Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

If you ended up with a huge tax bill this year and dont want another, you can use Form W-4 to increase your tax withholding. Thatll help you owe less next year.

If you got a huge tax refund, consider using Form W-4 to reduce your tax withholding. Youre giving the government a free loan and even worse you might be needlessly living on less of your paycheck all year. It may feel great to get a tax refund from the IRS, but think of how life mightve been last year if youd had that extra money when you needed it for groceries, overdue bills, getting the car fixed, paying off a credit card or investing.

Other Payroll Tax Items You May Hear About

-

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

-

SUTA tax: The same general idea as FUTA, but the money funds a state program. Employers pay the tax.

-

Self-employment tax: If you work for yourself, you may also have to pay self-employment taxes, which are essentially the full load of Social Security and Medicare taxes. Thats because the IRS imposes a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Typically, employees and their employers split that bill, which is why employees have 6.2% and 1.45%, respectively, held from their paychecks. Self-employed people, however, pay the whole thing. A 0.9% additional Medicare tax may also apply if your net earnings from self-employment exceed $200,000 if youre a single filer or $250,000 if youre filing jointly. Because you may not be receiving a traditional paycheck, you may need to file estimated quarterly taxes in lieu of withholdings.

Monitoring Ss And Medicare Status

The Research Foundation is solely responsible for processing the correct withholding or exemption of SS and Medicare taxes. Error where the RF has not withheld the taxes can result in significant risk of fines and penalties from the government. SS and Medicare status for all Research Foundation employees should be monitored periodically. The Discoverer query tool can be used to assist in reviewing this information. Appropriate action should be taken to discontinue SS and Medicare tax exemption for employees when it is notapplicable, and to change employees’ status to exempt when it is appropriate.

Don’t Miss: How To Pay Medicare Premium

What Is The Fica Tax

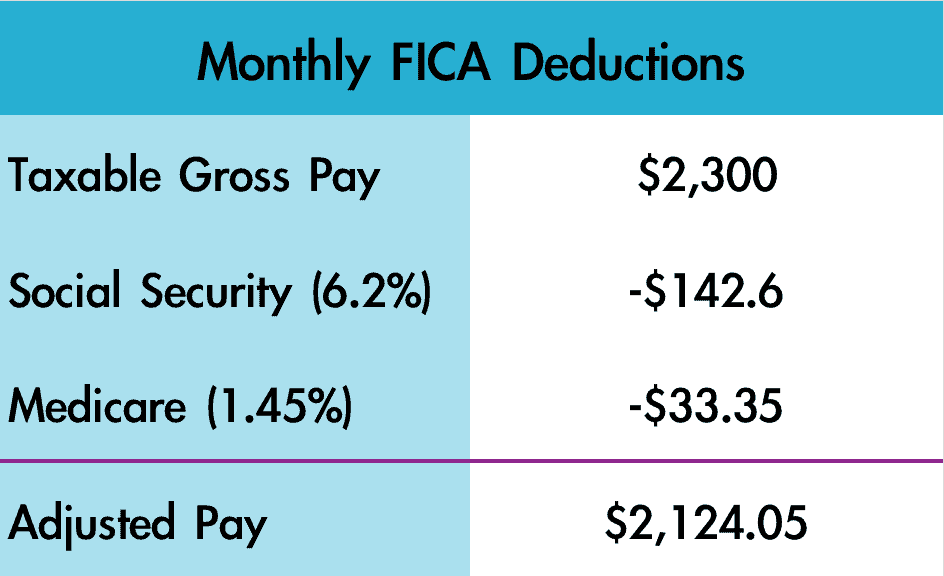

The FICA tax is a U.S. federal payroll tax paid by employees and their employers. It consists of:

- A 6.2% Social Security tax: This tax is referred to as Old Age, Survivors, and Disability Insurance, or OASDI. It provides benefits to retirees, disabled individuals under retirement age, spouses and former spouses, as well as dependent children .

- A 1.45% Medicare tax: This tax allows employees to qualify for Part A Medicare coverage with no additional cost to obtain coverage through Parts B, C, and D when eligible to do so.

The FICA tax rate is applied to all taxable compensation. This includes salary, wages, tips, bonuses, commissions, and taxable fringe benefits. IRS Publication 15-B has a chart of various fringe benefits that are subject to FICA and those that are exempt .

Compensation subject to FICA also includes salary reduction contributions employees make to 401 or comparable plans, even though such contributions are not taxable.

Before You Calculate Fica Tax Withholding

To calculate FICA taxes from an employee’s paycheck, you will need to know:

- The amount of gross pay for the employee for that pay period

- The total year-to-date gross pay for that employee

- The Social Security and Medicare withholding rates for that year

- Any amounts deducted from that employee’s pay for pre-tax retirement plans.

Employee pay subject to Social Security and Medicare taxes may be different from gross pay. This article on Social Security wages explains what’s included and what’s not.

In addition, you will need to know, for each year:

The Social Security Maximum. This is the maximum wages or salary amount for Social Security withholding for that year. Each year the Social Security Administration publishes a maximum Social Security amount no Social Security withholding is taken from employee pay above this amount. Go to this article on the “Social Security Maximum” to find this year’s maximum withholding amount.

The Additional Medicare Tax. The pay amount at which additional Medicare taxes must be withheld from higher-paid employees. The pay amount is different depending on the individual’s tax status At the specified level for the year, an additional 0.9% must be withheld from the employee’s pay for the remainder of the year. You must begin deducting the additional 0.9% when the employee’s wages reach $200,000 for the year, no matter what the employee’s marital status is.

Also Check: Does Medicare Supplement Cover Drugs

Pay Attention To Your Paycheck

Its important that you regularly track your paystub with your employer, particularly because of the temporary end-of-year changes. Calculate the dollar amount that you expect to see withheld every paycheck and make sure that the numbers are accurate. Mistakes happen, so its important to track things closely. Make sure you arent overpaying or underpaying for FICA each paycheck.

Those that are self-employed will want to be diligent in calculating as well. The other habit to form in your business is keeping track of the FICA percentages and accurately tracking your business expenses and income. Paying quarterly is a wise choice and keeping your expenses organized between each filing is imperative.

In some cases, people overpay on their FICA and are eligible for a refund once they file their taxes.

What Is The Medicare Tax Rate For 2021

The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

Thus, the total FICA tax rate is 7.65%. The maximum Social Security tax amount for both employees and employers is $8,239.80. For self-employed people, the maximum Social Security tax is $16,479.60. Anyone who earns wages over $200,000 will need to pay an extra 0.9% Medicare tax.

Employers arent responsible for this additional fee. The charge is withheld from the employees wages only. The self-employment tax rate is slightly higher, at 15.3%. Both the Social Security tax rate of 12.4% and the 2.9% Medicare tax rate contribute to this figure.

Read Also: How To Get Social Security Money

Read Also: Are Continuous Glucose Monitors Covered By Medicare

What Is The Additional Medicare Tax

The Affordable Care Act expanded the Medicare payroll tax to include the Additional Medicare Tax. This new Medicare tax increase requires higher wage earners to pay an additional tax on earned income.

All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax. An individual owes Additional Medicare Tax on all cumulative wages, compensation, and self-employment income once the total amount exceeds the threshold for their filing status.

The Cares Act Of 2020

On March 27, 2020, former President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19-related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

The CARES Act changes to Medicare will likely continue until the pandemic ends.

Recommended Reading: Can You Apply For Medicare At 64

Adjustments To Net Investment Income Tax

It is possible to lower your net investment income if you have the following:

- Received self-employment income from your partnership or S corporation.

- Sold business property.

- Have a capital loss carryover from the year before which includes a loss from a business property sale.

To avoid paying the extra net investment income tax and additional medicare tax, your goal should be to earn less than $200,000 as an individual or $250,000 as a couple.

One of the best ways to be more flexible with your income is to start and operate a business. You have more flexibility in terms of receiving payment, purchasing business equipment, and investing in your companies future to adjust your income accordingly.

For example, you can ask your vendor to pay you your fourth quarter receivables in the first quarter of next year if you think taxes will be more favorable. You can also decide to purchase your top of the line Macbook Pro and a company car in the current year if your income is much too high and is expected to decline next year.

Related: How To Pay Little Or No Taxes For The Rest Of Your Life

How To Calculate Your Wa Cares Fund Withholding

WA Cares deductions begin on January 1, 2022.

To calculate the amount of WA Cares withheld from your paycheck, it is 0.58 cents per every $100.00 of earnings.

For example, if an employee earns $50,000 annually, the total annual premium is $290 or $12.08 per paycheck.

Related Info

- To update your federal withholding in Workday, refer to the Update Federal Withholding Elections User Guide.

- For guidance on obtaining your year-end tax forms, refer to the Year End Tax Resources page.

As a reminder, the ISC cannot provide tax or financial planning advice.

Also Check: When Can You Get Social Security At What Age

Don’t Miss: How Much Do I Have To Pay For Medicare

Who Pays The Medicare Tax

Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer. In certain limited situations, you may have to pay the Medicare tax on income earned outside of the United States . If Medicare taxes are withheld from your paycheck in error, you should contact your employer to ask for a refund.

How To Calculate Additional Medicare Tax Properly

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return.

Lets look at how to calculate Additional Medicare Tax properly. For those of you fortunate to earn six-figures or more, Additional Medicare Tax is something you will face.

You May Like: Does Stanford Hospital Accept Medicare

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security Benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

What If An Employer Withholds Too Much Fica Tax From An Employees Pay

If you over-withhold FICA from an employees pay, you should take steps to correct the problem. Here are the options:

- Refund the excess withholding to the employee. This can be done by taking out less from the employees paycheck to offset the excess withholding. This is usually a good option.

- File a claim with the IRS to recoup the excess payment. This may be necessary if the employee is no longer on your payroll and there are no other options to adjust future withholding.

Use Form 941-X, Adjusted Employers Quarterly Federal Tax Return or Claim for Refund, or Form 944-X, Adjusted Employers Annual Federal Tax Return or Claim for Refund to make the make an adjustment in withholding or a claim for refund. If you do nothing, the employee can claim the excess payment as a tax credit on an income tax return.

Dont Miss: 154 Pierrepont Street Social Security Hours

Also Check: Does Medicare Pay For Cancer Drugs

It Looks Like The Ssa Used 3 Year Old Information To Calculate My Irmaa Even Though I Have A More Recent Tax Return On File What Can I Do

It appears that this is a common occurrence. In fact, its common enough for the SSA procedure manual to have its own section that outlines what to do:

To summarize, this is the process by which the SSA office should verify the taxpayers more recent return, and use that information to re-run the IRMAA calculation. For example, a client recently asked about her 2021 IRMAA, which was calculated using 2018 tax return information, even though she and her husband had filed a 2019 tax return.

This shouldnot require an SSA-44, because this is not considered a life-changing event. This is a completely different procedural matter that requires a different process to resolve it.

Update: Recently, a client had this conversation with the SSA on this very matter. It appears that something in the SSAs system is automatically generating a lot of these notices, which the SSA is trying to get fixed. Two different SSA employees told her that in the interim, the best way to resolve this is to

- Contact the SSA office to inform them of this

- Resubmit the SSA-44 form. If possible, put the form to the attention to the person/department you discussed this with

Your mileage may vary. Will update this post as warranted.

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Read Also: When Does Medicare Part D Start

Don’t Miss: Is Cobra Creditable Coverage For Medicare

What’s The Current Medicare Tax Rate

In 2021, the Medicare tax rate is 1.45%. This is the amount you’ll see come out of your paycheck, and it’s matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

| 2021 Medicare tax rate |

|---|

| Your employer pays | 1.45% |

For those who are self-employed, the full 2.9% must be paid by the individual, rather than splitting the tax with an employer. This tax toward Medicare is included in the self-employment tax that is paid quarterly through estimated tax payments.

The self-employment tax amount is based on net earnings calculated using IRS form Schedule SE. Even though the tax rate is higher for the self-employed, it’s being paid on a smaller portion of income because the taxable income is 92.38% of net profit.

For high-income self-employed earners, the Additional Medicare Tax of 0.9% also applies for any income above the annual threshold.

| 2021 Medicare tax for self-employed | |

|---|---|

| Rate you pay on 92% of net earnings | 2.9% |

| Additional amount you pay on income above the annual threshold | 0.9% |

What Do Payroll Taxes Fund

In the United States, payroll taxes are social security and medicare taxes. This means federal payroll taxes are used to fund social security and medicare programs across the country. This is intended to ensure a basic level of medical care and social support in old age, disability and various other cases.

Note, in the United States payment of medicare and social security taxes does not negate the need for comprehensive health insurance.

Don’t Miss: How Old To Be Covered By Medicare

Requesting A Reconsideration Or Appealing Irmaa Surcharges For A Life

While many higher-income individuals will find themselves perpetually subject to IRMAA, based on ongoing income that exceeds the MAGI thresholds, others may find that IRMAA impacts them only periodically, in occasional years where the first IRMAA tiers are reached.

Accordingly, its important to recognize that even if a household has been subject to IRMAA in the past, he/she will not automatically be subject to the IRMAA surcharges in the future. Instead, the determination is made based on his/her income each year. With the caveat that, due to the nature of the prior-prior year income calculation, that a household could have a reduction in income in the current year, and still be subject to IRMAA due to higher income in prior years.

For instance, a married couple that had higher income in 2016 and 2017, due to a series of substantial Roth conversions in retirement that put their household income over $170,000, would be subject to IRMAA surcharges on their Medicare Part B and Part D premiums in 2018 . Even though, in 2018, their income might be well below the specified threshold . Still, because the 2018 premiums and surcharges in 2018 were calculated based on their 2016 income, IRMAA will apply. Notably, the couple will benefit from their lower income in 2018 which makes them not subject to IRMAA anymore but the lower Medicare Part B and Part D premiums, without IRMAA surcharges, wont apply until 2020 .

Recommended Reading: Does Medicare Part C Cover Dentures