, Medicaid, and MedicareAdvantage plans.

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctor’s services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

You May Like: Why Is My First Medicare Bill So High

What If I Miss Medicare Open Enrollment

As we mentioned, the Medicare Open Enrollment deadline is December 7. If you fail to act during the Medicare Open Enrollment Period, your coverage will typically stay the same when the next benefit year begins on Jan. 1. So, if you were enrolled in Original Medicare and didnt take action during OEP, youll have the same type of Medicare the next year.

There are exceptions, however under certain circumstances. If December 7 comes and goes and you still need to make changes to your plan, check to see if you qualify for a Special Enrollment Period . These are enrollment periods that open when you experience a certain life-changing event, such as moving or losing other coverage. For example, if your doctor suddenly opts out of accepting your coverage, you may qualify for an SEP. Well get into more of these circumstances below.

What Is Medicare Part B

Medicare Part B helps cover medical services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

For more information about enrolling in Medicare, look in your copy of the “Medicare & You” handbook, call Social Security at 1-800-772-1213, or visit your local Social Security office. If you get benefits from the Railroad Retirement Board , call your local RRB office or 1-800-808-0772.Learn More:

Don’t Miss: What Is The Difference Between Medicare

Medicare Part A Vs Part B

Original Medicare is divided into two parts designed to cover the majority of your medical needs. Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care. Together, the two parts form Original Medicare.

Medicare Savings Programs To Help Pay For Medicare Health Care Costs

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay Medicare Part A and Medicare Part B deductibles, coinsurance, and copayments if you meet certain conditions. There are four kinds of Medicare Savings Programs:

- Qualified Medicare Beneficiary Program helps pay for Part A and/or Part B premiums, and in addition Medicare providers arent allowed to bill you for services and items Medicare covers like deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary Program helps pay for Part B premiums.

- Qualified Individual Program helps pay for Part B premiums and funding for this program is limited.

- Qualified Disabled and Working Individuals Program helps pay for Part A premiums only.

If you qualify for a QMB, SLMB, or QI program, you automatically qualify to get Extra Help paying for Medicare prescription drug coverage.

Recommended Reading: How Much Does Medicare Deduct From Social Security