What Is The Medicare Shared Savings Program

As part of ongoing healthcare reform the Centers for Medicare & Medicaid Services are currently exploring a number of different healthcare delivery models which promise to increase quality of care while decreasing cost. In this post we will explore the question: What is the Medicare Shared Savings Program?

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Provider Payment And Delivery Systems

States may offer Medicaid benefits on a fee-for-service basis, through managed care plans, or both. Under the FFS model, the state pays providers directly for each covered service received by a Medicaid beneficiary. Under managed care, the state pays a fee to a managed care plan for each person enrolled in the plan. In turn, the plan pays providers for all of the Medicaid services a beneficiary may require that are included in the plans contract with the state.

The majority of Medicaid enrollees, largely non-disabled children and adults under age 65, are in managed care plans, but just over half of Medicaid benefit spending is in managed care. The enrollment of high-cost populations, such as people with disabilities, in managed care has been more limited than for lower-cost populations. In addition, coverage of certain high-cost services may be excluded from managed care contracts, although such arrangements are growing in number.

You May Like: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

Mma Initiatives For Private Plans 2006

The 2003 MMA legislation increased payments to private plans for 2004-2005. It also created a new type of private planthe regional PPOand created special payment arrangements for this type of plan and for local plans. The payment arrangements for both plans are based on a comparison of benchmark prices and bids by plans for Parts A and B coverage. The benchmark for local plans is an enrollment-weighted average of the administratively determined county-level payment rates in the plan’s service area. The benchmark for regional PPOs beginning in 2006 will be a weighted average of the: county-level MA capitation rates within the region, and bids by regional PPOs within the region. The weight of the regional PPOs’ bids will be the percentage of beneficiaries who are enrolled in a local or regional private plan at the national level .

The MMA thus creates a system of bids for local MA plans and regional PPOs, but plan payments respond to bids only for regional PPOs . A more comprehensive bidding systemone that includes FFS Medicare and in which all health plan payments are based on bidswas relegated to a limited demonstration project: the CCA demonstration.

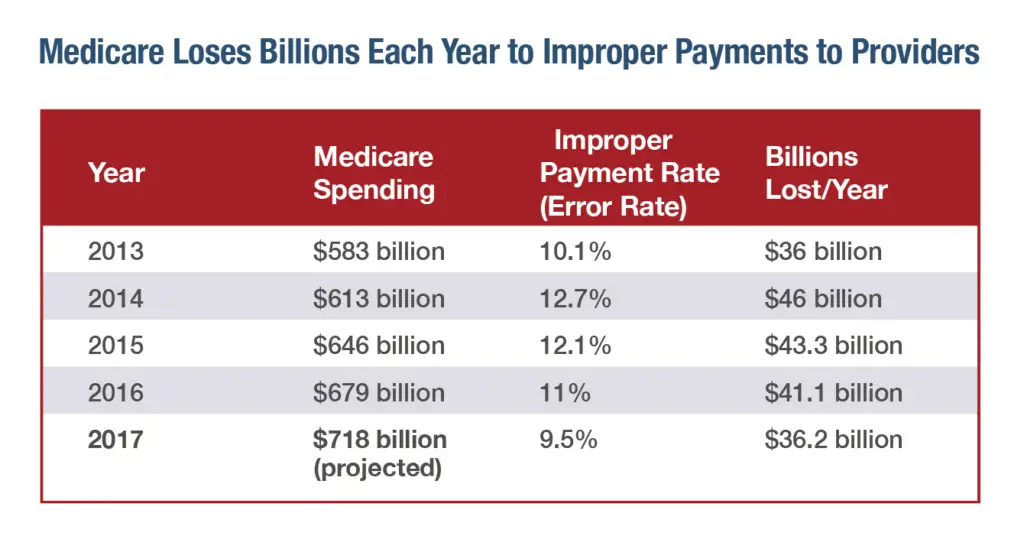

What Is The Purpose Of The Medical Review Program

Medical reviews identify errors through claims analysis and/or medical record review activities. Contractors use this information to help ensure they provide proper Medicare payments . Contractors also provide education to help ensure future compliance.

A Medicare contractor may use any relevant information they deem necessary to make a prepayment or post-payment claim review determination. This includes any documentation submitted with the claim or through an additional documentation request. .

Read Also: What States Have Medicare Advantage Plans

Competitive Pricing For Private Plans: 1995

Beginning in 1995, CMS began a series of demonstration projects centered on competitive pricing as a method for paying private health plans in Medicare. Instead of payments based on costs in FFS Medicare, private plans would be paid on the basis of bids in local market areas. Various benchmarks such as the median bid or enrollment-weighted average bid were considered.

The demonstration was proposed for four cities . In each site, however, members of Congress from the affected area were allowed to block the demonstration . Republicans were as quick to block the demonstration in their home State as were Democrats. In Kansas City and Phoenix, the demonstration was blocked by Congress despite the fact that Congress itself had mandated the demonstration in the 1997 BBA legislation . Despite these setbacks, however, some interesting results came to light. First, CMS demonstrated its ability to run a competitive bidding system for health plans. Second, the bids submitted by four health plans in Denver before the demonstration was stopped were found to be 24 to 38 percent below the prevailing payment rate at that time .

Fee For Service Vs Value Added Model

Local Licensed Medicare Professionals

Ready to see the difference a private plan makes? Call now to talk to a licensed insurance agent about your options or click Compare Plans to see the Medicare options available where you live. Your coverage matters. Let us help you find the right plan.

This website is privately owned and all information and advertisements are independent and are not associated with any state exchange or the federal marketplace. Additionally, this website is not associated with, sanctioned by or managed by the federal government, the Centers for Medicare & Medicaid or the Department of Health and Human Services. California Consumer Privacy

Read Also: Does Medicare Offer Dental Plans

Calculating Medicare Fee Schedule Rates

The Medicare Physician Fee Schedule uses a resource-based relative value system that assigns a relative value to current procedural terminology codes that are developed and copyrighted by the American Medical Association with input from representatives of health care professional associations and societies, including ASHA. The relative weighting factor is derived from a resource-based relative value scale. The components of the RBRVS for each procedure are the professional component technical component and professional liability component.

The Centers for Medicare and Medicaid Services determines the final relative value unit for each code, which is then multiplied by the annual conversion factor to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality. Payers other than Medicare that adopt these relative values may apply a higher or lower conversion factor.

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

You May Like: Is Medicare A Federal Program

What Is Covered By A Medicare Pffs Plan

Your PFFS plan will cover everything that Medicare Part A and Medicare Part B typically do. This includes:

- hospital stays

- ambulance rides

Since a PFFS is a Medicare Advantage plan, it might cover additional services such as dental and vision care. Some PFFS plans also cover medications. You can also purchase a separate Medicare Part D plan if your PFFS plan doesnt cover medications.

PFFS plans can allow you the freedom to keep or choose your own doctors and specialists. For many people, this makes them an appealing alternative to HMO plans.

You dont need to choose a primary care physician with a PFFS or get referrals to see a specialist. Some PFFS plans also allow members to use any Medicare-approved provider. This means youll never have to worry about going out of network.

Introduction And Brief History

Since the inception of the Medicare Program, policymakers have debated the proper relationship between FFS Medicare and private health plans. Why are private plans offered alongside a universally available FFS insurance program? Does either sectorprivate plans or FFS Medicareoffer advantages to beneficiaries or to the government that are difficult for the other sector to replicate? These questions, and policymakers’ answers to them, underlie recent legislation that will have a dramatic effect on the future of the Medicare Program. But the effects of policymakers’ views often are easier to identify than the views themselves. The purpose of this article is to provide a framework to help make these views of the program explicit, explore the roles of private plans and FFS Medicare, and attempt to identify the advantages and disadvantages of each sector.

Under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, Medicare+Choice plans were renamed Medicare Advantage plans. Three separate provisions of the MMA legislation directly affect the role of private health plans in the Medicare Program:

Don’t Miss: How Can I Sign Up For Medicare

Medicare Advantage Tends To Cost Less In Both Premiums And Out

January 21, 2020 – Medicare Advantage has a significant cost reduction value over traditional, fee-for-service Medicare, a recent report from UnitedHealth Group found.

Medicare Advantage plans cover the same services as Medicare FFS and typically offer additional protections and services, not covered by Medicare FFS, that support beneficiaries in staying healthy, improving care outcomes, and avoiding unforeseen medical costs, the report stated. Compared to Medicare FFS, MA beneficiaries with chronic conditions receive more preventative care and experience fewer emergency department visits and lower rates of avoidable hospitalizations.

While fee-for-service Medicare covers 83 percent of costs in Part A hospital services and Part B provider services, Medicare Advantage covers 89 percent of these costs along with supplemental benefits ranging from Part D prescription drug coverage to out-of-pocket healthcare spending caps. Medicare Advantage plans can also have rich supplemental benefits that help trim costs and add value.

Dig Deeper

The report looked at costs for a typical Medicare Advantage beneficiary: a 72-year-old who lives on a fixed income of less than $27,000. This individuals healthcare spending amounted to $3,632 per year in 2019.

This was 39 percent less than a beneficiary would pay to receive fee-for-service Medicare plus a prescription drug plan and a Medigap Plan F.

- Tagged

Who Are Recovery Audit Contractors

|

Cotiviti GOV Services |

AK, AZ, CA, DC, DE, HI, ID, MD, MT, ND, NJ, NV, OR, PA, SD, UT, WA, WY, Guam, American Samoa and Northern Marianas |

|---|---|

| 1-866-201-0580 |

RACs in Regions 1-4 will perform post payment review to identify and correct Medicare claims specific to Part A and Part B.

Region 5 RAC will be dedicated to review ofDurable Medical Equipment, Prosthetics, Orthotics, and Supplies and Home Health / Hospice

Don’t Miss: Is Medicare Advantage A Good Choice

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

What Medicare Jurisdiction Is Florida

4.3/5JurisdictionMedicareFloridaexplained here

Close ×

| Iowa, Minnesota, Montana, Nebraska, North Dakota, South Dakota, Wyoming | |

| Region 7 | |

| Florida | Nevada |

Also, what is a Mac jurisdiction? The DME MACs process Medicare Durable Medical Equipment, Orthotics, and Prosthetics claims for a defined geographic area or “jurisdiction,” servicing suppliers of DMEPOS. Learn more about the DME MAC in each jurisdiction.

Correspondingly, what Medicare jurisdiction is Massachusetts?

A/B MAC Jurisdiction K Part A and Part B Facts. JK processes FFS Medicare Part A and Part B claims for Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont.

Who is the Medicare contractor for Florida?

First Coast has proudly served as one of the nation’s largest Medicare administrators for 50 years, and is the current Medicare Administrative Contractor for Jurisdiction N , which includes Florida, Puerto Rico and the U.S. Virgin Islands.

Read Also: What Does Medicare Part B Include

What Is Medicaid

Like Medicare, Medicaid is a health care coverage program funded by the federal government. It was established to help low-income individuals access health care coverage. Unlike Medicare, however, Medicaid is partially funded by state governments. This means that states have the flexibility to design their Medicaid programs to best meet the needs of their residents, as long as the program meets the minimum federal guidelines. As a result, Medicaid eligibility, services, and cost-sharing policies will vary state-by-state, while the Medicare program is generally consistent across all states.

Call a Licensed Agent:

Who Are The Macs

MACs were created by the Centers for Medicare & Medicaid Services in 2003 by the Medicare Prescription Drug Improvement, and Modernization Act of 2003. The goal of this change was to replace the Medicare Part A fiscal intermediaries and Part B carriers with a single entity, the MAC. Specifically, MACs are private health care insurers that are awarded geographic coverage areas in which they can operate. These regions can, and often do, include multiple states.

Currently, there are two different types of MACs that are defined by the types of services they provide. In the United States, there are 12 Part A and B MACs that assist with Original Medicare. There are also four durable medical equipment MACs that operate independently of the A and B MACs. Together, these MACs assist roughly 68 percent of the Medicare beneficiary population.

Recommended Reading: Is Pennsaid Covered By Medicare

What Sources Of Information Do Contractors Use When Selecting Claims And Subjects For Medical Reviews

Medical review activities, such as the Targeted Probe and Educate program, are based on data analysis and other findings indicative of a potential vulnerability. This might include findings from the Comprehensive Error Rate Testing Contractor, the Office of Inspector General , the Government Accountability Office , or the Recovery Audit Contractors .

The Medicare Ffs Approach

The purpose of this message is to clearly communicate the approach that Medicare Fee-For-Service is taking to ensure compliance with the Health Insurance Portability and Accountability Act’s new versions of the Accredited Standards Committee X12 and the National Council for Prescription Drug Programs Electronic Data Interchange transactions.

The Standards Development Organizations have made corrections to the 5010 and D.0 versions of certain transactions. The Errata versions replace the Base versions for HIPAA compliance. Per the Federal Register , HIPAA compliance will require the implementation of the Errata versions and the Base versions for those transactions not affected by the Errata, as listed below. Compliance with the Errata must be achieved by the original regulation compliance date of January, 2012.

Table 1. Transactions Affected by the Errata – list of Base and Errata versions for 5010 and D.0.

| Transactions Affected by the Errata Version | Base Version |

|---|

Also Check: Which Medicare Plans Cover Silver Sneakers

Early Discussions Of Competitive Pricing

The relationship of FFS Medicare and private health plans was debated seriously during the 1980s and early 1990s. Private plans appeared to offer more generous benefit packages for the same level of expenditure as FFS Medicaredoubtless due, in part, to the favorable selection enjoyed by private plans , but also likely attributable to deeper fee discounts from providers and more aggressive management of care .

Since its inception in the early 1980s, the administered pricing system has had few supporters . found that private plans were overpaida result echoed in later analyses by the . Both plans and beneficiaries are frustrated by: the fluctuations in plan payments, out-of-pocket premiums, and benefits from year to year, often as a result of political tinkering with payment levels, and payment variation among counties in close geographic proximity. Many of the difficulties associated with private plan participation in the Medicare Program are linked to the administrative pricing system for plan payments, in which payment rates are set by the government as a function of the cost of caring for similar beneficiaries in FFS Medicare.