What Does Medicare Part D Cost

Your actual costs for Medicare Part D prescription drug coverage vary depending on the following:

- The prescriptions you take, and how often

- The stand-alone Medicare Part D Prescription Drug Plan or Medicare Advantage Prescription Drug plan you choose

- Whether you go to a pharmacy in your plans network

- Whether your prescription drugs are on your Medicare Part D plans formulary *

- Whether you get Extra Help paying your Medicare Part D costs

*Remember that formularies may change at any time. Youll be notified by your Medicare plan if necessary.

One of the costs you should consider is your monthly premium. Most stand-alone Medicare Part D Prescription Drug Plans and Medicare Advantage Prescription Drug plans charge a monthly premium that varies by plan, so youll be responsible for paying that premium. Please note that if youre enrolled in a Medicare Prescription Drug Plan and are also enrolled in Medicare Part B, you must also continuing paying your Medicare Part B premium. And, if youre enrolled in a Medicare Advantage plan , you must continue paying your Part B premium, along with any premium for your Medicare Advantage coverage.

In addition to your monthly premium, the costs for your Medicare Part D coverage may include:

You can find out more about this from the Social Security Administration or your State Medical Assistance Office.

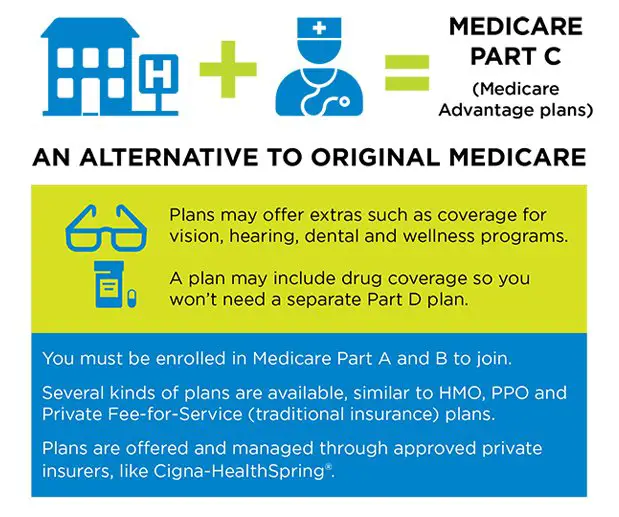

Can I Join A Medicare Advantage Plan

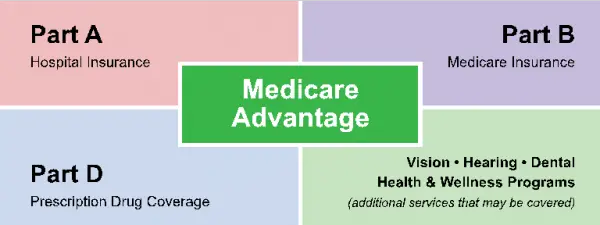

Medicare Advantage Plans is both Part A and Part B coverage .1 This can include dental, vision, and prescription drug coverage, as well as no-cost extras.

If you want to enroll, you must:

- Be eligible for Medicare

- Be enrolled in both Medicare Part A and Part B

- Not have end-stage renal disease

- Live within the plans service area

Find your plan service area with our Plan Finder tool

Based on the plan, there may be specific enrollment details. You can contact us for this information, or use our enrollment tool.

Once you are enrolled, the private company supporting your Medicare plan will set up your benefits. You do not lose your Original Medicare.

What Does Medicare Part C Cover

The law requires that Medicare Part C cover emergency care and other urgent care. Medicare Advantage plans also cover almost all of the services Original Medicare covers. That includes hospital care and other inpatient care that you can get through Medicare Part A. It also includes the outpatient care, like preventive care and lab services, that you receive from Medicare Part B.

Most Medicare Advantage plans also come with vision, dental, hearing, and prescription drug coverage. Medicare prescription drug plans that are part of Part C are known as Medicare Advantage Prescription Drug plans.

Some Medicare Advantage plans cover additional other services like transportation to doctor visits or adult day care services. Certain plans also tailor their benefits to chronically ill enrollees.

However, all of the benefits and services that go beyond what Original Medicare covers are optional. Insurers do not have to offer them and not all plans include them. Read the benefits information for a specific plan to see exactly what it covers.

No Medicare Advantage plan covers hospice care. However, Original Medicare still covers hospice care even if you primarily use Medicare Advantage.

Recommended Reading: Must I Take Medicare At 65

Private Fee For Service

A type of Medicare Advantage Plan in which your parent may see any Medicare-approved doctor or receive treatment from any hospital that accepts the plans payment. The insurance plan, rather than the Medicare Program, decides how much it will pay and what your parent must pay for the services they receive.

How To Enroll In Medicare Advantage

Signing up for Medicare is an important step to saving money on your health insurance every year. With Medicare Advantage, you can still get plans for zero or little cost per month, but they are sold through private health insurance companies. You can enroll in Medicare Advantage during your initial eligibility period for Medicare as well as during Open Enrollment Periods . The following section discusses how to sign up and what to understand about these enrollment periods.

Recommended Reading: When Can I Get My Medicare

Medicare Advantage Enrollment Periods

There are six different time periods for joining a Medicare Advantage plan after youve enrolled in Parts A and B. Theres also a designated time during which you cant join a Medicare Advantage plan for the first time but you can switch between plans if already in a Medicare Advantage plan.

Open Enrollment PeriodsAnyone who has Original Medicare or Medicare Advantage can use the first open enrollment period. But the second open enrollment period only allows changes for people who are already using a Medicare Advantage plan. The designations of first and second are names that we have applied for the sake of clarity. These designations are not used in Medicares own literature.

| Open Enrollment Periods for Medicare Advantage and Other Health Plans | |||

|

Switch From OM* to MA |

Revert to OM |

Drop One MA Plan and Join Another |

Timeframe for Making Changes |

*OM = Original Medicare. Those who have Original Medicare get all A and B services from Medicare itself. See the coverage section of this article for more information.

Enrollment Periods Based on Individual Circumstances If youre unable to utilize one of the open enrollment periods, or if youd like to enroll before or after those periods, chances are good that youll qualify for one of the five other Medicare Advantage enrollment periods below.

Are There Any Protections If I Enroll In A Plan And Do Not Like It

In order to enable beneficiaries to try a Medicare Advantage plan, but still have the option of returning to Original Medicare, a number of protections are in place. These protections will enable beneficiaries, in certain situations, to try a plan, but then return to Original Medicare and a Medicare Supplement policy if they want to do so.

Under these protections, beneficiaries will have guarantee issue of a Medicare Supplement policy as long as they meet one of the following criteria. For eligible beneficiaries, companies which sell supplement policies will not be able to deny coverage, charge more, or exclude benefits. However, to receive these protections, beneficiaries must apply for a supplement policy within 63 days of disenrolling from the health plan, or within 63 days of the termination of the health plan.

A beneficiary would be eligible for the Medicare Supplement protections if they meet one of the following criteria.

Case #1

You are enrolled in a Medicare Advantage plan and one of the following happens:

- The contract between Medicare and the plan ends.

- The plan service area no longer covers the county where you live.

- You move out of the plan service area.

- There are violations by the plan.

Protection: In this case, you would get a guaranteed issue of a Medicare Supplement Plan A, B, C, or F from any company .

Case #2

Case #3

Protection: You are guaranteed to get any Medicare Supplement plan with any company .

Case #4

Recommended Reading: Who To Talk To About Medicare

How Long Do People On Disability Have To Wait To Become Eligible For Medicare

Once you have collected SSDI payments for two years, you will become eligible for Medicare. You wont even have to sign upMedicare will automatically enroll you in Part A and Part B and mail your Medicare card to you shortly before your coverage begins.

Thankfully, your 24-month waiting period doesnt have to be all at once. For example, if you qualify for SSDI, lose eligibility, then re-qualify for SSDI, each month you collect checks counts toward the total 24-month waiting period.

Similarly, if you apply for SSDI and are denied disability benefits, you can appeal the decision. If you appeal and the decision is reversed, your 24-month waiting period will be backdated to when your disability benefits should have started. The result: your wait for Medicare will be shorter than two years.

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

Who Qualifies For Medicare Medicare Part A And Part B

To be eligible for Medicare Part A and Part B, you must be a U.S. citizen or a permanent legal resident for at least five continuous years. You must also meet at least one of the following criteria for Medicare eligibility:

- Be age 65 or older and eligible for Social Security: You may be automatically enrolled in Medicare Part A when you reach age 65 and become eligible for Social Security. But, if youre not receiving retirement benefits from Social Security or the Railroad Retirement Board , you must sign up for Medicare Part B when you meet the age requirement, as your enrollment isnt automatic.

- Be permanently disabled and receive disability benefits for at least two years: You automatically get Part A and Part B after you get disability benefits from Social Security for 24 months or certain disability benefits from the Railroad Retirement Board for 24 months.

- Have end-stage renal disease : You need to sign up for Medicare, as your enrollment isnt automatic.

- Have Lou Gehrigs disease : You automatically get Part A and Part B the month your disability benefits begin.

When To Enroll In Medigap

You may only purchase Medicare Supplement Insurance during your open enrollment period. This is a six-month period immediately following your 65th birthday and only after you have enrolled in Medicare Part B.

The enrollment period cannot be changed or repeated. Once the enrollment period ends, you may no longer be able to enroll in a Medigap policy. If you are able, it may cost you more.

Medigap insurers are not allowed to charge you more for a policy if you have pre-existing conditions and cannot ask you about your family medical history.

Read Also: Do I Need To Sign Up For Medicare Part B

Medicare Premiums Part A Part B Part C And Part D

- Reviewed byJohn Krahnert

The cost of health care may be expensive for Medicare beneficiaries, especially those who require coverage for vision, dental and prescription drugs. Many Medicare Advantage plans provide coverage for these types of services in addition to your Part A and Part B benefits, sometimes for a low or $0 monthly premium.

Where And When Can You Get Medicare Part D

its a good idea to sign up for Medicare Part D as soon as youre first eligible. If you choose to enroll later or go 63 consecutive days or more without Medicare Part D prescription drug coverage, you may have to pay a late-enrollment penalty, unless you can show that you had creditable prescription drug coverage during the time you were not enrolled in Part D. Creditable prescription drug coverage is coverage that pays at least as much as Medicares standard Part D prescription drug coverage. For example, health coverage you may get through your employer may be considered creditable prescription drug coverage. Your insurance should let you know every year whether your coverage is creditable if you arent sure, you should contact your insurance company to check.

As mentioned, you must first have Medicare Part A and/or Part B to be eligible to enroll in a Medicare Prescription Drug Plan and you must have both Medicare Part A and Part B to enroll in a Medicare Advantage Prescription Drug plan . Youre first eligible to sign up for Medicare Part D coverage during your Initial Enrollment Period for Part D, which typically takes place during the same seven-month period as your Initial Enrollment Period for Original Medicare. This is the seven-months that starts three months before you turn 65, includes your birthday month, and ends three months later. A good time to sign up for Medicare prescription drug coverage is usually as soon as youre enrolled in Original Medicare.

You May Like: Does Medicare Cover Erectile Dysfunction Pumps

Medicare Advantage Managed Care Plans: Beneficiary Protections

- The plan cannot charge more than a $50 copayment for visits to the emergency room.

- You or your doctor can appeal a denial of service and the appeal must be handled in a “timely” way. The plan must make an initial determination within 14 days. Reconsideration of a decision must be made within 30 days. Decisions regarding urgent care must be made within 72 hours.

- The plan must have a process for identifying and evaluating persons with complex or serious medical conditions. A treatment plan must be developed within 90 days of your enrollment.

- If your treatment plan includes specialists, you must have direct access to those specialists. You do not need a referral from your primary care physician.

Does Medicare Part C Cover Senior Care

In addition to hospital care, preventive care and treatments for illnesses and injuries, Medicare Part C covers several types of senior care.

Skilled Nursing

Although Medicare Part C doesnt cover custodial care, or care that someone can provide without any professional training, it may cover a stay in a skilled nursing facility . For Medicare Advantage to pay for your stay in an SNF, you must have a qualifying hospital stay, and a doctor must determine that you need daily skilled care when youre discharged. Skilled care is different from custodial care because it must be provided by a nurse, a therapist or another individual with professional skills and training. You must also receive skilled care in a Medicare-certified SNF if you want to use your Medicare Part C benefits to pay for your stay.

Medicare Part C may pay for the following services during your stay at an SNF:

- Physical and occupational therapy

- Services provided by a registered dietitian

- Medications

Home Health Care

Medicare Part C pays for home health services that can help you preserve your independence and stay in your own home as long as possible. If you have a chronic disease, you may need home health services to monitor your progress on a new treatment plan or make sure that your condition is as stable as possible. Medicare Part C also pays for physical therapy, occupational therapy, wound care, health-related education and injections.

Hospice Care

Read Also: How Old Do I Have To Be For Medicare

Top Rated Assisted Living Communities By City

- Monthly Plan Premiums Start at $0

- Zero Cost, No Obligation Review

- Find Plans That Cover Your Doctors and Prescription Drugs

Medicare Advantage , a privately offered alternative to Original Medicare , has grown in popularity over the years. In 1999, 18% of Medicare enrollees chose a Medicare Advantage plan rather than Original Medicare. By 2018, 34% of Medicare enrollees were using Medicare Advantage. Medicare Advantage plans vary in popularity by location, with enrollment rates tending to be highest in or near coastal states and lowest in the center of the country. In some cases, low enrollment rates may reflect fewer plan options in a state. However, on average, seniors have more Medicare Advantage options than ever before.

If youre considering switching to Medicare Advantage but want to learn more before taking action, this article can provide some clarity about many facets of Medicare Advantage. Read on to learn about eligibility and enrollment, costs, coverage, plan types, and more.

How To Apply For Medicare Part C

First, enroll in Original Medicare . You cannot enroll in Medicare Part C until you do this. If youâre on federal retirement benefits, meaning you have paid Medicare tax through your payroll taxes for at least 10 years, youâre automatically enrolled in Medicare on the first day of the month you turn 65. Youâre also automatically enrolled once youâve been receiving federal disability payments for 24 months regardless of your age.

If youâre 65, but not receiving federal retirement benefits, you have to enroll for Medicare by visiting your local Social Security office, calling 1-800-772-1213, or filling out an online application through the Social Security Administration website at ssa.gov.

Once youâre enrolled in Original Medicare, then you can shop for a Medicare Advantage plan. You can search for plans on the Medicare website and purchase the one you want directly from the insurer.

However, you can only enroll within a designated time period each year. New Medicare recipients have seven months to buy coverage, starting three months before the month you turn 65. This is your initial enrollment period. Outside of initial enrollment, these are the times you can purchase or make changes to a Medicare Advantage plan:

Learn more about how to apply for Medicare.

Don’t Miss: What Is Step Therapy In Medicare

What To Do If Something You Need Isnt Covered By Medicare Part C

Before paying out of pocket for services that arent covered by Medicare Part C, subscribers should explore the possibility of purchasing a Medicare prescription drug plan. This is the best option for subscribers whose Part C plans dont include prescription coverage. A prescription plan, known as Medicare Part D, covers medically necessary generic and brand-name drugs.

If the non-covered item isnt a prescription drug, the subscriber may be able to get it covered under a second insurance plan. For example, subscribers who are still working may be able to combine their Medicare Part C coverage with the coverage provided under an employer-sponsored health insurance plan. For subscribers with private insurance, the private plan usually pays first if the employer has at least 20 employees. Once the private plan processes the claim, a second claim is submitted to the Medicare Advantage insurer. Anything not covered by either plan must be paid out of pocket by the subscriber.