Should I Change From Plan F To Plan G

If you’re considering switching from your grandfathered Medicare Plan F to Plan G, it can feel like a constant game of tug-of-war. Some Medicare Supplement plans are guaranteed issue, which means you cant be refused for pre-existing conditions. But, its important to note that you might be required to undergo underwriting when switching Medicare Supplement plans. That means a plan carrier can increase your rate based on age and health factors or decide not to sell you the plan at all.

How Can I Get Medicare Supplement Plan G Prices

Unfortunately, most insurance companies no longer openly publish their rates online without requiring you to meet with an agent or enter your personal information first. So, although some companies put their Medicare Supplement Plan G prices online, the information will be slanted towards that one company and will not be a full picture of what is available to you.

There are two options for obtaining the prices for a Medicare Supplement Plan G. One, you can contact your state department of insurance to get a list of all the companies offering supplement plans in your state usually around 30-35 companies. From there, you can contact each insurance companys call center and set an appointment to have an agent from each company come to your home so you can meet with them and obtain the rates for their plans. Sounds enjoyable, right?!?!

The much-simpler, more consumer-friendly alternative is to contact a trusted, verified independent Medicare insurance broker. Whether that broker is 65Medicare.org or someone else, using an independent broker gives you the opportunity to compare multiple options in a centralized, unbiased place. The broker works with you based on your needs and is incentivized to put you in a plan that you are happy with and that fits your needs, not one that helps their employers bottom line.

What Benefits Does Medicare Supplement Plan G Cover

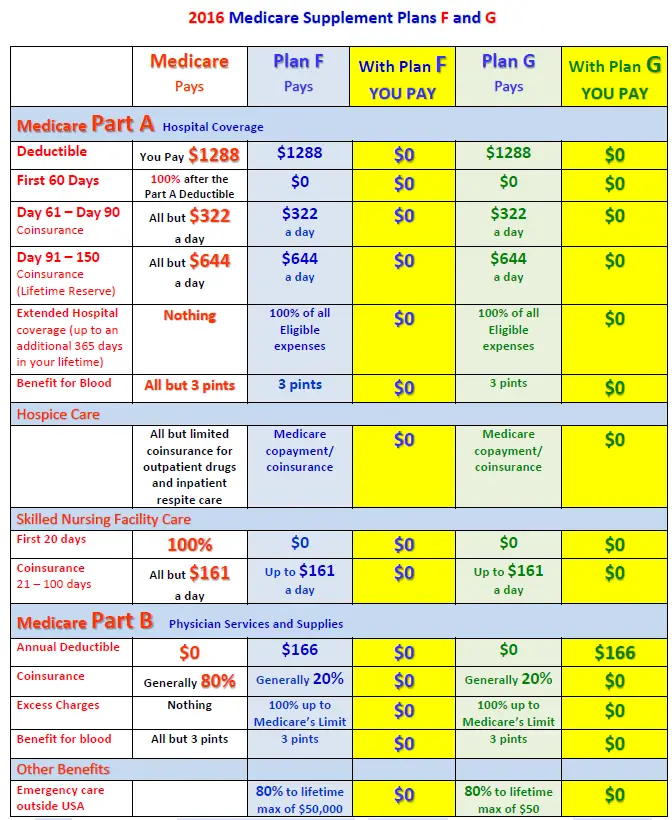

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, youll need to pay your Part B deductible , yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F. Even though it has similar coverage, Medigap Plan Gs monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible . Once you pay the Part B deductible, the coverage is the same for both plans.

Read Also: How To Pick The Best Medicare Plan

Is Medigap Plan G Better Than Plan F

While there can be a sizable difference in average premiums between Plan F vs. Plan G, there’s only a small difference in benefits these two plans offer.

-

Plan F provides coverage each of the 9 possible benefits that the 10 standardized Medigap plans can offer, including the Medicare Part B deductible.

-

Plan G does not cover the Medicare Part B deductible, but it offers coverage for all of the same out-of-pocket Medicare costs that Medigap Plan F covers.

Medigap Plan F and Plan G are the two most popular Medigap plans.2

In 2021, the Part B deductible is $203 per year.

The $203 annual deductible equates to around $17.00 per month.

This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

Important: Plan F is not available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you already had Medicare before that date, you can still enroll in Plan F if the plan is available in your area.

Below, Medicare expert John Barkett talks more about this and other Medicare changes.

When You Can Enroll

When you first enroll in Part B, you generally get six months to purchase a Medigap plan without an insurance company examining your health history and deciding whether to insure you. After that, depending on the specifics of your situation and the state you live in, you may have to go through medical underwriting.

“If you know going in that you have a health condition that will likely prevent you from being able to switch plans down the road, ask your broker for recommendations … for the long-term,” said Danielle Roberts, co-founder of insurance firm Boomer Benefits.

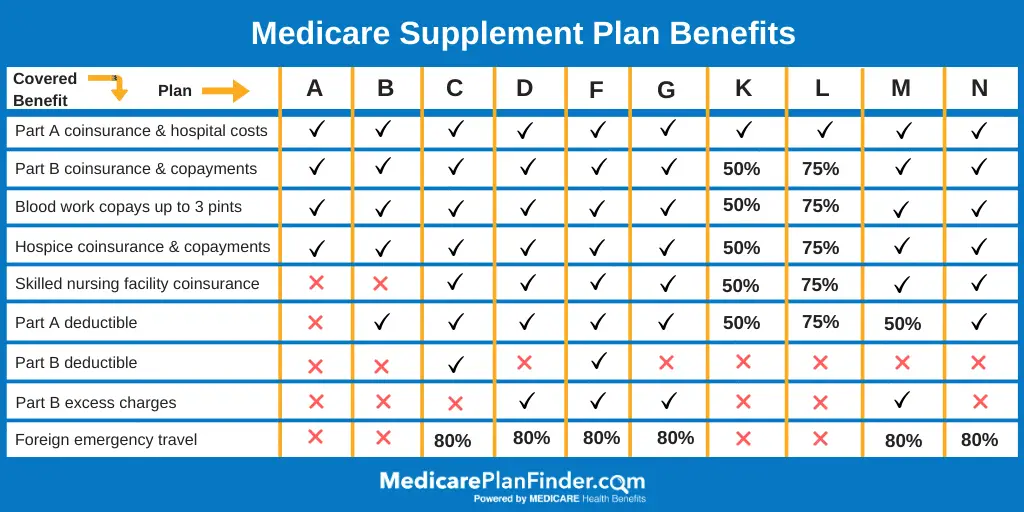

While a number of insurers offer Medigap policies, they can only offer policies from a list of about 10 standardized plans. Each is simply assigned a letter: A, B, C, D, F, G, K, L, M and N, although Plans C and F are not available to people who were newly eligible for Medicare on or after Jan. 1, 2020. Some states also offer high-deductible versions of Plan F and G.

If you know going in that you have a health condition that will likely prevent you from being able to switch plans down the road, ask your broker for recommendations … for the long-term.Danielle RobertsCo-founder of Boomer Benefits

The plans differ on what is covered. For example, some offer limited coverage for overseas travel, while others do not. The Centers for Medicare and Medicaid Services has a chart on its website that shows the differences. You also can use the agency’s search tool to find available plans in your ZIP code.

Also Check: Do You Have To Pay For Part B Medicare

How To Enroll In A Medigap Plan

Private insurance companies must offer supplemental insurance policies, such as Plan G, during the Initial Enrollment Period . The standardized policy is guaranteed to be renewed each year when the premiums are paid.

A person should consider their current and future medical needs before deciding on a Medigap plan. Switching policies later may not be possible. Not all private insurance companies provide insurance in all states.

The State Health Insurance Assistance Program may help a person find a comparison guide for their state.

The Medicare online tool shows plans offered in a persons area, what is covered, the approximate cost, and the companys contact information.

The programs are standardized, but the premiums are not. This means the same policy offered by different companies can have different prices.

Private companies must use a clearly worded summary of the plans benefits and costs. A person should read it carefully to ensure they are buying the right policy for their needs.

Which Is Better: Medicare Plan F Vs Plan G

No Medicare Supplement plan is better than another. It really depends on your needs and budget. However, as of December 31, 2019, Plan F is no longer available for new Medicare enrollees. Here are two things to consider as you evaluate keeping your Medicare Plan F.

Recommended Reading: How To Qualify For Medicare In Ga

How Much Does Each Medigap Plan Cost

The chart below shows the average monthly premium for each type of Medicare Supplement Insurance plan sold nationwide in 2018.1

The average Medigap premium cost across all plans in 2018 was $152 per month, but some types of Medigap plans have far fewer enrollees than other types of plans. This difference in enrollment affects the average monthly premium that is actually paid by Medigap beneficiaries.

That’s why the weighted average Medigap plan premium paid by a beneficiary in 2018 was $125.93 per month.

| Medicare Supplement Insurance Plan | |

| All plans | $152.00 |

* Medigap Plan J was discontinued for new enrollees in 2010. Only beneficiaries who enrolled in the plan prior to that time may be currently enrolled in Plan J.

Mutual Of Omaha Medicare Plan G

With over 100 years in business, Mutual of Omaha once again will be one of the best companies for Medicare Plan G in 2022. Theyll have some of the lowest premiums in several states, as well as their typical household discount of up to 12%, often if you just live with someone even if theyre not applying.

When were shopping rates for you, well often come across different subsidiaries of Mutual of Omaha which have slightly different names, such as:

- Mutual of Omaha

Don’t Miss: Do Any Medicare Plans Cover Dental

Medicare Plan G Supplement Insurance Basics

Medicare Plan G is a subset of Medicare Supplement or Medigapinsurance. Of the 10 plan types under the Medicare Supplement umbrella, Plan G is among the most popular.

Provided by private insurance companies, Medigap plans cover copays, coinsurance, deductibles, and some out-of-pocket costs that arent covered by Original Medicare .

The two other main parts of Medicare are Medicare Advantage and Medicare Part D prescription drug plans. In the context of Medicare Supplement plans, here are two important things to know:

- You cannot get a Medigap policy if you have Medicare Advantage. You must be subscribed to Original Medicare to sign on to a Medigap plan.

- Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, youll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.

Changes To Medigap Policies In : Plan G Vs Plan F

Medicare Plan F is a Medigap plan thats very similar to Plan G. The only difference is that it covers the Medicare Part B deductible in full.

While Plan F might seem more inclusive and comprehensive than Plan G, the availability of Plan F policies is now limited. Anyone who became eligible for Medicare after January 1, 2020, will not be eligible for Plan F.

From 2020 forward, all Medigap plans sold to newly eligible beneficiaries will no longer cover the Medicare Part B deductible.

Read Also: How To Qualify For Oxygen With Medicare

Does Plan G Pay For Prescription Drugs

Medicare Supplement plans only pay for covered expenses under Part A and Part B. Original Medicare doesnt typically cover prescription drugs, and you dont get any additional coverage with Medicare Plan G.

Plan G cant be used to cover prescription drug costs under Part D. The good news is that most companies that sell Plan G also sell Part D plans, so you can still get all your Medicare coverage in one place.

What Is Plan G

Medicare Plan G is the second most popular Medicare Supplement after Plan F, partly because it covers the most gaps in coverage of any Medigap plan available to new Medicare beneficiaries who first became eligible for Medicare after January 1, 2020.

All Medigap plans help pay for the costs that Parts A and B may not cover, such as deductibles, copayments and coinsurance. But each Medigap plan covers different charges at different amounts.

Medicare Supplement Plan G covers:

- Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out

- Part A deductible

- Part A hospice care coinsurance or copayment

- Part B coinsurance or copayment

- Part B excess charges

- Blood

- Skilled nursing facility coinsurance

- Foreign travel emergency care

The only thing that Plan G does not cover that Plan F does is the Part B deductible. However, Plan F is no longer available to those who became eligible for Medicare after Jan. 1, 2020. So for the newly eligible, Plan G may be the best option for the most extensive Medicare Supplement coverage.

Once you meet your Part B deductible, Plan G covers Part B outpatient medical services such as doctor visits, lab work, chronic disease supplies, durable medical equipment, X-rays, ambulance transportation, surgeries and a great deal more.

Recommended Reading: Is It Too Late To Change Medicare Advantage Plans

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

What Does Medicare Plan G Cover

There are many out-of-pocket costs with Original Medicare . Depending on the care you need, you could pay:

- Part A deductible

- Part B deductible

- Part A daily coinsurance for hospital, skilled nursing facility, and hospice stays

- Part B coinsurance

- Part B excess charges

Medicare Plan G covers all of those out-of-pocket costs, except for the Part B deductible.

Also Check: Does Medicare Cover Whooping Cough Vaccine

Who Can Enroll In Medicare Supplement Plan G

You can buy a MedSup Plan G policy if:

- Youre over 65.

- Youre not enrolled in a Medicare Advantage plan.

- You live in the plans service area.

Who cant buy a MedSup Plan G policy? One example is people under 65 with Medicare coverage due to a disability or end-stage renal disease. They may not be able to buy one of these plans. They may not be able to buy any MedSup or Medigap policy, period.

If youre in this situation and you want Plan G coverage, contact a few of the insurance companies in your area. They can tell you if youre allowed to buy one or not. If you cant, ask if you can buy any other MedSup policies.

Best In Extra Benefits: Humana

Humana

Humana has a string of extra benefits for those who enroll in Medicare Plan G, whether it’s the regular or the high-deductible option. The regular plan has premiums that vary with location and benefits. While the high-deductible plan is on the lower end of the cost spectrum, you must first pay your deductible to get benefits. A wellness plan called SilverSneakers provides discounts on vision and prescriptions and a 24-hour nurse hotline.

Choose between the standard and high-deductible plan by determining whether you currently have significant health care needs. If you do, then paying a higher monthly cost with no deductible may make more sense.

-

Covers Medicare Plan A & Plan B coinsurance and skilled nursing facility care coinsurance

-

Easy-to-use website with clearly explained information

-

Many extra benefits such as the wellness program

-

Doesnt cover Medicare Part B deductible

-

Some extra benefits may not be necessary for everyone .

You can buy Medicare supplement insurance from many providers in your state, but a Humana policy includes some perks other providers dont offer, including a 24-hour nurse phone line, SilverSneakers wellness program, and even access to Humana Transplant Centerswhich helps you navigate the complex world of transplant care and make informed decisions.

Humana is worth checking out if you want a more personalized experience and a concierge-like service throughout your Medicare Supplement program experience.

Read Also: Is Xolair Covered By Medicare Part B

Explore Your Medicare Supplement Options With Healthmarkets

The Medicare Plan F vs. Plan G decision doesnt have to be complicated. HealthMarkets can help you get the right Medicare Supplement plan for your needs. Best of all, this service comes at no cost to you. Compare plans online today or call to speak with a licensed insurance agent.

48182-HM-1121

* The cost of Plan G premiums will vary by state, age, sex, and tobacco use.

1.How to compare Medigap policies. Medicare.gov. Retrieved from https://www.medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies. Accessed on November 10, 2021. | 2.Medicare costs at a glance. Medicare.gov. Retrieved from https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance. Accessed on November 10, 2021. | 3.Supplement Insurance plans in Florida. Medicare.gov. Retrieved from https://www.medicare.gov/medigap-supplemental-insurance-plans/#/m/plans?fips=12083& zip=32162& year=2022& lang=en. Accessed on November 10, 2021.

How Does Medicare Part G Work

For starters, you need to be enrolled in Original Medicare, or Medicare Parts A and B. Then you can buy Medicare Part G from a private insurance company that serves your ZIP code.

Once thats out of the way, here’s how Medicare Part G works:

- You pay your monthly Medicare Part B premium. If you receive benefits from Social Security, the Railroad Retirement Board or the Office of Personnel Management, your premium will be automatically deducted from your benefit payment.

- You also pay the monthly premium for your Plan G policy.

- After you visit a healthcare provider, Medicare will pay its share of the Medicare-approved amount for covered treatments.

- Your MedSup policy then pays its share of those costs, if needed.

Read Also: What Is The Best Medicare Advantage Plan In Alabama

What Are My Costs For Original Medicare

With Medicare Part A, most people don’t pay a premium, though you may if you or your spouse worked and paid Medicare taxes for less than 10 years. Medicare Part B has a monthly premium you pay directly to Medicare, and the amount you pay can vary based on your income level. Other costs you may pay with Medicare Part A and Part B include deductibles, coinsurance and copays.

How To Shop For Plan G

Due to rates varying so much throughout the country, there is only one realistic way to shop for Medicare Plan G and thats to allow us to help. The reason is, were an independent Medicare supplement insurance agency.

That means we have access to the top companies offering these, but we dont work for any of them. We work for YOU.

Medicare Plan G is the same plan whether offered by Aetna or offered by Mutual of Omaha. But did you know these companies both charge entirely different rates for the same Plan G?

Why would you pay $15 or more extra to a company for the same thing? With us, you wont.

We shop all the top companies now, and each year for you to make sure youre always paying the least amount possible for your coverage.

Also Check: Does Medicare Cover Cpap Cleaner