Does Being On Medicaid Affect Your Citizenship

Use of Medicaid does not automatically disqualify someone from obtaining a green card. The public charge test does not apply in the naturalization process, through which lawful permanent residents apply to become U.S. citizens. Implementation of the new public charge rules remains subject to ongoing litigation.

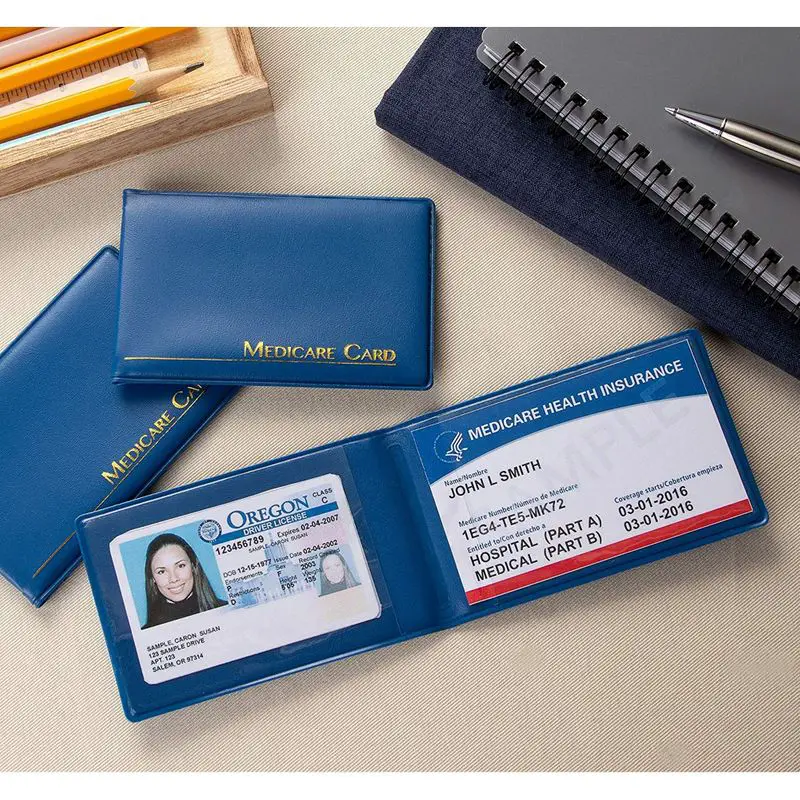

What Does Medicare Coverage Include

Medicare is the federal system of health insurance. Before discussing how a Green Card holder could be eligible for Medicare, it may be helpful to lay out the four parts of Medicare and what they generally include:

- Part A: Is hospital insurance that covers skilled nursing facility care, hospice care, and inpatient hospital stays

- Part B: Provides coverage for doctor visits, preventative services, some medical supplies, and outpatient care

- Part C: Also called Medicare Advantage, is an Original Medicare alternative provided by private insurance companies approved by the federal government

- Part D: Covers prescription medications

Children’s Health Insurance Program

CHIP provides health coverage to children living in families that cannot get Medicaid because their income is too high, but do not have enough money to pay for private insurance.

To normally qualify for CHIP, permanent residents must:

- have been a permanent resident for five years, and

- be a child under 21 AND live in a state that provides Full-Scope Medicaid to permanent residents, or

- be pregnant AND live in a state that provides Full-Scope Medicaid to permanent residents

The “deeming rules” described above may apply. However, many states have taken advantage of an option in the CHIP program to provide CHIP assistance to “lawfully residing” children and pregnant woman, regardless of their date of entry into the United States. Check with your state agency to see whether your state offers this benefit.

Read Also: Is Synvisc Covered By Medicare In Australia

How Does Immigration Status Affect Medicare Enrollment

First, to qualify for Medicare, an immigrant must be a lawful permanent resident of the United States. For example, if your immigrant parent has a green card and has lived in the U.S. at least five years, he or she may qualify for Medicare. Undocumented immigrants are not able to get Medicare.

Many older people who immigrate later in life have little or no work history in the United States. This can affect their Medicare costs.. If this situation applies to your parents, they will likely need to meet the 5-year permanent residency requirement. Once they meet this requirement, they can generally enroll in Medicare Part A and Medicare Part B . They can enroll in Medicare Part D if they have Part A and/or Part B.

Requirements For Medicare Eligibility As A Green Card Holder

To be eligible for full Medicare benefits as a green card holder, you need to be 65 or older, and you or your spouse need to have worked in the U.S. for at least 10 years .

You may still be eligible for Medicare if youve worked fewer years, but youll likely pay a higher cost for the benefits. Those who have worked in the U.S. for the required 10 years or more are eligible for Medicare Part A without the premiums. If you dont qualify for premium-free Part A benefits, you may still be able to purchase coverage.

The cost of Medicare Part B is based on how much you made in your working years rather than how long you worked. For this reason, most individuals still have to pay a premium for this coverage, even if theyve worked in the country for 20 to 30 years. Those who have to purchase Part A coverage are only eligible to do so after purchasing Part B coverage.

You May Like: Does Medicare Pay For Licensed Professional Counselors

Know About Immigrant Health Insurance

In October 2019 President Donald Trump signed The Proclamation stating that a new immigrant will have to show proof of health insurance when they enter the US.

This proclamation empowers the government to stop the entry of immigrants who either do not carry health insurance or do not have the ability to pay for their medical costs while visiting the US.

New immigrants might not qualify for domestic healthcare right away and can consider private insurance. You can opt for either Fixed or Comprehensive plans.

These health insurance plans for New immigrants can provide coverage for hospitalization, intensive care, prescriptions, and more. The plans typically exclude coverage for preventive care and pre-existing conditions. Be sure to read the brochure for coverage and exclusions.

How Much Does Medicare For Immigrants Cost

The Social Security Administration usually decides if someone is eligible for Medicare. Once your parents have met the permanent legal residency requirements, and the age or disability requirements, they can then apply for Medicare coverage.

Be aware that Medicare for immigrants may cost more than it does for U.S. citizens. Most U.S. citizens who have Medicare receive premium-free Medicare Part A because they paid Medicare taxes while working . Unless your parents have this qualifying U.S. work history, they will have to pay a monthly premium for Medicare Part A. Medicare Part B also comes with a monthly premium. Other types of Medicare coverage, available from private insurance companies, may also charge monthly premiums.

In 2021, Medicare Part A premiums can cost up to $471 per month. The standard Medicare Part B premium is $148.50 per month in 2021. Medicare Part D premiums may vary, depending upon the Medicare plan selected.

Read Also: Can You Have Medicare And Medical At The Same Time

How Long Do You Have To Be A Permanent Resident Before Applying For Medicare

You need to have established residency for at least five consecutive years before signing up for Medicare benefits. If you havent been a resident for the required amount of time, you may still qualify if youve been married to a fully insured green card holder or citizen for at least one full calendar year.

How To Apply For Covered California

Once you gain coverage, health insurance for immigrants works much the same way as health insurance for U.S. citizens. But, the application process might be a little different. Here is what immigrants should know about applying for Covered California insurance through the Health for California Insurance Center:

1. Getting a Quote

Getting an insurance quote is the first step in the application process. Applicants can get a free quote online simply by filling out the necessary information. You will not need to answer any questions about your health, but you will need to answer questions about your income, where you live, your household and your immigration status. Once you get your quote, you will have information on different carriers, plan category PPO or HMO, for example plan level, premium price and any subsidies or financial assistance for which you qualify. With all of this information in one place, you can weigh your options and select the plan that is right for you and your family.

2. Verifying Immigration Status

3. Qualifying for Financial Assistance

4. Open Enrollment vs. Special Enrollment

5. Getting Help

Although applying for Covered California is a fairly simple process, help is available to the people who need it. You can call to have an agent, navigator or certified enrollment counselor walk you through the process. You also have the option to print the application in a variety of different languages including Spanish and Chinese.

Recommended Reading: Where Can I Get Medicare Information

Is The Enrollment Process Different

If youre a green card holder applying for Medicare, the process is no different than for anyone else. Your initial enrollment period begins three months before your 65th birthday and ends three months after.

Its very important to apply within this time period so that you avoid penalties for delaying coverage. If youve received Social Security benefits for more than four months before turning 65, then you might be automatically enrolled in Medicare Part A and B.

Visit the Social Security Administration website to check if youre already enrolled and choose what Medicare plans youd like to enroll in.

Question: How Do Senior Immigrants Qualify For Medicare

First, to qualify for Medicare, an immigrant must be a lawful permanent resident of the United States. For example, if your immigrant parent has a green card and has lived in the U.S. at least five years, he or she may qualify for Medicare. Undocumented immigrants are not able to get Medicare.

Don’t Miss: How Do I Enroll In Medicare Part A And B

If I Buy Part A + Part B + Part D Will It Cover Everything

Absolutely not. Medicare has many copays, coinsurance and deductible. Depending upon the duration of hospitalization stay etc., the copays can be huge, even in thousand of dollars. That is why there are insurance plans called Medicare Supplement plans sold by various private health insurance companies. There are many levels of such plans available, varying from Plan A through Plan N.

What Are The Medicare Eligibility Requirements As A Green Card Holder

Several factors dictate whether lawful U.S. residents are eligible for Medicare. As weve mentioned, the main two are the span of time youve worked during your residence in America and how long youve lived here.

Though there are instances where if you fail to meet the Medicare prerequisites, but your spouse does, you could still qualify for coverage under Medicare.

Don’t Miss: Does Medicare Pay For Cpap Machines And Supplies

Learn How To Save On Medicare

Medicare Supplement Insurance plans cant cover your Medicare premiums, but they can help make your Medicare spending more predictable by paying for some of your other out-of-pocket costs such as Medicare deductibles, copayments, coinsurance and more.

Speak with a licensed insurance agent to learn more about Medigap plans in your area, and find a plan that can help you save on out-of-pocket Medicare costs.

How Do I Qualify For Medicare

En español | There are two main categories for qualifying for Medicare: You can become eligible at age 65 or older or at an earlier age due to disability. But in each case you must meet certain conditions:

Qualifying on the basis of age:

You must be 65 or older and

- a United States citizen, or

- a permanent legal resident who has lived in the United States for at least five years before applying or

- a green card holder who has been married to a fully insured U.S. citizen or green card holder for at least one year.

To be fully insured you must have earned at least 40 work credits through paying Medicare payroll taxes at work . This guarantees that you pay no monthly premiums for Part A hospital insurance. You can also qualify for premium-free Part A on the work record of your spouse, including a divorced or deceased spouse. If neither you nor your spouse has earned 40 work credits, you can nonetheless receive Part A benefits by paying monthly premiums for them.

You dont need any work credits to qualify for Part B or Part D services you just pay the required monthly premiums.

Qualifying on the basis of disability

Two groups of people can receive Medicare sooner:

- People with kidney failure who need regular dialysis or a kidney transplant and

- People with Lou Gehrigs disease .

If you have ALS, you must apply for Social Security disability. Your Medicare coverage begins at the same time as you start receiving disability benefits .

You May Like: How Do I Get Money Back From Medicare

Medical Insurance For Green Card Holders Senior Citizen

If you are a green card holder above the age of 65, you must consider purchasing medical insurance to save yourself from any unforeseen accidents. It is advised to purchase your health insurance from the United States itself.

Depending on your time of stay in the US, you should apply for medical insurance plans for green card holders. Visit Visitor Guard® and get your free quote.

Some of the best health insurance for green card holders over 65 years are-

| $206 per month |

What Is New Immigrantinsurance

Newimmigrant insurance is also known as Green Card Insurance. This coverageprovides medical coverage for three types of immigrants:

- GreenCard holders that travel between the US and their home state regularly

- GreenCard holders that are becoming permanent US residents

- Anew arrival to the US who just received a Green Card

Thepurpose of this type of insurance is to fill in the gap until the new immigrantis allowed to apply for US health insurance coverage. This type of coverage istypically used as a stopgap for elderly green card holders that are in the USto help or even stay with younger family members. These individuals must meetthe minimum requirements Medicare imposed for green card holders to obtainMedicare. In the meantime, they may be eligible for other insurance coverage.Until that minimum requirement is met, many new immigrants or those green cardholders that travel back and forth between countries are left uninsured andvulnerable to serious medical debt. New immigrant insurance provides a stopgappolicy to prevent this type of financial hardship.

The FrequentTraveler

The NewPermanent Resident

When you,as an immigrant, become a new permanent resident of the US, you have the rightto sign up for insurance as a US green cardholder. However, you may have missedthe registration deadline or may need to wait for the coverage to becomeactive. This period is the perfect time to use new immigrant insurance, or atemporary insurance policy, to make sure there is no gap in coverage.

Recommended Reading: Does Medicare Cover Me Overseas

Do You Qualify For Medicaid

If you are a green card holder for 5 years or more then you may be able to be covered by Medicaid, LaChip, or a similar state health program. Lawfully present immigrants are eligible for coverage through the health insurance marketplace when not eligible for Medicaid. Qualified non-citizens oftentimes will qualify for Medicaid and CHIP programs providing they meet residency criteria per their region. The only exception to the 5-year residency rule is previous asylees and refugees now recognized as LPRs.

If you fall under a protected status or have a valid non-immigrant visa you may also qualify. You can visit the official healthcare website to see a full list of immigration statuses eligible for Marketplace coverage.

Where pregnant women and children are concerned the 5-year residency rule may be waived, however, that depends on the state in which they have applied. Normally they are considered as lawfully present. if your state is one who offers this option. It is important to note that having healthcare through Medicaid or CHIP is, in fact, a public charge and wont interfere with their chances of becoming a Lawful Permanent Resident or US citizen when used responsibly.

Costs For Medicare Depending On Your Work History

If you have a full 10 years or 40 quarters of working in the United States, then you can enroll in Medicare Part A. For each quarter, youll need to have earned more than $1470 for it to count towards your 40 working quarters.

You can still purchase Medicare Part A insurance if you dont fulfill the working requirements.

Recommended Reading: How Much Does Medicare Part C Cost Per Month

Can Permanent Residents Get Medicare For Free

Only Medicare Part-A coverage can be obtained for free by Permanent Residents who meet the minimum residency and employment requirements. For all other parts of Medicare, they have to pay a premium. This doesnt just go for green card holders but applies to US citizens as well.

Every Medicare beneficiary must pay the premiums for Medicare Part B and D coverage, even if they qualify for premium-free Medicare Part A coverage. Other associated costs include deductibles and coinsurances.

Can Immigrants Buy Individual Health Insurance

This is the area that has changed the most for recent immigrants who are 65 or older. Prior to 2014, obtaining individual health insurance for your grandmother in the private market would have been difficult or impossible, since very few major insurers were interested in selling coverage to people over 65.

But the Affordable Care Act has changed that. Health history is no longer used to determine eligibility or premiums in the individual market, and private carriers now offer coverage to people who are 65 or older, as long as they are not enrolled in Medicare.

The ACA also stipulates that older enrollees cannot be charged more than three times the premiums that younger enrollees pay. Since most individual market enrollees are 64 or younger, this rule typically means that a 64-year-old will pay no more than three times as much as a 21-year-old for the same coverage. But if an 80-year-old enrolls in that plan, her premium will be the same as a 64-year-old.

So for the first five years that your grandmother lives in the United States , shell be able to purchase individual health insurance through the exchange in the state where she lives. Depending on her income, she may be eligible for subsidies to lower the cost of the premiums, and if her income is doesnt exceed 250% of the poverty level, shell also be eligible for cost-sharing reductions if she buys a silver plan.

Recommended Reading: When Do Medicare Benefits Start

What Happens If You Dont Sign Up For Medicare During The Initial Enrollment Period

Whether youre a green card holder, naturalized citizen, or a citizen by birth, you will become liable to pay the penalty if you do not enroll in Medicare during the initial enrollment window, which will increase the monthly cost of the health insurance plan.

This could be different depending on your Medicare plan. But, to give you an idea, delaying enrollment in Medicare Part A can increase your premium by 10% for twice the period for which you missed the coverage. For Part B, the premium can increase by 10% every year you delay enrollments.

There is also a penalty for delaying Medicare Part D coverage. Calculating it is a little more complex than Original Medicare. Get in touch with our Medicare experts if you have delayed enrollment in Medicare Part D, or Medicare, on the whole, to determine how much extra you will have to pay in terms of penalties and how long you will have to pay them.