Medicare Premium Payments Through Your Bank Account

Contact your bank, or go to your banks website, to set up automatic payment. Heres the payee information youll need:

- Your Medicare account number its on your red, white, and blue Medicare card. Dont enter the dashes when you enter this number.

- The payee name: CMS Medicare Insurance

- The remittance address: Medicare Premium Collection Center, P.O. Box 790355, St. Louis, MO 63179-0355

- The premium amount

Note: If your Medicare premium bill comes from the Railroad Retirement Board , or if you receive Civil Service benefits, see the information at the end of this article.

How Much Does Health Insurance Cost For A Family Of 4

The average premium for a family of 4 in 2018 was $1,168, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use and number of plan members.

Can Spouses Share The Same Medicare Supplement Policy

by Christian Worstell | Published December 16, 2020 | Reviewed by John Krahnert

You cannot be on the same Medicare Supplement insurance policy as your husband or wife you must have separate policies. However, you and your spouse may be able to get a discount if you both buy individual policies from the same insurance company.

You May Like: Does Medicare Pay For Varicose Veins

Medicare Reimbursement For Medicare Prescription Drug Coverage

Original Medicare does not typically cover prescription drugs you take at home. If you want this kind of coverage, you need to enroll in a stand-alone Medicare Part D Prescription Drug Plan. Or you can enroll in a Medicare Advantage Prescription Drug plan as an alternative way to get your Original Medicare benefits, and thus get all of your Medicare coverage through a single plan. You still need to pay your monthly Medicare Part B premium, in addition to any premium the Medicare Advantage plan may charge.

If you have a Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan that doesnt cover a prescription medication your doctor prescribes, you can file an appeal. However, you might first want to speak with your doctor to see if any prescription drug your plan does cover can be substituted.

This website and its contents are for informational purposes only. Nothing on the website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

How To Pay Social Security And Medicare Taxes

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. This article has been viewed 29,797 times.

Most people working in the United States are required to pay Social Security and Medicare taxes. If you earn wages from an employer, these are called Federal Insurance Contributions Act taxes, and they are split 50/50 between the two of you. If you are self-employed, according to the Self-Employment Contributions Act , you must pay the full amount of these taxes yourself. When completing your yearly income taxes, you will need to complete additional forms in order to calculate the amount of tax you owe and to pay the IRS.

You May Like: Who Qualifies For Medicare Part C

Is It A Good Idea For Couples To Choose The Same Medicare Insurance Plan

Q: Is it a good idea for couples to choose the same Medicare insurance plan?

A: No, you should normally choose Medicare coverage based on your own health care needs. The exception is if both spouses are offered retiree coverage, and in that case you both may end up in a more generous plan than what is available to most Medicare enrollees.

Also Check: Does Medicare Pay For Inogen Oxygen Concentrator

Other Reasons To File A Claim

In addition to the above reasons, an individual may also file a claim if the treating doctor delayed submitting the claim. Also, if the doctor or healthcare provider refused to submit a claim or if they were unable to file the claim, a person can complete the form.

To file a Medicare claim, a person needs to download and print the CMS form #14906, which is the patient request for medical payment. The form should be completed in full.

The following information will usually need to be sent with the form:

- Medicare ID number

- doctor or healthcare providers name and billing address

- date and place of service

- charges for each service and itemized bill

It is a good idea for a person to make a copy of all the forms and documents, and keep the information with their own records.

A person will then send the completed form to the Medicare administrative contractor in their state. The patient request for medical payment form usually has the contractors details or a person can call Medicare 1-800-MEDICARE for the address.

After a person submits the form, Medicare may take up to 60 days to process and review the claim.

You May Like: Does Medicare Cover A1c Test

Read Also: Which Medicare Plan Covers Prescription Medications

How Long Do I Have To File A Claim

Original Medicare claims have to be submitted within 12 months of when you received care. Medicare Advantage plans have different time limits for when you have to submit claims, and these time limits are shorter than Original Medicare. Contact your Advantage plan to find out its time limit for submitting claims.

What Should I Do If My Provider Doesnt File My Claim

Before receiving care, ask your providers office whether they will submit your bill to Original Medicare. While they arent required to do so, some non-participating providers will still file your claims with Medicare.

The same situation applies for Medicare Advantage enrollees who see out-of-network providers. These providers dont have to file claims with your Advantage plan, but may choose to do so.

If you have Original Medicare and a participating provider refuses to submit a claim, you can file a complaint with 1-800-MEDICARE. Regardless of whether or not the provider is required to file claims, you can submit the healthcare claims yourself. You can file an Original Medicare claim by sending a Beneficiary Request for Medical Payment form and the providers bill or invoice to your regional Medicare Administrative Contractor . Keep copies of everything you submit.

, Home Health Advance Beneficiary Notice, or Skilled Nursing Advance Beneficiary Notice if they believe Medicare will not cover your care. Providers normally will not bill Medicare after they issue an ABN.

You have the right to demand bill, which is when you demand that the provider or facility submit a claim to Medicare for your care. In order to demand bill, you must sign the ABN and agree to pay the charges if Medicare denies coverage. Demand billing can be used to generate a formal Medicare coverage denial, which gives you further appeal rights.)

Recommended Reading: Does Medicare Pay For Blepharoplasty

How To Get Reimbursed From Medicare

To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out. You can print it and fill it out by hand. The form asks for information about you, your claim, and other health insurance you have.

The itemized bill must contain the following information:

- Date of service

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Employers Often Bear Costs

But many employers do pay the lions share of the cost to add family members, even though theyre not required to do so. In 2020, the average total premiums for family coverage under employer-sponsored plans was $21,342, and employers paid an average of nearly 74% of that total cost.

But the amount the employers paid varies considerably depending on the size of the organization smaller firms are much less likely to pay a significant portion of the premium to add dependents and spouses to their employees coverage.

Also Check: What Does Regular Medicare Cover

Read Also: Why Sign Up For Medicare At 65

Ways To Pay Your Medicare Part B Premium

If youre like most people, you dont pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . You will need to make arrangements to pay this bill every month.

If you are required to pay a Part D income-related monthly adjustment amount , you will also need a way to make your payment.

How To Cancel Medicare Part B

You may be automatically enrolled in Part B medical insurance. When you receive your Medicare card and welcome packet in the mail, the back of your Medicare card will include instructions for disenrolling from Part B.

If you do not initially disenroll in Part B, you will have to do so by contacting your local Social Security office or calling 1-800-772-1213 .

You may not disenroll from Part B online. You will have to speak directly to a Social Security agent to complete the process.

Don’t Miss: What Preventive Care Does Medicare Cover

What Should I Do If Ive Received This Notice

Although you may continue to receive the 1095-B form, the good news is theres nothing you need to do about it. You dont have to fill anything out or send the form anywhere. Just file it with your other tax documents.

Receiving multiple forms can get confusing, and they generally look alike. The 1095-B is an explanation of the healthcare coverage you had for the previous year. It is not the same as your benefit statement from Social Security.

Medicare Medicaid And Billing

Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims youd send to a private third-party payer, with a few notable exceptions.

Since these two government programs are high-volume payers, billers send claims directly to Medicare and Medicaid. That means billers do not need to go through a clearinghouse for these claims, and it also means that the onus for clean claims is on the biller.

Don’t Miss: Is Xolair Covered By Medicare Part B

Avoiding The Need For Claims

Make sure that your doctor accepts Medicare assignment. For Original Medicare, Part A and Part B, this means that your doctor or provider agrees to be paid by Medicare, and that they accept the Medicare-approved amount for a particular service. When your doctor accepts Medicare assignment, it also means she or he agrees not to bill you for more than the Medicare deductible and/or coinsurance. Private insurance companies contracted with Medicare may bill Medicare differently.

If your health-care provider doesnt accept Medicare assignment, you may have to pay the full cost for the service up front, and get reimbursed by Medicare. You also might have to pay more than the Medicare-approved amount. In most cases, the doctors office should file the reimbursement claim for you. If you have to file your own claim, see below.

You May Like: How Is Part B Medicare Premium Determined

Who Normally Files A Claim

Typically, your Medicare claims should be sent directly from your provider to Medicare. Your provider will then be paid a reimbursement rate according to the programs regulations and legislation. Your medical provider is required by law to submit these claims so it is typically not your individual responsibility.

Enter your zip code above and make sure you have the best Medicare provider your state has to offer!

Recommended Reading: Will Medicare Pay For A Bedside Commode

How To File Your Medicare Reconsideration Request

If you wish to appeal your IRMAA, you should print out Form SSA-44 titled Medicare Income-Related Monthly Adjustment Amount Life-Changing Event. This form walks you through the steps of providing updated income information as well as listing what documentation will be required for evidence of your new MAGI.

As with any kind of appeal, the most important thing is your documentation. Write a cover letter explaining why you think you are being overcharged. Then provide backup documentation. For example, you could include a letter from your former employer confirming that you have you now retired. Include a copy of your last pay stub to show them what you used to earn that you are not earning anymore.

Other documents you could include that may prove loss of income are: bank statements, termination or retirement letters from employers, and other financial statements.

Bottom line: provide as many official documents and facts as possible to support your case.

If your appeal is successful, Social Security will automatically correct your Medicare Part B premium amounts. If they deny your appeal, they will provide instructions on how to appeal the denial to an Administrative Law Judge.

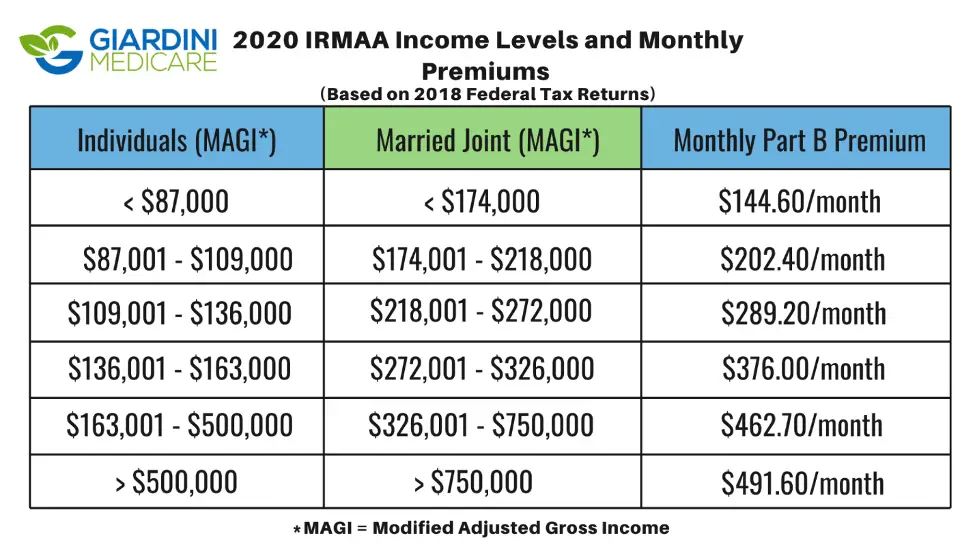

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

Don’t Miss: How To Apply For Medicare Insurance

Can I Use Social Security Benefits To Pay My Medicare Premiums

Your Social Security benefits can be used to pay some of your Medicare premiums.

In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance or Social Security retirement benefits.

However, this doesnt apply to all Medicare premiums. Each part of Medicare has its own premiums and rules for interacting with Social Security.

Well discuss how this works for each part next.

B Premium Can Be Limited By Social Security Cola But That Wasnt An Issue For Most Beneficiaries In 2020 Or 2021

In 2021, most enrollees pay $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 and in 2019 . But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees.

Also Check: Does Medicare Part B Cover Prolia Shots

If You Are Not Receiving Social Security Retirement Benefits

Youll receive an invoice every 3 months from Medicare and need to choose from one of the following payment options:

Write a check

You can write a check for the balance due , and mail it directly to the Medicare Premium Collection Center .

On the premium invoice, you have an option to enter your credit or debit card information. Be sure to add your signature to authorize the payment. Then mail the invoice to the Medicare Premium Collection Center at the address listed above.

Pay through your banks online bill pay system

Just like any other bill you pay through your banks website, you can simply add CMS Medicare Insurance as an online bill payment. Use your Medicare Number as the account number. Your Medicare Number is listed on your Medicare card, as well as on the billing invoice.

Medicare Easy Pay

This is a commonly underutilized option that automates monthly payments, rather than paying each quarter. You will need to complete and return the to the Medicare Premium Collection Center . NOTE: This is a different P.O. Box than the one for mailing premium payments.

In Your MyMedicare.gov Account

After creating your account at MyMedicare.gov, select My Premiums and then Pay Now. You will then be prompted to select your payment method, such as credit/debit card, checking account, or savings account. Follow the instructions to complete the transaction.