When Can I Sign Up For Medicare Part C Or Part D Or Change Plans

- If youre new to Medicare, you can enroll in Medicare Part C or Part D during your Initial Enrollment Period.

- The fall may be a good time to compare plans and see if youre getting the best possible Medicare health or prescription drug plan for your needs. You can change plans during the Annual Election Period.

Is it time to compare plans to see if theres any plan in your area that may be better for you? Just click the button on this page to get started with no obligation. You can also contact eHealth to reach our licensed insurance agent.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

What Is Medigap Plan C

Medicare supplement insurance, also called Medigap, has 10 plans, identified by letters: A, B, C, D, F, G, K, L, M, and N.

From , no Medigap policy is allowed to pay the Part B deductible, which means Medigap Plan C cannot be offered to new enrollees in Medicare. However, a person previously enrolled in Plan C can keep the policy.

Medigap Plan C helps pay for the following costs:

- Part A deductible

- Part A coinsurance and hospital costs

- Part A coinsurance or copayment for hospice

- Part A coinsurance for skilled nursing facility care

- Part B deductible

- Part B coinsurance or copayment

- blood, first 3 pints

- foreign travel exchange, up to 80%

However, there are two benefits Plan C does not cover, including the Part B excess charge and the out-of-pocket limit.

Because Medicare Part C and Medigap Plan C are different, eligibility is also different.

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area. Learn about these factors and how to get cost details.

Don’t Miss: Does Aspen Dental Accept Medicare

Tricare Help: Medicare Part C Plans Ins And Outs

Q. I’m an Air Force retiree whose wife uses Medicare/Tricare for Life. All has gone well so far, but now her doctor says he’s going to stop taking Medicare on assignment and has suggested my wife might want to look into a Medicare Advantage plan. Doctors who accept Medicare assignment are fairly scarce in our area. Since TFL always pays last, how would it work if she joined a Medicare supplement or Part C plan?

A. Should your wife choose to go with a Medicare Part C plan, she would not lose eligibility for Tricare for Life, but the way her health care is paid for would change a bit.

If she signed up for a Part C plan, that company would provide Medicare Part A and B benefits, and your wife would still pay her regular Part B premiums . Since she would still be paying Part B premiums, which is the bedrock requirement for TFL eligibility, she would not be shut out of Tricare.

That said, most beneficiaries who are eligible for TFL don’t need a Part C plan because the basic combination of Medicare Parts A and B plus Tricare Standard that comprise Tricare for Life will cover 100 percent of a beneficiary’s medical bills on the vast majority of claims. So the other option is simply to find another Medicare provider .

Either way regular Medicare Parts A/B or Medicare Part C Medicare would continue to be your wife’s primary coverage, with Tricare Standard serving as a backup secondary payer.

Know The Pros & Cons Of Medicare Advantage Plans

June 2, 2021 / 5 min read / Written by

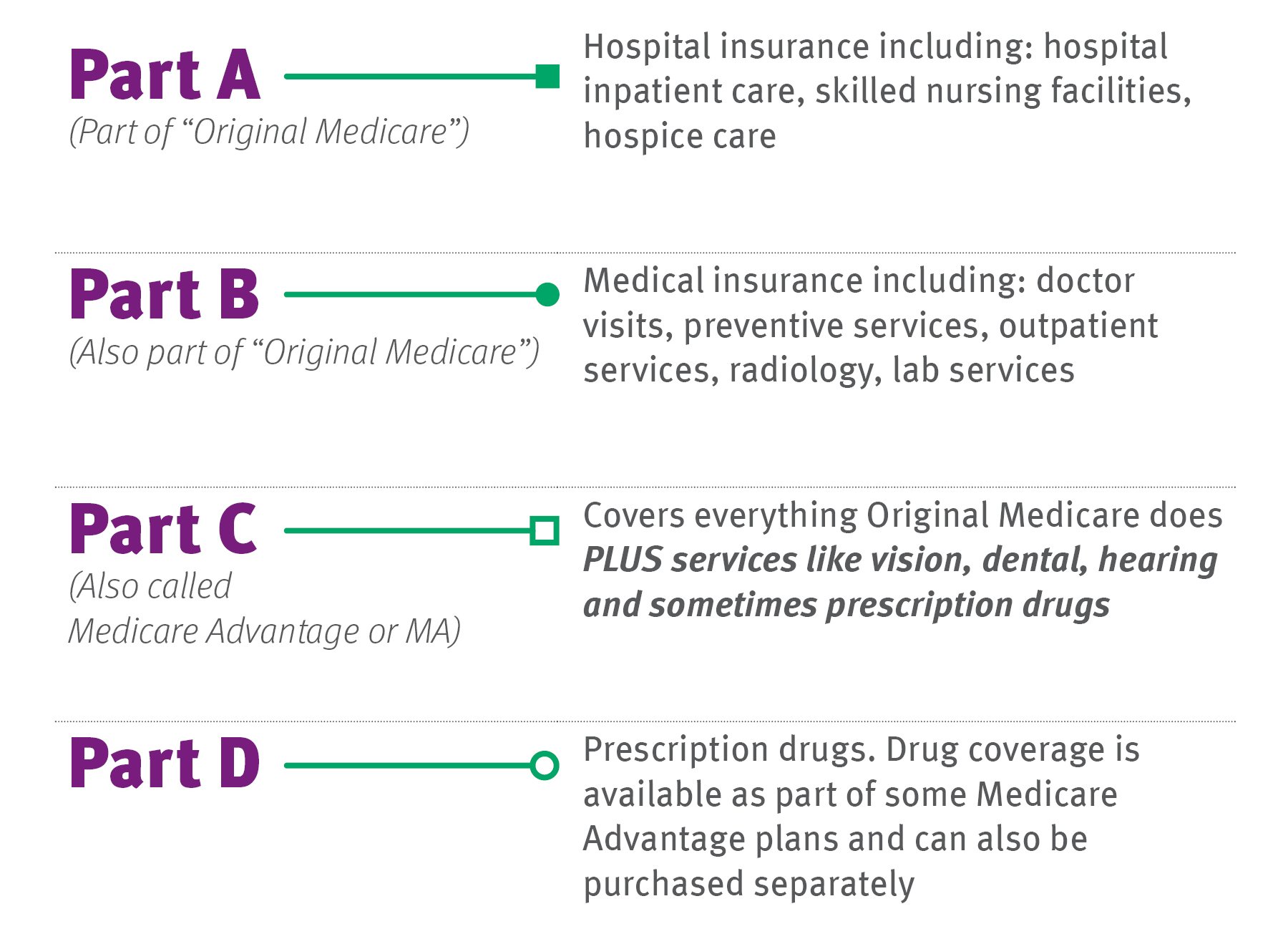

Medicare Advantage, also known as Medicare Part C, makes it possible for people with Medicare Part A and Part B to receive their Medicare benefits in an alternative way. Medicare Advantage plans are offered by private insurance companies contracted with Medicare and provide at least the same level of coverage that Medicare Part A and Part B provide.

You may be wondering which is the better choice: sign up for a Medicare Advantage plan or Original Medicare. There isnt a simple answer because Medicare Advantage plans have key features that many people find attractive and other characteristics that may not match with your personal preferences and/or lifestyle. Lets take a closer look at some of the important pros and cons of Medicare Advantage plans.

Also Check: When Does Medicare Coverage Start

How Does Medicare Part C Work

If you enroll in a Medicare Advantage Plan, you will have a few different types of plans to choose from. The exact availability of plans will depend on the health insurance provider and your geographic location. Some of these plan types may be familiar to you if you previously had private health insurance through an employer. Your needs will ultimately determine which type of plan is right for you.

How Much Does Medicare Advantage Cost Per Month

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month.1

Depending on your location, $0 premium plans may be available in your area.

Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare Advantage plans include additional benefits that Original Medicare doesnt cover.

Because Medicare Advantage plans are sold by private insurance companies, plan costs can vary based on location, carrier, benefits offered and more.

Find out the average cost of Medicare Advantage plans in your state.

You May Like: Does Medicare Cover Cosmetic Surgery

How Medicare Part C Works

Medicare Part C includes your Part A and Part B benefits. The only exception is hospice care, which is still covered under Part A. Many Medicare Advantage plans offer additional coverage beyond Original Medicare. Some of those benefits might include:

- Routine dental care

- Wellness programs called SilverSneakers

- Prescription medications

Medicare Part C plans can also offer additional benefits today, such as over-the-counter medications, transportation to and from doctor appointments, and adult daycare services.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

You May Like: How To Check Medicare Status Online

Do I Need Medicare Part B

January 2, 2020 By Danielle Kunkle Roberts

Imagine if you had a heart attack and needed open heart surgery. Now imagine that you did not have any coverage for that and would need to pay 100% of the cost of that surgery. Pretty upsetting thought, isnt it?

That could potentially happen if you fail to enroll in Part B, and its astonishing how often it happens. We get calls from at least a dozen people every year who either misunderstood about what they really needed to have. Now they have some significant health issue and are learning they have no way to pay for their care.

So if you are wondering Do I Need Medicare Part B this post will really help you. Lets tackle this question by looking at some common scenarios.

This article has been updated for 2021.

Eligibility And Enrollment Part B Vs Part C

Original Medicare and Advantage plans vary in their eligibility and enrollment requirements.

Part B

After a person gets Social Security benefits at age 65, Medicare automatically enrolls them in Part A and Part B. If a person meets the age requirement but does not receive Social Security benefits, they will not automatically get Medicare and will need to sign up for it.

If someone does not sign up for Part A and Part B during the Initial Enrollment Period when they first become eligible, they may sign up during the general enrollment period, which is from January 1 to March 31 every year.

An individual may apply for Medicare online here.

Part C

A person who has Medicare Part A and Part B and does not have end stage renal disease is eligible for an Advantage plan. An individual may switch from Part A and Part B to an Advantage plan during the initial enrollment period or the open enrollment period, which is from October 15 to December 7 of every year.

To enroll in an Advantage plan, a person first needs to select a plan in their area. After they decide on a plan, they may request an enrollment form from the insurance company offering it or enroll on the companys website.

Don’t Miss: Who Pays The Premium For Medicare Advantage Plans

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2021, the average monthly premium for a Medicare Part D plan is $41.64 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

What Does Medicare Advantage Cover

Medicare Advantage plans must cover everything that Original Medicare covers, including inpatient hospital and skilled nursing facility care, emergency and urgent care, doctor visits, surgery, preventive care, certain vaccines and medical equipment such as wheelchairs and walkers. 2

Medicare Advantage plans may also cover additional services not included in Part A and Part B. Most plans include Part D prescription drug coverage. Many offer some coverage for dental and vision care, hearing aids, and fitness centers. Plans recently have been permitted to provide other benefits, including adult daycare, in-home support services, and home safety modifications, such as grab bars and wheelchair ramps. Traditional Medicare does generally not cover those services.3

Recommended Reading: How To Apply For Medicare Insurance

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur until you can switch plans during the next open season for Medicare. At that time, you can switch to an Original Medicare plan with Medigap. If you do, keep in mind that Medigap may charge you a higher rate than if you had enrolled in a Medigap policy when you first qualified for Medicare.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

What Does Medicare Part C Cost

Medicare Part C plans generally have lower premiums than Medigap plans. This is because you are agreeing to treat in the plans network and pay copays as you go. The network may be an HMO network, where youll need to choose a primary care physician and get referrals.

There are also Medicare PPO and Medicare PFFS options, which have some out of network benefits. Besides your monthly premium, your spending might include deductibles, copays and coinsurance up to the plans out of pocket maximum.

Some Medicare Part C plans have premiums as low as $0. This does not mean that Medicare Part C is free. When you enroll in a Medicare Part C Advantage plan, Medicare pays a fixed monthly sum to the insurance carrier to provide your care. The Medicare Part C company will offer you a monthly premium as low as possible to attract you to their plan.

The premiums, copays, benefits, and drug formulary can and do change from year to year. This is because the Medicare Part C plan must renew its contract with Medicare annually.

Also Check: How Much Does Medicare Pay For Hospice

Can My Spouse Continue Contributing Into The Hsa Even If I Dont

Yes, as long as your spouse is covered by the qualifying insurance, he/she can continue contributing up to the individual maximum into the account in his/her name. The contribution just cant be in your name. You can also use funds that are already in the account to pay for expenses for both of you until the fund are exhausted. For more rules about contribution, visit this page on the IRS website.

Late Enrollment Penalty For Part D

There can be an IRS penalty with Medicare and an HSA. Therecan also be a late penalty for not enrolling in Part D if your group coverageis not considered creditable.

Many high-deductible health plans do not have drug coveragethat is considered creditable for Part D. In other words, the insurance planwill not pay as much as the standard Part D plan would. If that is the case,your employer is responsible to send you an annual Medicare Part D notice priorto October 15th. They must advise you that your drug coverage is not creditablefor Part D.

This means that later on when you enroll in Part D, you willlikely owe a late enrollment penalty. Part D penalties are assessed at 1% per month for every month that you couldhave been enrolled but were not. At just 1%, it is a small penalty, but it iscumulative. If you postpone Part D for several years, it can add up.

You will also pay the penalty for the rest of your life, soit does need to be considered. You should work with an insurance agent to helpyou calculate the potential penalty. Then make your own decision on whether itis still best to delay enrollment into Medicare so that you can continue yourHSA contributions.

You May Like: Does Costco Pharmacy Accept Medicare

Who Is Eligible For Medicare Advantage

Anyone over 65 years of age who is enrolled in Medicare Part A and Part B may opt for a Medicare Advantage plan that serves their geographic area. If you are receiving Social Security Disability benefits, you will be enrolled automatically in Medicare when you become eligible, usually after you have been receiving SSDI benefits for two years.

An exception used to be people with end-stage renal disease , which requires regular dialysis or a kidney transplant. Starting in 2021, Medicare Advantage plans now offer coverage for ESRD.

Prior to 2021, you could only keep your Medicare Advantage plan if you were enrolled and developed ESRD. Another way was if you enrolled in a Special Needs Plan.

What Do Medicare Advantage Plans Cover

Medicare Advantage plans provide all of your Part A and Part B coverage and must cover all medically necessary services. Many plans also offer prescription drug coverage and additional programs not covered by Original Medicare. To enroll in a Medicare Advantage Plan, you must already have Original Medicare Part A and B coverage.

Part C

- Combines Original Medicare, Part A and Part B, in 1 plan

- Often also includes Medicare Part D prescription drug coverage

- May come with additional programs and services not offered by Original Medicare

These plans are part of the government’s Medicare program, but are offered and managed through private insurers, like Cigna. Medicare Advantage Plans may include plan extras not found in Original Medicare. You must be enrolled in Medicare Part A and Part B to join.

Read Also: Who Do You Call To Sign Up For Medicare

Whats Medicare Part C

Medicare Part C is the Medicare Advantage program. Part C gives you an alternative way to get your Original Medicare benefits.

So, you could say that Part C = Part A + Part B.

Medicare Advantage plans are available through private, Medicare-approved health insurance companies. Its common for Medicare Advantage plans to include prescription drug coverage through Medicare Part D. These are sometimes called Medicare Advantage Prescription Drug plans.

When it comes to Medicare Advantage Prescription Drug plans, you could say that Part C = Part A + Part B + Part D.

Under Medicare Part C, Medicare Advantage plans can also offer extra benefits, like routine dental services or membership in fitness programs.

Should I Get Medicare Part B

Another way to put the question is this: when dont you need Part B?

Two situations in which you might not rely on Medicare Part B coverage include:

- A Medicare Advantage plan is an alternative to Part A and Part B . Your Medicare Advantage plan carrier provides all of your Part A and Part B benefits, instead of the federal government. Many Medicare Advantage plans may provide additional benefits Original Medicare doesnt cover, such as prescription drug coverage.

- You may have that Medicare regards as equivalent to Part B.Situations in which you have creditable coverage include:

- Having an employer health insurance plan

- Having a retiree health plan provided by a prior employer

- Being covered under someone elses employer health insurance or retiree health insurance plan

Also Check: Do I Need Health Insurance With Medicare