Am I Eligible For Medicare Part A

Generally, youre eligible for Medicare Part A if youre 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as youre already collecting Social Security or Railroad Retirement benefits.

If youre already receiving Social Security or Railroad Retirement benefits, all you need to do is check your mail for your Medicare card, which should automatically arrive in the mail about three months prior to your 65th birthday . The card will arrive with the option to opt-out of Part B , but opting out of Part B is only a good idea if youre still working and have employer-sponsored coverage that provides the same or better coverage, or if your spouse is still working and you have coverage under their plan.

If youre not already receiving Social Security or Railroad Retirement benefits, youll need to enroll in Medicare during a seven-month open enrollment window that includes the three months before the month you turn 65, the month you turn 65, and the three following months. If you enroll before the month you turn 65, your benefits will start the month you turn 65 . If you enroll in the three months after you turn 65, your coverage could have a delayed effective date.

In addition to turning 65, people can become eligible for Medicare due to a disability , or due to end-stage renal disease or amyotrophic lateral sclerosis .

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

Can I Get Medicare If I Never Worked

Yes, you can get Medicare if you never worked, but youll need to pay a premium for Medicare Part A. If you are a U.S. citizen over 65 and you or your spouse did not pay Medicare taxes for at least 10 years, you may be eligible to purchase Medicare Part A health insurance. In 2020, seniors who did not receive premium-free Part A coverage paid $458 per month if they paid Medicare taxes for less than 30 quarters those who paid Medicare taxes for 30 to 39 quarters pay $252 per month.

You will not be enrolled automatically, so you need to file an application with the Social Security Administration. You can then enroll in Medicare Part A and Part B for a monthly premium during a valid Medicare enrollment period. You will not be able to purchase Part A alone.

Recommended Reading: What Age Do You Register For Medicare

Medicare Part D Enrollment

The Medicare Part D enrollment period takes place each year form April 1 to June 30. If you enrolled in coverage for Medicare parts A or B and want to add Part D, you can enroll during this period the first time. After this, to change Part D plans, you must wait for open enrollment to come around again.

How Do You Receive Your Medicare Benefits When You Meet Medicare Eligibility Requirements At Age 65

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

If youre not enrolled in Original Medicare automatically, you may need to file an application with the Social Security Administration. You can enroll in Medicare Part A and Part B during the period that begins three months before your 65th birthday month, includes your birthday month and ends three months after your birthday month.

Note: You have a choice if you want to keep or refuse enrollment in Medicare Part B. If you refuse it, you dont lose your Medicare Part B eligibility. However, you may have to wait for a valid enrollment period before you can enroll. You may also have to pay a late enrollment penalty for as long as you have Medicare Part B coverage.

Recommended Reading: How Soon Before Turning 65 Do You Apply For Medicare

Can A 62 Year Old Get Medicaid

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

Learn more about the difference between Medicare and Medicaid.

The Improving Medicare Coverage Act Would Be A Boon Not Only To Many Americans Ages 60

The Improving Medicare Coverage Act makes all Medicare enrollees with income below 200 percent of the Federal Poverty Level eligible for a new Medicare Cost Assistance Program that would zero out premiums, coinsurance and deductibles for Medicare Parts A and B. | Image: Tijana / stock.adobe.com

Reviewed by our health policy panel.

During the 2020 presidential campaign, then-Candidate Joe Biden proposed lowering the Medicare eligibility age to 60. Early this month, Rep. Pramila Jayapal introduced a bill, the Improving Medicare Coverage Act, to do just that and do it simply and cleanly, with Medicare offered on the same terms at age 60 as it is now at age 65. The expanded eligibility would kick in six months after the bill becomes law. The bill is cosponsored by 130 House Democrats.

Passage of this bill would be a boon to many of the 21 million Americans between the ages of 60 and 64, particularly the roughly 1.6 million who are uninsured. That probably wont happen: as Democrats wrestle to decide which of their many policy goals can be included in the omnibus Built Back Better bill they hope to pass this fall, dropping the eligibility age appears to be low on the priority list. But Jayapal is a savvy legislator, and her Improving Medicare Affordability Act also makes Medicare much more affordable for lower income enrollees of all ages. Its not inconceivable that some version of these reforms may become law.

Also Check: Can You Only Have Medicare Part B

What Is Medicare Part A When Can You Enroll

Medicare Part A is hospital insurance. It covers inpatient hospital, hospice, and skilled nursing facility care. Part A also covers home health care.

You can sign up for Part A:

- During your Initial Enrollment Period , if youre not automatically enrolled, or

- At any time after youre first eligible. If you qualify for premium-free Part A, you wont have a penalty if you enroll past your IEP.6

Medicare Enrollment For Ssdi Recipients

To become eligible for Medicare based on disability, you must first qualify for Social Security Disability Insurance. SSDI pays monthly benefits to people with disabilities who might be limited in their ability to work. If you are injured or have a medical condition that limits your ability to work, you may be eligible for SSDI.

Call a Licensed Agent:

You May Like: How Much Does Medicare Pay For Physical Therapy In 2020

Can You Enroll In Medicare Before You Turn 65

You may be eligible for Medicare before age 65 if:

- Youve received Social Security Disability Insurance for at least 24 months

- Youll get Medicare Part A and Part B automatically starting the first day of your 25th disability month. You should get your Medicare card in the mail three months before this date.

- You have Amyotrophic Lateral Sclerosis , or Lou Gehrigs disease

- Youll get Part A and Part B automatically in the month your SSDI benefits begin.

Note: Part B isnt automatic if you live in Puerto Rico.4 Youll have to contact Social Security to enroll.

- You have permanent kidney failure, or end-stage renal disease

- Youll need to sign up for Medicare yourself. Your coverage usually starts the first day of the fourth month of dialysis treatment or in the month youre admitted to a Medicare-certified hospital for a kidney transplant.5

A Word of Advice

If you dont have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65.

Important Information Regarding The Medicare Advantage Plan:

All participants in the Medicare Advantage Plan must be enrolled in Medicare Parts A & B. If you are enrolled in Medicare Parts A & B but your spouse is not, you may only enroll in this plan by removing your spouse from City medical coverage. If your spouse is enrolled in Medicare Parts A and B but you are not, you may not enroll in the MAPD Plan.

The MAPD plan incorporates Medicare Part D prescription drug coverage. You will be disenrolled from the MAPD plan if you enroll in another Part D plan.

Also Check: What States Have Medicare Advantage Plans

How Do You Receive Your Medicare Benefits When You Meet Medicare Eligibility Requirements For People Younger Than Age 65

- If you receive Social Security benefits for 24 months, usually you will automatically be enrolled in Medicare Part A and Part B at the beginning of the 25th month.

- If you have Lou Gehrigs disease, usually you will automatically be enrolled in Medicare Part A and Part B as soon as you receive the first month of Social Security disability benefits.

- If you have ESRD, you might be eligible for Medicare but you must apply for Medicare benefits by visiting your local Social Security office or contacting Social Security from 7AM 7PM Monday Friday, all U.S. time zones. Medicare coverage usually starts on the first day of the fourth month of your dialysis treatments.

Are you unsure whether you meet Medicare eligibility requirements? Contact me. I will be happy to help you.

- You can use the links below to reach me or have me send you customized information through an email.

If you wish to learn more about some of the Medicare plans where you live, use the Compare Plans button on this page.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

What Happens If You Enroll In Part D Late

If you dont enroll in Part D when youre first eligible and you didnt have other drug coverage for 63 consecutive days, Medicare may charge a penalty when you enroll, adding it to your monthly premium. Part D premiums vary by plan.

If youre concerned about drug coverage costs, Medicare has a program called Extra Help for people with limited incomes. There is no Part D penalty if you get Extra Help.13

Read Also: When You Are On Medicare Do You Need Supplemental Insurance

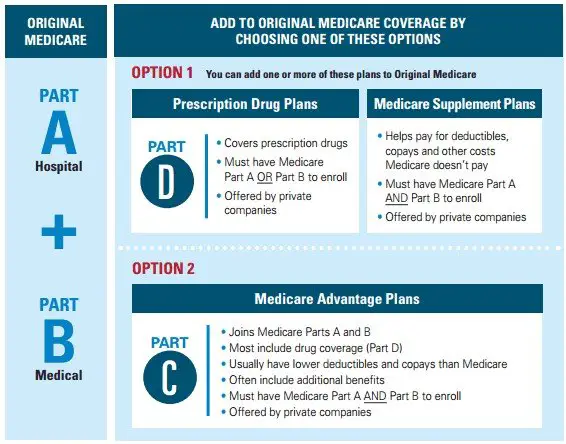

Medicare Part C Eligibility

Medicare Part C, also called Medicare Advantage, is an insurance option for people who are eligible for Medicare. These plans are offered through private insurance companies.

You dont need to buy a Medicare Part C plan. Its an alternative to original Medicare that offers additional items and services. Some of these include prescription drugs, dental, vision, and many others.

To be eligible for a Medicare Part C plan:

- You must be enrolled in original Medicare .

- You must live in the service area of a Medicare Advantage insurance provider thats offering the coverage/price you want and thats accepting new users during your enrollment period.

To enroll in original Medicare , in general, you must qualify by:

Who Would Benefit From Medicare Cost Assistance

Providing a Medicare benefit that covers all premiums and almost all out-of-pocket costs to all Medicare enrollees with incomes up to 200% FPL would be a huge boon to millions of Medicare enrollees. As of 2018, according to the federal Center for Medicare and Medicaid Services , 12.2 million Medicare enrollees had some form of dual eligibility, and 8.7 million were full dual eligibles, with all or almost all costs paid. Almost 40% of dual eligibles are on disability Medicare. Only 5.3 million seniors are full dual eligibles.

According to the Kaiser Family Foundation , while 6.9 million Medicare enrollees have incomes below 100% FPL, many more 11.0 million have incomes in the 100-200% FPL range. Some enrollees in the 100-200% FPL range do obtain partial or full dual eligibility, but most dont. For lower income enrollees who dont obtain dual eligibility, Medicare premiums and out-of-pocket cost exposure impose a substantial burden and dilemma.

Perhaps the most valuable extra benefit provided by Medicare Advantage plans is a yearly cap on out-of-pocket costs, which averages $5,091 for in-network services, and $9,208 for combined in-network and out-of-network services . Conversely, the most glaring weakness in traditional, fee-for-service Medicare is the lack of an OOP cap .

Recommended Reading: How Can I Sign Up For Medicare

Medicare Eligibility At 65 And Older

The year you turn 65, you can apply for Medicare starting three months before your birth month until three months after. You generally have to meet three eligibility requirements to qualify for full Medicare benefits when you turn 65.

The chief requirement is that you must be a U.S. citizen or permanent legal resident who has lived at least five years in the United States.

In addition, you have to meet one of the following other requirements:

- You or your spouse must have worked long enough to also be eligible for Social Security benefits or for railroad retirement benefits. This usually means youve worked for at least 10 years. You must also be eligible for Social Security benefits even if you are not yet receiving them.

- You or your spouse is either a government employee or retiree who did not pay into Social Security but did pay Medicare payroll taxes while working.

Paying Medicare payroll taxes for 10 full years means you wont have to pay premiums for Medicare Part A, which covers hospital care.

You dont need the work credits to qualify for Medicare Part B, which covers doctor visits or outpatient services, or Medicare Part D, which covers prescription drugs. But everyone has to pay premiums for both.

You can still get Medicare if you never worked but it may be more expensive depending on your spouse or total work history.

Prepare for Medicare Open Enrollment

Medicare Eligibility If You Are Under 65

People younger than 65 may qualify for Medicare if they have certain costly medical conditions or disabilities.

If you are under 65, you qualify for full Medicare benefits if:

- You have been receiving Social Security disability benefits for at least 24 months. These do not need to be consecutive months.

- You have end-stage renal disease requiring dialysis or a kidney transplant. You qualify if you or your spouse has paid Social Security taxes for a specified period of time based on your age.

- You have amyotrophic lateral sclerosis, also known as Lou Gehrigs disease. You qualify for Medicare immediately upon diagnosis.

- You receive a disability pension from the Railroad Retirement Board and meet certain other criteria.

Recommended Reading: How Much Does Medicare Part B Cost At Age 65

When Can I Enroll In Medicare Advantage

Enrollment into Medicare is time-sensitive and should be started roughly 3 months before you turn age 65. You can also apply for Medicare on the month you turn age 65 and the 3 months following your 65th birthday although your coverage will be delayed.

If you miss the initial enrollment period, Medicares open enrollment period is another chance to sign up for a Medicare plan. This period runs from October 15 through December 7 every year.

Finally, theres also the Medicare Advantage open enrollment period. This is from January 1 to March 31 each year. However, this period only lets you make changes to your plan if youre already enrolled in a Medicare Advantage plan.

These plans combine your original Medicare Part A with Medicare Part B .

Often, they also include Medicare Part D and other benefits, such as vision and dental coverage.

There are many different companies offering Medicare Advantage plans. Each offers different levels of coverage and monthly premiums. Many are Preferred Provider Organizations or Health Maintenance Organizations .

At a minimum, these plans will replace Medicare parts A and B, while offering a minimum of all of the benefits provided by parts A and B as required by law.

Tips For Choosing A Medicare Part D Plan

Remember, the plan you choose isnt set in stone. If your needs change year to year, you can switch to another plan in the next open enrollment period. Youll have to stay in the plan an entire year, so choose carefully.

When using the Medicare plan finder to choose a Part D plan, enter your medications and doses, then select your pharmacy options. Of the available drug plans, youll see the lowest monthly premium plan displayed first. Keep in mind, the lowest premium plan may not fit your needs.

Theres a drop-down selection to the right of the screen listing three options: lowest monthly premium, lowest yearly drug deductible, and lowest drug plus premium cost. Click through all the options and look at your choices before making a final decision.

Don’t Miss: Where Do I Apply For Medicare Benefits