How To Make Medicare The Primary Insurance

Some people have health insurance coverage both from Medicare and some other plan, such as employer-provided health insurance. In some cases, Medicare is the primary payer, which means it is responsible for paying for covered charges before any other plans, which are called secondary payers because they’re responsible only for covered charges left unpaid by the primary payer. In other cases, the other plan is primary and Medicare is secondary. The determination of which plan is primary rests in Medicare regulations and the nature of the plans themselves. If youre in this situation and Medicare is a secondary payer, you can make it primary, but usually only by changing the circumstances of your other coverage.

If You Can Have Medicare And Private Insurance How Does That Work

If you have private health insurance along with your Medicare coverage, the insurers generally do coordination of benefits to decide which insurer pays first.

For example, suppose youre enrolled in Medicare Part A and Part B, and youre still covered through an employer, or your spouses employer.

- If the employer has 20 or more employees, the group health plan usually pays first.

- If the employer has fewer than 20 employees, Medicare usually pays first.

Important: If youre eligible for both Medicare and private insurance such as a retiree group plan, check with the group plan to find out how your coverage may change when youre eligible for Medicare.

Does It Help Me In Any Way To Give Va My Health Insurance Information

Yes. Giving us your health insurance information helps you because:

- When your private health insurance provider pays us for your non-service-connected care, we may be able to use the funds to offset partor allof your VA copayment.

- Your private insurer may apply your VA health care charges toward your annual deductible .

Recommended Reading: Can You Use Medicare In Any State

Medicare Cob When Medicare Does Not Pay The Provider

In some circumstances, Medicare does not make an actual payment to the members provider, either because a Medicare-eligible member is not enrolled in Medicare or the member visited a provider who does not accept, has opted-out of or for some other reason is not covered by the Medicare program. When a provider does not accept, has opted-out of or is not covered by the Medicare program, that means that the provider is not allowed to bill Medicare for the providers services and that the member may be responsible for paying the providers billed charge as agreed in a contract with the doctor that the member signs.

For example, if a providers billed charge is $200, the Medicare coverage percentage is 80%, and the Employer Plans coverage percentage is 100%, Uniteds methodology would result in a secondary benefit payment of $40 . By contrast, if the Medicare fee schedule were used to determine the Allowable Expense and it was $100 for that same procedure, then the Employer Plans secondary benefit payment would be $20 .4

Coordination Of Benefits Process

Coordination of benefits allows insurers to know what their responsibilities are when it comes time to pay for your health care services.

The insurers know when they have to pay and what their share of payment will be if you are covered by more than one health care plan.

How the Coordination of Benefits Process Works

- Ensures Claims Are Paid Correctly

- The COB process identifies what Medicare benefits are available to you. From there, it can coordinate the payment process for your health care claims. This ensures that the primary payer whether its Medicare or other insurance pays first.

- The process ensures that this data gets to your other insurers. It also lets them know how much Medicare paid toward the claim and what their share is if they are the secondary payer.

- Prevents Duplicate Payments

- The process makes sure that Medicare and other payers do not exceed 100 percent of the claim.

- Coordinates Part D Drug Benefits

- It determines the correct primary payer and makes sure pharmacy claims are sent to each insurer in the proper order. It also exchanges your drug coverage information between insurers and prescription drug assistance programs in which you are enrolled so they can coordinate their share of payments.

Prepare for the Medicare Advantage Open Enrollment Period

You May Like: Should I Get Medicare Part C

How Medicaid Works With Other Coverage

You may still qualify for Medicaid even if you have other health insurance coverage, and coordination of benefits rules decide who pays your bill first. In this case, your private insurance, whether through Medicare or employer-sponsored, will be the primary payer and pays your health care provider first. Medicaid comes in as second insurance to settle what your private insurance doesnt pay, up to its limit.

If you have both Medicaid and private health insurance, you should show both your private health insurance card and Medicaid card to your medical provider every time you receive services.

A health-service provider who accepts both your Medicaid and private insurance card wont bill you for copayments or deductibles.

Any money received from an insurance company or as compensation for a medical care lawsuit must be used to pay the health provider. If Medicaid already has covered the cost of care, you must make a refund to Medicaid. If your private insurance is through an employer-sponsored plan, you may be an eligible candidate for the Health Insurance Premium Payment program. HIPP is a voluntary program that may pay your insurance premium as long as you or a family member qualifies for Medicaid coverage.

If your service provider wont take your Medicaid and private insurance card, your insurance company may help you locate a doctor in its provider network.

Who Can Have More Than One Insurance

Anyone can have more than one insurance plan but the most common people are parents who both add a child to their individual plans. Other people who have more than one health insurance plan are married couples, who often have individual plans through work and are also added to a spouses plan. Also, people under the age of 26 sometimes remain on their parents plans but buy an employers plan too.

You May Like: Is Skyrizi Covered By Medicare

Signing Up For Medicare Might Make Sense Even If You Have Private Insurance

If youre about to turn 65 and you have private health insurance coverage, you may be wondering if you need to sign up for Medicare. The short answer is it depends. You might be able to delay enrolling in some parts of Medicare however, not signing up for other parts can cost you.

Navigating Medicares options, enrollment deadlines, and requirements can be confusing. But its important to know when you need to apply for coverageespecially if you have other health insurance coverageso you dont get hit with costly penalties. Heres how Medicare works, what to consider when you already have health insurance, and how to avoid penalties for late enrollment.

Example: Primary And Secondary Payer Coordination

You visit your doctor for a normal checkup. Your doctors office bills both Medicare and the group insurance you have through your employer for the visit. Your group insurance is the primary payer because youre over 65 and your employer has more than 20 employees, so your group health plan pays whatever their standard rate for a doctors office visit is. Medicare is the secondary payer, so they pay whatever charges are left over. If there happens to be any amount left after both Medicare and your group insurance pay what they will cover, you may have to pay the remainder to your doctors office.

Medicare offers a helpful guide on Medicare.gov that covers different situations and how Medicare works with your other insurance. You can also call the Medicare Benefits Coordination & Recovery Center Monday through Friday, from 8:00 a.m. to 8:00 p.m., Eastern Time, except holidays, at toll-free lines: 1-855-798-2627 if you have questions about who pays first.

To learn more about Medicare, visit Medicare.gov, check the Medical Mutual website, or like our to see the latest updates in this series. You can also for more details.

Read Also: When Do Medicare Benefits Kick In

How Do The Benefits Differ

Private insurance and original Medicare plans provide varying benefits and coverage.

Most of both types of plans cover hospital care and outpatient medical services, including doctors visits, physical therapy, and diagnostic tests.

However, Medicare may have gaps in coverage that private insurers cover. For example, Medicare does not cover prescription drugs, meaning that a person needs to get a Medicare Part D plan. However, private insurance plans often include prescription drug coverage.

Medicare Advantage plans, which replace original Medicare, may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

Retirement Insurance And Medicare

Sometimes when employees retire, they are provided group health coverage from the employer.These opportunities are not as widespread as they used to be because most companies no longer offer pensions. However, a news release prompted by Willis Towers Watsons 2017 Global Benefits Attitudes Survey reports that a majority of people surveyed would pay for this benefit if it was brought back.

Specifically, out of 5,000 U.S. employees questioned, Willis Towers Watson found that 66 percent said they would have no problem paying more per month for their benefits in return for a better retirement package. Sixty-one percent said theyd even give up a portion of their pay if they were to receive a guaranteed retirement benefit.

If your company offers health insurance benefits for retirees, Medicare.gov says that Medicare will typically be the primary payer and the retirement plan the secondary. It all depends on the rules created by this other plan as this has an impact on which plan pays first.

Medicare.gov also warns that your former employer or union has have the right to change the benefits of that coverage or increase its premiums because they have control over it. They can even cancel the coverage if they wish.

Read Also: What Is A 5 Star Medicare Plan

Medicare Helps You Avoid Age Surcharges

Believe it or not, private insurance providers set their own rates. These companies are free to charge different people different amounts anytime they wish. This means if youre older or are otherwise considered high-risk, you may pay more for coverage.

Medicare plans wont penalize you for being older or having pre-existing health conditions. The plans exist specifically for individuals over the age of 65.

They assume that youll need more frequent medical care and already need prescription medications to manage existing health conditions. They wont penalize you for being older or using your insurance plans more often.

The Coverage Lacks True Flexibility

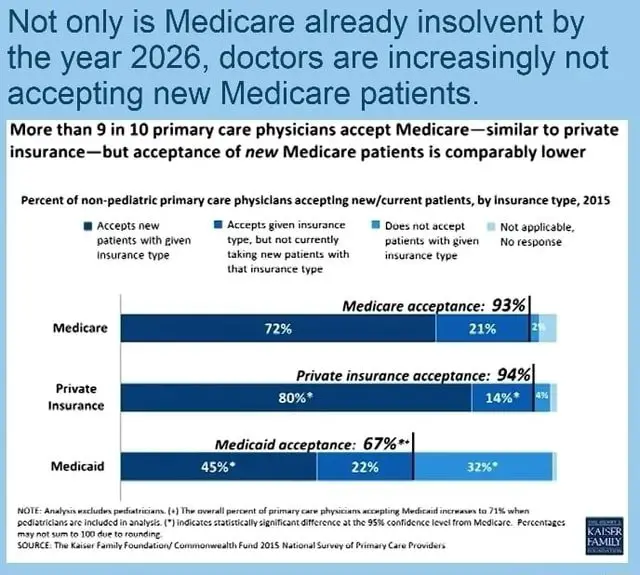

When you enroll in any type of insurance, youre permitted to see any doctor you wish. However, its up to the doctor to decide if theyll accept your insurance or not. This is the case for both private insurance and Medicare coverage.

Typically, more doctors are willing to accept private insurance than Medicare plans. This is because they already network with those private insurance providers. Theyre able to get higher payments from the companies.

For those that enroll in Medicare instead, finding a doctor you like thats willing to accept your insurance coverage can be more difficult. You could end up paying more for the same services than you would with a private insurance policy. Worse, you may need to change your primary care doctor once you enroll.

If youre trying to figure out which type of insurance is best for your needs, consider the amount of flexibility you need. Call your doctor and find out what plans they accept and make the decision that works best for you.

Also Check: Which Medicare Plans Cover Silver Sneakers

Other Insurance & Medicare Part D

If you have other health insurance with drug coverage that is , you do not need to enroll in a Part D plan.

If you dont have drug benefits under other insurance or those benefits are not creditable, you may want to enroll in a Part D plan. If your benefits are not creditable and you do not enroll when you are first eligible, you will be charged 1% of the average national premium for Part D plans for each month you delayed enrolling in a plan. For more information, see our Prescription Drugs section.

Private Health Insurance Rebate

You may be able to get a rebate on what you pay for private health insurance if you:

- earn less than the income threshold

- have a high enough level of hospital cover.

Your income must be within the threshold to get the rebate. It can either:

- reduce your insurance premium

Use the private health insurance rebate calculator to work out your rebate amount on the Australian Taxation Office website.

Don’t Miss: How Do I Get Dental And Vision Coverage With Medicare

What Is Private Insurance

Private insurance is offered by health insurance companies.

You can access private insurance through individual or group plans. Many employers offer health coverage as part of their benefit. When health insurance is offered through an employer, the employer will generally pay a portion or all of the premium.

If you purchase individual insurance, you can also access the federal Healthcare Marketplace. There are four tiers of coverage within the Healthcare Marketplace:

- Bronze Plans: Cover 60% of healthcare costs.

- Silver Plans: Cover 70% of costs.

- Gold Plans: Cover 80% of costs.

- Platinum Plans:latcosts.

Deductibles vary based on the plan. Premiums are higher the more coverage you have.

All private plans will structure their coverage differently. You will find a wide variety of structures such as HMOs , PPOs , PFFS and MSAs .

Medicare vs Private Insurance Differences

A good way to understand the differences between Medicare and private Insurance is to look at a side-by-side chart of options offered by each.

| Medicare | |

|---|---|

| This is an add-on to Original Medicare. It can be included in some Advantage plans | These are almost always additional coverages that need to be added. |

What are the Gaps in Medicare?

Part A Gaps

Most people will not pay for Part A because of Medicare taxes taken from their paycheck while they worked. Premium costs are not the concern.

Medicare also does not pay for blood if it is needed while being hospitalized.

Explore Your Private Medicare Advantage Coverage Options

Learn more about when Medicare pays first for your care and compare Medicare plan options that may be available where you live. To get started, call to speak with a licensed insurance agent or compare plans for free online.

Find $0 premium Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

You May Like: How To Qualify For Medicare Disability

What If I Have Additional Questions About Coverage

Working with both private insurance and Medicare can be a complicated process. If you have questions or concerns about whats covered and which provider pays first, there are several sources you can reach out to, including:

- Medicare. You can get in touch with Medicare using its general contact information or by reaching out to its Benefits Coordination and Recovery Center directly at 800-MEDICARE .

- Social Security Administration . Contacting the SSA at 800-772-1213 can help you get more information on Medicare eligibility and enrollment.

- State Health Insurance Assistance Program . Each state has its own SHIP that can aid you with any specific questions you may have about Medicare.

- United States Department of Labor. If your employment has ended, you can contact the Department of Labor to learn more about COBRA coverage at 866-487-2365.

- TRICARE. Contacting TRICARE directly at 866-773-0404 may be beneficial when navigating coverage alongside Medicare.

Medicare Vs Private Insurance Premiums

The table below provides a general comparison of the costs of Medicare and private insurance. However, it shows the average monthly premiums for private insurance in 2021 and the costs for Medicare plans in 2022.

| Private insurance | |||

| $22,221 per year for families | Free for people who have paid Medicare tax for 40 quarters | Standard monthly premium of $170.10 | $33.37 on average, but purchased in addition to other Medicare plans |

| $7,739 per year for individuals | $274 for people who have paid Medicare tax for 3039 quarters | Income-related adjustments to Part B premiums go from $238.10 to $578.30 for people who filed an income higher than $91,000 per year on their previous tax return | |

| $5,969 per year for family coverage for employees after the employer covers part of the cost | $499 for people who have paid Medicare tax for fewer than 30 quarters |

Don’t Miss: What’s The Eligibility For Medicare

What Is The Difference Between Primary And Secondary Health Insurance

When a member has double insurance, his or her individual circumstances determine which insurance is primary and which is secondary. Following are some examples of how this might work:

- A married couple A wife has a health plan with her employer, but her husbands health plan also covers her. In this case, the wifes employer is the primary insurer and the spouses health plan is secondary.

- A child under 26 The Affordable Care Act lets children stay on their parents health plan until they turn 26. That could result in a child having her own health plan through an employer while remaining on the familys plan. In that case, the childs health plan is primary and the parents plan is secondary.

- Parents have separate plans and a child is on both plans In this situation, the so-called birthday rule applies. Whichever parent has the earlier birthday in a year is considered the primary health plan and the other spouse is secondary. Its not which parent is older. Instead, its which one has the earliest birthday in a calendar year.

- Medicare and a private health plan Typically, Medicare is considered primary if the worker is 65 or older and his or her employer has less than 20 employees. A private insurer is primary if the employer has 20 or more employees.